- Summary

- Table Of Content

- Methodology

Piperylene Market Size :

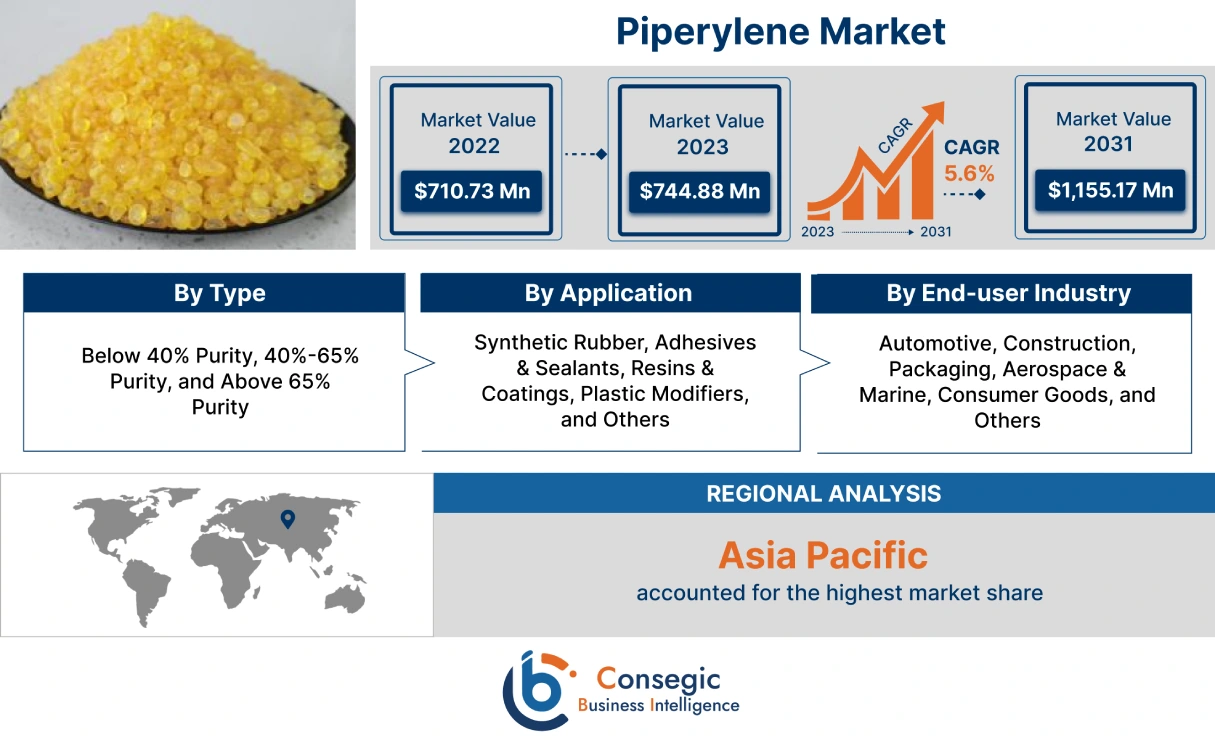

Consegic Business Intelligence analyzes that the piperylene market size is growing with a CAGR of 5.6% during the forecast period (2023-2031), and the market is projected to be valued at USD 1,155.17 Million by 2031 and USD 744.88 Million in 2023 from USD 710.73 Million in 2022.

Piperylene Market Scope & Overview:

Piperylene, which is also known as 1,3-pentadiene is a flammable, colorless liquid hydrocarbon compound with the chemical formula C5H8. It is a type of conjugated diene, which contains a double bond in its molecular formula. It is typically manufactured by the cracking of petroleum or natural gas. The process involved the breaking down of larger hydrocarbons into smaller ones.

It is an important intermediate used to form plastics, adhesives, and resins. The resin is widely used in many applications including adhesives, inks, and building materials. This resin has unique properties that allow it to be used in hot melting and pressure-sensitive applications such as road marking paint, rubber traffic equipment, and waterproof coatings.

Piperylene Market Insights :

Key Drivers :

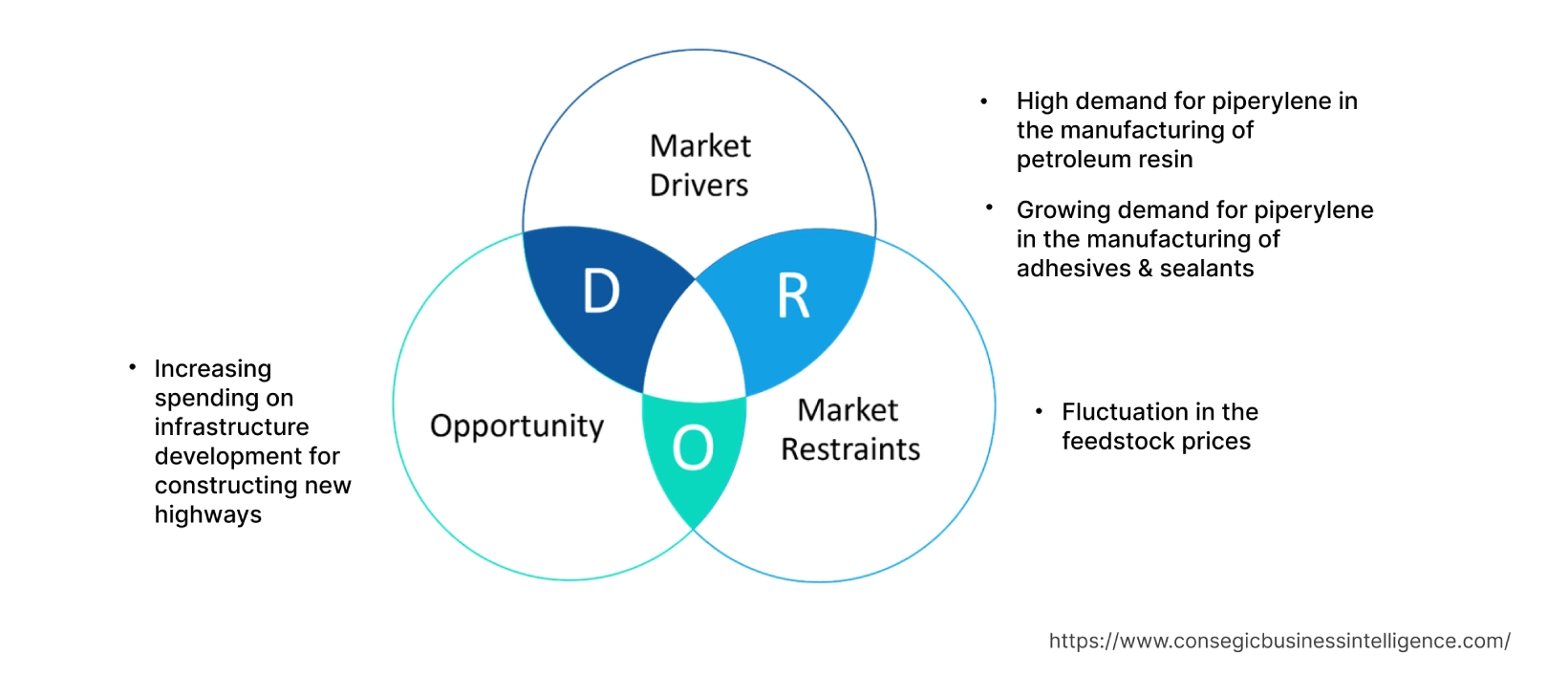

High demand for piperylene in the manufacturing of petroleum resin

Piperylene is primarily used in the manufacturing of petroleum resins as a feedstock or starting material. Petroleum resins are versatile materials with a wide range of applications due to their excellent properties and versatility. Petroleum resins find application in adhesives, coating, printing inks, packaging, rubber compounds, and others. Petroleum resin is used as a tackifier in rubber compounds, such as tires and footwear, to improve their adhesion properties and durability. As per the analysis, the growing focus of automotive tire manufacturers across the globe on the expansion of their manufacturing operations is leading to increasing requirement for petroleum resins for the manufacturing of rubber compounds. For instance, in March 2023, JK Tyre, a tire manufacturing company announced a partnership with International Finance Corporation for the expansion of their manufacturing capacity. As per the partnership, International Finance Corporation invested USD 30 million for the construction of a new manufacturing facility. Thus, the growing investment in the production of tires is increasing the requirement for petroleum resins which is further driving the global piperylene market trend worldwide.

Growing demand for piperylene in the manufacturing of adhesives & sealants

Piperylene is heavily used as a key raw material in the manufacturing of adhesives and sealants. It is used to produce tackifying resins, which are essential components in adhesives. Tackyfiers improve the adhesive properties of the final products, such as their ability to stick to the surface and maintain adhesion over time. This is crucial in applications such as packaging tapes, labels, and pressure-sensitive adhesives. From corrugated cardboard boxes to plastic films and glass containers, adhesives are used to ensure that packaging remains intact during transportation and storage, as well as to enhance the visual appeal and functionality of packaging. Based on the analysis, significant development in the e-commerce sector is improving the requirement for functional packaging and thus leading to requirement for adhesives and sealants. The increasing focus of various players on the expansion of their adhesives manufacturing facilities is driving the segment trend. For instance, in August 2022, PPG Industries Inc., a global manufacturer and supplier of paints and coatings announced an investment of USD 9 million for the expansion of the existing adhesives and sealants production line in Texas. Thus, the requirement for adhesives and sealants for e-commerce packaging is driving the requirement of this compound for adhesives and sealants manufacturing. This, in turn, is driving the market growth and trends.

Key Restraints :

Fluctuation in the feedstock prices

Piperylene is typically produced from petrochemical feedstocks such as ethylene production from crude oil. The prices of the pipeline are mainly influenced by the fluctuation in the prices of these feedstocks such as crude oil and natural gas. Volatility in the prices of crude oils and natural gas prices significantly affected the production and profitability of this compound resulting in the high cost of product. Thus, the high volatility in the prices of crude oils is restraining the piperylene market growth across the globe. For instance, according to the report by the World Bank in December 2022, the Brent prices of crude oil in 2020 accounted for USD 63.6/bbl in January 2020, USD 54.55/bbl in January 2021 and USD 85.53/bbl in 2022. Thus, the volatility in the prices of crude oil across the globe is leading to the high production and product cost of this compound worldwide and hampering the growth of piperylene industry.

Future Opportunities :

Increasing spending on infrastructure development for constructing new highways

The increasing spending on infrastructure development for constructing nre highways is creating lucrative piperylene market opportunities and trends. Piperylene-based resins are essentially used in hot melting and pressure-sensitive applications such as road marking paints due to their unique properties. Road marking paints are a great choice for car parks, shipping ports, highways, block paving surfaces, warehouses, and transport yards. Road marking paints help raise awareness of approaching danger spots and keep drivers in proper control of their speed. Growing focus on the development of advanced road and highway infrastructure across various developing economies is creating heavy demand for road marking paints which is expected to drive the demand for this compound for the manufacturing of road marking paints. For instance, in July 2023, the Union Road and Transport Minister of India Mr. Nitin Gadkari announced the provisional target of constructing 13,800 kilometers of national highways (NHs) in 2023-2024. Furthermore, in November 2021, President of the U.S. Mr. Biden signed the Infrastructure Investment and Jobs Act (IIJA) (Public Law 117-58, also known as the "Bipartisan Infrastructure Law") into law. The Bipartisan Infrastructure Law is the largest long-term investment in our infrastructure and economy in our Nation's history. It provides USD 550 billion over fiscal years 2022 through 2026 in new Federal investment in infrastructure, including roads, bridges, mass transit, water infrastructure, resilience, and broadband. Hence, the significant rise in the construction of various infrastructures across the globe is expected to provide lucrative opportunities and trends for this compound in road marking paint applications globally in the upcoming years.

Piperylene Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 1,155.17 Million |

| CAGR (2023-2031) | 5.6% |

| By Type | Below 40% Purity, 40%-65% Purity, and Above 65% Purity |

| By Application | Synthetic Rubber, Adhesives & Sealants, Resins & Coatings, Plastic Modifiers, and Others |

| By End-user Industry | Automotive, Construction, Packaging, Aerospace & Marine, Consumer Goods, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Shell Chemicals, China Petrochemical Corporation, Sunny Industrial System GmbH, LyondellBasell Industries N.V., Mitsui & Co., Shandong Yuhuang Chemical, LOTTE Chemical, Braschem, Henghe (Nanjing)Materials & Science Technology Co.,Ltd., and Zibo Luhua Hongjin New Material Group Co.,Ltd |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Piperylene Market Segmental Analysis :

By Type :

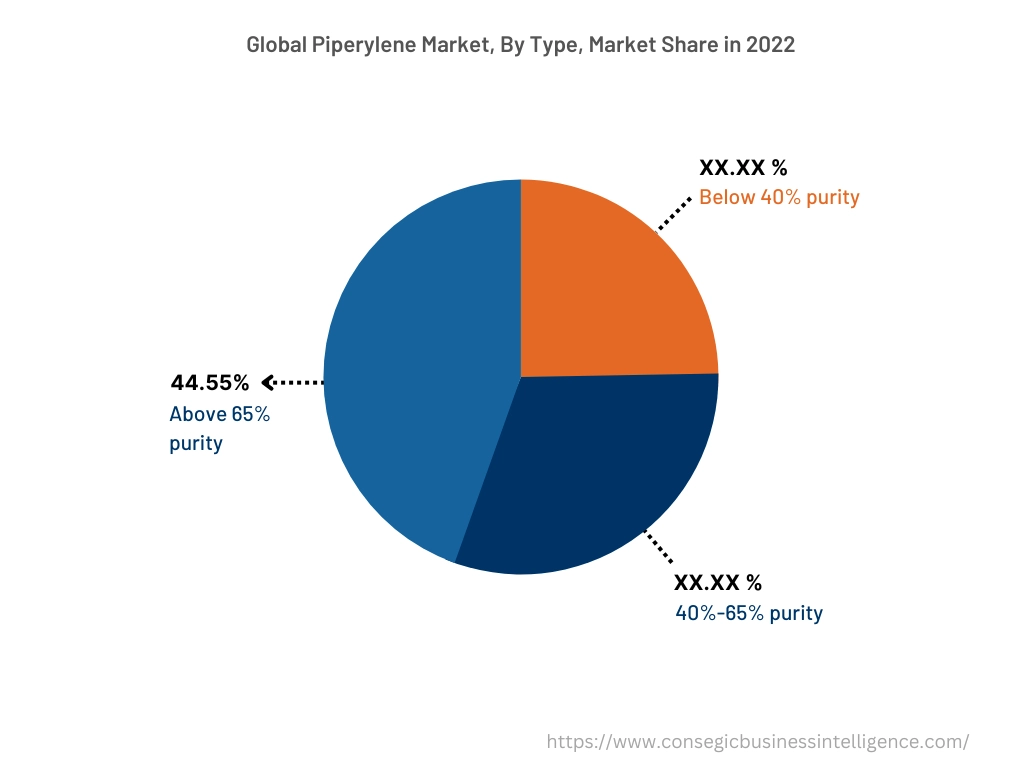

The type segment is categorized into below 40% purity, 40%-65% purity, and above 65% purity. In 2022, the above 65% purity segment accounted for the highest piperylene market share of 44.55% in the piperylene market and is also expected to hold the highest CAGR over the forecast period. Above 65% purity of this compound, which is also known as high purity of this compound is a specialized grade of chemical compound having significant applications in the manufacturing of synthetic rubber, adhesives & sealants, resins & coatings, plastic modifiers, and others. High-purity of this compound in plastic modifiers is used for the manufacturing of plastic materials that are suitable for use in pharmaceutical, food processing, and semiconductor manufacturing industries. Based on the analysis, high-purity piperylene-based plastic is crucial in semiconductors as it is a precursor in the production of ultra-pure electronic materials, particularly for the deposition of thin films and the development of epitaxial layers in semiconductor device lubrication. The high demand for semiconductors from the electronics sector is driving the segment trend across the globe.

By Application :

The application segment is categorized into synthetic rubber, adhesives & sealants, resins & coatings, plastic modifiers, and others. In 2022, the synthetic rubber segment accounted for the highest market share in the overall piperylene market. It is an essential raw material in the production of synthetic rubber and it is primarily used in the production of two important types of synthetic rubber polybutadiene rubber (PBR) and styrene butadiene rubber (SBR). Polybutadiene rubber is used in the manufacturing of industrial belts, tire threads, footwear golf ball cores, and others. As per the analysis, Styrene butadiene rubber is used for the manufacturing of tires, footwear, automotive parts, belts conveyor systems, and others. The significant development in the production of polybutadiene rubber is driving the market segment worldwide. For instance, in April 2023, Arlanxeo, a leading synthetic rubber manufacturing company announced the launch of a new production line of polybutadiene in Brazil with an annual production capacity of 65,000 metric tons per year. Thus, the aforementioned factors are propelling the trend of the market.

Furthermore, the resins & coatings segment is expected to be the fastest-growing CAGR over the forecast period. It is used in the production of resins and coatings that are used for various applications. Resins have excellent bonding properties and are suitable for use in coated flooring, lining, and civil engineering repair applications. Hence, as per the analysis, the increasing piperylene market demand to provide resins and coatings for various construction applications is expected to drive the segment during the forecast period.

By End-User Industry :

The application segment is categorized into automotive, construction, packaging, aerospace & marine, consumer goods, and others. In 2022, the automotive segment accounted for the highest market share in the overall piperylene market, and it is also expected to grow at the highest CAGR over the forecast period. It is used in various applications such as the manufacturing of synthetic rubber, sealants, adhesives, paints and coatings, plastic, and others. Based on the analysis, these applications are heavily incorporated in the automotive sector. Synthetic rubber is widely used in the automotive sector for tires, doors, and window profiles. It is also used as a seal such as O-rings and gaskets, hoses, belts, matting, and flooring. Sealants in the automotive sector are used to waterproof weather seals around windows. The significant development in the automotive sector across the globe is driving the segment development over the forecast period. For instance, according to the report by the European Automobile Manufacturers Association in February 2023, in 2022, global new car registrations reached 66.2 million units, as sales recovered in the last quarter of the year. North American car production rose by 10.3% in 2022 to 10.4 million units, primarily driven by strong demand in the US. Thus, the significant growth in the automotive industry and across the globe is driving the trend and the segment growth.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

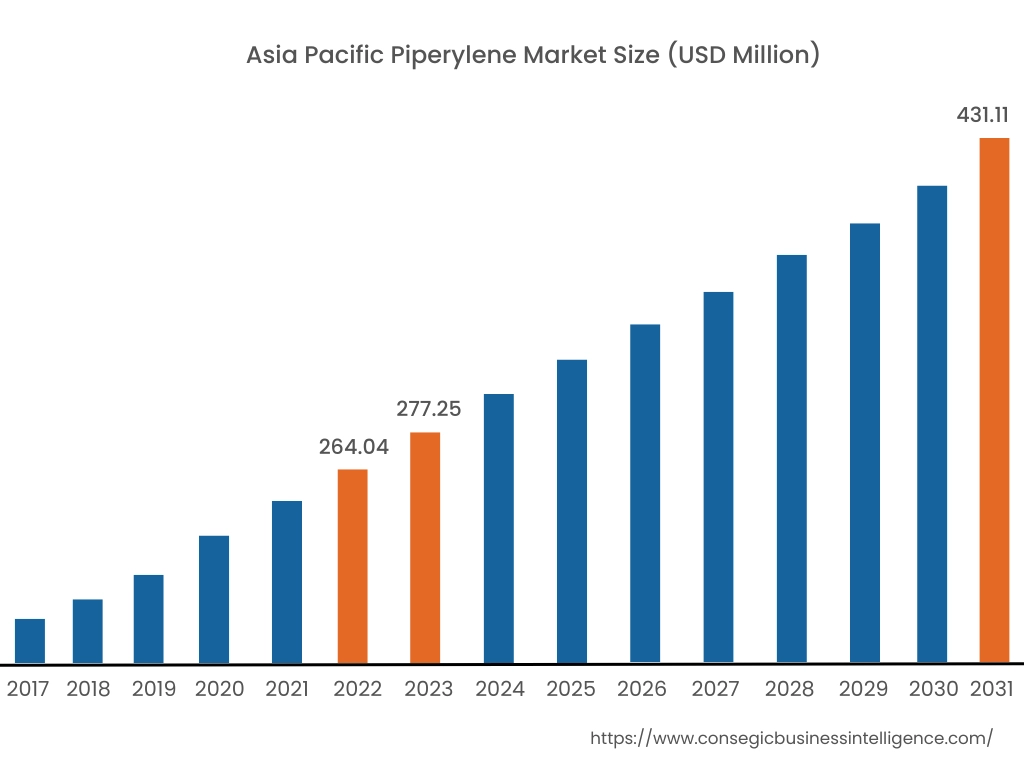

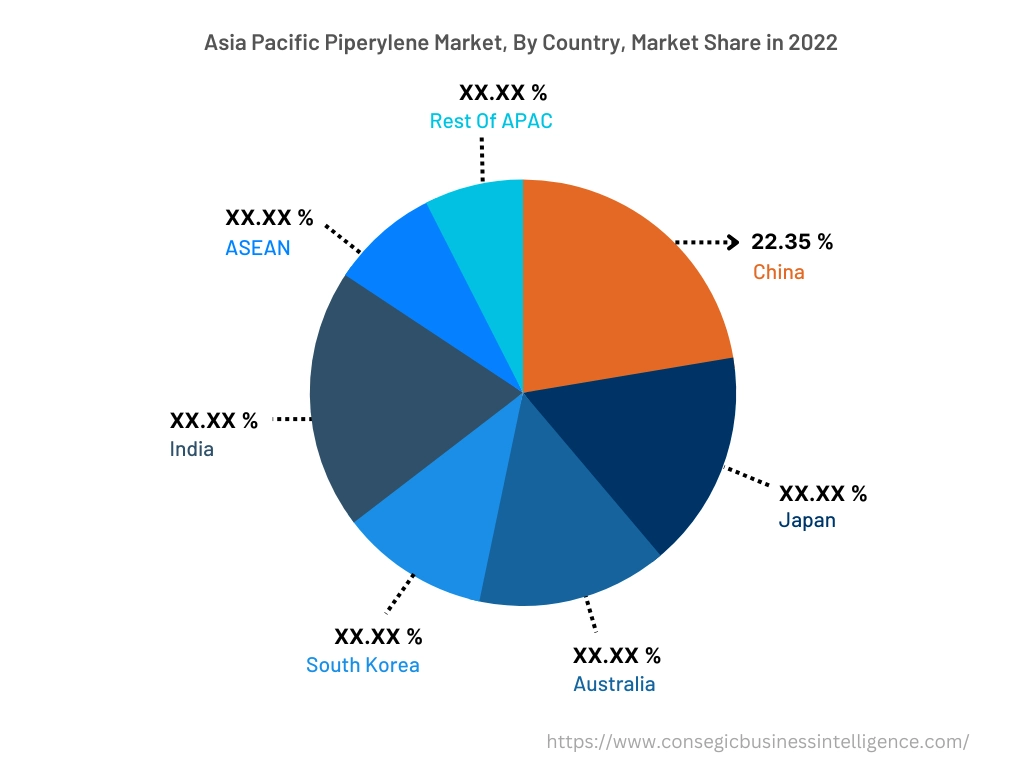

In 2022, Asia Pacific accounted for the highest market share at 37.15% valued at USD 264.04 million in 2022 and USD 277.25 million in 2023, it is expected to reach USD 431.11 million in 2031. In Asia Pacific, China accounted for the highest market share of 22.35% during the base year of 2022. As per the analysis, the significant growth in the automotive and paper & packaging sector across the region is fueling the market growth. For instance, according to the report by the International Trade Administration in April 2023, China is the largest vehicle market in the world by both sales and manufacturing output, with automotive production expected to reach 35 million vehicles by 2025. Furthermore, according to the report by the European Automobile Manufacturers Association in February 2023, car production in China increased by 11.7% in 2021, with 23.2 million vehicles built, representing 34% of global production. Furthermore, according to the report by the Indian Brand Equity Foundation in October 2022, the paper and packaging sector in India is growing rapidly and has significant potential for future expansion. The sector was valued at USD 50.5 billion in 2019 and is anticipated to reach USD 204.81 billion by 2025, with a CAGR of 26.7% from 2020-2025. Thus, the development of above-mentioned sector is driving the segment.

However, North America region is expected to witness the highest CAGR of 6.1% during 2023-20230. Based on the piperylene market analysis, this is due to the increasing investments in infrastructure projects across the region. For instance, in February 2022, the government of Mexico prepared a third infrastructure package of USD 3.53 billion for various infrastructure projects across the country. Thus the aforementioned factors are propelling the development of the region in the upcoming years.

Top Key Players & Market Share Insights:

The Piperylene market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market revenue through mergers, acquisitions, and partnerships. The key players in the market include-

- Shell Chemicals

- China Petrochemical Corporation

- Braschem

- Henghe (Nanjing)Materials & Science

Technology Co.,Ltd. - Zibo Luhua Hongjin New Material Group Co.,Ltd

- Sunny Industrial System GmbH

- LyondellBasell Industries N.V.

- Mitsui & Co.

- Shandong Yuhuang Chemical

- LOTTE Chemical Corp.

Recent Industry Developments :

- In January 2022, Lotte Chemical Corp., which is a South Korea-based chemical company announced its plan for the construction of a large-scale petrochemical complex in Indonesia with an Investment of USD 3.9 billion.

Key Questions Answered in the Report

What was the market size of the piperylene industry in 2022? +

In 2022, the market size of piperylene was USD 710.73 million.

What will be the potential market valuation for the piperylene industry by 2031? +

In 2031, the market size of piperylene will be expected to reach USD 1,155.17 million.

What are the key factors driving the growth of the piperylene market? +

High demand for piperylene in the manufacturing of petroleum resin across the globe is fueling market growth at the global level.

What is the dominating segment in the piperylene market by type? +

In 2022, the above 65% purity segment accounted for the highest market share of 44.55% in the overall piperylene market.

Based on current market trends and future predictions, which geographical region is the dominating region in the piperylene market? +

Asia Pacific accounted for the highest market share in the overall piperylene market.