- Summary

- Table Of Content

- Methodology

Sprockets Market Introduction :

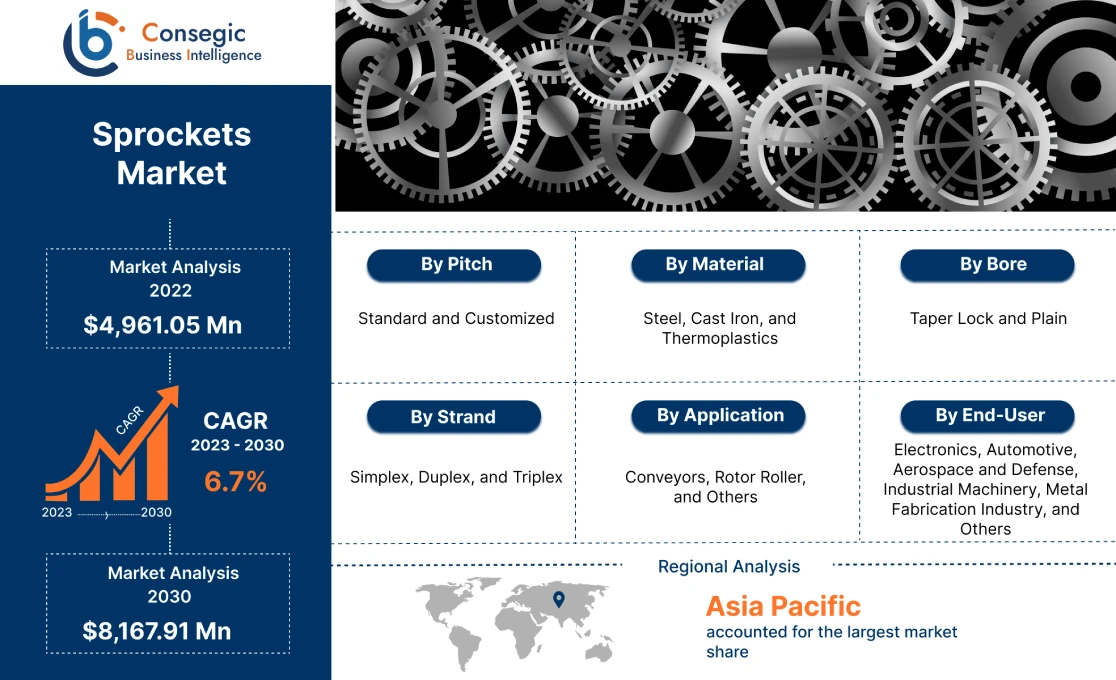

Sprockets Market is estimated to reach over USD 8,167.91 Million by 2030 from a value of USD 4,961.05 Million in 2022, growing at a CAGR of 6.7% from 2023 to 2030.

Sprockets Market Definition & Overview:

Sprockets are defined as mechanical devices employed in various systems including industrial machinery and equipment that involve the transmission of rotary motion. Sprockets are utilized in conjunction with chains, belts, and other toothed components to transmit power and motion between rotating shafts. Additionally, sprockets consist of a circular disc or wheel with evenly spaced teeth around the periphery and are installed in conveyors, escalators, motorcycles, automobiles, and manufacturing systems. Sprockets are responsible for transmitting power, controlling speed ratios, and facilitating the precise positioning of components within a system.

Sprockets Market Insights :

Key Drivers :

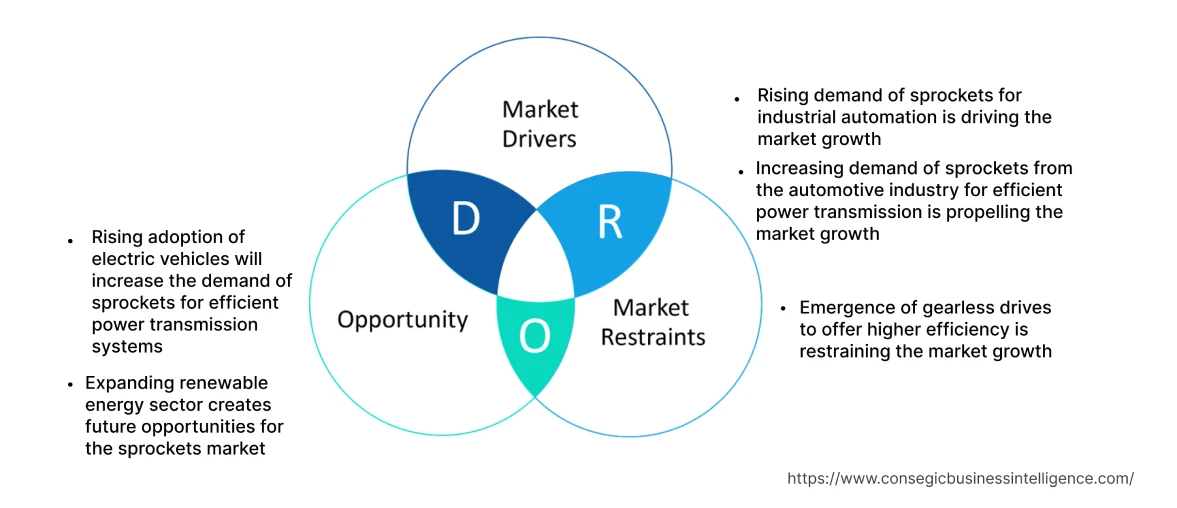

Rising demand of sprockets for industrial automation is driving the market growth

Industrial automation involves the integration of various machinery and equipment to streamline production processes and sprockets play a crucial role in power transmission within automated systems. Sprockets enable the smooth transfer of rotational motion between different components namely motors, gears, and conveyors, ensuring the synchronized operation of the entire system. Additionally, conveyor systems are extensively deployed in automated manufacturing and logistics operations. Sprockets, along with chains and belts form an integral part of conveyor systems, thus facilitating the movement of materials and components along the production line. Moreover, the ability of sprockets to effectively manage the torque to produce greater efficiency and energy-saving capabilities is also driving the market growth. For instance, in May 2020, U.S. Tsubaki Power Transmission LLC launched a torque limiter sprocket to effectively manage the speed of the torque in an automated system. The product is designed to offer protection and a powerful and long-lasting torque limiting solution, thus contributing remarkably in accelerating the growth of the market.

Increasing demand of sprockets from the automotive industry for efficient power transmission is propelling the market growth

Sprockets in conjunction with chains or belts form the primary power transmission system, transferring power from the engine to the rear wheel in two-wheeler vehicles including motorcycles, scooters, and mopeds. Similarly, in bicycles sprockets and chains are deployed for pedaling power transmission to offer improved efficiency. Additionally, sprockets offer superior strength at a low noise level to two-wheelers, further contributing significantly in driving the market growth. For instance, in March 2021, SKF India launched three products namely timing belts and steering, chain and sprockets for 2-wheeler, and suspension systems for 4-wheelers. The sprockets are responsible for delivering superior strength, high quality, and long life to the vehicle, thus driving the growth of the sprockets market.

Key Restraints :

Emergence of gearless drives to offer higher efficiency is restraining the market growth

Gearless drives, also known as direct drives eliminate the need for sprockets and gears by directly connecting the motor to the driven load. Gearless drives employ technologies including permanent magnet motors and synchronous reluctance motors to offer advantages including higher efficiency, reduced maintenance, and compact design. Additionally, by eliminating the need for sprockets, gearless drives minimize energy losses associated with power transmission through mechanical components, resulting in higher overall system efficiency. Consequently, the emergence of gearless drives is limiting the adoption of sprockets, thus impeding the growth of the sprockets market.

Future Opportunities :

Rising adoption of electric vehicles will increase the demand of sprockets for efficient power transmission systems

Electric vehicles require efficient power transmission systems to transfer torque from the electric motor to the wheels and sprockets play a critical role in power transmission, coupled with chains or belts. Additionally, electric vehicles place a strong emphasis on lightweight and efficient components to maximize range and overall performance. Sprocket manufacturers seize the opportunity by developing lightweight sprockets made from advanced materials namely high-strength alloys and composites. Therefore, sprockets contribute significantly in reducing the overall weight of EVs and also improving energy efficiency. Consequently, with the rising number of electric vehicles the demand for sprockets to allow efficient transmission of the power is also expected to increase. For instance, in April 2023, according to International Energy Agency (IEA), more than 10 million electric cars were sold worldwide in 2022, and the sales are projected to grow by 35% in 2023 accounting for 14 million. The increase in sales of electric cars is thus projected to create potential opportunities for the growth of the sprockets market.

Expanding renewable energy sector creates future opportunities for the sprockets market

Wind turbines are a vital component of the renewable energy sector that relies on sprockets for power transmission between the rotor and generator. The rising need for wind energy increases the demand for sprockets to withstand the high loads and harsh operating conditions in wind turbine systems. Additionally, the emergence of solar tracking systems to maximize the efficiency of solar panels by adjusting the panel position to capture the maximum amount of sunlight is also expected to drive market growth in upcoming years. Sprockets play a crucial role in solar systems, enabling the movement and positioning of solar panels. Subsequently, the expanding renewable energy sector is anticipated to create potential opportunities for the growth of the sprockets market. For instance, in September 2022, according to International Energy Agency (IEA), the renewable share is expected to grow from 29% in 2021 to 60% by 2030. The expanding renewable energy sector is thus expected to contribute notably in the upcoming year.

Sprockets Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 8,167.91 Million |

| CAGR (2023-2030) | 6.7% |

| By Pitch | Standard and Customized |

| By Material | Steel, Cast Iron, and Thermoplastics |

| By Bore | Taper Lock and Plain |

| By Strand | Simplex, Duplex, and Triplex |

| By Application | Conveyors, Rotor Roller, and Others |

| By End-User | Electronics, Automotive, Aerospace and Defense, Industrial Machinery, Metal Fabrication Industry, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Players | ABL Products Inc., Allied-Locke Industries Inc., AB SKF, B&B Manufacturing, G&G Manufacturing, Industrias Dolz, S.A., International Association for Measurement and Evaluation of Communication (AMEC), Linn Gear Co., Martin Sprocket & Gear, Maurey Manufacturing Corporation |

Sprockets Market Segmental Analysis :

Based on the Pitch :

The pitch segment is bifurcated into standard and customized. The standard pitch segment accounted for the largest market share in 2022 as the standard pitch is a cost-effective option in comparison to the customized pitch. Additionally, standard pitch sprockets adhere to widely accepted industry standards including American National Standards Institute (ANSI) and International Organization for Standardization (ISO). The above-mentioned standards ensure compatibility between sprockets and chains, safeguarding customers from purchasing standard pitch sprockets and integrating into the existing systems. For instance, the International Organization for Standardization (ISO) 1275.2006 is a standard that is applicable to sprockets with 5 to 75 teeth and the preferred numbers of teeth are 7, 9, 10, 11, 13, 19, 27, 38 and 57. Consequently, the acceptance of standard pitch sprockets by ANSI creating a large customer base, contributes significantly in driving the growth of the segment.

Customizable pitch sprockets are expected to register the fastest CAGR in the market as customizable sprockets offer the advantage of being tailored to meet specific customer requirements. Customized sprockets are designed with unique pitch sizes and tooth profiles to address specific application needs. Additionally, industries that require specialized power transmission solutions, non-standard equipment configurations, or compatibility with legacy systems often opt for customizable pitch sprockets. Moreover, customizable pitch sprockets allow for the precise optimization of power transmission systems by tailoring the pitch size and tooth profile to enhance system efficiency, reduce energy losses, improve performance, and extend equipment lifespan. In conclusion, the aforementioned factors are collectively responsible in accelerating the growth of the sprockets market.

Based on the Bore :

The bore segment is bifurcated into taper lock and plain. Taper lock bores accounted for the largest market share in 2022 and are also expected to register the fastest CAGR during the forecast period. The growth is attributed to the ability of taper lock bore sprockets to provide a secure and reliable connection between the sprocket and the shaft. The taper lock design ensures a tight fit, minimizing the chances of slippage or misalignment during operation. The secure connection enhances the overall efficiency and performance of the power transmission system, reducing the risk of equipment damage and downtime. Consequently, the ability of taper lock bores to provide a safe and reliable connection is the key factor responsible for driving the growth of the segment in the upcoming years.

Based on the Material :

The material segment is categorized into steel, cast iron, and thermoplastics. Steel accounted for the largest market share in 2022 as steel sprockets are deployed across diverse industries, including manufacturing, automotive, mining, construction, and agriculture. Steel is suitable for a broad range of power transmission systems, from light-duty to heavy-duty machinery owing to its exceptional strength and durability. Additionally, steel withstands high loads, shocks, and continuous operation, becoming an ideal material for power transmission components. Moreover, the advancements in technology including the diamond cut manufacturing method ensuring the smooth operation of the industrial process is also driving the market growth. For instance, in October 2021, ProX introduced ProX steel rear sprockets to offer improved durability for various industrial applications. The lightweight design provides ProX ultralight steel rear sprockets with up to 35% weight savings in comparison to standard steel sprockets and enhanced longevity even in extreme riding conditions.

Thermoplastics are anticipated to register the fastest CAGR in the sprockets market as thermoplastics namely nylon and polyethylene are lightweight materials that are easily molded into complex shapes, allowing for customizations. The lightweight nature of thermoplastics contributes to reduced inertia and energy consumption in power transmission systems. In addition, thermoplastics are inherently resistant to corrosion and suitable for environmental applications where moisture, chemicals, or exposure to harsh substances are concerns. Furthermore, industries including food processing, pharmaceuticals, and chemical manufacturing that require resistance to corrosive elements raise the demand for thermoplastic sprockets, which in turn, is expected to promote market growth.

Based on the Strand :

The strand segment is classified into simplex, duplex, and triplex. Simplex sprockets accounted for the largest market share in 2022 as simplex sprockets offer a simple and cost-effective solution for power transmission. Additionally, simplex sprockets have fewer teeth and require only one chain for operation, thus reducing the complexity of the system. Moreover, industry standards including ANSI (American National Standards Institute) and ISO (International Organization for Standardization), provide standardized dimensions and specifications for simplex sprockets. The standardization ensures compatibility between sprockets and chains safeguarding customers to purchase standard pitch sprockets and integrate into the existing systems. Consequently, the acceptance of simplex sprockets by ANSI and ISO to reduce the complexity of the system creating a large customer base, contributes significantly in driving the growth of the segment.

Duplex sprockets are predicted to witness the fastest CAGR in the market during the forecast period. Duplex sprockets with two parallel strands of teeth, provide higher power transmission capacity compared to simplex sprockets. The additional strand allows for engagement with two chains simultaneously, distributing the load across both strands. The increased capacity is suitable for applications that require higher torque or power transmission including heavy-duty machinery or equipment. Additionally, duplex sprockets distribute the load across two chains, reducing the strain on individual chains and sprocket teeth. The load distribution minimizes wear and tear and enhances the longevity of both the sprockets and the chains. In conclusion, the ability of duplex sprockets to distribute the load more evenly along with offering durability and longevity is predicted to accelerate the market growth in the upcoming years.

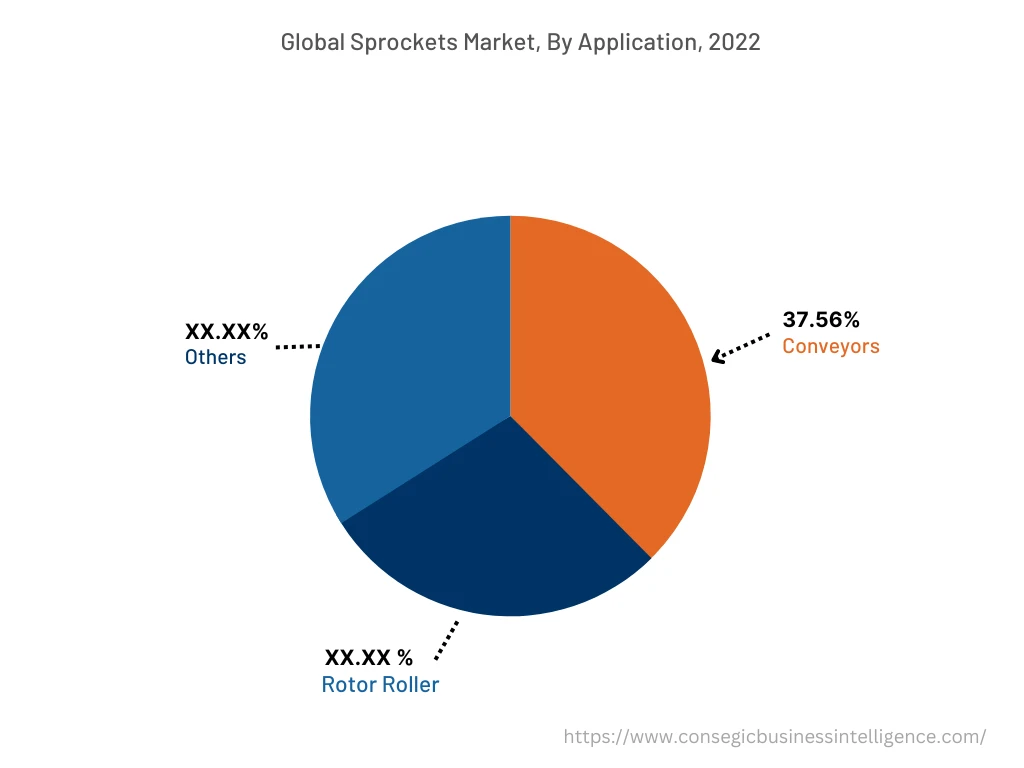

Based on the Application :

The application segment is divided into conveyors, rotor rollers, and others. Conveyors accounted for the largest market share of 37.56% in 2022 as conveyors are widely employed in various industries including manufacturing, logistics, warehousing, and distribution. Additionally, conveyor sprockets are versatile to handle a wide range of products from small packages to heavy loads to provide smooth and efficient movement of materials. Moreover, the ability of sprockets to reduce downtime, provide greater reliability, and increase savings for conveyor systems in forestry and metal recycling facilities is also propelling the market growth. For instance, in May 2023, U.S. Tsubaki power transmission launched dura drum sprockets for heavy-duty operations and to reduce downtime for conveyor systems in forestry and metal recycling facilities. The product is designed to improve connectivity, reliability, and longevity, thus contributing notably in bolstering the market growth.

Rotor rollers are projected to witness the fastest CAGR during the forecast period in the sprockets market. Rotor rollers sprockets are designed to withstand heavy loads and are constructed with durable materials including steel and thermoplastics to ensure that the sprockets support the weight of heavy items. Additionally, rotor rollers are known for their excellent reliability and durability and the sprockets ensure smooth and consistent movement of products, minimizing the risk of jams or disruptions in the material flow. Consequently, the capability of sprockets to withstand continuous environmental exposure owing to the improved durability is expected to drive the market growth in the upcoming years.

Based on the End-User :

The end-user segment is classified into electronics, automotive, aerospace and defense, industrial machinery, metal fabrication industry, and others. The automotive industry accounted for the largest market share in 2022 as sprockets are deployed in the timing belt drive system of internal combustion engines. The timing belt that connects the crankshaft and the camshaft relies on sprockets to ensure precise synchronization of the engine's valves and pistons. In addition, sprockets are also employed in the transmission systems of both manual and automatic vehicles. In manual transmissions, sprockets are a part of the gear mechanism, engaging with the chain or gear teeth to transmit power from the engine to the wheels. In automatic transmissions, sprockets are deployed in the torque converter to facilitate smooth power transfer between the engine and the transmission. Consequently, the surge in the number of vehicles owing to the expanding automotive industry is increasing the demand of sprockets, which in turn, promotes market growth. For instance, in April 2023, according to India Brand Equity Foundation (IBEF), the passenger car market of India was sized at USD 32.70 billion in 2021 and is projected to reach USD 54.84 billion by 2027, witnessing a CAGR of 9% between 2022-2027. The growing automotive sector thus contributes significantly in driving the market growth.

The industrial machinery segment is predicted to witness the fastest CAGR in the sprockets market during the forecast period. The growth of the market is endorsed by the increasing adoption of sprockets in conveyor systems to facilitate the movement of materials and products along the conveyor line is driving the market growth. Additionally, sprockets are also employed in machinery drives to transmit power from a motor to various components including chain drives to transfer rotational motion and torque to different parts of the machinery. Furthermore, the increasing applications of sprockets in material handling equipment including forklifts, cranes, and hoists to transmit power and control the movement of lifting mechanisms is also boosting the market growth. The aforementioned factors including the conveyor systems, machinery drives, and material handling contribute collectively in accelerating the market growth during the forecast period.

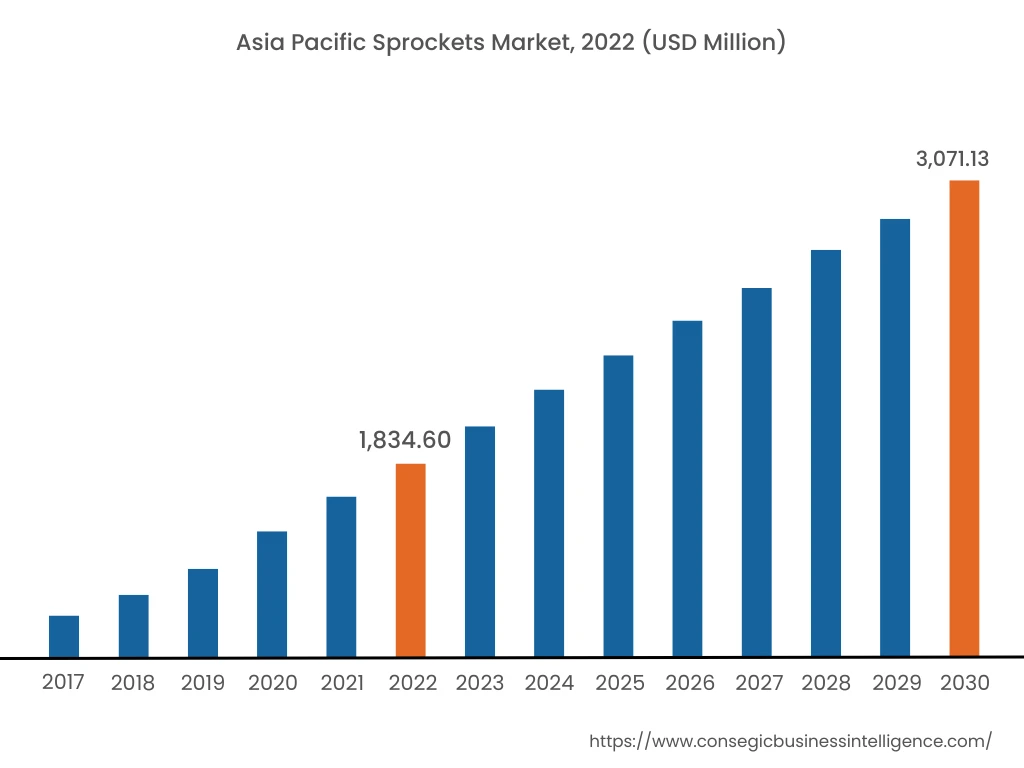

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific accounted for the largest market share of USD 1834.60 million in 2022 and is anticipated to witness the fastest CAGR of 7.0% accounting to USD 3071.13 million in the sprockets market during the forecast period. In addition, in the region, China accounted for the maximum revenue share of 27.6% in the year 2022. The growth of the market is attributed to the expanding automotive industry in countries including China, Japan, and South Korea. Sprockets play a vital role in automotive applications namely timing belt drives, transmission systems, and power steering systems, driving the growth of the market in the region. Additionally, Asia Pacific encompasses a large manufacturing sector that requires sprockets for various applications, including conveyor systems, machinery drives, and material handling equipment. Consequently, the growing manufacturing sector serves as the major driver for the growth of the sprockets market in the region. For instance, in February 2023, according to National Statistical Office, the second revised estimate of the Indian manufacturing sector in 2020-21 was INR 23,25,438 crore and the revised estimate for 2021-22 was INR 25,82,473 crore witnessing a rise of 11.1%. The growth in the manufacturing sector thus contributes remarkably in bolstering the market growth in Asia Pacific countries.

Top Key Players & Market Share Insights:

The competitive landscape of the Sprockets market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and application launches have accelerated the growth of the Sprockets market. Key players in the Sprockets market include-

- ABL Products Inc.

- Allied-Locke Industries Inc.

- Linn Gear Co.

- Martin Sprocket & Gear

- International Association for Measurement and Evaluation of Communication (AMEC)

- AB SKF

- B&B Manufacturing

- G&G Manufacturing

- Industrias Dolz, S.A.

- Maurey Manufacturing Corporation

Recent Industry Developments :

- In June 2021, Industrias Dolz launched an advanced timing chain kit including a crank sprocket and cam sprocket made of steel to offer improved durability and longevity.

Key Questions Answered in the Report

What are sprockets? +

Sprockets are defined as mechanical devices employed in various systems including industrial machinery and equipment that involve the transmission of rotary motion.

What specific segmentation details are covered in the sprockets market report, and how is the dominating segment impacting the market growth? +

In the material segment, steel accounted for the largest market share in the year 2022 as steel is suitable for a broad range of power transmission systems, from light-duty to heavy-duty machinery owing to the exceptional strength and durability.

What specific segmentation details are covered in the sprockets market report, and how is the fastest segment anticipated to impact the market growth? +

The strand segment witnessed duplexes as the fastest-growing segment during the forecast period. Duplex sprockets distribute the load across two chains, reducing the strain on individual chains and sprocket teeth. The load distribution minimizes wear and tear and enhances the longevity of both the sprockets and the chains.

What specific segmentation details are covered in the sprockets market report, and how does each dominating segment is influencing the demand globally? +

The dominance of each segment is influenced by the market trends and dynamics that are responsible for driving the sprockets market.