- Summary

- Table Of Content

- Methodology

Powdered Creamer Market Introduction :

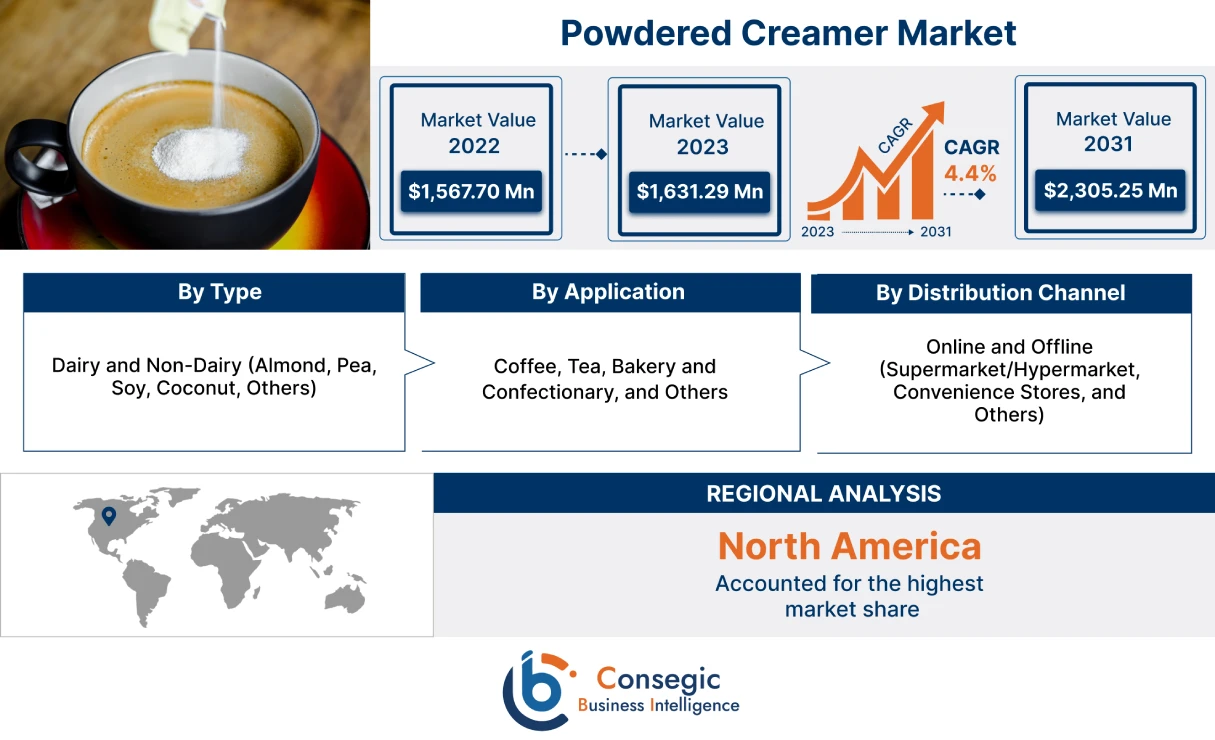

Consegic Business Intelligence analyzes that the powdered creamer market is growing with a CAGR of 4.4% during the forecast period (2025-2032). The market accounted for USD 1,664.54 million in 2024 and USD 1,707.45 million in 2025, and the market is projected to be valued at USD 2,341.77 Million by 2032.

Powdered Creamer Market Definition & Overview:

Powdered creamer is a type of creamer that is made from a dry powder. It is typically made from a combination of corn syrup solids, hydrogenated vegetable oil, and sodium caseinate (a milk derivative). Other ingredients may include anti-caking agents, emulsifiers, and artificial flavors.

Powdered creamer is a popular choice for coffee drinkers because it is convenient, inexpensive, and has a long shelf life. It is also lactose-free and cholesterol-free, making it a good option for people with dietary restrictions. Overall, powdered creamer is a versatile and cost-effective ingredient that can be used in a variety of business settings.

Powdered Creamer Market Insights :

Key Drivers :

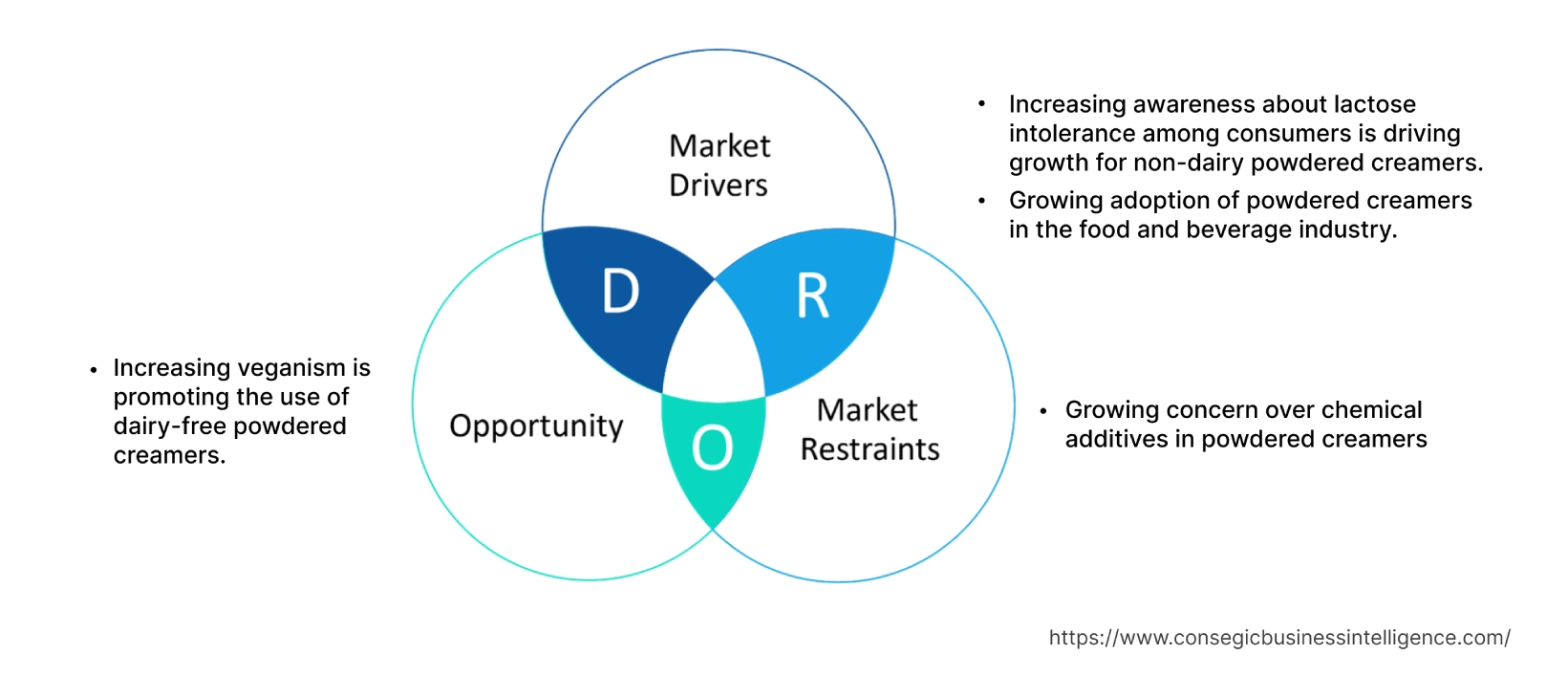

Increasing awareness about lactose intolerance among consumers is driving growth for non-dairy powdered creamers

Powdered creamers are also available in the form of dairy-free and have a longer shelf life than milk products, making them an ideal choice for lactose-intolerant consumers. Lactose intolerance is a digestive condition that affects people who have difficulty digesting lactose, the sugar found in milk and other dairy products. Symptoms of lactose intolerance can include bloating, gas, diarrhea, and abdominal cramps. Powdered creamer is a powder that can be added to hot beverages such as tea and coffee to give them a smooth texture. According to a report by the National Institute of Health U.S. in 2020, about 65% of the adult human population has some form of lactose intolerance.

In addition, there is an increasing trend of shifting towards dairy-free or vegan products owing to the potential health and environmental benefits. Furthermore, dairy-free products have many health advantages such as weight management, reduced exposure to antibiotics and hormones, clear skin, bone health, and others. As a result, the demand for non-dairy powdered creamers is rising among lactose-intolerant consumers. Hence, the rising demand for non-dairy powdered creamers is likely to boost the powdered creamers market.

Growing adoption of powdered creamers in the food and beverage industry

Powdered creamers are used in the food and beverage industry in packaged foods and beverages such as coffee, tea, instant soup, cakes, and others. Also, powdered creamers have a longer shelf life compared to traditional milk products, which makes them an ideal choice for the food processing industry. Furthermore, dairy-free creamers can be used in plant-based beverages where using whipped cream or half and half is not possible. Increasing initiatives by key players across the globe for the use of powdered creamer in food and beverages are further driving the market growth. For instance, in July 2021, Nestle Japan is promoting the wider use of its powdered creamer, which is typically used for coffee and tea, in cooking applications. The company also sells a liquid creamer under the Nestle Krematop brand. The company's goal is to increase sales of its powdered creamer by promoting its wider use in cooking applications.

Powdered creamer is a convenient and versatile ingredient that can be used in a variety of dishes, such as soups, sauces, and baked goods. It can also be used to add creaminess and richness to dishes that are typically made with dairy cream, such as mashed potatoes and macaroni and cheese. Moreover, powdered creamers are also used in infant formulas to improve the texture of milk. As a result, the various applications in the food and beverage industry are boosting the demand for powdered creamers. Hence, the aforementioned factors are driving the powdered creamer market.

Key Restraints :

Growing concern over chemical additives in powdered creamers

Powdered creamers are widely used in many beverages and act as an alternative to other milk products. However, powdered creamers are highly processed foods with many sugar and chemical additives such as vegetable oils, sodium caseinate, dipotassium phosphate, artificial flavors, and others. Further, the additives in powdered creamers can be toxic if consumed in high quantities or for longer durations.

Moreover, certain additives such as sodium caseinate are obtained from cows' milk which can be harmful to lactose-intolerant consumers. Also, preservatives like dipotassium phosphates are used in many fertilizers and pesticides. As a result, these additives make consumers hesitant to consume powdered creamers. Thus, the growing concern over chemical additives in powdered creamers is restraining the growth of the global powdered creamer market. Consumers are becoming more health-conscious and are looking for alternatives to powdered creamers that are made with healthier ingredients.

Future Opportunities :

Increasing veganism is promoting the use of dairy-free powdered creamers

Dairy-free powdered creamers can be used by lactose-intolerant as well as vegan consumers. Increasing veganism is driving the market for powdered creamers by promoting the use of dairy-free powdered creamers. Veganism is a lifestyle that excludes all forms of animal exploitation and cruelty, for ethical, environmental, and health reasons. Vegans do not eat meat, fish, poultry, eggs, or dairy products. According to a report by PETA Prime organization report in January 2023, the number of vegans in the United States increased 30-fold between 2004 and 2019. In 2004, there were 290,000 vegans in the US. In 2019, that number increased to almost 10 million. With rising awareness about the health and environmental benefits of veganism powdered creamer demands are predicted to increase. Also, many key manufacturers of powdered creamers such as Nestle S.A. are developing their dairy-free and vegan alternatives to cater to the growing demand from vegan consumers. As a result, the increasing demand from the vegan population is likely to boost the demand for non-dairy powdered creamers. Hence, the aforementioned factors are likely to boost the powdered creamer market in the forecast year.

Powdered Creamer Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2,341.77 Million |

| CAGR (2025-2032) | 4.4% |

| By Type | Dairy and Non-Dairy (Almond, Pea, Soy, Coconut, Others) |

| By Application | Coffee, Tea, Bakery and Confectionary, and Others |

| By Distribution Channel | Online and Offline (Supermarket/Hypermarket, Convenience Stores, and Others) |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Nestle S.A., TreeHouse Foods Inc., Ripple Foods, Nutpods, Super Group Ltd., Laird Superfood, Califa Farms, Kerry Group, Rick Product Corporation, Barry Callebaut, Chobani, and Danone |

Powdered Creamer Market Segmental Analysis :

Based on the Type :

The type is categorized into dairy and non-dairy. The non-dairy types of powdered creamer are further bifurcated into almond, pea, soy, coconut, and others. In 2024, the dairy segment accounted for the highest market share in the powdered creamer market. Dairy creamers offer a rich, creamy, and satisfying mouthfeel that closely resembles the texture of fresh milk or cream. This characteristic makes them a preferred choice for enhancing the taste and texture of beverages like coffee, tea, and hot chocolate. Furthermore, dairy creamers offer a source of essential nutrients, including calcium, protein, and vitamin D, which are important for maintaining overall health. This nutritional aspect makes them appealing to health-conscious consumers. The high benefits, easy availability and lower price of the dairy creamers are driving the segment growth across the globe.

Moreover, the non-dairy creamer segment is expected to hold the highest CAGR over the forecast period. The rising awareness of the health risks associated with dairy consumption, such as lactose intolerance, high cholesterol, and heart disease along with the increasing demand for plant-based foods and beverages due to ethical, environmental, and health concerns are driving the non-dairy segment growth across the globe. The increasing launch of non-dairy creamers is expected to provide lucrative growth opportunities for the segment growth over the forecast period. For instance, in January 2023, Chobani, an American food company announced the launch of Plant-Based Coffee Creamers are made with plant-based ingredients to create a rich, creamy, and dairy-like product.

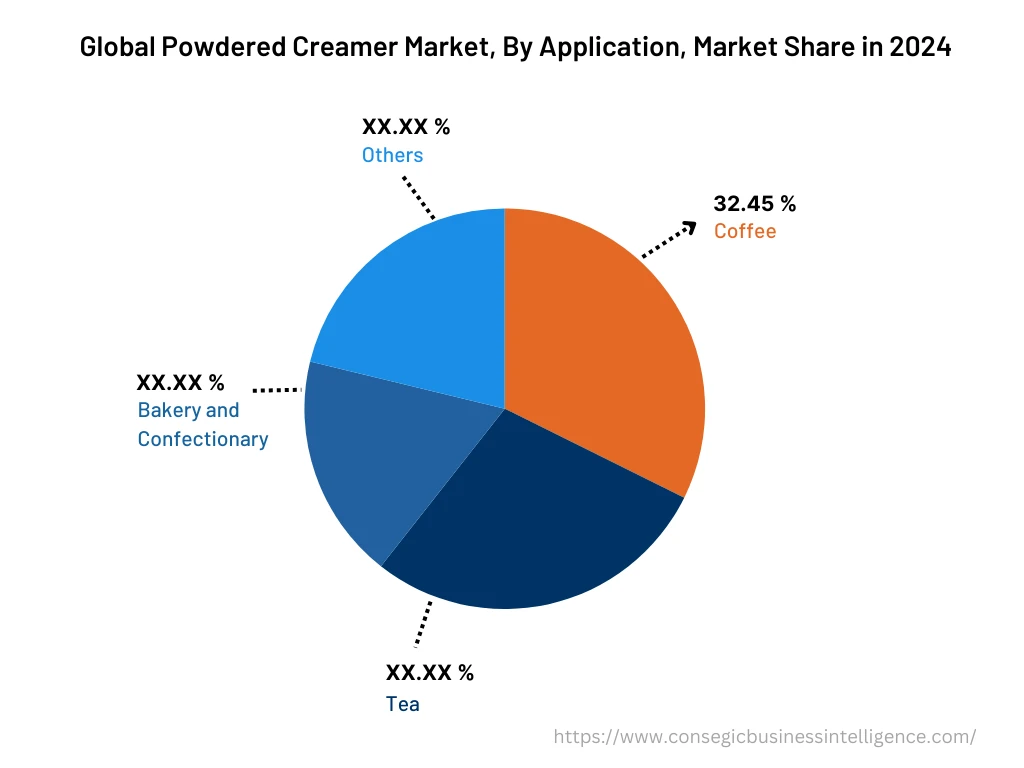

Based on the Application :

The application segment is categorized into coffee, tea, bakery and confectionary, and others. In 2024, the coffee segment accounted for the highest market share of 32.45% in the overall powdered creamer market and is expected to hold the highest CAGR over the forecast period. Powdered creamer is a convenient and affordable way to add creaminess and flavor to coffee. It is also lactose-free and cholesterol-free, making it a good option for people with dietary restrictions. The increasing expansion of powdered coffee creamer is driving the segment growth across the globe. For instance, in June 2021, Laird Superfood announced the expansion of its popular Powdered Superfood Coffee Creamer line with the launch of Aloha Oat & Macadamia Nut Superfood Creamer a plant-based oat milk creamer inspired by the flavors of Hawaii and created the superfood way. Thus, the significant growth in powdered creamer product launches for coffee applications is driving the segment growth across the globe.

Based on the Distribution Channel :

The distribution channel segment is categorized online and offline. In 2024, offline channels are further segmented as supermarket/hypermarket, convenience stores and others. The offline segment accounted for the highest market share in the overall powdered creamer market. The offline distribution channels offer a wide variety of powdered creamer brands and flavors, as well as the ability for consumers to physically inspect the product before purchase. Additionally, many consumers prefer to purchase powdered creamer from supermarkets/hypermarkets because they are convenient and one-stop shops for all their grocery needs. Furthermore, offline stores are convenient for consumers who need to purchase powdered creamer immediately. Consumers can simply go to their local grocery store or convenience store and purchase the product they need without having to wait for it to be shipped. The high convenience offered by the offline distribution channels is driving the segment growth across the globe.

Moreover, the online segment is expected to hold the highest CAGR over the forecast period. The convenience and affordability of online shopping, as well as the growing popularity of plant-based and specialty powdered creamers, are often more widely available online than in offline stores. Additionally, many online retailers offer competitive prices on powdered creamer, especially when purchased in bulk. The significant growth in the e-commerce channels is expected to drive the segment growth. For instance, according to the report by the International Trade Administration, Retail consumer goods e-commerce is by far the most dynamic and leading of the two consumer focuses. It had an 18% share of the total global retail sales for 2020 and is forecast to have over a 1% annual growth rate, achieving a nearly 22% share of total global retail sales by 2024. The growing sales through e-commerce channels are providing lucrative growth opportunities for the segment growth over the forecast period.

Based on the Region :

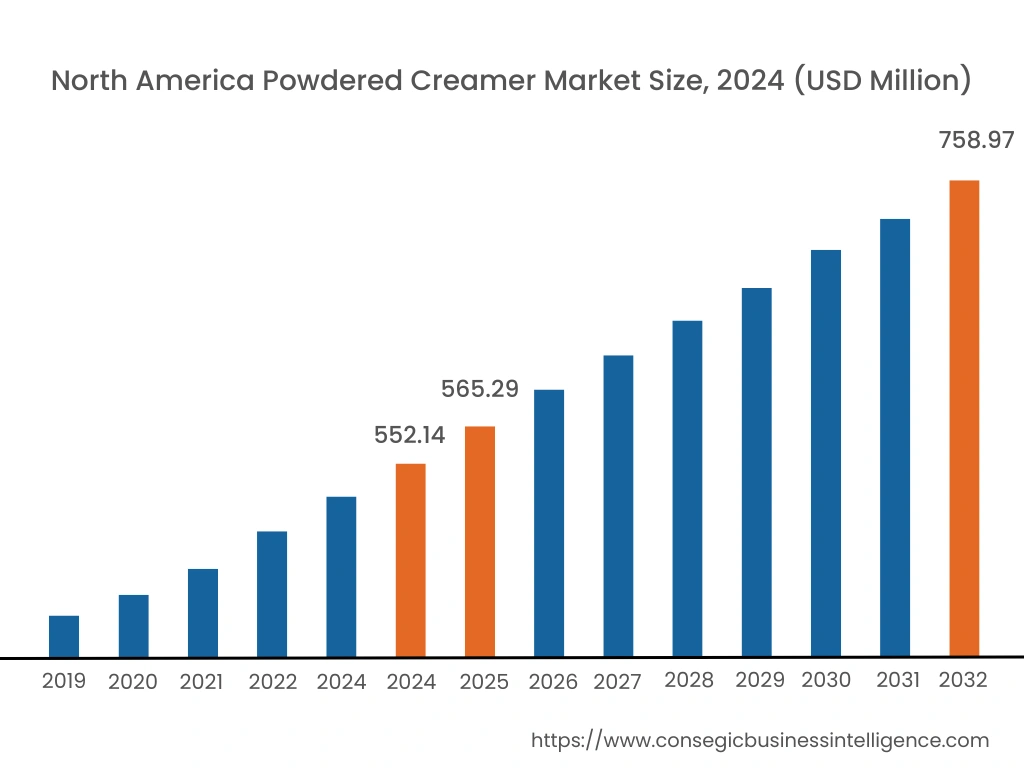

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

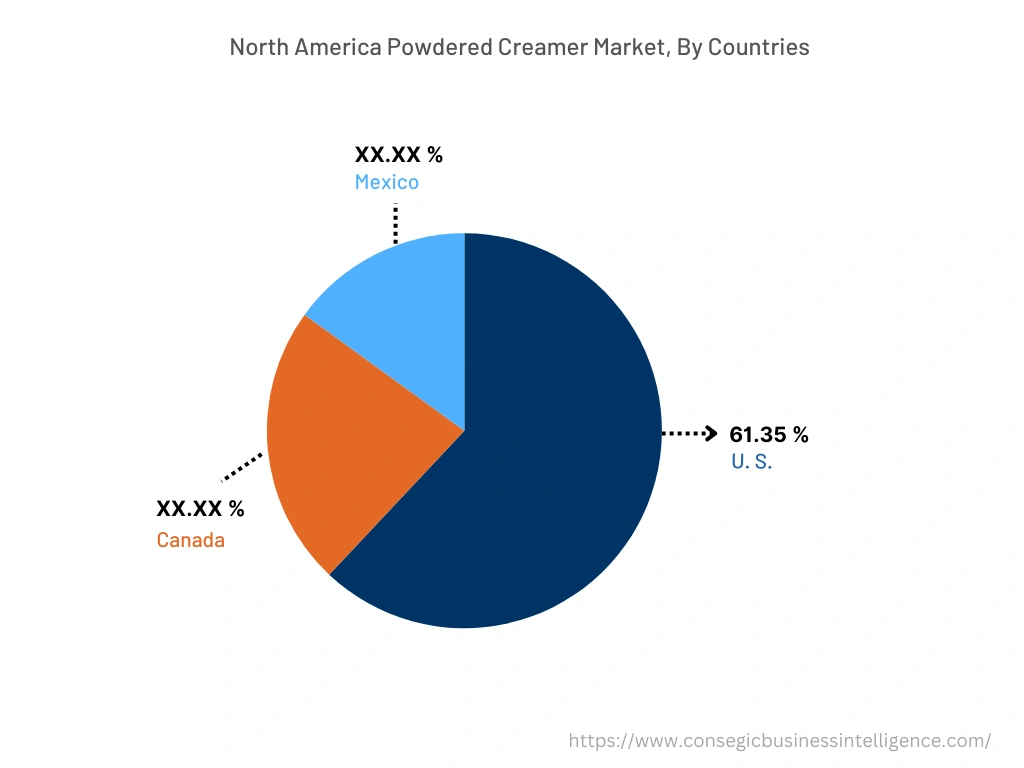

In 2024, North America accounted for the highest market share at 35.22% valued at USD 552.14 Million in 2024 and USD 565.29 Million in 2025, it is expected to reach USD 758.97 Million in 2032. In North America, the U.S. accounted for the highest market share of 61.35% during the base year of 2024. Coffee is the most popular beverage in North America, and its popularity continues to grow. As more people drink coffee, the demand for coffee creamer is also increasing. The high consumption of coffee in this region is one of the prominent factors driving the market growth across the region. For instance, according to the report by the National Institute of Health factors driving the market growth across the region. For instance, according to a report by the National Institute of Health in August 2020, 64% of Americans aged 18 years and older drink a cup of coffee every day, and 79% of them drink coffee at home. Coffee consumption increased with age, with 72% of adults over 60 years classed as coffee drinkers. Thus, the high consumption of coffee across the region is driving the demand for powdered creamer across North America.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 4.80% during 2025-2032. The growth of the coffee culture in China is presenting several opportunities for the powdered creamer market. For instance, according to a report released during the 2022 Shanghai Coffee Culture Week, China's coffee market was valued at 380 billion yuan in 2021, a 27% increase from the previous year. The market is expected to exceed one trillion yuan in 2025. Thus, the significant growth in the coffee culture across the Asia Pacific is providing lucrative growth opportunities for the powdered creamer market growth over the forecast period.

Top Key Players & Market Share Insights:

The Powdered Creamer market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Nestle S.A.

- TreeHouse Foods Inc.

- Barry Callebaut

- Chobani

- Danone

- Ripple Foods

- Nutpods, Super Group Ltd.

- Laird Superfood

- Califa Farms

- Kerry Group

- Rick Product Corporation

Recent Industry Developments :

- In June 2022, Califia Farms is a US plant-based beverage company that makes dairy-free creamers. Their Iced Café Mixers are designed for iced coffees and contain 3g of sugar per serving. They are made with a blend of oat and almond milk.

- In June 2021, Laird Superfood is announced the expansion of its line of powdered superfood coffee creamers with the launch of Aloha Oat & Macadamia Nut Superfood Creamer. This plant-based oat milk creamer is inspired by the flavors of Hawaii and is made with real, whole-food ingredients. It is also Laird Superfood's first non-coconut-based creamer.

- In January 2021, Coffee Mate, a Nestlé brand, launched three new coffee creamer flavors: M&M's Milk Chocolate, Oatmeal Crème Pie, and Glazed Donut. The Oatmeal Crème Pie flavor is a combination of cinnamon, brown sugar, and oatmeal cookie flavors.

Key Questions Answered in the Report

What was the market size of the powdered creamer market in 2024? +

In 2024, the market size of powdered creamer was USD 1,664.54 million.

What will be the potential market valuation for the powdered creamer industry by 2032? +

In 2032, the market size of powdered creamer will be expected to reach USD 2,341.77 million.

What are the key factors driving the growth of the powdered creamer market? +

Increasing awareness about lactose intolerance among consumers across the globe is fueling market growth at the global level.

What is the dominant segment in the powdered creamer market for the application? +

In 2024, the coffee segment accounted for the highest market share of 32.45% in the overall powdered creamer market.

Based on current market trends and future predictions, which geographical region is the dominating region in the powdered creamer market? +

North America accounted for the highest market share in the overall market.