- Summary

- Table Of Content

- Methodology

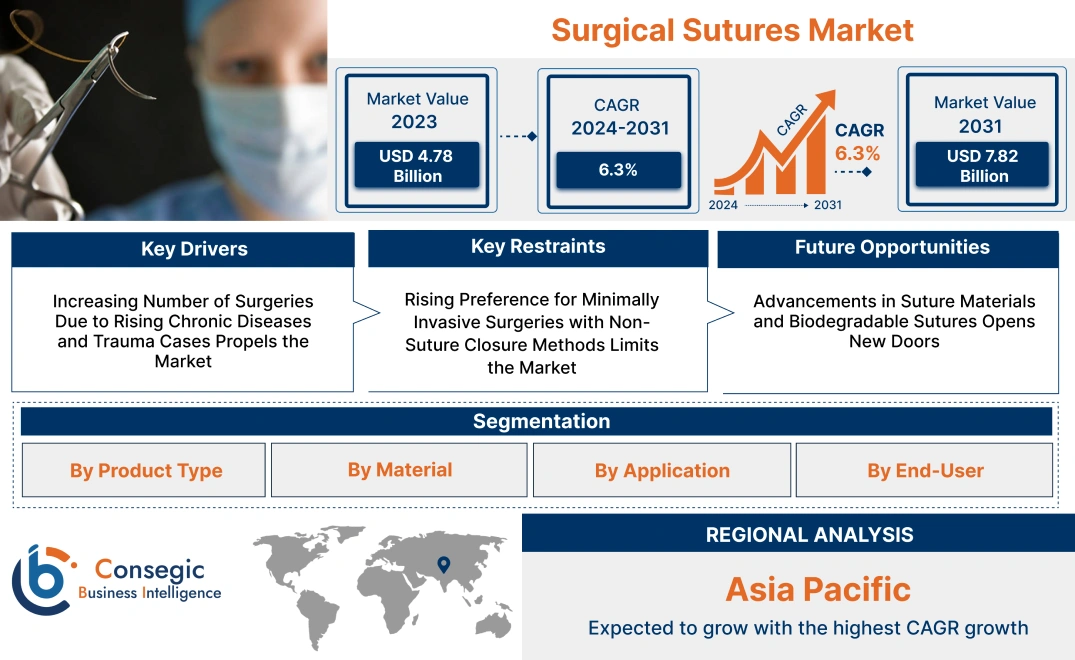

Surgical Sutures Market Size:

Surgical Sutures Market size is estimated to reach over USD 7.82 Billion by 2031 from a value of USD 4.78 Billion in 2023 and is projected to grow by USD 5.00 Billion in 2024, growing at a CAGR of 6.3% from 2024 to 2031.

Surgical Sutures Market Scope & Overview:

Surgical sutures are sterile medical threads used to close wounds or surgical incisions, facilitating proper tissue healing. These sutures are available in two main types: absorbable, which dissolves naturally in the body over time, and non-absorbable, which requires removal once the wound has healed. They are made from materials such as silk, catgut, and synthetic polymers like polyglycolic acid and polypropylene, each offering specific advantages based on the type of surgery and healing requirements. The application of surgical sutures spans various fields, including general surgery, cardiovascular, orthopedic, and plastic surgery, where precision and safety are critical. Hospitals, ambulatory surgical centers, and specialized clinics are key end-users of surgical sutures.

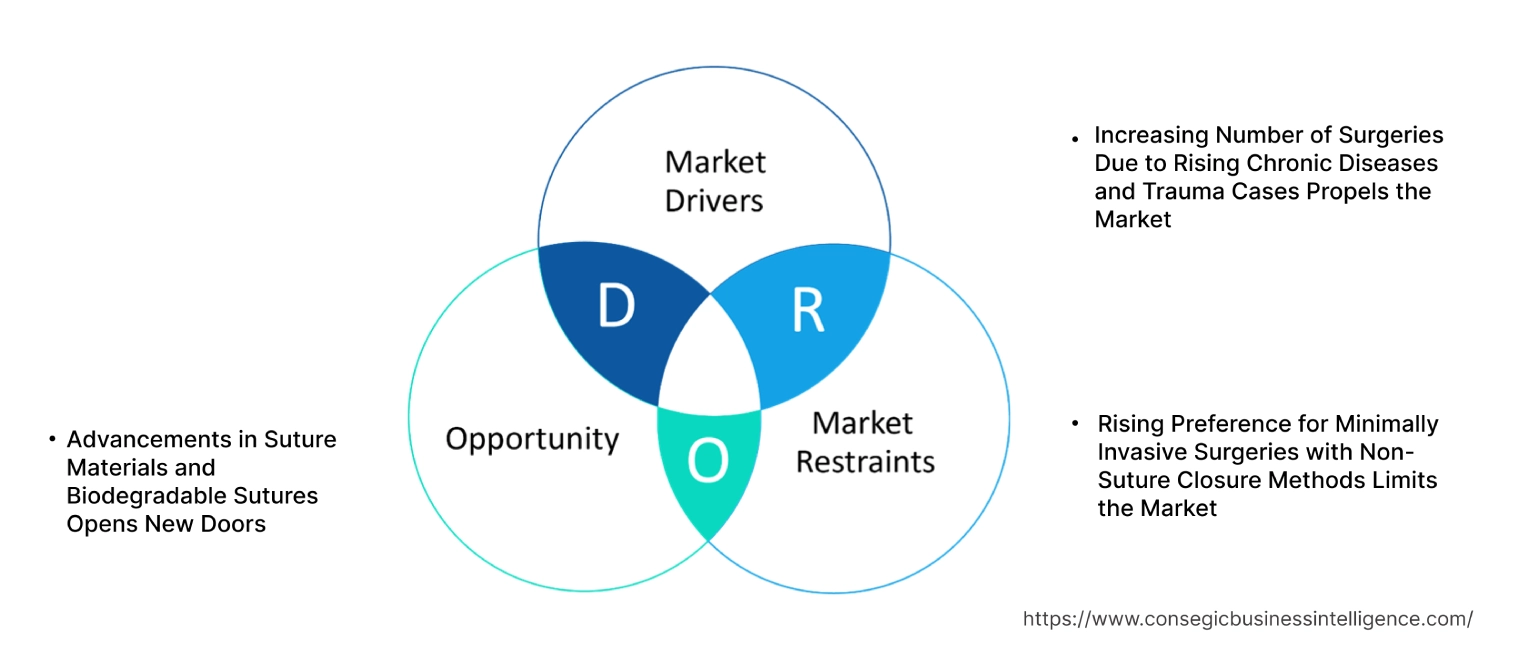

Surgical Sutures Market Dynamics - (DRO) :

Key Drivers:

Increasing Number of Surgeries Due to Rising Chronic Diseases and Trauma Cases Propels the Market

The market is driven by the growing number of surgeries being performed globally, primarily due to the increasing prevalence of chronic diseases such as cardiovascular diseases, cancer, and diabetes, along with the rising number of trauma cases. The surge in elective and emergency surgeries, including cardiovascular, orthopedic, and gastrointestinal surgeries, has significantly increased the demand for sutures as a primary wound closure method. Furthermore, the aging population is more prone to chronic illnesses that often require surgical interventions, further boosting the adoption of surgical sutures in both developed and emerging economies. The preference for minimally invasive surgeries often requires sutures with specific characteristics such as absorbability and antimicrobial properties. Thus, as per the market trends analysis, the aforementioned factors add to surgical sutures market growth.

Key Restraints :

Rising Preference for Minimally Invasive Surgeries with Non-Suture Closure Methods Limits the Market

The growing preference for minimally invasive surgical techniques, which often use non-suture closure methods such as staples, adhesives, and sealants, is a key restraint for the surgical sutures market demand. These alternatives provide faster wound closure, reduced scarring, and minimized infection risks compared to traditional sutures, making them popular among both patients and healthcare providers. This shift away from sutures, particularly in laparoscopic and robotic surgeries, has slowed the growth of the suture market in specific areas. Moreover, the adoption of advanced wound care products, such as tissue adhesives, for external wound closure further impacts the usage of traditional sutures, especially in high-tech surgical centers and advanced healthcare facilities.

Future Opportunities :

Advancements in Suture Materials and Biodegradable Sutures Opens New Doors

Technological advancements in suture materials, particularly in the development of synthetic and biodegradable sutures, present significant surgical sutures market opportunities. Biodegradable sutures, which dissolve naturally within the body, are increasingly preferred in both internal and external surgeries due to their reduced risk of infection and the elimination of the need for suture removal. Additionally, antimicrobial-coated sutures are gaining traction as they reduce the risk of post-surgical infections, which is a critical concern for both patients and healthcare providers. Innovations in suture technology, such as drug-eluting sutures that release therapeutic agents to enhance healing, also offer potential for the market. These advanced sutures not only improve patient outcomes but also address the growing need for more effective and safe surgical materials in the healthcare industry.

Surgical Sutures Market Segmental Analysis :

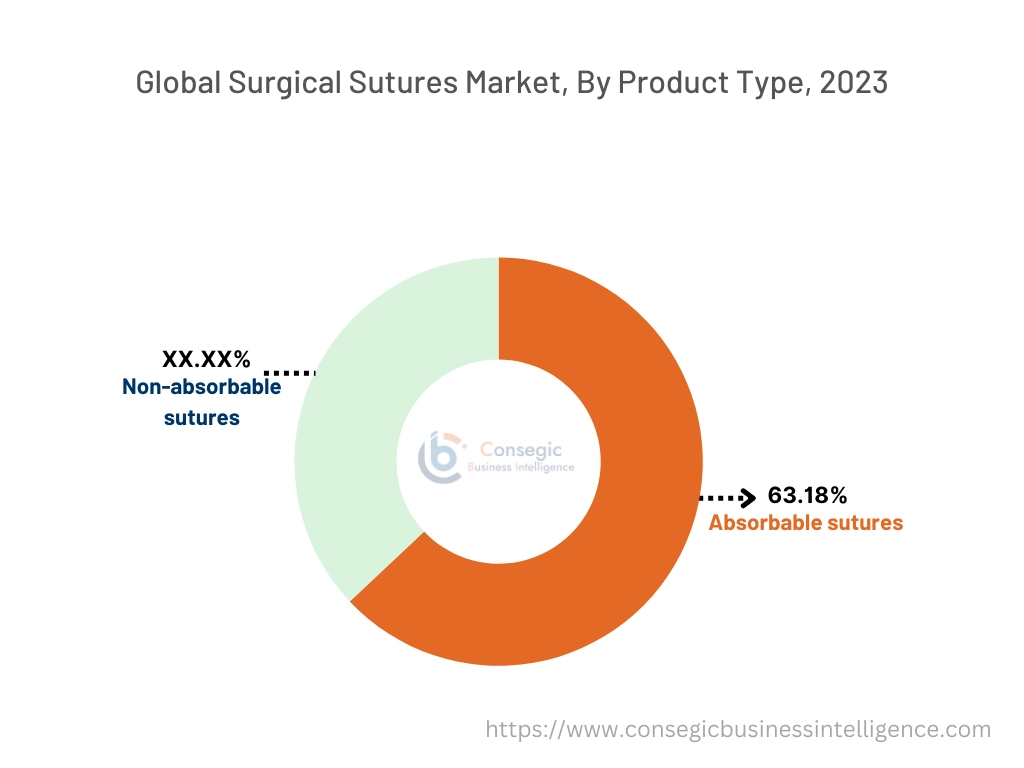

By Product Type:

Based on product type, the market is bifurcated into absorbable sutures and non-absorbable sutures.

The absorbable sutures segment accounted for the largest revenue share of 63.18% in 2023 and is anticipated to register the fastest CAGR during the forecast period.

- Absorbable sutures are designed to be naturally degraded and absorbed by the body over time, eliminating the need for removal post-surgery.

- These sutures are widely used in internal surgeries such as cardiovascular, orthopedic, and gynecological procedures, where natural tissue healing is critical.

- The global rise in surgical procedures and the growing preference for sutures that do not require follow-up for removal are driving the demand for absorbable sutures.

- Technological advancements in suture materials that offer enhanced tensile strength and control over absorption rates further support the rapid growth of this segment.

- Absorbable sutures lead the market, driven by their extensive use in internal surgeries and the convenience they offer by eliminating the need for removal. Innovations in suture materials continue to propel surgical sutures market growth.

By Material:

Based on material, the market is bifurcated into monofilament sutures and multifilament (braided) sutures.

The monofilament sutures segment accounted for the largest revenue of the total surgical sutures market share in 2023.

- Monofilament sutures consist of a single, smooth strand, which reduces tissue trauma and minimizes the risk of infection.

- These sutures are especially favored in cardiovascular and ophthalmic surgeries, where precision and minimal tissue reaction are crucial.

- The smooth surface of monofilament sutures also reduces the likelihood of bacterial growth, making them ideal for use in delicate or sensitive surgical areas.

- The increasing adoption of minimally invasive procedures, which require sutures that minimize tissue damage, drives the segment's dominance in the market.

- Monofilament sutures lead the market due to their ability to minimize tissue trauma and infection risks, making them suitable for cardiovascular and ophthalmic procedures, and boosting the surgical sutures market demand.

The multifilament (braided) sutures segment is expected to grow steadily during the forecast period.

- Multifilament sutures are composed of several intertwined strands, offering superior flexibility, knot security, and tensile strength.

- These qualities make them ideal for surgeries where strong wound closure is required, such as orthopedic and general surgeries.

- The superior handling and knotting capabilities of multifilament sutures make them essential in procedures involving high-tension areas, contributing to their steady progress.

- The segment is particularly supported by the growing number of complex surgeries that require strong and reliable sutures.

- Multifilament sutures are expected to experience steady growth, driven by their superior knot security and strength, making them essential for high-tension surgeries like orthopedic and general procedures, proliferating the surgical sutures market trends.

By Application:

Based on application, the market is segmented into cardiovascular surgery, general surgery, orthopedic surgery, gynecological surgery, ophthalmic surgery, cosmetic & plastic surgery, and others.

The cardiovascular surgery segment accounted for the largest revenue of the overall surgical sutures market share in 2023.

- Cardiovascular surgeries, including heart bypasses, valve repairs, and other critical procedures, require sutures with high tensile strength and durability.

- Both absorbable and monofilament sutures are commonly used in cardiovascular surgeries, where tissue compatibility and precise closures are critical.

- The increasing prevalence of cardiovascular diseases, coupled with advancements in cardiac surgical techniques, has driven the adoption of high-quality sutures in this segment.

- The precision and strength required in cardiovascular procedures make sutures indispensable, reinforcing this segment's market leadership.

- Cardiovascular surgery leads the market due to the rising incidence of cardiovascular diseases and the critical role sutures play in providing secure and reliable closures in high-risk procedures, leading the surgical sutures market expansion.

The orthopedic surgery segment is anticipated to register the fastest CAGR during the forecast period.

- Orthopedic surgeries, such as joint replacements, ligament repairs, and fracture fixations, require sutures that can withstand high tension and provide durable wound closures.

- Multifilament sutures are particularly favored in orthopedic procedures for their superior knot security and tensile strength.

- As the global population ages and the number of orthopedic surgeries, including treatments for conditions like osteoarthritis and fractures, increases, the adoption of surgical sutures in orthopedic applications is expected to grow rapidly.

- The segmental trends analysis shows that orthopedic surgery is expected to grow rapidly, driven by the increasing number of joint replacements, ligament repairs, and other high-tension surgeries requiring durable sutures, boosting the surgical sutures market trends.

By End-User:

Based on end-users, the market is segmented into hospitals & clinics, ambulatory surgical centers (ASCs), and specialty clinics.

The hospitals & clinics segment accounted for the largest revenue share in 2023.

- Hospitals and clinics perform the majority of surgeries worldwide, making them the largest consumers of surgical sutures.

- These facilities handle a wide range of complex procedures, including cardiovascular and orthopedic surgeries, which require significant suture use.

- The growing number of surgeries globally, particularly in developing regions where healthcare infrastructure is rapidly expanding, supports the dominant position of hospitals and clinics in the market.

- Furthermore, the demand for high-performance sutures in emergency and critical care settings reinforces their leadership in the market.

- Hospitals and clinics dominate the market as the largest consumers of surgical sutures, driven by the high volume of complex surgeries performed and the expansion of healthcare infrastructure, especially in developing regions, boosting the surgical sutures market expansion.

The ambulatory surgical centers (ASCs) segment is anticipated to register the fastest CAGR during the forecast period.

- Ambulatory surgical centers (ASCs) are becoming increasingly popular for outpatient procedures due to their cost-effectiveness and convenience.

- ASCs perform a variety of surgeries, including orthopedic, cosmetic, and general procedures, all of which require sutures for wound closure.

- The rising trend toward minimally invasive and outpatient surgeries, particularly in developed regions, is driving the adoption of surgical sutures in ASCs.

- The shorter recovery times and lower costs associated with ASCs make them an attractive option for patients and healthcare providers, contributing to the rapid growth of this segment.

- Thus, as per the analysis, ambulatory surgical centers are expected to grow rapidly as the demand for outpatient surgeries increases, driven by their cost-effectiveness and the rising trend toward minimally invasive procedures, proliferating the surgical sutures market opportunities.

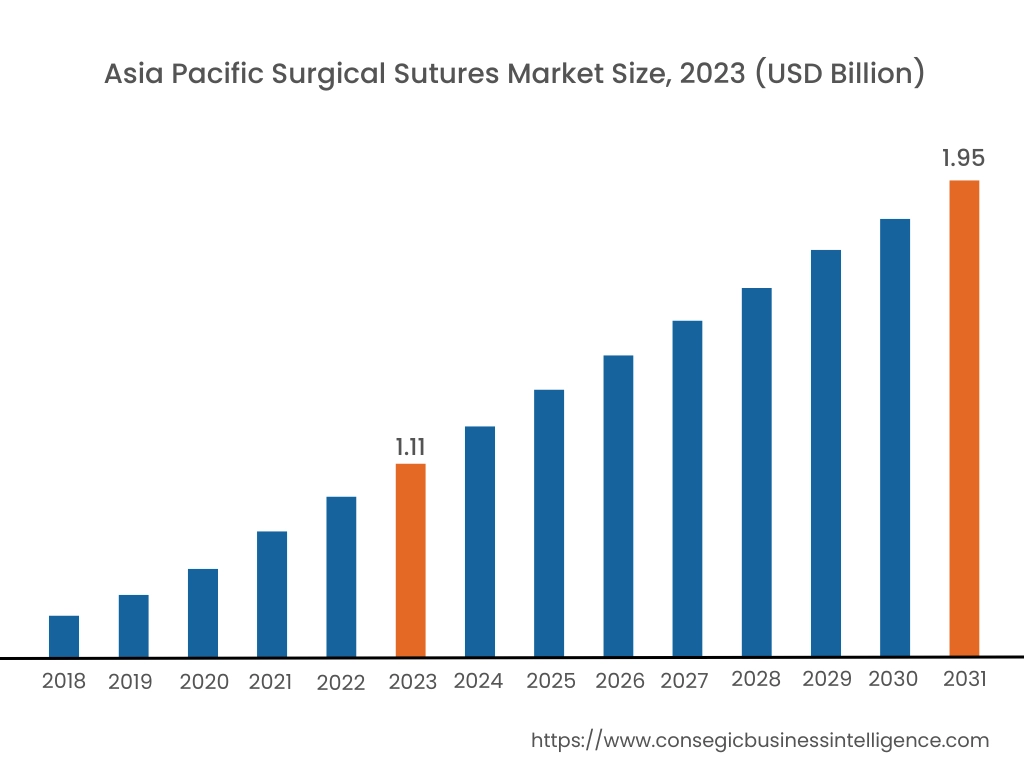

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 1.11 Billion in 2023. Moreover, it is projected to grow by USD 1.17 Billion in 2024 and reach over USD 1.95 Billion by 2031. Out of this, China accounted for 32.3% of the total market share. Asia-Pacific is the fastest-growing region in the surgical sutures market, fueled by the rising incidence of chronic diseases, improving healthcare infrastructure, and increasing healthcare investments in countries like China, India, and Japan. The growing number of surgeries, particularly in general surgery, gynecology, and orthopedics, is driving the adoption of sutures. Government initiatives to improve healthcare access and a rising medical tourism industry in countries like India and Thailand further support market development. However, limited access to advanced surgical technologies in rural areas remains a challenge.

North America dominates the market, driven by the high volume of surgical procedures, a well-established healthcare infrastructure, and the prevalence of chronic diseases requiring surgical intervention. The regional trends analysis depicts that The U.S. leads the region due to advancements in minimally invasive surgeries, the adoption of innovative suture materials, and a strong focus on patient safety and wound management. Increasing numbers of cosmetic surgeries and rising healthcare expenditure further boost the market. However, the high costs of advanced sutures and a shift towards surgical staplers may restrain market development.

As per the surgical sutures market analysis, Europe holds a significant share of the market, led by countries like Germany, the UK, and France. The region benefits from a robust healthcare system and an aging population, driving the adoption of surgical interventions, especially in cardiovascular and orthopedic surgeries. Additionally, advancements in suture materials, such as bioabsorbable and antimicrobial sutures, are contributing to market expansion. However, stringent regulatory frameworks and the increasing use of non-invasive surgical techniques could pose challenges to the market's expansion.

The Middle East & Africa region is seeing moderate growth in the market, particularly in Saudi Arabia, the UAE, and South Africa. The market is driven by increasing investments in healthcare infrastructure and the rising demand for surgical interventions, especially in trauma and emergency surgeries. The expansion of medical tourism in the UAE and Saudi Arabia, along with government initiatives to improve healthcare services, boosts the adoption of surgical sutures. However, limited access to advanced suturing materials in some African countries may hamper the market in the region.

The surgical sutures market analysis shows that Latin America is an emerging market, led by Brazil and Mexico. The region's market is driven by the rising number of surgeries related to trauma, cardiovascular diseases, and general surgeries, coupled with an improving healthcare system. Brazil's growing cosmetic surgery market and Mexico's increasing focus on healthcare access are key drivers of the market. However, economic instability and inconsistent healthcare funding in some countries may pose challenges to the market's potential.

Top Key Players & Market Share Insights:

The surgical sutures market is highly competitive with major players providing treatments to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global surgical sutures market. Key players in the surgical sutures industry include -

- Ethicon (Johnson & Johnson) (USA)

- Medtronic plc (Ireland)

- B. Braun Melsungen AG (Germany)

- Smith & Nephew plc (UK)

- Boston Scientific Corporation (USA)

- Teleflex Incorporated (USA)

- DemeTECH Corporation (USA)

- Internacional Farmacéutica (Mexico)

- Sutures India Pvt Ltd (India)

- Melsungen AG (Germany)

Recent Industry Developments :

Product Launches:

- In August 2023, Healthium Medtech introduced TRUMAS™, a specialized range of sutures tailored to address challenges in minimal access surgeries. This innovation aims to improve surgical outcomes in minimally invasive procedures.

Mergers and Acquisitions:

- In May 2024, KKR announced its acquisition of Healthium Medtech Ltd., a prominent Indian medical devices firm, from its private equity owner, Apax Partners, for an undisclosed amount.

Approvals:

- In September 2023, Genesis MedTech received approval from China's National Medical Products Administration (NMPA) to market antibacterial absorbable sutures. These sutures are designed to enhance healing and reduce infection risks.

- In October 2022, Healthium MedTech Limited, an international medical devices company specializing in surgical, post-surgical, and chronic care products, secured a new CE certification under the stringent EU Medical Device Regulation (EU MDR). This certification is essential for sales in European and other regulated markets, ensuring that manufacturers adhere to global safety standards to produce safe products.

Surgical Sutures Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 7.82 Billion |

| CAGR (2024-2031) | 6.3% |

| By Product Type |

|

| By Material |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Surgical Sutures Market? +

Surgical sutures market size is estimated to reach over USD 7.82 Billion by 2031 from a value of USD 4.78 Billion in 2023 and is projected to grow by USD 5.00 Billion in 2024, growing at a CAGR of 6.3% from 2024 to 2031.

What segmentation is covered in the Surgical Sutures Market Report? +

Segmentation based on product type, material, application, end-user, and region are covered in the report.

Which region will lead the Surgical Sutures Market? +

Asia Pacific will lead the surgical sutures market.

What are the major key players in the surgical sutures industry? +

Major key players in the industry are Ethicon (Johnson & Johnson) (USA), Medtronic plc (Ireland), B. Braun Melsungen AG (Germany), Smith & Nephew plc (UK), Boston Scientific Corporation (USA), Teleflex Incorporated (USA), DemeTECH Corporation (USA), Internacional Farmacéutica (Mexico), Sutures India Pvt Ltd (India), and Melsungen AG (Germany).