- Summary

- Table Of Content

- Methodology

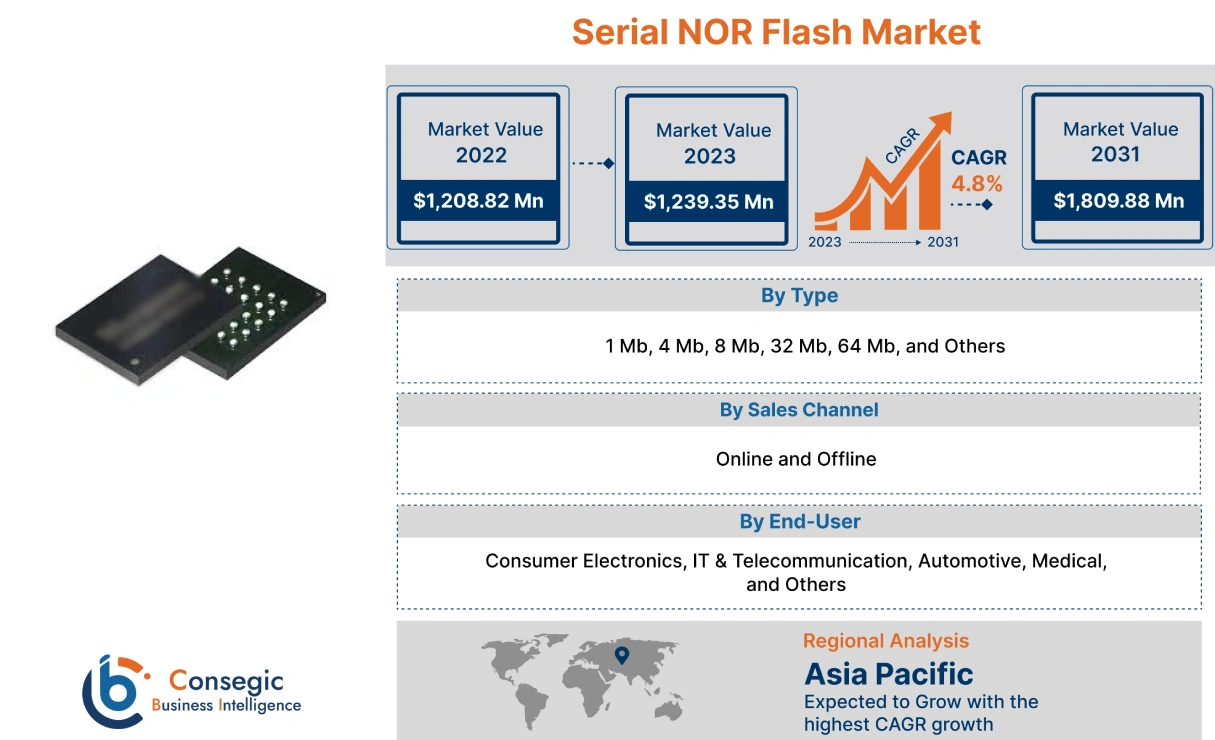

Serial NOR Flash Market Size :

Global Serial NOR Flash Market Size is estimated to reach over USD 1,809.88 Million by 2031 from a value of USD 1,208.82 Million in 2022 and is projected to grow by USD 1,239.35 Million in 2023, growing at a CAGR of 4.8% from 2023 to 2031.

Serial NOR Flash Market Scope & Overview :

Serial NOR flash (SPI NOR) refers to a type of non-volatile memory that is primarily used in electronic devices for storing data. It is usually available in the form of integrated circuits. It comprises of a block of memory in which all contents are erasable at a time while the data is written on the pages. Moreover, it offers several benefits including high data retention capability, higher read capability, random access interface, dense memory, and others. Its aforementioned benefits are key determinants for increasing its utilization in consumer electronics, IT & telecommunication, automotive, medical, and other sectors.

Serial NOR Flash Market Insights :

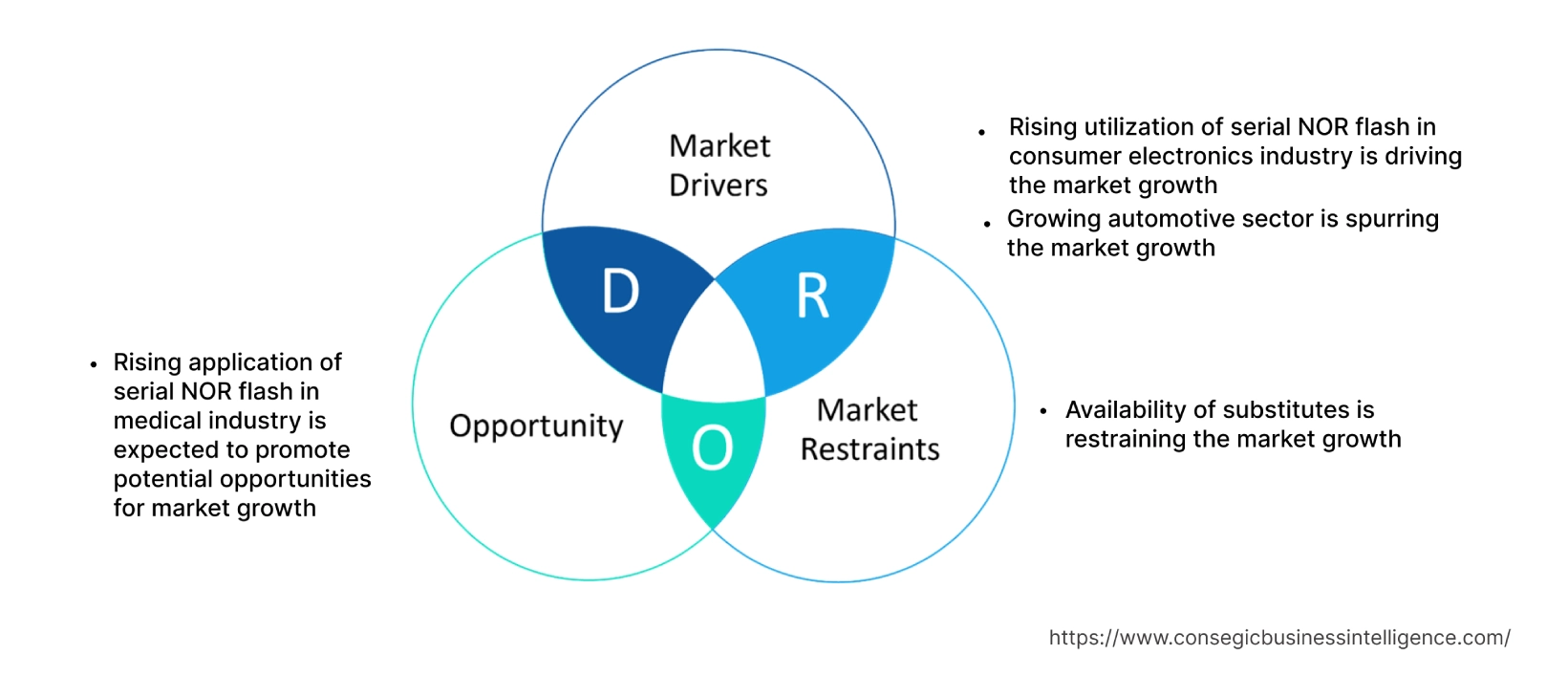

Key Drivers :

Rising utilization in consumer electronics sector

Serial NOR flash is primarily used in the consumer electronics sector, particularly in computers, smartphones, television, digital cameras, wearable devices, and other related consumer devices. Moreover, it is used for storage and data transfer applications in consumer devices. Its benefits including high speed transfer rates, reliability, and high durability are key determinants for increasing its utilization in consumer electronic devices.

Analysis of market trends indicates that factors including progressions in consumer electronics including adoption of AI (Artificial Intelligence) and IoT (Internet of Things), growing penetration of smartphones, computers, and rising need for efficient storage solutions are key prospects driving its adoption.

According to the Brazilian Electrical and Electronics Industry Association (ABINEE), the value of electrical and electronics industry in Brazil reached USD 42.2 billion in 2022, depicting an increase of nearly 8% in comparison to USD 39.2 billion in 2021. Additionally, according to GSM Association, the adoption of smartphones in Germany is projected to reach 84% by 2025, witnessing an increase from 80% in 2021.

Hence, the growing consumer electronics sector is increasing its utilization in smartphones, computers, wearables, and other consumer devices for storage and data transfer applications, which leads in increase of serial NOR flash market demand.

Growing automotive sector

Serial NOR flash is used in the automotive sector, particularly in Advanced Driver-Assistance Systems (ADAS) and infotainment system. The NOR flash memory plays a significant role as part of a safety-critical system, attributing to the wide range of features including non-volatility, programmability robustness, and reliability. It is used for permanent storage of data, code, and images for utilization during automobile start-up. Moreover, it provides a large temperature range, which enables its utilization in various environments and applications in the vehicle.

Analysis of market trends indicates that factors including the advanced driving systems, rising need for enhanced automobile storage solutions, and increasing production of automobiles are key prospects fostering the development of the automotive sector.

For instance, according to the European Automobile Manufacturers Association, the production of passenger cars in the Europe Union reached 10.9 million in 2022, depicting an increase of 8.3% as compared to 2021.

Additionally, according to the International Organization of Motor Vehicle Manufacturers, the overall automotive production in North America reached 14,798,146 units in 2022, witnessing a rise of 10% from 13,467,065 units in 2021. Hence, the rising automotive production is increasing the adoption of NOR flash memory for application in automobile ADAS and infotainment system among others, which contributes in increase of serial NOR flash market demand.

Key Restraints :

Availability of substitutes

The primary substitutes for NOR flash memory includes NAND flash, Resistive Random-Access Memory (RRAM) among others. Comparatively, the substitutes have similar properties, performance, and applications, with respect to SPI NOR, which is a prime factor restricting the market expansion.

For instance, NAND flash offers several benefits including faster read/write speed, lower manufacturing cost, higher capacity storage as compared to NOR flash memory. Similarly, NAND flash memory is used in a wide range of applications including consumer electronics, medical devices, and other related applications.

Additionally, the utilization of Resistive Random-Access Memory (RRAM) enables storage devices to flip between two resistance levels to store binary data. RRAM offers faster switching speed, smaller devices, and improvement in wear life as compared to NOR flash memory. Therefore, the availability of substitute of NOR flash memory with improved operational benefits is constraining the growth of the market.

Future Opportunities :

Rising application of serial NOR flash in medical sector

The rising application of serial NOR flash in medical sector is expected to present potential opportunities for the expansion of the market. It is often used in medical devices due to its range of benefits such as modular form factors, high reliability, enhanced performance, and long life cycles without BOM change.

Factors including the increasing trend in healthcare expenditure, rising surgical and diagnostic procedures, and growing investments in production of advanced medical devices are driving the proliferation of the medical sector.

According to the European Medical Technology Industry, the medical device sector in Germany accounted for 25.8% of the total share of the medical device industry Europe in 2021, followed by France with 14.3%, UK with 10.4%, Italy with 9.0%, and Netherlands with 6.4% among others.

Additionally, according to the International Trade Administration (ITA), the medical device sector in Canada was valued at USD 6.5 billion in 2022, with primary activities including research & development and manufacturing of medical diagnostic, and therapeutic devices. Analysis of market trends indicates that the development of medical sector is anticipated to increase SPI NOR's integration in medical devices for storage of medical test results, images, and other sensitive information is emerging as one of many serial NOR flash market opportunities during the forecast period.

Serial NOR Flash Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 1,809.88 Million |

| CAGR (2023-2031) | 4.8% |

| Based on the Type | 1 Mb, 4 Mb, 8 Mb, 32 Mb, 64 Mb, and Others |

| Based on the Sales Channel | Online and Offline |

| Based on the End-User | Consumer Electronics, IT & Telecommunication, Automotive, Medical, and Others |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Microchip Technology Inc., Macronix International Co. Ltd., Infineon Technologies AG, Micron Technology Inc., Winbond, GigaDevice, Texas Instruments Incorporated, Renesas Electronics Corporation, LAPIS Semiconductor Co. Ltd., Integrated Silicon Solution Inc. |

Serial NOR Flash Market Segmental Analysis :

By Type :

Based on the type, the market is bifurcated into 1 Mb, 4 Mb, 8 Mb, 32 Mb, 64 Mb, and others. The largest serial NOR flash market share for type segment is accounted to 32 Mb segment in year 2022. 32 Mb product type offers several features including SPI/DTR (Double Transfer Rate) read, programmable output driver strength, individual block/sector write protection, and others. The above benefits of 32 Mb product type is further increasing its utilization in automotive, medical devices, and other related applications.

For instance, in June 2021, Digilent introduced Pmod SF3 which is a 32 Mb serial NOR flash memory module. The memory module is designed to provide additional non-volatile storage capacity for microcontrollers and FPGA boards. Therefore, the rising innovations associated with 32 Mb product type is a prime factor proliferating the expansion of the segment.

The 64 Mb segment is anticipated to register fastest CAGR growth during the forecast period. The 64 Mb product type memory offers a range of features including SPI-compatible serial bus interface, increased throughput, program/erase suspend operations, erase capability, and enhanced performance among others. Analysis of market trends indicates that the 64 Mb NOR flash is primarily used in consumer devices, communication systems, military & defense systems, and other industrial applications.

For instance, Winbond is among few of the memory module manufacturers that offers a range of 64 Mb product type solutions for application in automotive, communication, and industrial applications. SPI NOR is optimized for utilization in wearable and industrial applications including health monitors, fitness trackers, GPS trackers, drones, and others. Thus, the increasing development of 64 Mb product type for utilization in automotive, communication, and industrial applications is a vital factor expected to drive the expansion of the market during the forecast period.

By Sales Channel :

Based on the sales channel, the market is segregated into online and offline. The largest serial NOR flash market share for sales channel segment is accounted to sales channel segment in year 2022. Online sales channel offers a method of distribution in which the manufacturers sell products through the company websites or any other third-party e-commerce websites that are available on the internet. Online distribution channels offer several benefits including easy access to the products, quicker comparison of multiple products and prices, faster buying process, and higher flexibility. The above benefits of online sales channels are key determinants for driving its utilization for the distribution of NOR flash memory.

For instance, Microchip Technology Inc. is among the few memory module manufacturers that provide a range of solutions for online purchase through the company website along with multiple e-commerce websites including Amazon, eBay, and others. Hence, the increasing availability of SPI NOR through online sales channels is a prime factor fostering the rise of the market.

Evaluation of market trends indicates that offline segment is expected to witness fastest CAGR growth during the forecast period. Offline sales channel involves the distribution of products from manufacturers to the end-users indirectly through offline distributors including specialty stores, regional distributors, and others. The expansion of the offline segment is attributed to several factors including the including a strong customer base, higher credibility, and ease of customization as per the target market among others.

For instance, Infineon Technologies AG, and Winbond are few of the manufacturers of memory module that offers a range of product solutions through various offline regional distributors including Mouser Electronics Inc., DigiKey, Arrow Electronics, and others. Hence, the increasing availability of product in offline sales channel is prominently driving the serial NOR flash market growth during the forecast period.

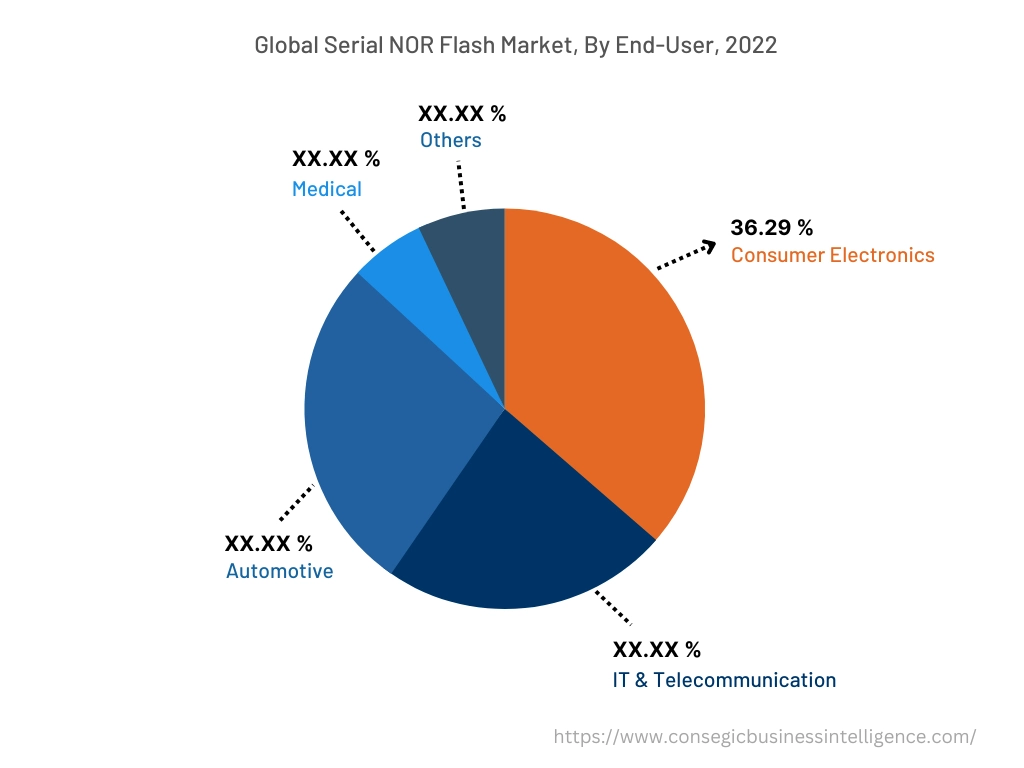

By End-User :

Based on the end-user, the market is segregated into consumer electronics, IT & telecommunication, automotive, medical, and others. The serial NOR flash market analysis suggested that the consumer electronics segment accounted for the largest revenue share of 36.29% in the year 2022. Factors including progressions in consumer electronics including growing demand of smartphones, computers, and other consumer devices, and rising popularity of smart wearable devices are driving the expansion of the consumer electronics segment.

According to GSM Association, the adoption of smartphones in Italy is projected to reach 81% by 2025, witnessing an increase from 77% in 2021. Additionally, according to Japan Electronics and Information Technology, the overall production by the Japanese electronics sector reached up to worth USD 95.2 billion in 2021, depicting an increase of 9.9% in contrast to 2020. Thus, the growing consumer electronics sector is increasing the utilization of NOR flash memory in smartphones, computers, wearables, and other consumer devices, in turn driving the rise of the market.

The serial NOR flash market analysis indicated that automotive segment is expected to witness the fastest CAGR growth during the forecast period. The proliferation of automotive segment is primarily driven by multiple factors including advancements in autonomous driving systems, growing need for enhanced automobile storage solutions, and rising production of automobiles among others.

For instance, Microchip Technology offers a broad product range of including 4 Mb, 8 Mb, 32 Mb, 64 Mb, and others in its product portfolio that are particularly designed for utilization in automotive applications. Additionally, Winbond offers W25H02JV_DTR model that is designed for deployment in automotive applications including ADAS, infotainment systems, instrument clusters, and others. Thus, the rising development of NOR flash memory or utilization in automotive applications is among the key factors significantly boosting the serial NOR flash market growth during the forecast period.

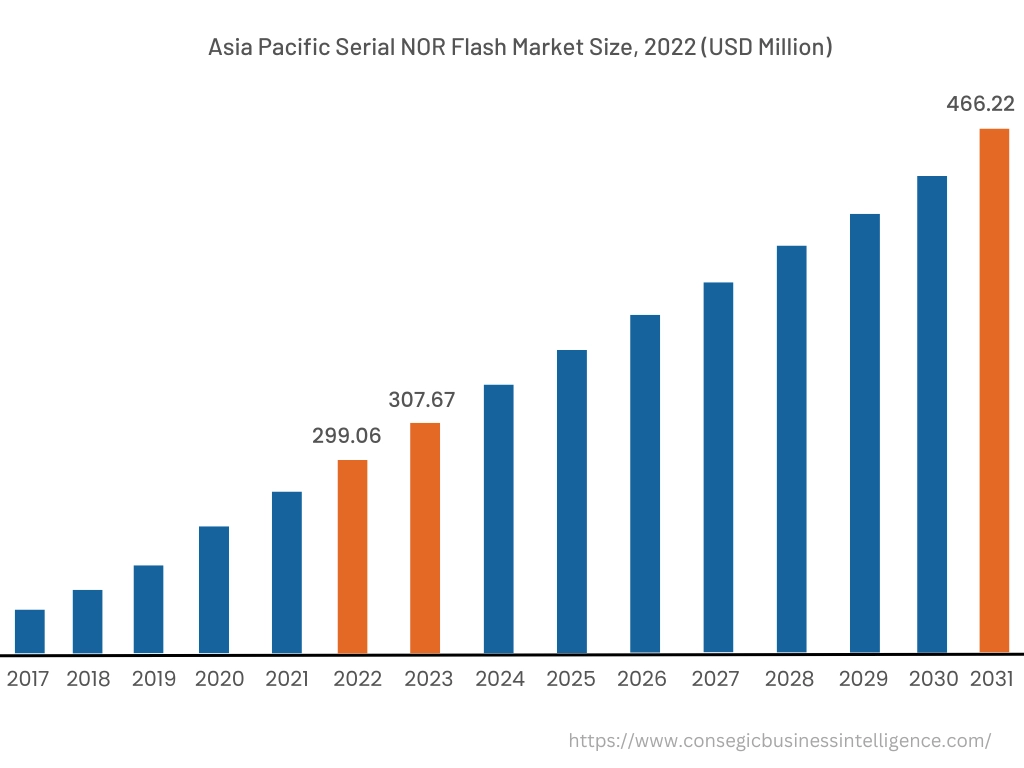

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America is estimated to reach over USD 599.07 Million by 2031 from a value of USD 400.00 Million in 2022 and is projected to grow by USD 410.11 Million in 2023. The market expansion in the North American region is driven by the deployment of memory in automotive, medical, IT & telecommunication, and other sectors. Analysis of serial NOR flash market trends concludes that the, rising development of telecom data centers and increasing demand for high-capacity server and storage solutions in data centers are among the significant factors driving the market expansion in the region.

For instance, in January 2023, ManageEngine announced the launch of two new data centers in Montreal and Toronto cities in Canada, with the aim of offering Canadian customers the benefits of localized data centers with enhanced data security and functionality. The above factors are driving the integration of NOR flash memory for application in data center servers, storage, and networks for storing large volumes of data and electronic information, in turn driving rise of the market in North America. Furthermore, the increasing investments in electric vehicles and rising demand for medical devices are projected to drive the market proliferation in North America during the forecast period.

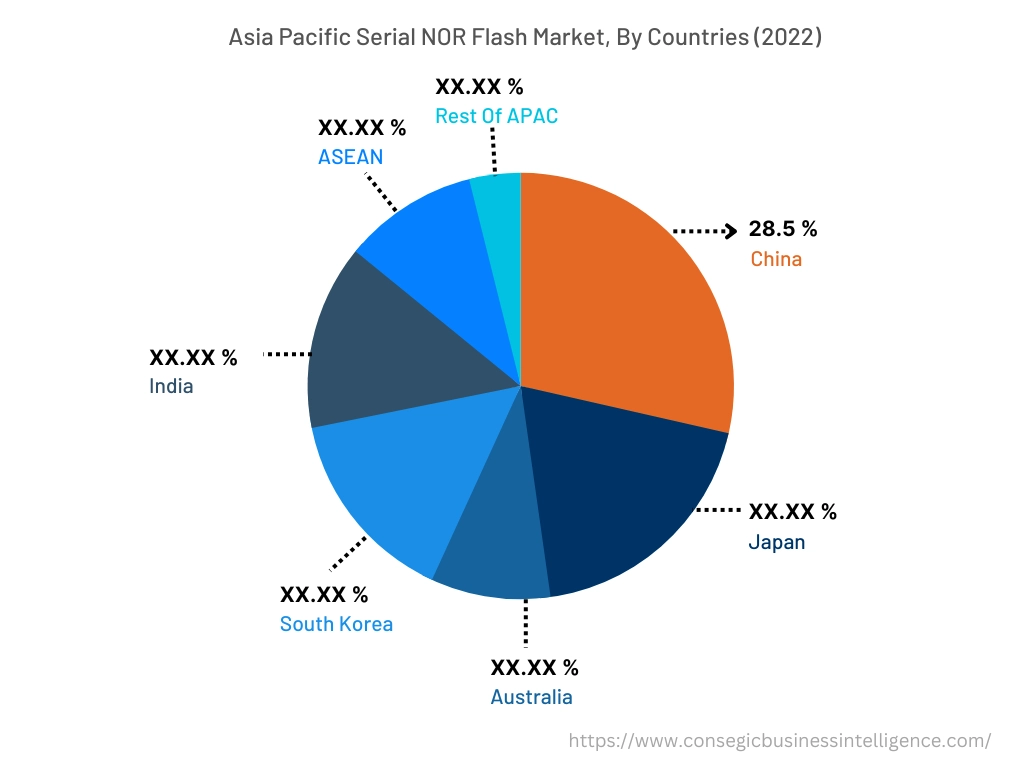

Asia-Pacific is expected to grow with the highest CAGR growth of 5.3% and is estimated to reach over USD 466.22 Million by 2031 from a value of USD 299.06 Million in 2022 and is projected to grow by USD 307.67 Million in 2023. In addition, in the region, the China accounted for the maximum revenue share of 28.5% in the same year. The growing pace of industrialization and development is creating lucrative growth aspects for the market in the region. Evaluation of serial NOR flash market trends concludes that the factors including the development of various industries including consumer electronics, automotive, and others are driving the market expansion in the Asia-Pacific region.

For instance, according to the International Organization of Motor Vehicle Manufacturers, the overall automotive production in Asia-Pacific reached 50,020,793 units in 2022, witnessing a rise of 7% from 46,768,800 units in 2021. SPI NOR are primarily used in the automotive sector for storage applications, particularly in ADAS, infotainment system, and other safety-critical systems. Therefore, the growing automotive sector in the Asia-Pacific region is thereby proliferating rise of the market in the region during the forecast period.

Top Key Players & Market Share Insights :

The global serial NOR flash market is highly competitive with major players providing their product to the national and international markets. companies operating in serial NOR flash industry are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in market. Key players in the serial global NOR flash market include-

- Microchip Technology Inc.

- Macronix International Co. Ltd.

- Microchip Technology Inc.

- KIOXIA Holdings Corporation

- Renesas Electronics Corporation

- Infineon Technologies AG

- Toshiba Corporation

- SK Hynix Inc.

- Intel Corporation

- Infineon Technologies AG

Recent Industry Developments :

- In June 2023, Winbond launched its new 8Mb W25Q80RV model of serial NOR flash. It is capable of delivering high performance and available in small form factor for addressing the requirement of connected IoT edge devices utilized in consumer and industrial segments.

Key Questions Answered in the Report

What is serial NOR flash? +

Serial NOR flash refers to a type of non-volatile memory that is primarily used in electronic devices for storing data. Serial NOR flash comprises of a block of memory in which all contents are erasable at a time while the data is written on the pages.

What specific segmentation details are covered in the serial NOR flash report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed 32 Mb serial NOR flash as the dominating segment in the year 2022, owing to its increasing utilization in automotive, medical devices, and other related applications.

What specific segmentation details are covered in the serial NOR flash market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed automotive as the fastest-growing segment during the forecast period due to rising adoption of serial NOR flash in automobile ADAS and infotainment system among others.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2031? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of industrialization and growth of multiple industries such as including consumer electronics, automotive, and others.