- Summary

- Table Of Content

- Methodology

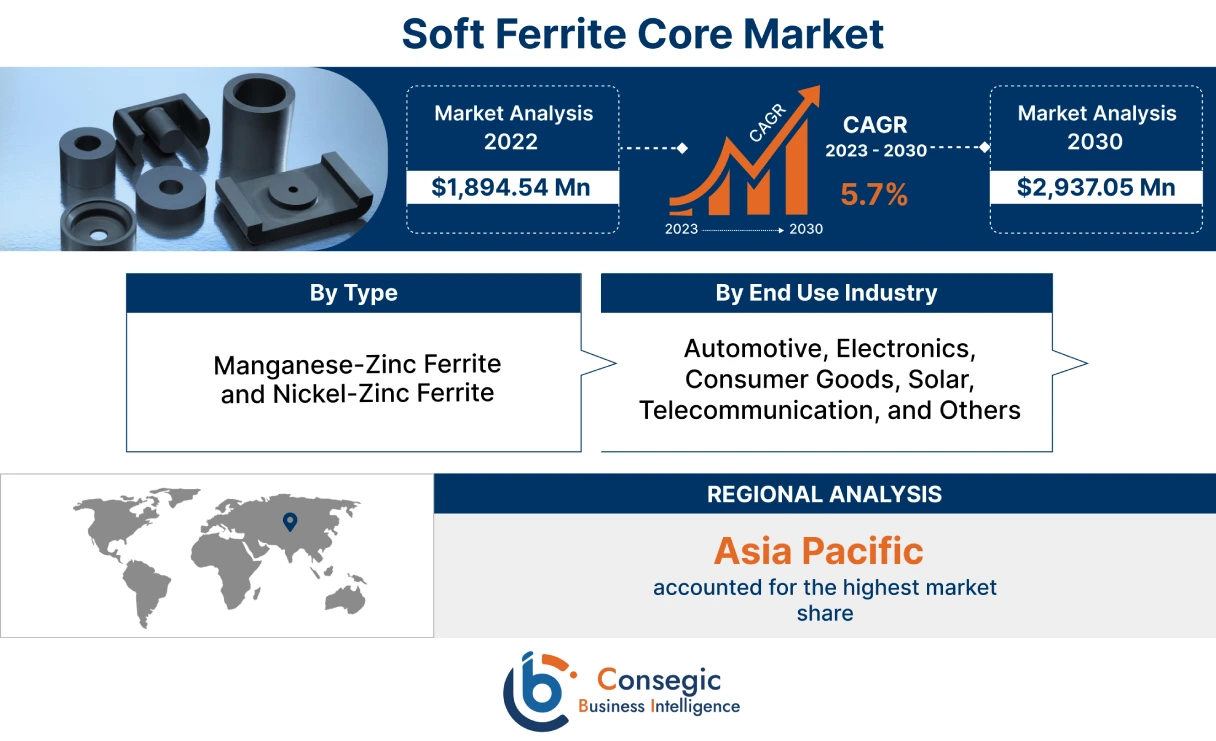

Soft Ferrite Core Market Size :

Consegic Business Intelligence analyzes that the soft ferrite core market size is growing with a CAGR of 5.7% during the forecast period (2023-2030), and the market is projected to be valued at USD 2,937.05 Million by 2030 from USD 1,894.54 Million in 2022.

Soft Ferrite Core Market Scope & Overview:

Soft ferrite cores are made from a class of ceramic materials known as ferrites, which is typically composed of iron oxide and other metal oxides namely manganese, nickel, and zinc. These cores can be easily magnetized and demagnetized, allowing them to be efficient in transforming alternating current into magnetic energy and vice versa. Moreover, these materials are characterized by their high magnetic permeability, low electrical conductivity, and low losses at high frequencies. These properties make them ideal for use in transformers, inductors, EMI filters, antennas, and other electronic components. They are used in wide industrial phases such as Automotive, Electronics, Consumer Goods, Solar, and Telecommunication, among Others.

Soft Ferrite Core Market Insights :

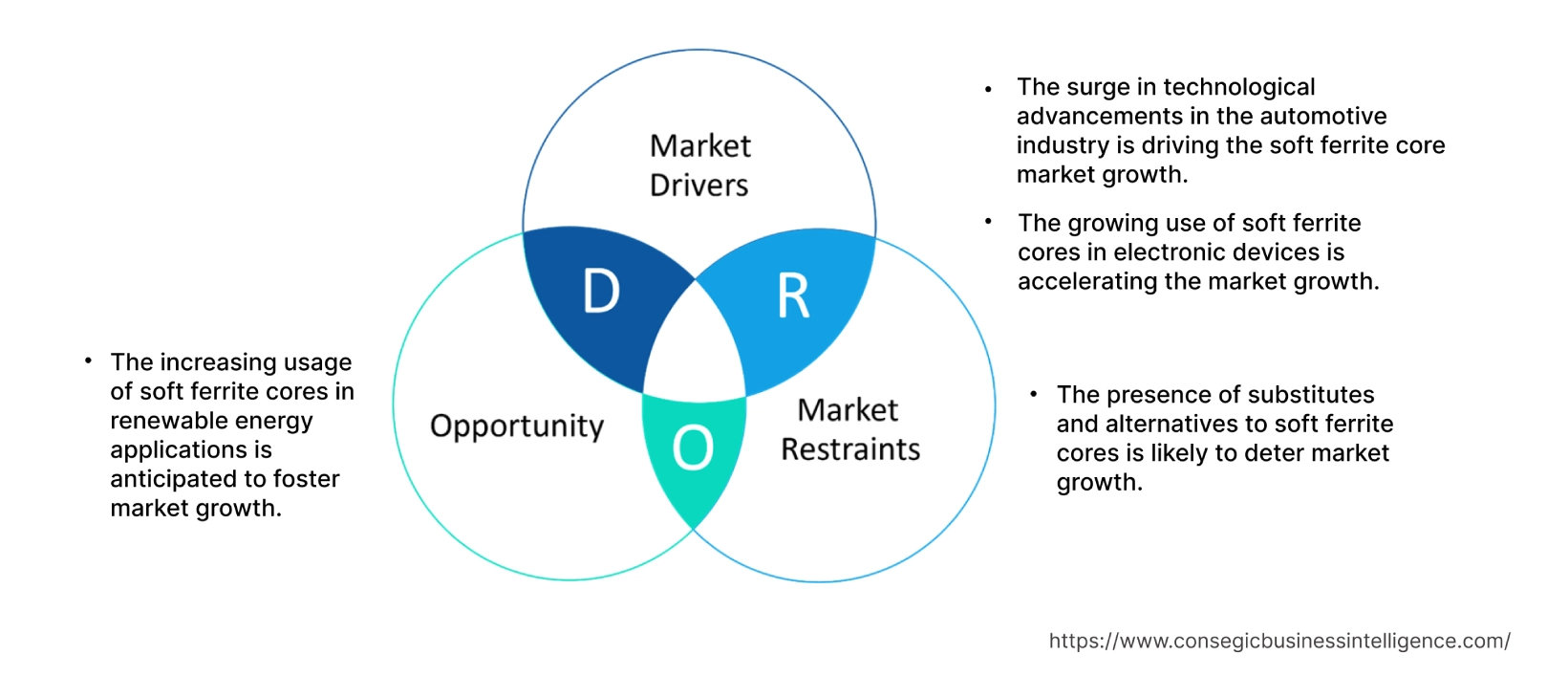

Key Drivers :

The surge in technological advancements in the automotive sector is driving the soft ferrite core market

Soft ferrite cores are used in various automotive components such as ignition coils, power converters, and motor drives. Additionally, power transformers are widely used in vehicles to minimize core losses in the operating temperature range. The expansion of the automotive sector, particularly in the hybrid and electric vehicle segments is contributing to the rising soft ferrite core market demand. Furthermore, as per the analysis, emerging electric vehicle (EV) technology requires power converters in the motors. For instance, according to the report published by the International Energy Agency, electric cars accounted for 17% of Europe's auto sales in 2021. The key driver accelerating the electric vehicles expansion in Europe is the stringent EU regulations for CO2 emissions standards. As a result, the aforementioned factors are propelling the demand and trend of this material in the automotive sector.

The growing use of soft ferrite cores in electronic devices is accelerating the market

Soft ferrite cores find extensive use in electronics due to their unique magnetic properties and performance characteristics. The rise of high-frequency electronic devices and circuits in telecommunications, data communications, and consumer electronics has led to an increased demand for this material. Further, based on the analysis, the proliferation of consumer electronics including smartphones, tablets, and laptops, among others has significantly contributed to the growing use of ferrite cores. For instance, according to the Mobile Economy report published by GSM Association, there will be nearly 7.5 billion smartphone connections by 2025 across the globe. The growing adoption of smartphones is one of the key drivers that has surged the demand and trends of this material.

Key Restraints :

The presence of substitutes and alternatives to soft ferrite cores is likely to deter market

Magnetic core materials such as powdered iron cores, nanocrystalline cores, and amorphous cores can serve similar purposes and can be used as alternatives to these ferrite cores in certain applications. Powdered iron cores are comparatively less expensive than the traditional materials and have a higher saturation magnetization. Hence, the availability of these substitutes and alternatives is likely to limit the market.

Future Opportunities :

The increasing usage of soft ferrite core in renewable energy applications is anticipated to foster market

The rise in the use of renewable energy applications is creating lucrative soft ferrite core market opportunities and trends in the coming years. Renewable energy systems such as solar photovoltaic and wind turbines generate power in DC form that needs to be converted into AC using power inverters. They are commonly used in power inverters for efficient and high-frequency AC conversion. In addition, according to the analysis, some renewable energy systems use resonant converters, that require these materials for their high frequency operation. According to the report published by the International Energy Agency, power generation from solar photovoltaic increased by a record 26% in 2022 from the previous year. Also, solar photovoltaic accounted for 4.5% of total global electricity generation. Moreover, the increasing investment of governments and businesses in renewable energy infrastructure is anticipated to fuel the opportunities and trends during the forecast period.

Soft Ferrite Core Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 2,937.05 Million |

| CAGR (2023-2030) | 5.7% |

| By Type | Manganese-Zinc Ferrite and Nickel-Zinc Ferrite |

| By End-Use Industry | Automotive, Electronics, Consumer Goods, Solar, Telecommunication, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | COSMO FERRITES LIMITED, MAGNETICS, Infantron Singapore, MMG India Pvt. Ltd, Shaanxi Gold-Stone Electronics Co.,Ltd, TOMITA ELECTRIC CO., LTD., PROTERIAL, Ltd., Samwha Capacitor Group, and Haining Ferriwo Electronics Co., Ltd. |

Soft Ferrite Core Market Segmental Analysis :

By Type :

The type segment is categorized into manganese-zinc ferrite and nickel-zinc ferrite. In 2022, the manganese-zinc ferrite segment accounted for the highest market share and is anticipated to grow at the fastest CAGR during the forecast period.

Manganese zinc ferrites are technically and scientifically a very important class of ferrite materials owing to their high magnetic permeability and low core losses. These materials have been broadly used in electronic applications such as transformers, choke coils, noise filters, and memory devices. Furthermore, transformers are majorly used in the electrical power system for different purposes, such as power generation, distribution, and transmission. As per the analysis, the surging need for transformers in power generation is proliferating the demand for manganese zinc ferrite cores. For instance, according to the statistics reported by the Ministry of Power (Govt. of India), the total electricity generation (including renewable sources) during 2022-23 was 1,624.2 billion units as compared to 1491.9 billion units generated during 2021-22, representing a growth of about 8.87%.

In addition to this, the ongoing research for the potential use of manganese-zinc ferrite nanoparticles in cancer treatment is another factor expected to enhance segment growth and trend in the forecast years.

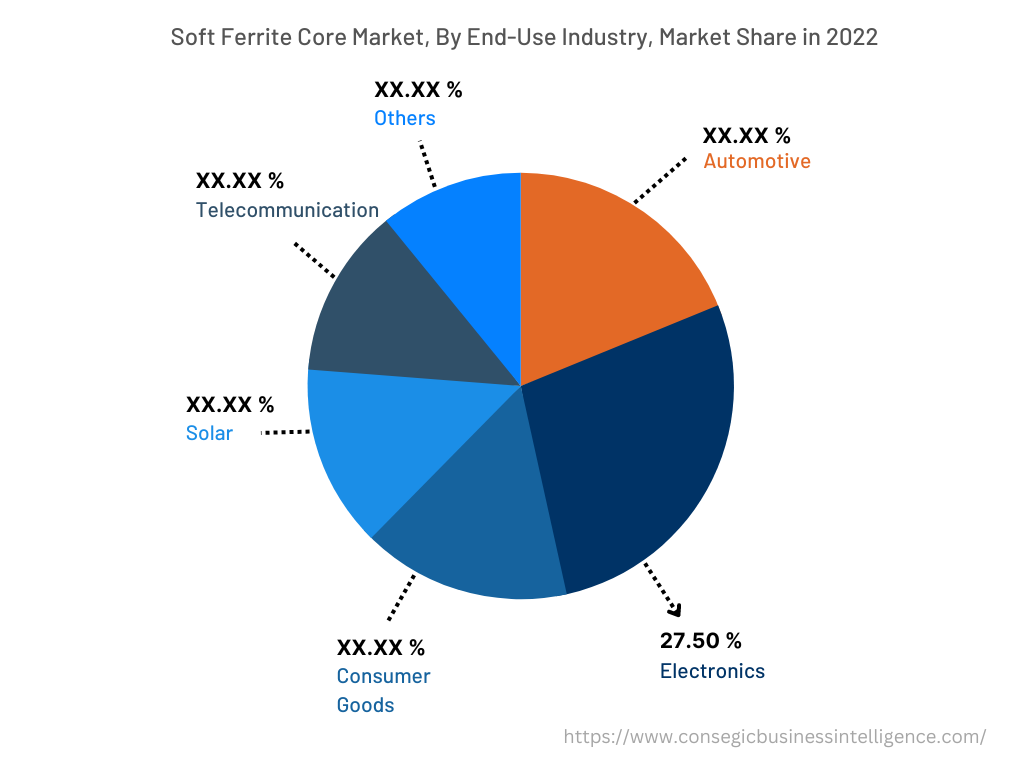

By End-Use-Industry :

The end-use industry segment is categorized into automotive, electronics, consumer goods, solar, telecommunication, and others. In 2022, the electronics segment accounted for the highest soft ferrite core market share of 27.50% in the overall soft ferrite core market. Based on the analysis, they possess unique magnetic properties, making them ideal for use in a variety of electrical components such as transformers, inductors, and chokes. As electronic devices become more compact and powerful, these materials are used for EMI suppression, reducing unwanted noise, and others. Hence, the above mentioned factors are contributing to the growing product demand in the electronics sector.

However, the telecommunication segment is anticipated to grow at the fastest CAGR during the forecast period. The growth of the segment is driven by the rise in the proliferation of wireless communication technologies such as 5G and IoT devices, leading to an increasing need for these materials for operating efficiently at high frequencies. Based on the analysis, the increasing prevalence of cell phones and the simultaneous decline in landline phones across the globe is one of the key factors that is expected to foster segment growth and trends. For instance, according to the data reported by WorldData, in 2021, 91.75% of all residents in the U.S. have access to the internet, out of which 37.9% have a fast internet connection.

By Region :

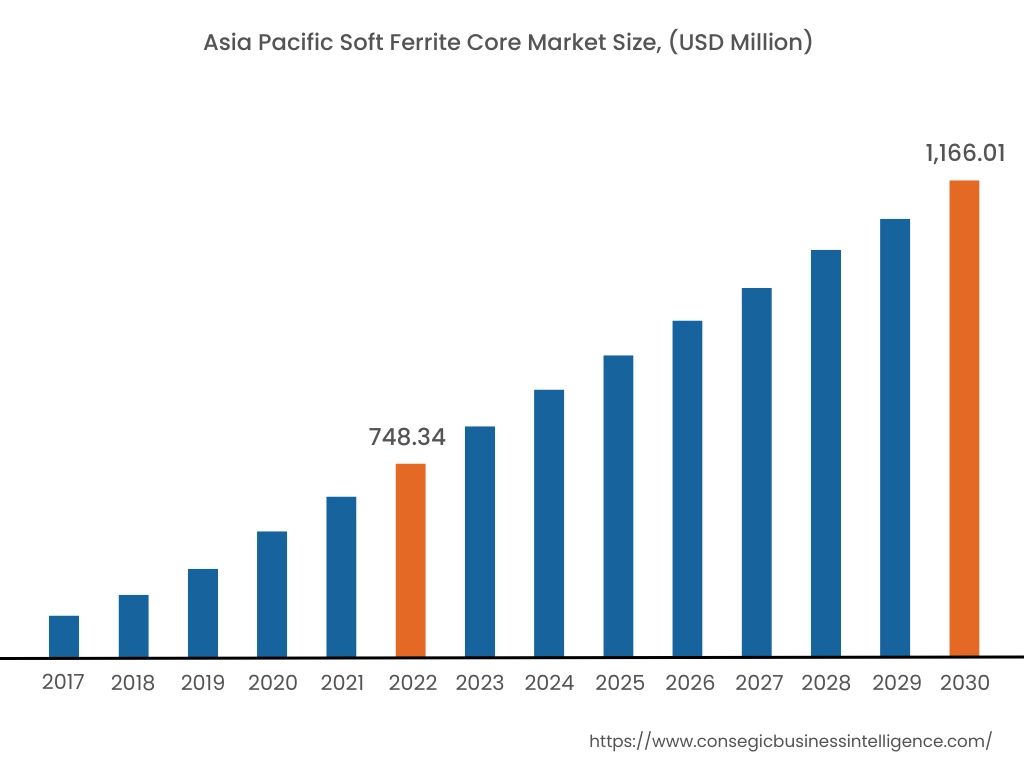

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

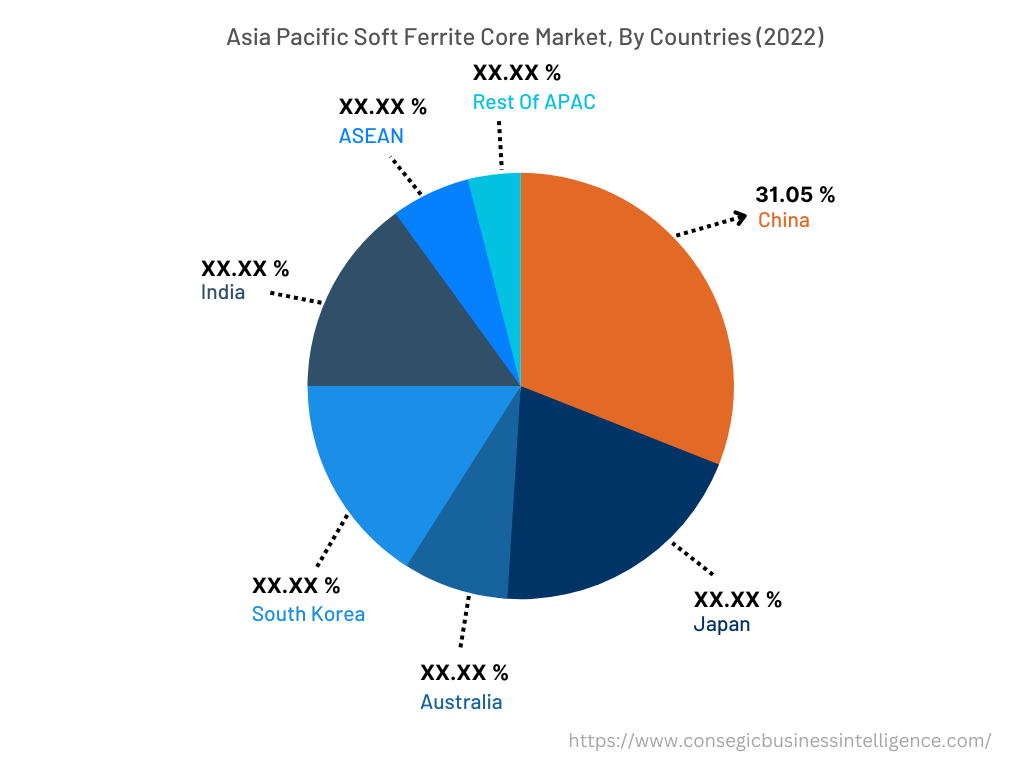

In 2022, Asia Pacific accounted for the highest market share of 39.50% and was valued at USD 748.34 million and is expected to reach USD 1,166.01 million in 2030, growing at the fastest CAGR of 6.1% over the forecast period. Based on the soft ferrite core market analysis, in the Asia Pacific region, China accounted for the highest market share at 31.05%. The soft ferrite core market growth and trends in the region is attributed to factors such as the increasing adoption of electronic devices, the expansion of telecommunication networks, and the rise in renewable energy sources, among others. China's telecommunications sector registered rapid growth in business revenue owing to the application of new Information Technology (IT) infrastructure including the 5G network. For instance, according to the statistics published by the China State Council, by the end of 2021, China built and put into operation about 1.43 million 5G base stations, accounting for over 60% of the world's total and accounting for the largest 5G network globally. Furthermore, according to the report published by the International Energy Agency, China was responsible for about 38% of solar photovoltaic generation growth in 2022. Also, in 2021, India installed 18 GW of solar photovoltaic in 2022, approximately 40% more than the previous year. Thus, the factors mentioned above are creating an optimistic growth prospect for the soft ferrite core market trends in the region.

Top Key Players & Market Share Insights:

The global soft ferrite core market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The soft ferrite core industry is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- COSMO FERRITES LIMITED

- MAGNETICS

- PROTERIAL, Ltd.

- Samwha Capacitor Group

- Haining Ferriwo Electronics Co., Ltd.

- Infantron Singapore

- MMG India Pvt. Ltd

- Shaanxi Gold-Stone Electronics Co.,Ltd

- TOMITA ELECTRIC CO., LTD.

Recent Industry Developments :

- In May 2021, Cosmo Ferrites Ltd. launched an improved version of CF295 for the power conversion sector.

- In January 2023, Proterial, Ltd. changed the company's trade name from Hitachi Metals, Ltd.

Key Questions Answered in the Report

What was the market size of the soft ferrite core market in 2022? +

In 2022, the market size of soft ferrite core was USD 1,894.54 million

What will be the potential market valuation for the soft ferrite core market by 2030? +

In 2030, the market size of soft ferrite core is expected to reach USD 2,937.05 million.

What are the key factors driving the growth of the soft ferrite core market? +

The growing use of soft ferrite cores in electronic devices such as smartphones, laptops, and others is accelerating market growth.

What is the dominant segment in the soft ferrite core market by type? +

In 2022, the manganese-zinc ferrite segment accounted for the highest market share in the overall soft ferrite core market.

Based on current market trends and future predictions, which geographical region will have the fastest impact on the soft ferrite core market's growth in the coming years? +

Asia Pacific is expected to be the fastest-growing region in the market during the forecast period.