- Summary

- Table Of Content

- Methodology

Xylene Market Size :

Consegic Business Intelligence analyzes that the xylene market size is growing with a CAGR of 5.9% during the forecast period (2023-2031). The market accounted for USD 37.88 billion in 2022 and USD 39.94 billion in 2023, and the market is projected to be valued at USD 63.08 billion by 2031.

Xylene Market Scope & Overview:

Xylene is a versatile aromatic hydrocarbon that plays a crucial role in the manufacturing of monomers and solvents. Its unique properties, including high boiling point, strong solvency, and ability to produce high-gloss finishes, make it an indispensable ingredient in various industrial processes. As per the analysis, the compound is used as a solvent in various industries, including paints, coatings, adhesives, and pharmaceuticals.

Furthermore, it is used in the production of printing inks, adhesives, and other products. It is used in the rubber sector as a solvent for rubber compounds and additives. It helps to dissolve these substances and make them more pliable, enabling the formation of rubber products with desired properties.

Xylene Market Insights :

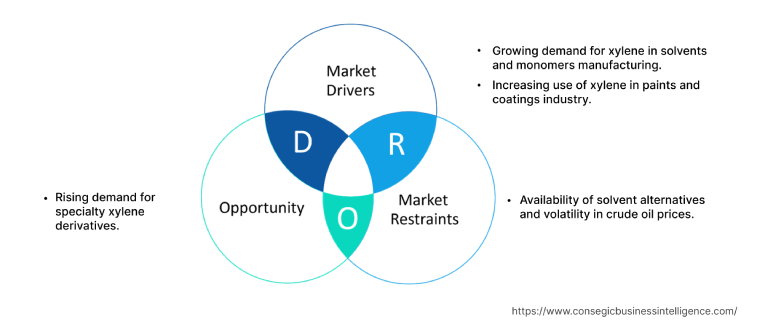

Key Drivers :

Growing demand for xylene in solvents and monomers manufacturing

Xylene is a versatile aromatic hydrocarbon that plays a crucial role in the manufacturing of monomers and solvents. Its unique properties, including high boiling point, strong solvency, and ability to produce high-gloss finishes, make it an indispensable ingredient in various industrial processes. Based on the analysis, it is primarily used as a feedstock to produce para-xylene (PX), which is a key monomer in the manufacturing of polyethylene terephthalate (PET). PET is a widely used plastic resin with a wide range of applications, including packaging, textiles, and automotive components. Furthermore, it is also extensively used as a solvent in various industrial applications. Its strong solvency power allows it to dissolve a wide range of substances, making it suitable for a variety of tasks, including thinning, degreasing, resin solvents, specialty solvents, and others. Monomers are highly used for the manufacturing of PET which is an essential component in the plastic sector. Increasing production of such materials is driving the requirement for monomers and solvents. For instance, in April 2023, The Chinese company Fujian Billion Petrochemicals plans to launch a new Polyethylene Terephthalate (PET) factory in the city of GO Dau in Vietnam's southeast. The plant will have an initial capacity of 300,000 tonnes annually. The company expects that the new manufacturing facilities for the polyester bottle chips production business will be put into commercial production gradually from June 2023. Thus, this compound is a crucial ingredient in the manufacturing of various monomers and solvents that are used in different end-user industries, the increasing requirement for monomers and solvents is driving the demand for this compound across the globe.

Increasing use of xylene in paints and coatings sector

Xylene is a versatile solvent with a wide range of applications in the paints and coatings sector. It is a clear, colorless liquid with a pleasant odor and a high boiling point, making it a suitable solvent for various applications such as thinning, degreasing, solvent for resins, gloss enhancement, paint remover, and others. It is commonly used as a thinning agent for paints, lacquers, and varnishes. It helps to reduce the viscosity of these coatings, making them easier to apply and ensuring even coverage. This property is particularly important for spray painting, where a properly thinned mixture is essential for achieving smooth, professional-looking results. Significant development in the investments for the development of the paints and coatings sector is driving the xylene market demand. For instance, in July 2022, AkzoNobel, a Dutch paints and coatings group, announced a USD 21.39 million investment to increase and improve production at two of its sites in France. A total of USD 16.05 million will be spent on the company's aerospace coatings facility in Pamiers, and USD 5.35 million will be spent on improving production flexibility at the decorative paints site in Montataire, which is one of the company's most important manufacturing locations for wall paints in Europe. Thus, the growing investments in the paints and coatings sector and the high requirement of this compound from the paints and coatings sector are driving the global xylene market trend.

Key Restraints :

Availability of solvent alternatives and volatility in crude oil prices

Alternative solvents, such as toluene , ethylbenzene, and isopropyl alcohol, offer similar properties and performance to this compound in various applications. These solvents can be used as thinners, degreasers, and solvents for resins, making them viable substitutes for this compound in many industries. The availability of alternative solvents has intensified competition in the solvent market, forcing producers to constantly innovate and differentiate their products. Moreover, the growing requirement for eco-friendly products and sustainable solutions has further challenged xylene's position. Bio-based solvents, derived from renewable feedstocks such as plant-based materials, offer a more environmentally friendly alternative to petroleum-based solvents. As environmental concerns intensify and governments implement stricter environmental regulations, bio-based solvents are likely to gain traction, potentially replacing this compound in certain applications.

Furthermore, it is generally derived from crude oils, fluctuating prices of crude oil lead to volatility in the prices of this compound which leads to reduced profitability of the producers and diverts for alternative products. Thus, as per the analysis, the fluctuating crude oil process is restraining the xylene industry across the globe. For instance, according to the report by the National Center for Biotechnology Information in December 2021, 2020, the COVID-19 pandemic caused international crude oil prices to fall sharply. In March, WTI crude oil prices dropped to USD 46.78 per barrel, and in April, they fell to a historic low of USD 36.98 per barrel. However, in 2021, prices began to recover as requirements increased and OPEC countries reduced crude oil production. Thus, the xylene market is facing increasing pressure from the growing availability of solvent alternatives, particularly bio-based options, and restraining the global xylene market growth.

Future Opportunities :

Rising demand for specialty xylene derivatives

Xylene is used to produce different derivatives that include dimethyl terephthalate, toluene diamine, dimethyl naphthalene, and others. these derivatives are used for various applications in different end-use industries. Dimethyl naphthalene is used to produce polyphenylene sulfide (PPS), which is a high-performance polymer used in a variety of applications, including automotive parts, electronics, and aerospace components. Furthermore, dimethyl terephthalate, which is another derivative, is used to produce polymers such as polyethylene terephthalate (PET) and polybutylene terephthalate (PBT). As per the analysis, polybutylene terephthalate (PBT) is used in the electronics sector for the manufacturing of electronic parts such as TV set accessories, Motor covers, Motor brushes, Switches, Sockets, and others. significant development in the electronics manufacturing sector is expected to drive the requirement for PBT. For instance, according to the report by the Press Information Bureau of the Government of India in June 2023, Electronics manufacturing grew from USD 37.1 billion in 2015-16 to USD 67.3 billion in 2020-21. Thus, increasing the requirement for these compound derivatives from various applications is expected to create lucrative xylene market opportunities and trends over the forecast period.

Xylene Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 63.08 Billion |

| CAGR (2023-2031) | 5.9% |

| By Type | Ortho-Xylene, Meta-Xylene, Para-Xylene, and Mixed Xylene |

| By Application | Solvents, Monomers, Specialty Chemicals, and Others |

| By End-user Industry | Petrochemicals, Paints and Coatings, Textile, Electronics, Pharmaceutical, Leather, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Exxon Mobile Corporation, Reliance Industries Limited, INEOS, Mitsubishi Gas Chemical Company Inc., CNPC (China National Petroleum Corporation), Chevron Phillips Chemical Company, Eastman Chemical Company, Honeywell International Inc., Saudi Arabian Oil Co., and Royal Dutch Shell plc |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Xylene Market Segmental Analysis :

By Type :

The type is categorized into ortho-xylene, meta-xylene, para-xylene, and mixed xylene. In 2022, the para-xylene segment accounted for the highest market share in the xylene market. Para-xylene (PX), a key organic compound, is the primary raw material used to produce terephthalic acid (PTA), an essential component in the manufacturing of polyethylene terephthalate (PET). According to the analysis, the requirement for PET is increasing driven by several factors, including rising disposable incomes, urbanization, and growing consumer preference for packaged goods. PET's versatility, strength, and cost-effectiveness make it an attractive material for various applications, fueling the requirement for para-xylene. Significant development in the packaging sector is driving the requirement for para-xylene in PET manufacturing. For instance, according to the report by the Indian Investment Promotion and Facilitation Agency report in October 2021, The India Packaging Market is expected to reach USD 204.81 Bn by 2025, registering a CAGR of 26.7% during the period of 2020-2025. thus, the growing packaging sector is driving segment expansion across the globe.

Moreover, the meta-xylene segment is expected to hold the highest CAGR over the forecast period. The fastest-growing type of this compound is m-xylene, driven by its increasing requirement in the production of high-performance solvents and specialty chemicals. M-xylene is used in the formulation of high-solvency coatings, adhesives, and lubricants, which are finding increasing applications in various industries, including automotive, electronics, and construction, which is expected to create lucrative trends.

By Application :

The application segment is categorized into solvents, monomers, specialty chemicals, and others. In 2022, the solvents segment accounted for the highest market share in the xylene market. It is a solvent used in the printing, rubber, and leather industries. It is used in the leather sector as a glue additive. increasing investment in the leather sector is driving the segment's expansion. For instance, in February 2022, Hermès announced plans to open new leather goods factories in France to meet requirements for its Birkin and Kelly handbags. The company's goal was to increase production capacity as these products became more difficult to find in stores. The company also opened a new 50,600-square-foot building next to the location of its current facility in the New Aquitane region. The new factory will eventually house 250 artisans, the majority being 210 leather artisans with the addition of 40 glove makers. The growing investment in the leather sector is driving the segment growth and is expected to create lucrative trends.

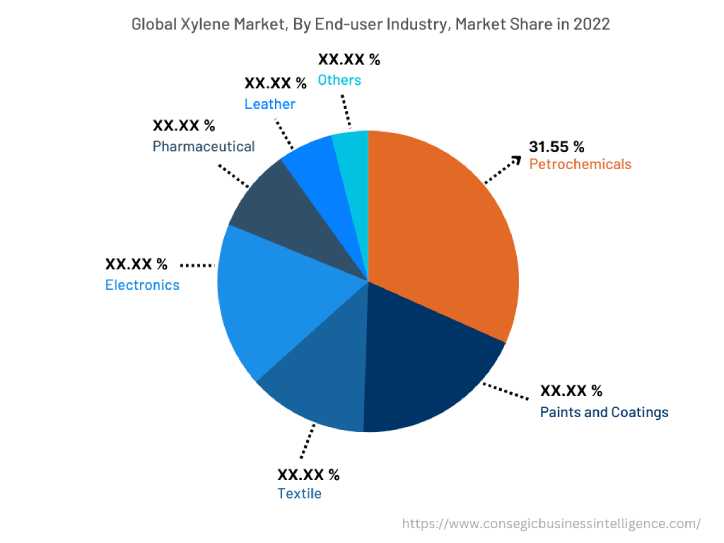

By End-Use-Industry :

The end-user industry segment is categorized into petrochemicals, paints and coatings, textiles, electronics, pharmaceutical, leather, and others. In 2022, the petrochemicals segment accounted for the highest xylene market share of 31.55% in the overall xylene market. This compound in the petrochemical sector is used for solvent extraction, hydrocracking, fluid catalytic cracking, and others. It is used as a feedstock in hydrocracking processes, which are used to convert heavy hydrocarbons into lighter, more valuable products. Significant growth in the production of petrochemicals across the globe is driving the requirement of this compound in the petrochemical sector. For instance, In 2022, SABIC produced around 37.7 million metric tons of chemicals, 5.7 million metric tons of performance polymers and industrial solutions, and 4.6 million tons of polyethylene. Thus, the growing petrochemical production is driving the demand for this compound in the petrochemical sector across the globe.

Moreover, the electronics segment is expected to hold the highest CAGR over the forecast period. It is used to clean and decrease electronic components before they are assembled or packaged. They are also used in the production of semiconductors to clean and etch silicon wafers. As per the analysis, increasing initiatives for the expansion of consumer electronics production facilities are expected to create lucrative trends for the segment growth globally. For instance, in March 2023, Apple supplier Foxconn announced that it plans to increase investment outside of China and efforts to attract automakers to its contract manufacturing business. Foxconn said it would ramp up investment outside China to meet customer demand and lower its reliance on China for production. The growing initiative for consumer electronics production is creating lucrative xylene market trends over the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

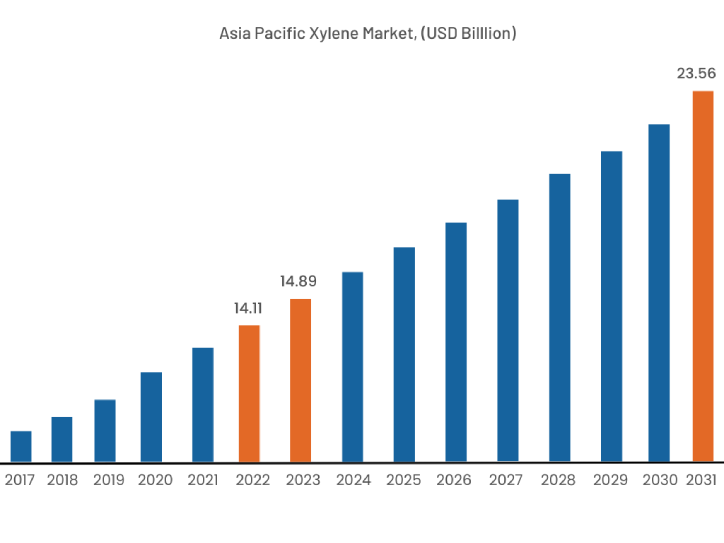

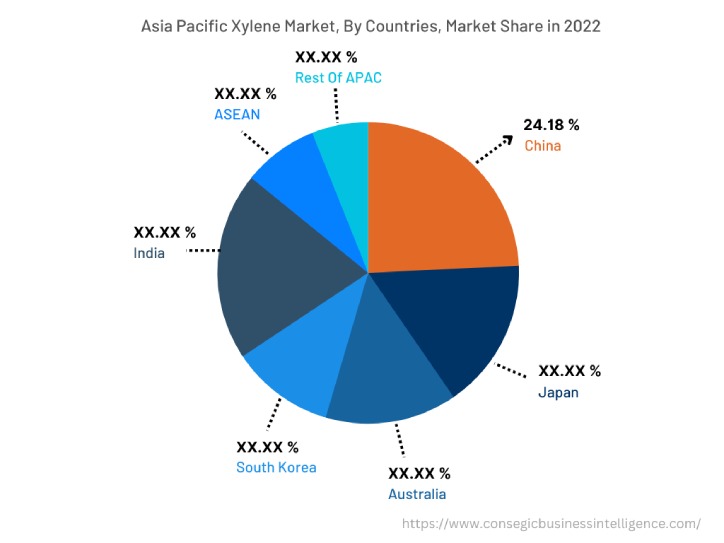

In 2022, Asia Pacific accounted for the highest market share at 37.26% valued at USD 14.11 billion in 2022 and USD 14.89 billion in 2023, it is expected to reach USD 23.56 billion in 2031. Asia Pacific is also the fastest-growing region across the globe, growing with a CAGR of 6.3% over the forecast period. In the Asia Pacific region, China accounted for a dominant market share of 24.18% in year 2022. As per the xylene market analysis, the market across the Asia Pacific region is growing owing to the significant growth of a variety of industries, such as construction, paints and coatings, adhesives, leather, and other industries. The significant growth in the investment of the paint and coatings sector is driving the market growth across the region. For instance, In October 2022, Asian Paints announced plans to invest USD 25.21 million to set up a manufacturing facility for Vinyl Acetate Ethylene Emulsion (VAE) and Vinyl Acetate Monomer (VAM) in India. The installed capacity of the facility would be 100,000 tons per annum for VAM and 150,000 tons per annum for VAE. furthermore, according to the report by the Government of China, China's petrochemical sector grew 14.4% in 2022, reaching a total revenue of USD 2.41 trillion. However, its total profit eased 2.8% to USD 0.16 trillion. All these above-mentioned factors are collectively driving the demand for this compound from various end user industries across the Asia Pacific region and creating lucrative growth opportunities and xylene market trends in the Asia Pacific region.

Top Key Players & Market Share Insights:

The Xylene market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research trends and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market revenue through mergers, acquisitions, and partnerships. The key players in the market include-

- Exxon Mobile Corporation

- Reliance Industries Limited

- Honeywell International Inc.

- Saudi Arabian Oil Co.

- Royal Dutch Shell plc

- INEOS

- Mitsubishi Gas Chemical Company Inc.

- CNPC (China National Petroleum Corporation)

- Chevron Phillips Chemical Company

- Eastman Chemical Company

Recent Industry Developments :

- In August 2023, Chevron Phillips Chemical Company (CPChem) produced benzene toluene xylene (BTX) at its plant in Sweeny, Texas. It is designated as a Hazardous Air Pollutant (HAP) and an emitter of Volatile Organic Compounds (VOC).

- In March, Saudi Aramco plans to build a USD 10 billion oil refinery and petrochemical complex in China. The complex will have a capacity of 300,000 barrels of crude per day. Aramco will supply 201,000 barrels per day. The complex will also include a petrochemical plant with an annual production capacity of 1.65 million tons of ethylene and 2 million tons of paraxylene.

- In March 2022, INEOS Aromatics spent USD 70 million to modernize its purified terephthalic acid (PTA) plant in Merak, Indonesia. The modernization increased the site's capacity by 15% from 500,000 tons to 575,000 tons per year and reduced CO2 emissions by 15% per ton.

Key Questions Answered in the Report

What was the market size of the xylene market in 2022? +

In 2022, the market size of xylene was USD 37.88 billion.

What will be the potential market valuation for the xylene industry by 2031? +

In 2031, the market size of xylene will be expected to reach USD 63.08 billion.

What are the key factors driving the growth of the xylene market? +

Growing demand for xylene in solvents and monomers manufacturing across the globe is fueling market growth at the global level.

What is the dominant segment in the xylene market for the end-user industry? +

In 2022, the petrochemicals segment accounted for the highest market share of 31.55% in the overall xylene market.

Based on current market trends and future predictions, which geographical region is the dominating region in the xylene market? +

Asia Pacific accounted for the highest market share in the overall market.