- Summary

- Table Of Content

- Methodology

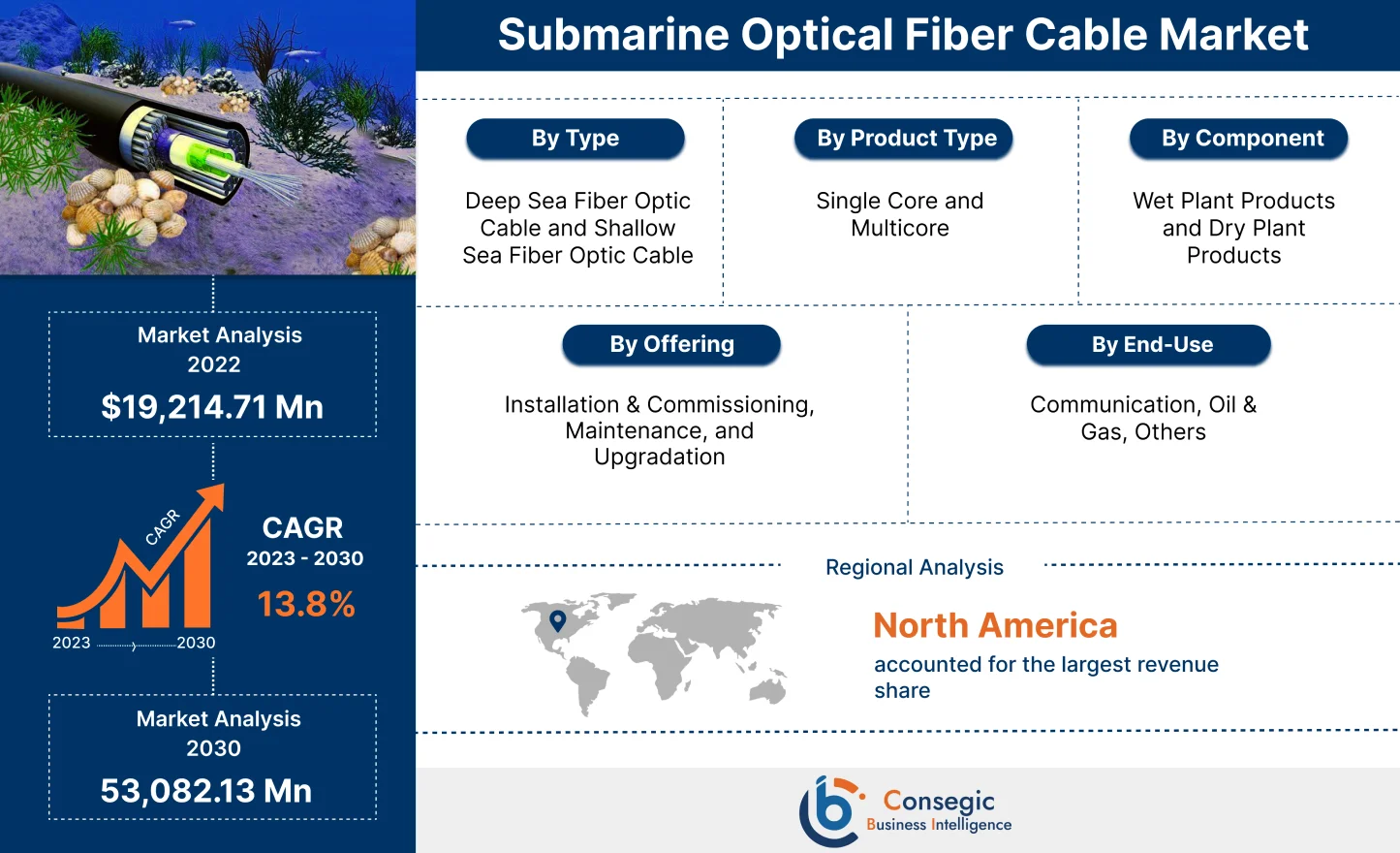

Submarine Optical Fiber Cable Market Size :

Submarine Optical Fiber Cable Market size is estimated to reach over USD 53,082.13 Million by 2030 from a value of USD 19,214.71 Million in 2022, growing at a CAGR of 13.8% from 2023 to 2030.

Submarine Optical Fiber Cable Market Scope & Overview:

Submarine optical fiber cables are advanced communication infrastructures laid beneath oceans and seas to transmit high-speed data across vast distances. These cables consist of multiple layers, including optical fibers, protective coatings, and metal sheaths, ensuring durability and reliable performance in underwater environments. Designed to support global internet, voice, and data traffic, submarine cables are critical for international communication and the smooth operation of cloud services, financial systems, and streaming platforms. They offer low-latency, high-capacity data transmission, making them integral to modern telecommunications. The cables are typically installed using specialized ships that carefully place them on the seabed, often spanning thousands of kilometers. As demand for faster internet and global connectivity grows, innovations such as ultra-high-capacity cables and resilient designs are shaping the market. Submarine optical fiber cables continue to play a foundational role in connecting continents, driving economic globalization, and enabling advanced communication technologies.

Submarine Optical Fiber Cable Market Insights :

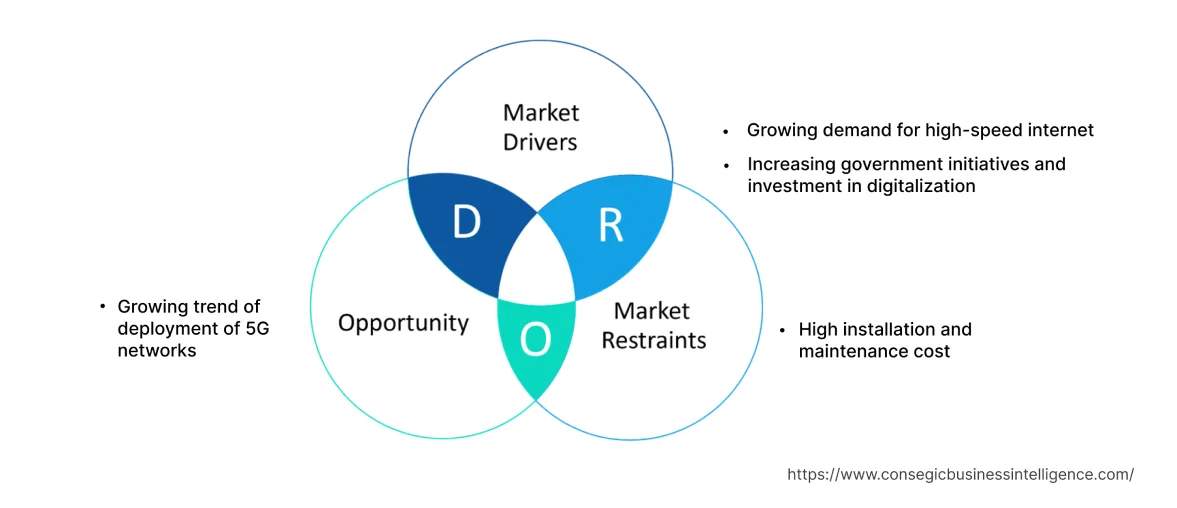

Key Drivers :

Growing demand for high-speed internet

The growing global reliance on digital connectivity is resulting in the increased need for high-speed internet connectivity. Submarine optical fiber cable plays a crucial role by providing the necessary infrastructure required for high-capacity & low-latency data transfer. Further, the need for seamless connectivity has surged due to the interconnected nature of businesses, organizations, and individuals worldwide. The optical fiber network is the primary means of data transfer and information exchange. For instance, in September 2022, the World Economic Forum published a report according to which, in 2021, 70% of homes in the European Union had high-speed internet connections compared to 13% in 2016.

In addition, the increased need for high-speed connectivity for data clouds and cloud computing is further driving the market. These cables are essential for interconnecting data centers and facilitating the transfer of vast amounts of data. The cables ensure efficient data transmission, low latency, and high reliability which in turn drives the global submarine optical fiber cable market growth.

Increasing government initiatives and investment in digitalization

Governments around the world are increasing investment in digitalization to boost economic growth and improve connectivity. Many governments have implemented national broadband plans aimed at expanding high-speed internet to promote digital inclusion. For instance, in August 2020, the Government of India inaugurated a submarine optical fiber network between Chennai and Andaman Nicobar Islands. The project was launched by the government to improve digital connectivity in the country.

Further governments are actively promoting digital transformation across various sectors including healthcare, education, transportation, and public services among others. Submarine optical fiber cables are vital for seamless data exchange and communication in the aforementioned sectors. Thus, considering the overall trend drives the submarine optical fiber cable market demand.

Key Restraints :

High installation and maintenance cost

The installation and maintenance of submarine cables involve complex processes and substantial investment. The installation of submarine optical fiber involves processes including marine surveys, cable lying, burial & plowing, and connection to land-based networks. Further, submarine cables are exposed to various risks including anchor damage, geological events, and natural disasters. The protection of the cables from the aforementioned trends requires additional investment in protective measures such as burying the cables or using heavy armoring.

Additionally, maintaining and repairing submarine cables is a challenging and costly endeavor. The maintenance of cables requires specialized vessels equipped with equipment & tools resulting in a further rise in the maintenance cost. Therefore, the high cost associated with the installation and maintenance of submarine optical fiber is limiting the market growth.

Future Opportunities :

Growing trend of deployment of 5G networks

The growing need for high-speed internet connectivity is resulting in the increased deployment of 5G networks. The network provides significant data speed enabling high-definition video streaming and seamless real-time gaming. Also, the growing trend for enhanced speed and capacity supports the increasing need for data-intensive applications and services. For instance, according to the International Trade Administration, NTT DOCOMO, one of the key telecom providers in Japan launched 5G services in March 2020. Further, the company plans to invest up to USD 7 billion by 2025 to expand the 5G network in the country. Additionally, according to Fitch Research, 4G subscriptions will start reducing in Japan and by 2026 the 5G technology will become dominant, and 5G subscriptions are expected to reach 151 million by 2029.

Moreover, the 5G networks provide less latency resulting in reduced time for information to travel which in turn results in the increased need for 5G networks. Thus, the growing need for high-speed connectivity and low latency is resulting in the growing deployment of 5G networks which in turn promotes submarine optical fiber cable market opportunities.

Submarine Optical Fiber Cable Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 53,082.13 Million |

| CAGR (2023-2030) | 13.8% |

| By Type | Deep Sea Fiber Optic Cable and Shallow Sea Fiber Optic Cable |

| By Product Type | Single Core and Multicore |

| By Component | Wet Plant Products and Dry Plant Products |

| By Offering | Installation & Commissioning, Maintenance, and Upgradation |

| By End-User | Communication, Oil & Gas, Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Fujitsu Limited, NEC Corporation, Ciena Corporation, ABB Ltd., SubCom, Xtera, Alcatel-Lucent Submarine Networks SAS, Cable & Wireless Communications Ltd., NTT World Engineering Marine Corporation, S. B. Submarine Systems Co., Ltd., Seaborn Networks LLC |

Submarine Optical Fiber Cable Market Segmental Analysis :

By Type :

The type segment is classified into deep-sea fiber optic cables and shallow-sea fiber optic cables. Among these, the deep-sea fiber optic cable segment dominated the market in 2022 and is projected to exhibit the highest CAGR during the forecast period. Deep-sea fiber optic cables are engineered to transmit data over extensive distances, connecting continents and islands. These cables are characterized by their robust construction, with multiple protective layers including polyethylene, steel wire armoring, and waterproof sheaths, ensuring durability against harsh underwater conditions such as high pressure and potential damages from maritime activities.

Deep-sea cables typically offer higher capacity and bandwidth compared to shallow-sea cables, enabling the handling of massive data traffic essential for global communication networks. These cables incorporate advanced technologies like Dense Wavelength Division Multiplexing (DWDM), allowing them to transmit multiple data channels simultaneously, further enhancing their efficiency. The rising demand for high-speed, low-latency data transmission and the expansion of cloud services and global internet infrastructure are key drivers fueling the growth of the deep-sea fiber optic cable segment.

By Product Type :

The product type segment is divided into single-core and multicore fiber optic cables. In 2022, the multicore segment held the largest market share and is expected to grow at the fastest CAGR during the forecast period. Multicore fiber optic cables are increasingly favored due to their ability to support higher bandwidth and enhanced data transmission efficiency. Unlike single-core cables, which contain a single optical fiber, multicore cables consist of multiple optical fibers within a single sheath. This configuration enables parallel data transmission, significantly increasing data rates and reducing latency.

The demand for multicore cables is driven by the exponential growth in data traffic from cloud computing, video streaming, and 5G networks. Additionally, these cables offer reduced spatial and power consumption compared to multiple single-core cables, making them cost-effective and environmentally efficient for large-scale deployments. The ability of multicore cables to transmit multiple independent signals or data streams simultaneously positions them as a critical component in the evolving global telecommunication infrastructure.

By Component :

The component segment is divided into wet plant products and dry plant products. The wet plant products segment held the largest market share in 2022 and is expected to grow at the highest CAGR during the forecast period. Wet plant products include the physical submarine cables and other essential components that are deployed underwater. The demand for wet plant products is primarily driven by their critical role in ensuring the durability, seawater resistance, and flexibility of submarine optical fiber cables. These cables are exposed to a harsh and corrosive underwater environment, where factors like salinity, pressure, and mechanical stresses can significantly impact their performance.

Wet plant products are specifically designed to offer superior protection against water penetration, which is vital for maintaining long-term integrity and preventing degradation due to corrosion. With increasing data traffic and the need for reliable, high-capacity transmission across oceans, wet plant products have become indispensable in modern submarine optical fiber infrastructure. The robust design of these products enhances cable performance, ensuring better reliability and longevity, thus boosting their market demand in the global submarine optical fiber cable market.

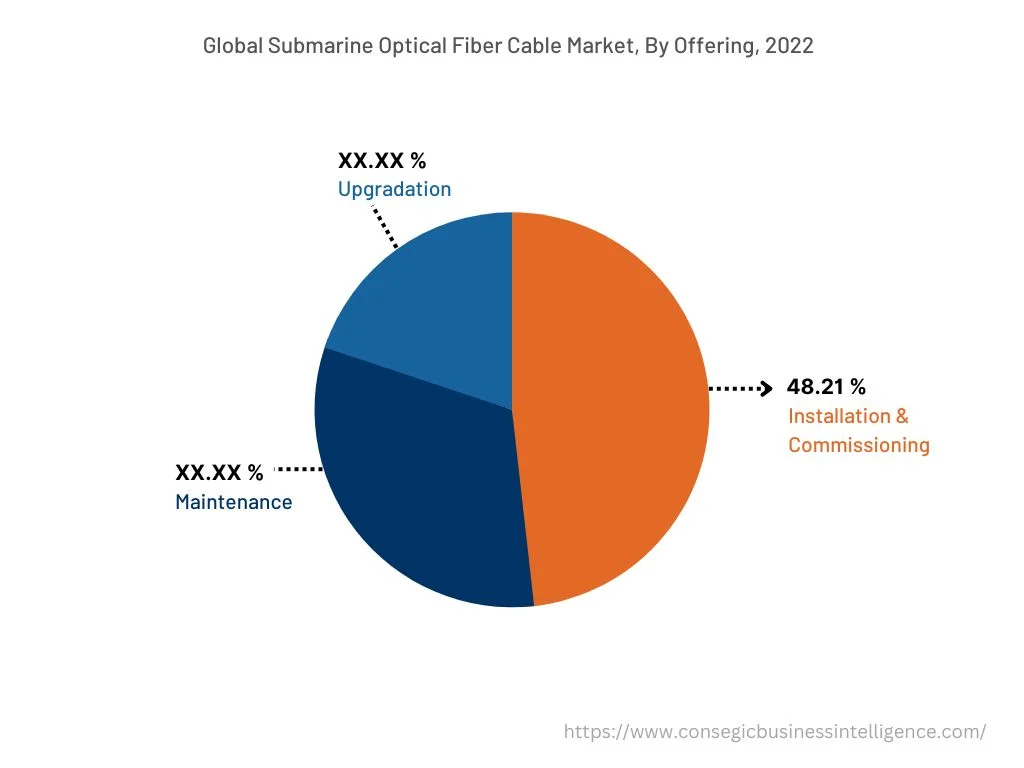

By Offering :

The Offering segment is categorized into installation & commissioning, maintenance, and upgradation. In 2022, the installation & commissioning segment held the largest market share and is expected to continue dominating the market during the forecast period. The growth in the installation and commissioning of submarine optical fiber cables is primarily driven by the rapid increase in global internet traffic, fueled by the growing number of connected devices, cloud computing, video streaming, and digital services. As the demand for higher bandwidth and faster data transfer increases, the installation of new submarine cables becomes crucial in ensuring seamless global connectivity. These cables are instrumental in meeting the needs of international communication, supporting industries like e-commerce, finance, and media. Submarine fiber optic cables also play a significant role in fostering economic growth and development by improving communication infrastructure.

For instance, in October 2021, NEC Corporation received a contract to lay a subsea fiber cable network between Kochi and Lakshadweep in India, highlighting the strategic importance of these installations. The growing emphasis on infrastructure expansion and the need for high-capacity data transmission is expected to drive the continued expansion of the installation & commissioning segment.

By End-User :

The end-user segment is classified into communication, oil & gas, and others. The communication segment accounts for the largest market share in 2022 and is likely to grow with the highest CAGR. The several factors driving the demand for optic fiber cable in communication include increasing bandwidth requirements, global connectivity, a growing number of data centers, and government initiatives among others. The need for global connectivity is growing as individuals and organizations around the world are becoming more interconnected. The submarine fiber optic cable provides infrastructure for high-speed communication between different countries. In addition, the rising trend in the adoption of cloud services and the establishment of data centers around the world are resulting in an increased need for these cables. For instance, in May 2022, Telstra announced the first direct subsea cable to connect Australia with the US. The subsea connectivity between Asia Pacific and the US is expected to meet the growing demand for high-speed data communication in the region. Thus, the analysis depicts that the aforementioned factors drive the submarine optical fiber cable market trends and opportunities.

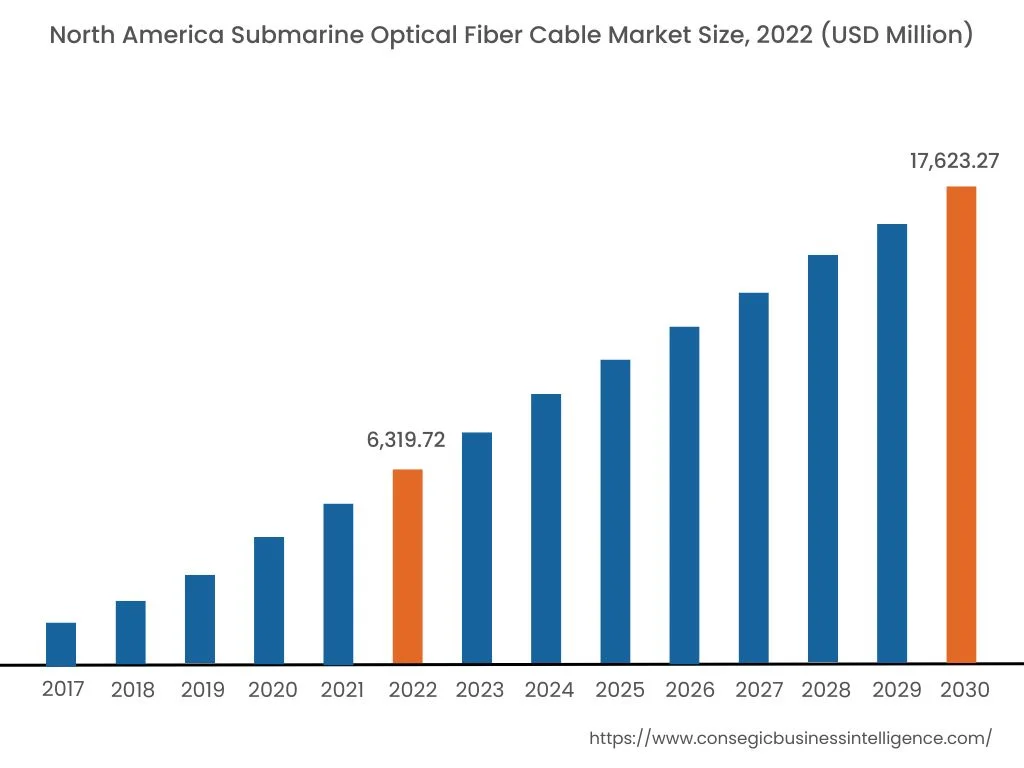

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2022 valued at USD 6,319.72 Million and is projected to grow at a CAGR of 13.9% during the forecast period. The growth is attributed to the increasing internet usage in the region for a wide range of applications including digital devices, online services, and streaming platforms among others. Further, people rely on the Internet for various activities including communication, entertainment, education, and e-commerce among others. Consequently, the rising demand from data centers for efficient transfer of data is primarily responsible for boosting the submarine fiber optic cable market opportunities in the region. For instance, in August 2022, according to Cushman and Wakefield, the Northern Virginia region was the largest data center market that needed high-speed internet connectivity for operation. The surge in data centers is contributing considerably to propelling the industry in North America.

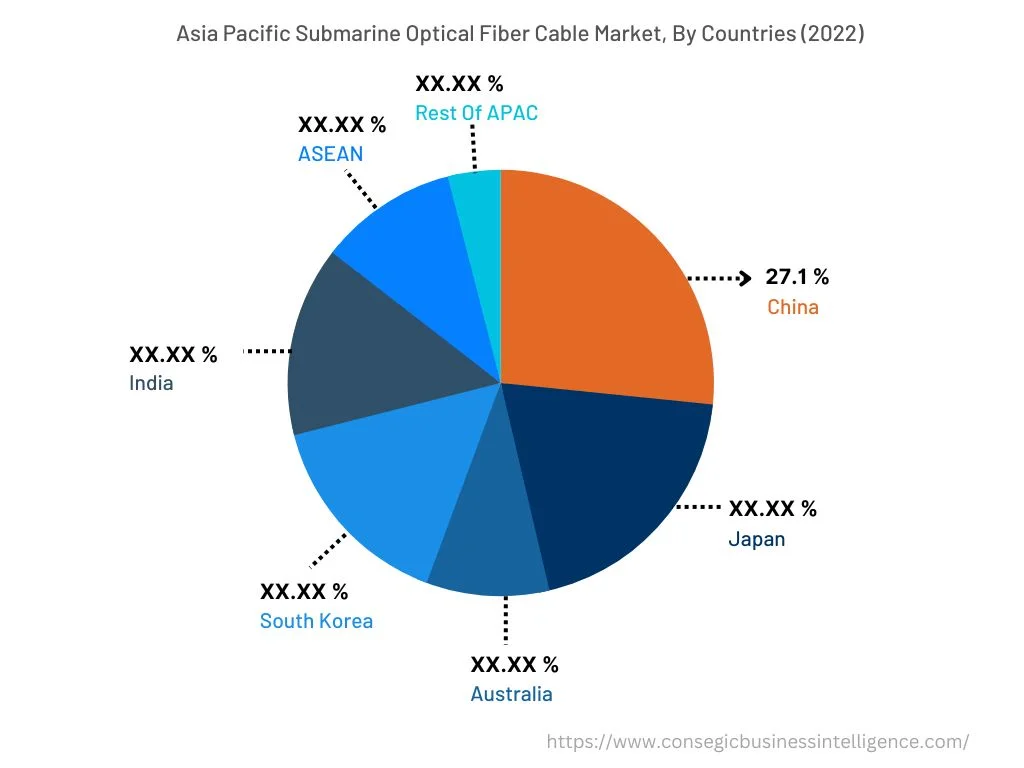

Asia Pacific accounted for USD 4,590.39 Million in 2022 and is anticipated to witness the fastest CAGR of 14.1% in the submarine optical fiber cable market during the forecast period. In addition, in the region, China accounted for the maximum revenue share of 27.1% in the year 2022. This is attributed to the increasing trend of economic growth and digitalization in the region. The Asia Pacific region is home to a large and rapidly growing middle-class segment which is resulting in an increased demand for internet usage. Further, submarine optical fiber cable market analysis shows that the growing penetration of the internet in rural areas and the increasing adoption of smartphones are driving the submarine optical fiber cable market trend.

Top Key Players & Market Share Insights:

The competitive landscape of the submarine optical fiber cable market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), market analysis, product innovation, various business strategies, and application launches have accelerated the submarine optical fiber cable market growth. Key players in the submarine optical fiber cable industry include-

- Fujitsu Limited

- NEC Corporation

- Ciena Corporation

- ABB Ltd.

- SubCom

- Xtera

- Alcatel-Lucent Submarine Networks SAS

- Cable & Wireless Communications Ltd.

- NTT World Engineering Marine Corporation

- S. B. Submarine Systems Co., Ltd.

- Seaborn Networks LLC

Recent Industry Developments :

- In July 2022, NEC Corporation launched a high-capacity multi-core optical transmission system. The multi-core fiber cable has a high demand which is expected to boost the company's market presence.

- In October 2021, Xtera and GCS Pte. Ltd. launched the construction of the Galapagos Cable System. The cable system has a design capacity of 20 terabits per second and the state-of-the-art submarine system is expected to increase the regional bandwidth by more than 2,500 times.

Key Questions Answered in the Report

What is Submarine Optical Fiber Cable? +

A Submarine Optical Fiber Cable is referred to as a networking device capable of transferring data between an Ethernet local area network and a computers or a device’s serial port.

What specific segmentation details are covered in the Submarine Optical Fiber Cable Market report, and how is the dominating segment impacting the market growth? +

The report consists of segments including type, product type, component, offering and end use. Each segment has a key dominating sub-segment being driven by industry trends and market dynamics. For instance, the type segment has witnessed Deep Sea Fiber Optic Cable as the dominating segment in the year 2022. The growth is attributed to the increasing application of cable to meet the growing demand for high sped internet.

What specific segmentation details are covered in the Submarine Optical Fiber Cable market report, and how is the fastest segment anticipated to impact the market growth? +

The report consists of segments including type, product type, component, offering and end use. Each segment is projected to have the fastest-growing sub-segment fueled by industry trends and drivers. For instance, in offering segment, the installation & commissioning is anticipated to witness the fastest CAGR growth during the forecast period. The growth is attributed to the growing need for connectivity for transfer of data an communication among different regions.

What specific segmentation details are covered in the Submarine Optical Fiber Cable market report, and how does each dominating segment is influencing the demand globally? +

As aforementioned, each dominating segment is influencing the demand globally due to growing industrial needs. Moreover, fluctuation in demand being witnessed from different sectors is responsible for driving the Submarine Optical Fiber Cable market.