- Summary

- Table Of Content

- Methodology

Super Hard Materials Market Introduction :

Consegic Business Intelligence analyzes that the Super hard materials market is growing with a healthy CAGR of 5.5% during the forecast period (2023-2030), and the market is projected to be valued at USD 9,017.83 Million by 2030 from USD 5,910.83 Million in 2022.

Super Hard Materials Mairket Defintion & Overview:

Super hard materials are a type of material that has a hardness value exceeding 40 gigapascals (GPa) when measured by the Vickers hardness test. Super hard materials are primarily incompressible solids with excellent electron density and superior bond covalency. Furthermore, the key properties associated with super hard materials include tensile strength in the range of 70 to 110 and 45 to 60 GPa, oxidation at temperatures above 800 °C, superior mechanical properties, and others. As a result of the superior performance properties, super hard materials are utilized in various industries for applications, including, abrasives, disc brakes, polishing and cutting tools, wear-resistant, and protective coatings, among others. The major types of super hard materials include diamond, cubic boron nitride, and others.

Super Hard Materials Market Insights :

Key Drivers :

Booming building and construction activities at the global level

Diamond tools is a type of super hard material frequently require in construction sites to make rapid work of cutting through concrete surfaces. In addition, diamond tools are employed in the construction industry for polishing concrete floors. Thus, the increasing adoption of diamond tools in construction sites is fostering the demand for super hard materials as these are vital materials in diamond tools.

The factors such as increasing investments in residential building projects, government initiatives for infrastructure projects, and other factors are proliferating the building & construction activities growth at the global level. This, in turn, is driving the demand for super hard materials to break the hard surface, thereby spurring the growth of the global super hard materials market growth.

For instance, according to the United States Census Bureau, in 2020, the new residential construction projects commenced in the United States were 1,379.61 thousand units, and in 2021, it was 1,610 thousand units, an increase of 16.7% as compared with the year 2020. Thus, the growth of the construction industry in the United States is amplifying the super hard materials market growth.

Rising adoption of super hard materials in the electrical and electronics industry

The super hard material such as cubic boron nitride is an ideal solution for the electrical and electronic industry. The cubic boron nitride is equipped with various beneficial properties for electronics products, including superior insulating properties, wide band gap, and others. These properties ensure excellent thermal conductivity for electrical and electronic products such as semiconductors, and televisions, among others.

For instance, according to the recent statistics published by the German Electrical and Electronic Manufacturers' Association (ZVEI), in 2020, the German electronics market, which consists of products such as television, smartphones, and others was valued at EURO 128 billion (USD 146.2 billion), and in 2021, it was EUR0 140.8 billion (USD 166.5 billion). The German electrical & electronics industry registered a year-on-year growth rate of 11% in 2021. Hence, the growth of the electrical and electronics industry is fostering the demand for super hard materials to ensure superior insulating properties, which, in turn, is driving market growth.

Key Restraints :

The high cost of super hard materials is restraining the growth of the market

The overall cost of super hard material is dependent on the cost of production, followed by the cost of raw materials, transportation cost, electricity cost, labor cost, and others. The change in the above pricing factors has a direct implication on the overall pricing of super hard materials products.

For instance, according to the recent statistics published by the International Gem Society LLC. (IGS), the prices for synthetic diamonds in the range of 3 to 3.99 carats increased by 1.2% in 2020. The prime factors for the increase in the prices of synthetic diamonds were due to supply chain constraints, shortage of raw materials, and others. Hence, the factors such as higher transportation costs, supply constraints, and others are some of the prominent determinants fostering the prices of super hard materials, which, in, turn, is restraining the growth of the market.

Future Opportunities :

Future anticipated growth of the aerospace industry

The prime aspects such as reduction in the structural weight and fuel economy are primary considerations for aircraft manufacturers. Super hard materials such as diamond abrasives increase the precision lapping of aircraftparts in the production and service centers for aerospace.

For instance, according to the Airbus 2023-2042 forecast, the demand for new passengers and freighter aircraft will be 40,850 in the upcoming 20 years. Thus, it is evident from the above data that the aerospace industry will register growth in the long run. Henceforth, the growth of the aerospace industry will boost the demand for super hard materials as these materials are utilized in the manufacturing process of aircraft. This, in turn, will create a potential growth opportunity for the super hard materials in the upcoming years.

Super Hard Materials Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 9,017.83 Million |

| CAGR (2023-2030) | 5.5% |

| By Product Type | Diamond, Cubic Boron Nitride, and Others |

| By Form | Monocrystalline, Polycrystalline, and Composite |

| By End-use Industry | Aerospace, Building and Construction, Chemicals and Petrochemicals, Mining, Electrical and Electronics, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Element Six, ILJIN Diamond, Huanghe Whirlwind, SF Diamond, Besco Superabrasives, Henan Yalong Superhard Materials, Anhui HongJing, Hyperion Materials & Technologies, Zhengzhou E-Abrasive Superhard Materials Co., Ltd, and Zhengzhou Sino-Crystal Diamond Co., Ltd. |

Super Hard Materials Market Segmental Analysis :

Based on the Product Type :

The product type segment is categorized into diamond, cubic boron nitride, and others. In 2022, the diamond segment accounted for the highest market share in the super hard materials market. Diamond is equipped with various beneficial properties, including superior toughness, unparalleled, hardest abrasive, superior heat dissipation, the highest frequency filter, and others. These properties ensure the superior durability of the products. As a result, diamond is utilized in cutting tools and equipment in various end-use industries, including metallurgy, oil drilling, construction, aerospace, electrical & electronics, and others. For instance, according to the recent statistics published by Electronic System Design Alliance (ESD Alliance), in Q4 of 2021, the global electronics systems design revenue increased to 14.4% from USD 3,031.5 million in Q4 2020 to USD 3,468.2 million in Q4 of 2021. Moreover, the Americas reported the largest revenue followed by Asia Pacific and EMEA (Europe, Middle East, and Africa), generating a revenue of USD 1,577.2 million, USD 1,408.4 million, and USD 482.5 million respectively. Therefore, the growth of the above-mentioned industries at the global level is driving the overall demand for diamonds to ensure superior dielectric breakdown strength. This prime determinant is accelerating the growth of the market.

Furthermore, cubic boron nitride is expected to be the fastest-growing segment in the market over the forecast period. This is due to the increasing demand for cubic boron nitride in end-use industries such as building & construction, aerospace, chemicals, and others.

Based on the Form :

The form segment is categorized into monocrystalline, polycrystalline, and composite. In 2022, the monocrystalline segment accounted for the highest market share of 41.94% in the overall super hard materials market. The monocrystalline form of super hard materials has a superior thermal conductivity at room temperature of 33.2 W/cm°K. This is five times more as compared with the thermal conductivity of copper. Therefore, monocrystalline forms of super hard materials are employed for particularly demanding applications that have high tool wear. The monocrystalline form of super hard materials is utilized in the cutting tools in oil & gas drilling applications. For instance, in March 2022, Sinopec announced an investment of USD 31.10 billion in new oil and gas upstream projects in China. Thus, the increasing oil & gas drilling projects in key regions such as the Asia Pacific, the Middle East, and others will create a prominent opportunity for segment growth in the upcoming years.

However, composite is expected to be the fastest-growing segment during the forecast period because of the increasing production activities associated with electronics products, growth of construction activities, and others.

Based on the End-use Industry :

The application segment is categorized into aerospace, building and construction, chemicals and petrochemicals, mining, electrical and electronics, and others. In 2022, the building & construction segment accounted for the highest market share in the super hard materials market. Super hard materials have superior performance features such as excellent deformation resistance and thermal conduction. As a result of the above properties, super hard materials are an ideal choice for construction applications, including marble grinding wheels, wood & aluminum cutter blades, diamond electroplated glass cutter, and many more. For illustration, as of June 2023, various commercial projects are under the development phase in the Asia Pacific region, including USD 900 million Commerz III Commercial Office Complex in India (the completion year 2027), USD 500 million Shibaura 1-Chome Mixed-Use Complex in Japan (the completion year 2030), USD 92 million Cangnan County People's Hospital Phase II in China (the completion year 2024), and others. Hence, the ongoing commercial development projects in the Asia Pacific region will create a lucrative opportunity for super hard material demand growth as these materials are utilized in various construction equipment. This, in turn, will drive the market growth in the upcoming years.

However, the electrical and electronics segment is expected to be the fastest-growing segment in the super hard materials market during the forecast period. This is due to increasing investment in new manufacturing facilities, rising research & development activities, and others.

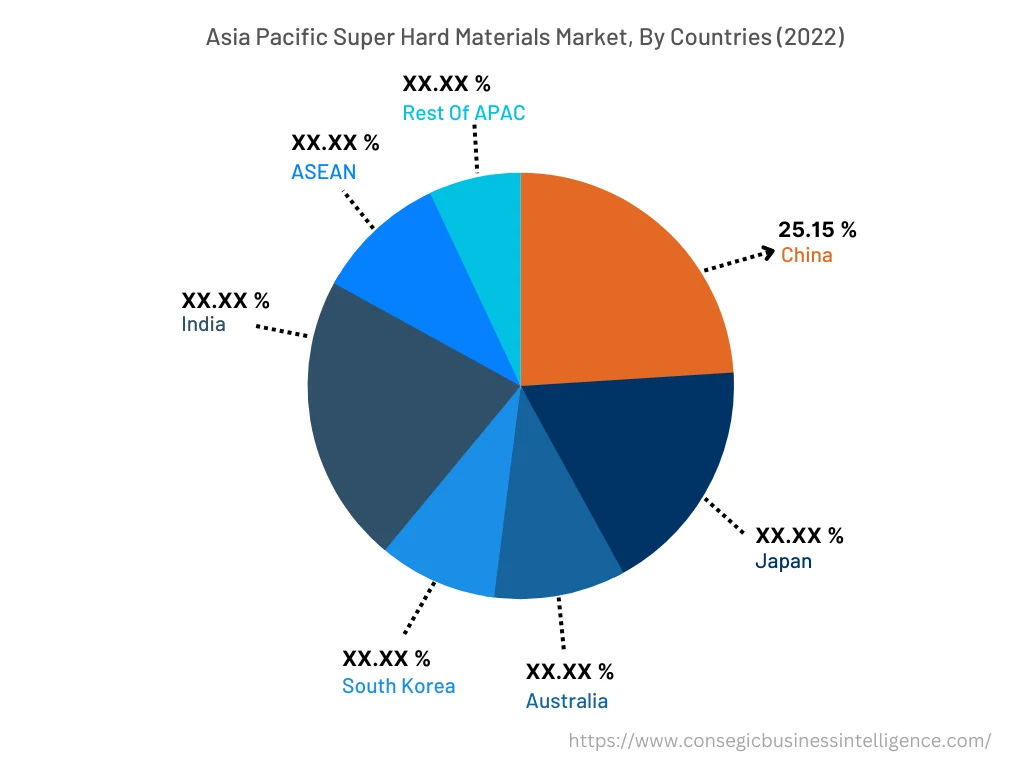

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

In 2022, Asia Pacific accounted for the highest market share at 37.20% and was valued at USD 2,198.83 million, and is expected to reach USD 3,366.36 million in 2030. In Asia Pacific, China accounted for the highest market share of 25.15% during the base year of 2022. This is due to the growth of the various end-use industries, including building & construction, chemical & petrochemicals, electrical & electronics, and others. For instance, in quarter 3 of 2021, the construction work commenced on USD 3,170 million Hamamatsucho Shibaura 1 Chome Redevelopment project in Tokyo, Japan. The project includes the development of a 550,000m2 multi-use building complex, which consists of two towers. The construction work is expected to complete by the end of 2030. Henceforth, the growth of the aforementioned industries in the region is accelerating the demand for super hard materials, thereby favoring market growth.

Furthermore, Europe is expected to witness significant growth over the forecast period, growing at a CAGR of 6.3% during 2023-20230. This is attributed to the growing demand for super hard materials from various end-use industries, including building & construction, aerospace, and others.

Top Key Players & Market Share Insights:

The super hard materials market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Element Six

- ILJIN Diamond

- Hyperion Materials & Technologies

- Zhengzhou E-Abrasive Superhard Materials Co., Ltd

- Zhengzhou Sino-Crystal Diamond Co., Ltd.

- Huanghe Whirlwind

- SF Diamond

- Besco Superabrasives

- Henan Yalong Superhard Materials

- Anhui HongJing

Recent Industry Developments :

- In June 2023, Hyperion Materials & Technologies, a leading manufacturer of super hard materials acquired Dura-Metal Products Corporation, a provider of Ultra-Hard Materials in the United States. The prime focus of this acquisition was to expand Hyperion Materials & Technology's market position in the United States.

Key Questions Answered in the Report

What was the market size of the super hard materials industry in 2022? +

In 2022, the market size of super hard materials was USD 5,910.83 million

What will be the potential market valuation for the super hard materials industry by 2030? +

In 2030, the market size of super hard materials will be expected to reach USD 9,017.83 million.

What are the key factors driving the growth of the super hard materials market? +

Booming building and construction activities at the global level are spurring the growth of the global super hard materials market.

What is the dominating segment in the super hard materials market by form? +

In 2022, the monocrystalline segment accounted for the highest market share of 41.94% in the overall super hard materials market.

Based on current market trends and future predictions, which geographical region is the dominating region in the super hard materials market? +

Asia Pacific accounted for the highest market share in the overall super hard materials market.