Smart Power Distribution System Marke Size :

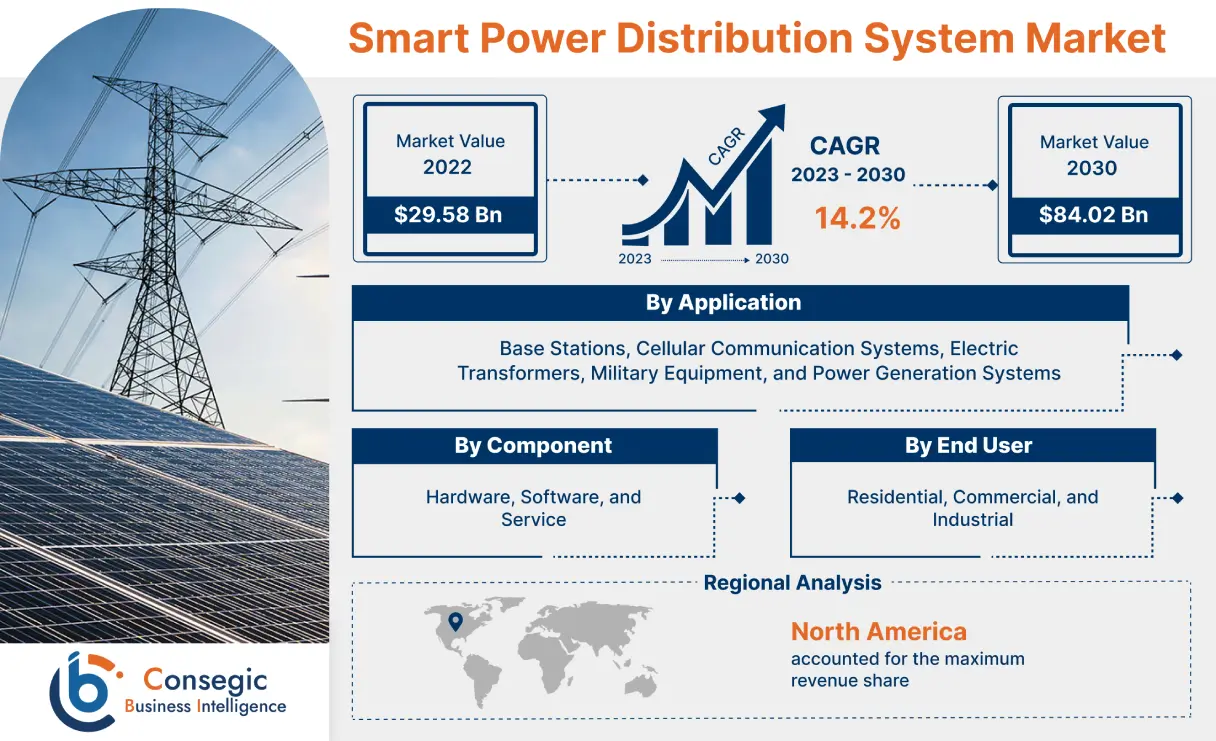

Smart Power Distribution System Market size is estimated to reach over USD 84.02 Billion by 2030 from a value of USD 29.58 Billion in 2022, growing at a CAGR of 14.2% from 2023 to 2030.

Smart Power Distribution System Marke Scope & Overview:

A smart power distribution system refers to an advanced and integrated network infrastructure that utilizes modern technologies, namely artificial intelligence, and real-time data analytics, to efficiently manage and optimize the flow of electricity from generation sources to end-users. Additionally, a smart power distribution system enables real-time monitoring, control, and automation of electricity distribution, allowing for better load balancing, fault detection, and predictive maintenance. Furthermore, by leveraging smart sensors and smart meters, the smart power distribution system aims to enhance sustainability and cost-effectiveness while fostering a more resilient and adaptable energy grid to meet the evolving needs of consumers and the environment.

Smart Power Distribution System Marke Insights :

Smart Power Distribution System Marke Dynamics - (DRO) :

Key Drivers :

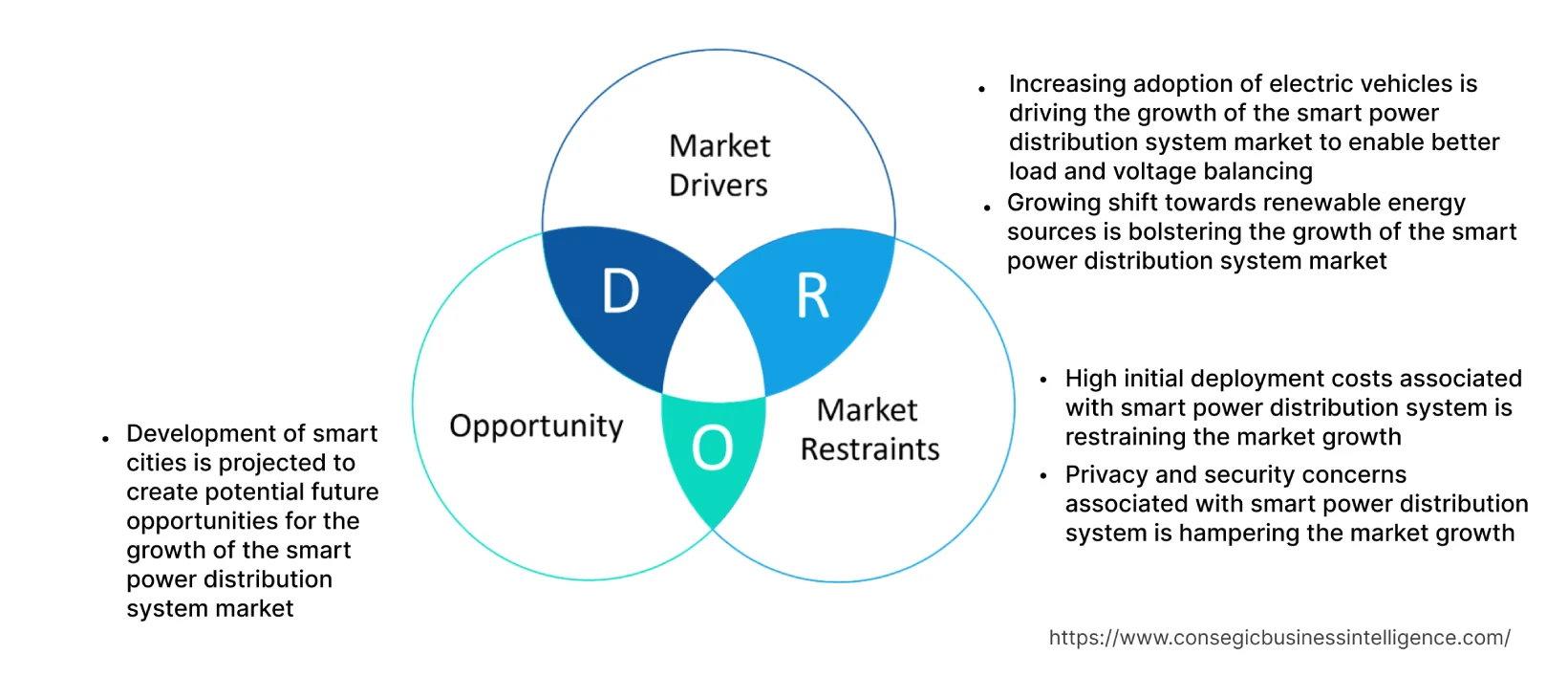

Increasing adoption of electric vehicles is driving the growth of the smart power distribution system market to enable better load and voltage balancing

The rising electricity demand owing to the shift from traditional internal combustion engine vehicles to electric vehicles serves as the key factor responsible for fueling the market growth. Smart power distribution systems are utilized to better manage and optimize the increased electricity load from electric vehicle charging infrastructure, thus contributing significantly in propelling the market growth. Additionally, smart power distribution systems play a critical role in ensuring that the charging infrastructure is effectively integrated into the existing power grid. The systems enable better load balancing, demand response, and real-time monitoring, ensuring that charging stations operate efficiently and cost-effectively. Furthermore, electric vehicles impose sudden and significant loads on the electrical grid, especially during peak charging times, leading to voltage fluctuations and blackouts. Smart power distribution systems employ advanced algorithms and real-time data analytics to manage the loads effectively, ensuring grid stability and reliability. Consequently, the increasing number of electric vehicles is contributing considerably in driving the adoption of smart power distribution systems to enable better load and voltage balancing. For instance, in July 2023, according to International Energy Agency (IEA), electric car sales exceed more than 10 million in 2022 and the share has tripled from 4% in 2020 to 14% in 2022. Additionally, China has witnessed the maximum sales of 6 million and 8 million in 2022 and 2023 respectively and global sales are expected to reach 14 million by the end of 2023.

Growing shift towards renewable energy sources is bolstering the growth of the smart power distribution system market

Renewable energy sources including solar, and wind are inherently intermittent, and generate power based on weather conditions. Smart power distribution systems are crucial in efficiently integrating variable energy sources into the grid. The power distribution systems dynamically balance supply and demand, ensuring stable and reliable power distribution despite fluctuations in renewable energy generation. Additionally, smart power distribution systems also enable the efficient management and coordination of distributed energy resources, optimizing energy flows and enhancing grid stability. Furthermore, the distribution systems offer advanced monitoring, control, and automation capabilities, allowing grid operators to quickly respond to changes in supply and demand. Moreover, the increasing government investment in various renewable energy and grid modernization projects further promotes market growth to provide reliable power distribution. For instance, in June 2021, the Government of Canada invested USD 960 million in renewable energy to transform the electricity grid. The investment was made to modernize the electricity system operations, to reach the country's net-zero emission, thus contributing significantly in boosting the growth of the smart power distribution system market.

Key Restraints :

High initial deployment costs associated with smart power distribution system is restraining the market growth

The initial investment required for deploying smart power distribution systems is considerably high, thus hindering the growth of the market. Additionally, the cost of upgrading and replacing existing systems, implementing communication networks, and installing data management systems is also significantly high. The high upfront expenses limit the adoption of smart power distribution systems by small enterprises with limited financial resources, hence impeding the growth of the global market.

Privacy and security concerns associated with smart power distribution system is hampering the market growth

Smart power distribution systems including smart meters collect granular energy consumption data, which is considered personally identifiable information (PII) and raises concerns regarding the storage and accession of data. Additionally, power distribution systems are vulnerable to unauthorized access with cybercriminals potentially manipulating meter readings, disrupting data transmission, or gaining unauthorized control over the metering system. Consequently, the implementation of strong access controls, encryption, and intrusion detection systems is essential to prevent unauthorized access and maintain the integrity of the system. The addition of an access control system leads to significant upfront costs, thus restraining the growth of the global smart power distribution system market.

Future Opportunities :

Development of smart cities is projected to create potential future opportunities for the growth of the smart power distribution system market

Smart cities aim to optimize energy consumption and reduce environmental impact. Smart power distribution system plays a crucial role in monitoring and managing energy usage at the city level. In addition, by deploying smart meters throughout the city, utilities and city administrators gather real-time energy consumption data, identify patterns, and implement energy efficiency measures. Moreover, smart cities integrate multiple energy systems including electricity and water and smart metering infrastructure facilitates the seamless integration and coordination of such systems. For instance, smart meters monitor electric vehicle charging, enable dynamic pricing, and optimize energy usage across various sectors. Subsequently, the growth of smart cities necessitates an interconnected energy infrastructure, hence creating potential opportunities for the growth of the smart power distribution system market.

Smart Power Distribution System Marke Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 84.02 Billion |

| CAGR (2023-2030) | 14.2% |

| By Component | Hardware, Software, and Service |

| By Application | Base Stations, Cellular Communication Systems, Electric Transformers, Military Equipment, and Power Generation Systems |

| By End-User | Residential, Commercial, and Industrial |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | ABB Ltd., Aclara Technologies, Eaton Corporation, Emerson Electric Co., General Electric Company, Honeywell International Inc., Itron Inc., Oracle Corporation, Schneider Electric SE, Siemens AG, Tech Mahindra, Trilliant Holdings Inc., ZTE Corporation, Duke Energy Corporation |

Smart Power Distribution System Marke Segmental Analysis :

By Component :

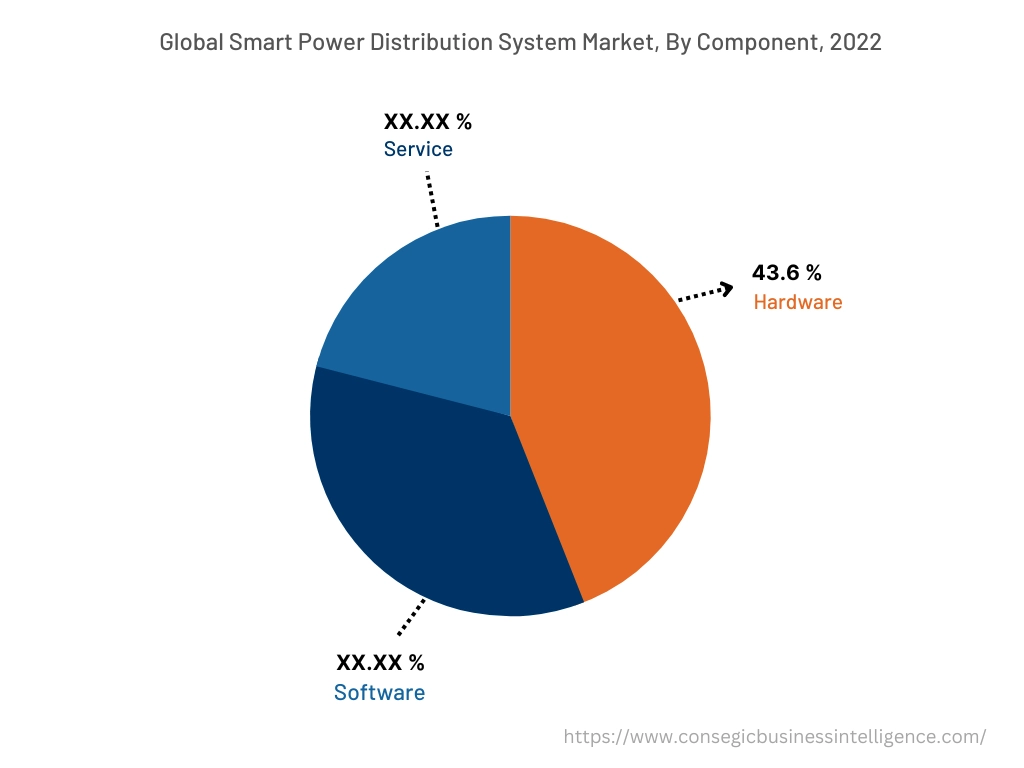

The component segment is trifurcated into hardware, software, and services. Hardware accounted for the largest market share of 43.6% in 2022 and comprise sensors, switchgear, smart meters, smart transformer, programmable logic controllers, and others. Smart meters hold the maximum share as the meters play a crucial role in energy efficiency and grid optimization. Smart electric meters provide accurate and real-time data on electricity consumption, enabling utilities to identify patterns, monitor peak demand, and optimize energy distribution. Additionally, smart meters enable utilities to implement demand response programs effectively, allowing customers to adjust electricity usage during peak demand periods, to balance the grid and avoid power shortages. Consequently, the ability of smart electric meters to focus on energy efficiency and grid stability is contributing considerably in driving the growth of the hardware segment. For instance, in November 2022, Trilliant Holdings Inc. partnered with Manx Utilities for the installation of smart electricity meters for 8,000 customers across the Isle of Man. The aim of the partnership is to replace existing electricity meters with smart meters to reduce electricity consumption and save on energy costs for approximately 50,000 industrial, residential, and commercial customers.

The services segment is predicted to register the fastest CAGR in the smart power distribution market during the forecast period. The installation and deployment of smart power distribution systems involve complex processes, including the physical installation of fiber optic cable assemblies, configuration, and network integration. Service providers offer specialized expertise and resources to ensure seamless deployment, efficient project management, and timely implementation. Additionally, smart power distribution systems require ongoing maintenance, monitoring, and support to ensure optimal performance. Service providers offer maintenance services to address issues namely firmware updates, meter calibration, and fault detection, and also provide support services, including troubleshooting, meter replacements, and customer assistance. Consequently, the aforementioned factors are responsible for accelerating the growth of the services segment during the forecast period.

By Application :

The application segment is classified into base stations, cellular communication systems, electric transformers, military equipment, and power generation systems. Base stations accounted for the largest market share in 2022 and are also predicted to register the fastest CAGR during the forecast period as smart power distribution systems help to optimize energy usage in base stations. Additionally, advanced energy management algorithms and real-time monitoring enable base stations to adjust power consumption based on actual demand, minimizing energy waste, and reducing operational costs. Moreover, smart power distribution systems incorporate battery energy storage solutions to store excess energy during periods of low demand and discharge during peak usage. The storage helps to stabilize the power supply and improve the efficiency and resilience of the base station's power system. Furthermore, smart power distribution systems also enable operators to build low carbon 5G networks, resulting in improved energy efficiency of the base stations. For instance, in October 2021, Huawei introduced GreenSite and PowerStar2.0, two power distribution solutions for the development of low carbon 5G networks. In addition, GreenSite enhances the energy efficiency of base stations by 20 times and PowerStar2.0 reduces energy consumption by approximately 25%. Consequently, the aforementioned factors are collectively responsible for driving the growth of the smart power distribution system market in upcoming years.

By End-User :

The end-user segment is categorized into residential, commercial, and industrial. Residential sector accounted for the largest market share in 2022 as smart power distribution systems provide precise measurements of electricity consumption in residential properties. The smart power distribution system ensures accurate billing based on actual usage, eliminating manual readings, thus benefitting the customers by providing more fair billing practices. Additionally, smart distribution systems also enable real-time monitoring of energy consumption in residential properties through online portals and mobile apps, allowing consumers to access energy usage data, view consumption patterns, and track costs. Moreover, the emergence of the Internet of Things (IoT) offers advanced grid-edge intelligence to support distribution system operators in maintaining an efficient and reliable grid, further increasing the adoption of smart power distribution systems in the residential sector. For instance, in November 2022, Landis+Gyr introduced E360 residential smart electric meter, made from100% recyclable material and is based on IoT technologies. The electric meter provides ten times more accuracy and speed in comparison to traditional meters to maintain a reliable and efficient grid, hence contributing remarkably in propelling the growth of the residential sector.

The industrial sector is expected to witness the fastest CAGR in the smart power distribution system market during the forecast period. The growth is endorsed by the ability of industrial smart power distribution systems to monitor and manage energy consumption in real-time by tracking energy usage patterns and identifying areas of high consumption. In addition, advanced metering infrastructure provides accurate data for energy audits, to monitor the electricity demand and identify peak usage periods. Moreover, smart meters equipped with power quality monitoring capabilities help industrial facilities track and assess the quality and stability of the electricity supply. The monitoring parameters include voltage fluctuations, harmonics, and power factors for detecting and rectifying power quality issues, reducing equipment downtime, optimizing performance, and ensuring reliable operations. In conclusion, the aforementioned factors are contributing notably in fueling the growth of industrial smart power distribution systems during the forecast period.

By Region :

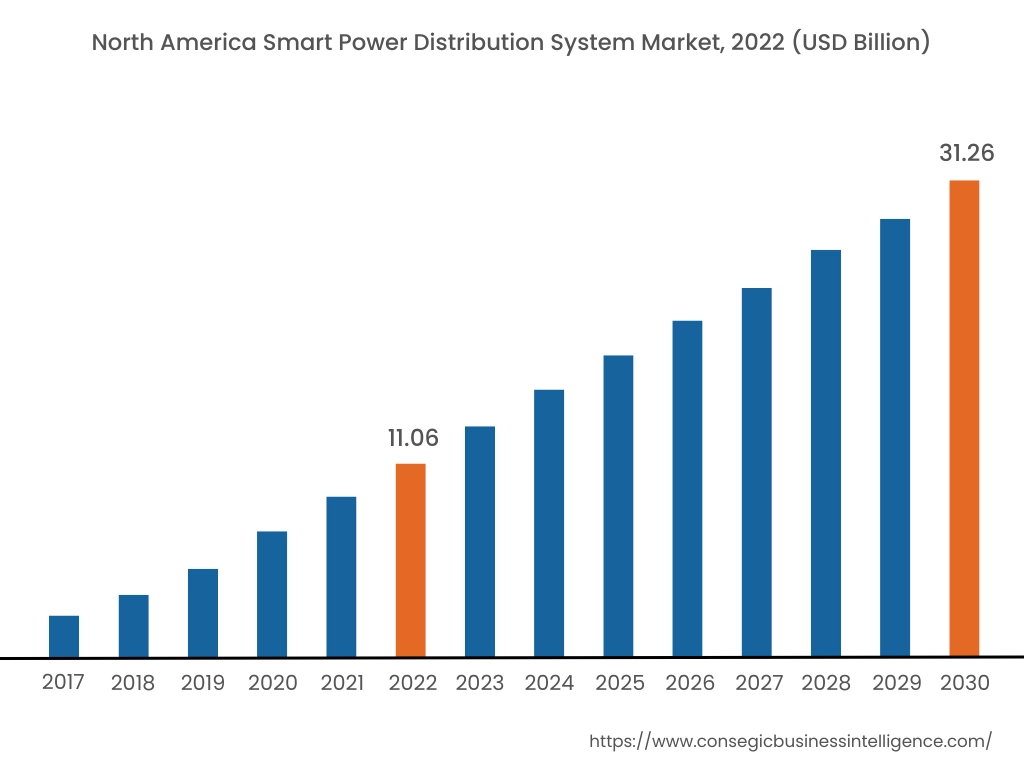

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

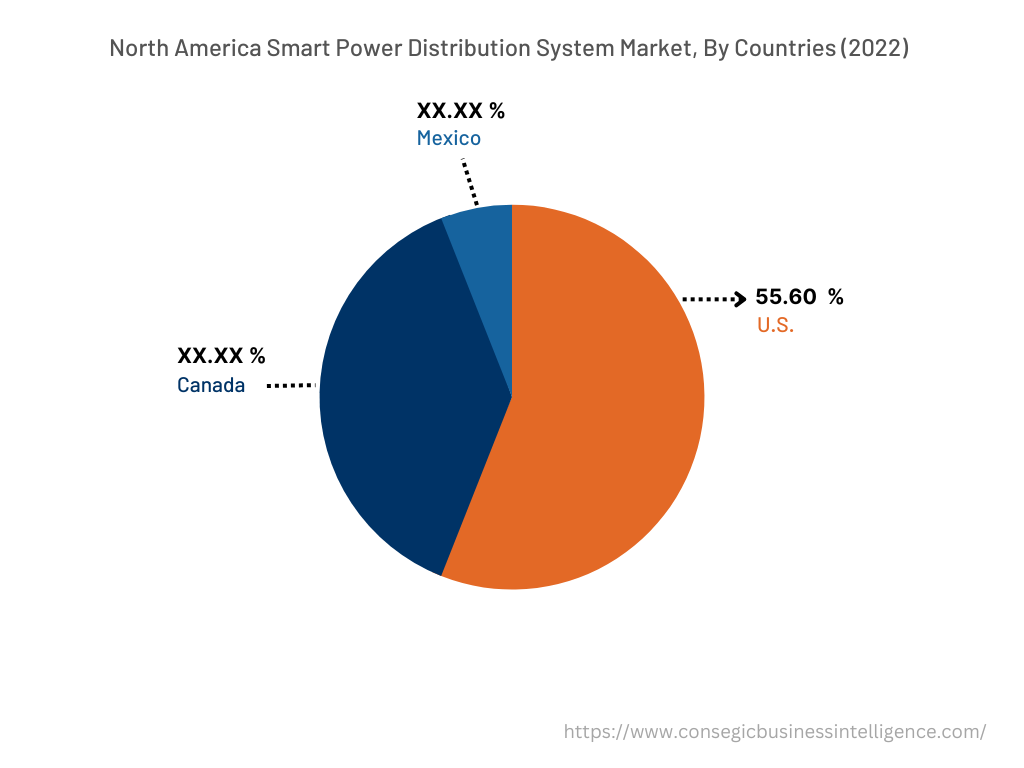

North America accounted for the maximum revenue share in the year 2022 sized at USD 11.06 Billion and is projected to reach USD 31.26 Billion in the smart power distribution system market. In addition, in the region, the United States accounted for the maximum revenue share of 55.60% in the year 2022. North America is at the forefront of implementing regulatory policies that drive the adoption of smart power distribution systems. In particular, the United States is witnessing significant regulatory support at the federal and state levels, mandating utilities to deploy smart power distribution systems for improved energy efficiency, grid modernization, and consumer benefits. Moreover, the aging infrastructure in North America, particularly in the electricity sector, is creating a need for modernization and improved efficiency. Smart power distribution system offers a solution for utilities to upgrade the systems, enhance data collection, and optimize operations. Furthermore, the presence of key players in the region including Trilliant Holdings Inc., General Electric Company, and Emerson Electric Co. constantly applying innovations and strategic decisions to expand the market portfolio is also contributing to the market growth. For instance, in July 2022, Trilliant Holdings Inc. deployed more than 3.5 million smart meters in the Asia-Pacific region and also started its manufacturing in Malaysia. In conclusion, the aforementioned factors are contributing remarkably in bolstering the growth of smart power distribution systems in the region.

Asia Pacific is expected to witness the fastest CAGR of 14.7% owing to the significant investments in the development of smart cities. Smart power distribution system is a critical component of a smart city, enabling efficient energy management, demand response, and sustainability practices. Additionally, the growing awareness of energy efficiency and the importance of sustainable practices among consumers, businesses, and governments in Asia Pacific is also propelling market growth. Smart power distribution systems empower consumers to monitor energy consumption, make informed decisions, and actively participate in energy-saving initiatives. Moreover, Asia Pacific is witnessing significant growth in renewable energy generation, including solar and wind power. Smart power distribution system plays a crucial role in integrating and managing distributed energy resources into the grid. Consequently, the expanding renewable energy sector is driving the growth of the smart power distribution system market to enable efficient integration, grid stability, and optimized energy usage.

Top Key Players & Market Share Insights:

The landscape of the smart power distribution system market is highly competitive and has been examined in the report, along with complete profiles of the key players operating in the industry. In addition, the surge in innovations, acquisitions, mergers, and partnerships has further accelerated the growth of the smart power distribution system market. Major players in the market include-

- Eaton Corporation

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Itron Inc.

- Oracle Corporation

- Schneider Electric SE

- ABB Ltd.

- Aclara Technologies

- Siemens AG

- Tech Mahindra

- Trilliant Holdings Inc.

- ZTE Corporation

- Duke Energy Corporation

Recent Industry Developments :

- In April 2023, the Asian Development Bank, Tata Power Co. Ltd., and Tata Power Delhi Distribution Limited signed an agreement and invested USD 18.2 million to upgrade the power distribution of Delhi through grid enhancements. The companies also invested USD 2 million in financing and integrating a pilot battery energy storage system (BESS).

- In December 2021, Schneider Electric SE introduced EcoStruxure Power, a power distribution system to provide reliable "always-on" power for healthcare, commercial buildings, data centres, industry and infrastructure.

Key Questions Answered in the Report

What is a smart power distribution system? +

A smart power distribution system refers to an advanced and integrated network infrastructure that utilizes modern technologies, namely artificial intelligence and real-time data analytics, to efficiently manage and optimize the flow of electricity from generation sources to end-users.

What specific segmentation details are covered in the smart power distribution system market report, and how is the dominating segment impacting the market growth? +

Hardware component dominates the market in 2022 as hardware provide accurate and real-time data on electricity consumption, enabling utilities to identify patterns, monitor peak demand, and optimize energy distribution.

What specific segmentation details are covered in the smart power distribution system market report, and how is the fastest segment anticipated to impact the market growth? +

Services will witness the fastest CAGR as the smart power distribution system requires ongoing maintenance, monitoring, and support to ensure optimal performance. Service providers offer maintenance services to address issues namely firmware updates, meter calibration, and fault detection, and also provide support services, including troubleshooting, meter replacements, and customer assistance.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is expected to witness the fastest CAGR during the forecast period owing to the significant investments in the development of smart cities. Smart power distribution system is a critical component of smart city initiatives, enabling efficient energy management, demand response, and sustainability practices.