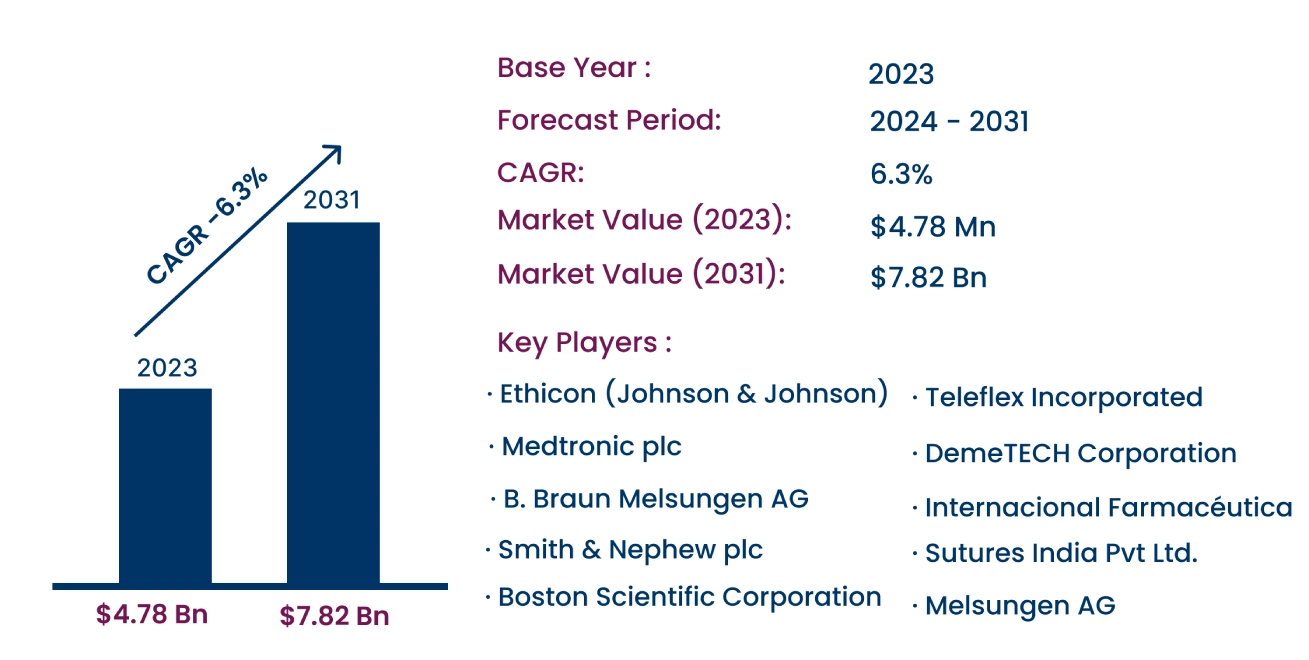

Global Surgical Sutures Market to Reach USD 7.82 Billion by 2031 | CAGR of 6.3%

Category : Healthcare | Published Date : Nov 2024 | Type : Press Release

Surgical Sutures Market Scope & Overview:

As per the Consegic Business Intelligence newly published report, the Surgical Sutures Market was valued at USD 4.78 Billion in 2023 and is projected to reach USD 7.82 Billion by 2031, growing at a CAGR of 6.3% from 2024 to 2031. Surgical sutures are sterile threads used to close wounds or surgical incisions, promoting proper tissue healing. They are classified into two main types: absorbable sutures, which dissolve naturally, and non-absorbable sutures, which require removal after healing. Made from materials like silk, catgut, polyglycolic acid, and polypropylene, these sutures are critical in fields such as cardiovascular, orthopedic, and general surgeries, ensuring precise wound closure.

The report comprises the Surgical Sutures Market Share, Size & Industry Analysis, By Product Type (Absorbable Sutures, Non-Absorbable Sutures), By Material (Monofilament Sutures, Multifilament (Braided) Sutures), By Application (Cardiovascular Surgery, General Surgery, Orthopedic Surgery, Gynecological Surgery, Ophthalmic Surgery, Cosmetic & Plastic Surgery, Others), By End-User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Specialty Clinics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), and Forecast, 2024-2031.

The report contains detailed information on Surgical Sutures Market Trends, Opportunities, Value, Growth Rate, Segmentation, Geographical Coverage, Company Profile, In-depth Expert Analysis, Revenue Forecast, Competitive Landscape, Growth Factors, Restraints or Challenges, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, and Cost Analysis.

Increased global surgeries and advances in suture materials are driving market growth, while biodegradable sutures offer significant growth opportunities.

Segmental Analysis :

Based on product type, the market is bifurcated into absorbable sutures and non-absorbable sutures.

- Absorbable sutures held the largest share of 63.18% in 2023, driven by their extensive use in internal surgeries where natural healing is crucial.

- Absorbable sutures are expected to grow at the fastest CAGR, with demand driven by their ability to dissolve naturally, reducing the need for removal post-surgery.

Based on material, the market is segmented into monofilament sutures and multifilament (braided) sutures.

- Monofilament sutures dominated the market in 2023, valued for their ability to minimize tissue trauma and infection risk, particularly in cardiovascular surgeries.

- Multifilament sutures are projected to see steady growth, driven by their superior knot security and strength, essential in high-tension surgeries like orthopedic procedures.

Based on application, the market includes cardiovascular surgery, general surgery, orthopedic surgery, gynecological surgery, ophthalmic surgery, cosmetic & plastic surgery, and others.

- Cardiovascular surgery accounted for the largest market share in 2023, with the rising incidence of cardiovascular diseases driving demand for sutures in critical procedures.

- Orthopedic surgery is expected to register the fastest CAGR, as aging populations and increased orthopedic surgeries fuel demand for high-tension sutures.

Based on end-users, the market is segmented into hospitals & clinics, ambulatory surgical centers (ASCs), and specialty clinics.

- Hospitals & clinics led the market in 2023, being the largest consumers of surgical sutures for a wide range of complex surgeries.

- Ambulatory surgical centers (ASCs) are projected to grow rapidly, as minimally invasive outpatient procedures continue to rise in popularity.

Based on regions, the global market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

- Asia-Pacific led the market in 2023, driven by increased surgeries and improved healthcare infrastructure in countries like China and India.

- North America is expected to grow significantly due to a high volume of surgeries and well-established healthcare systems, particularly in the U.S.

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 7.82 Billion |

| CAGR (2024-2031) | 6.3% |

| By Product Type | Absorbable Sutures, Non-Absorbable Sutures |

| By Material | Monofilament Sutures, Multifilament (Braided) Sutures |

| By Application | Cardiovascular Surgery, General Surgery, Orthopedic Surgery, Gynecological Surgery, Ophthalmic Surgery, Cosmetic & Plastic Surgery, Others |

| By End-User | Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Specialty Clinics |

| By Region | North America(U.S., Canada, Mexico) Europe(U.K., Germany, France, Spain, Italy, Russia, Benelux, Rest of Europe) APAC(China, South Korea, Japan, India, Australia, ASEAN, Rest of Asia-Pacific) Middle East & Africa(GCC, Turkey, South Africa, Rest of MEA) LATAM(Brazil, Argentina, Chile, Rest of LATAM) |

Top Key Players & Competitive Landscape :

The competitive landscape encompasses major innovators, aftermarket service providers, industry giants, and niche players, all of which are thoroughly examined by Consegic Business Intelligence in terms of their strengths, weaknesses, and value-addition potential. This report includes detailed profiles of key players, market share analysis, mergers and acquisitions, resulting market fragmentation, and emerging partnership trends and dynamics.

List of prominent players in the Surgical Sutures Industry:

- Ethicon (Johnson & Johnson) (USA)

- Medtronic plc (Ireland)

- B. Braun Melsungen AG (Germany)

- Smith & Nephew plc (UK)

- Boston Scientific Corporation (USA)

- Teleflex Incorporated (USA)

- DemeTECH Corporation (USA)

- Internacional Farmacéutica (Mexico)

- Sutures India Pvt Ltd (India)

- Melsungen AG (Germany)

Recent Industry Developments :

- In August 2023, Healthium Medtech launched TRUMAS™, a specialized range of sutures for minimally invasive surgeries.

- In September 2023, Genesis MedTech received NMPA approval for antibacterial absorbable sutures, designed to reduce infection risks post-surgery.