- Summary

- Table Of Content

- Methodology

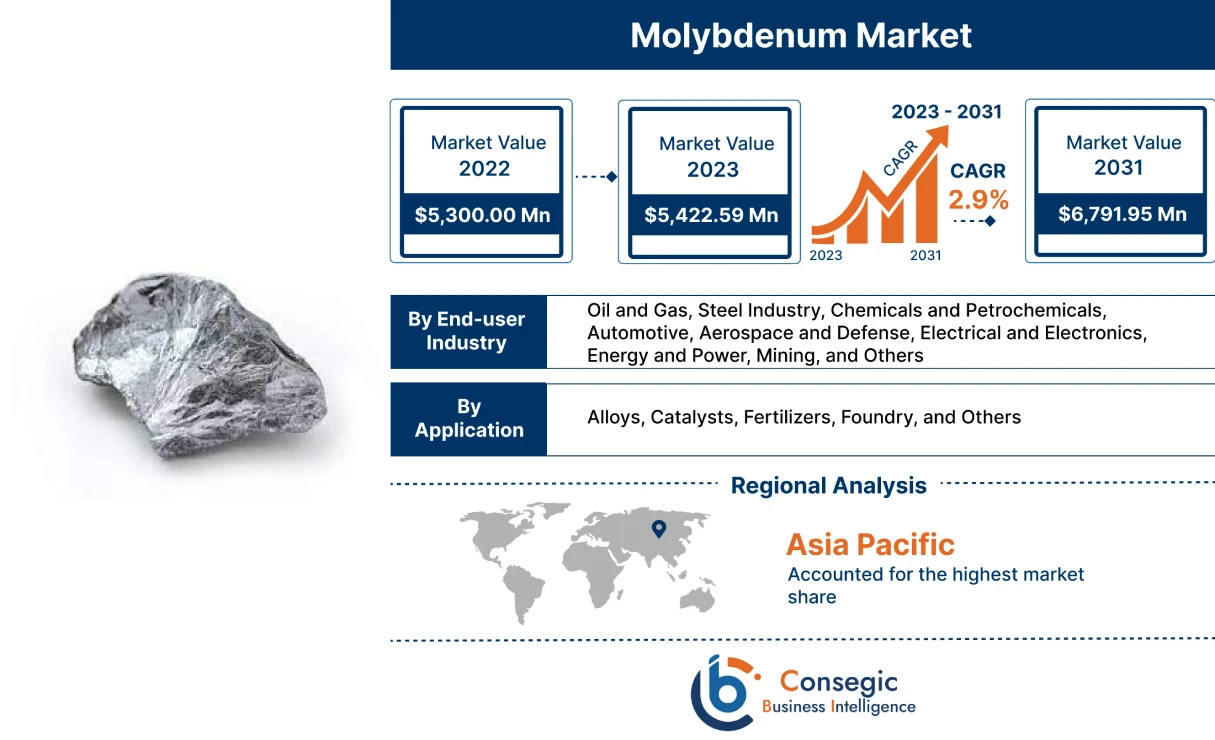

Molybdenum Market Size :

Consegic Business Intelligence analyzes that the molybdenum market size is growing with a CAGR of 2.9% during the forecast period (2023-2031). The market accounted for USD 5,300.00 million in 2022 and USD 5,422.59 million in 2023, and the market is projected to be valued at USD 6,791.95 Million by 2031.

Molybdenum Market Scope & Overview:

Molybdenum (Mo) is a chemical element with the atomic number 42. It's a silvery-white, hard transition metal with one of the highest melting points of all pure elements. It's also a micronutrient essential for life. It is available in two different forms in nature such as pure molybdenum and molybdenum alloys. Pure molybdenum is highly refined and has a purity of 99.9% or more. It is used in a variety of applications, such as electrical contacts, heating elements, and sputtering targets.

It is often alloyed with other metals to improve its properties. These alloys are used in a wide range of applications, including aircraft and automotive parts, construction materials, and oil and gas equipment. It is primarily used in alloys, but it is also used in a variety of chemical applications such as catalysts, pigments, electrodes, and dietary supplements.

Molybdenum Market Insights :

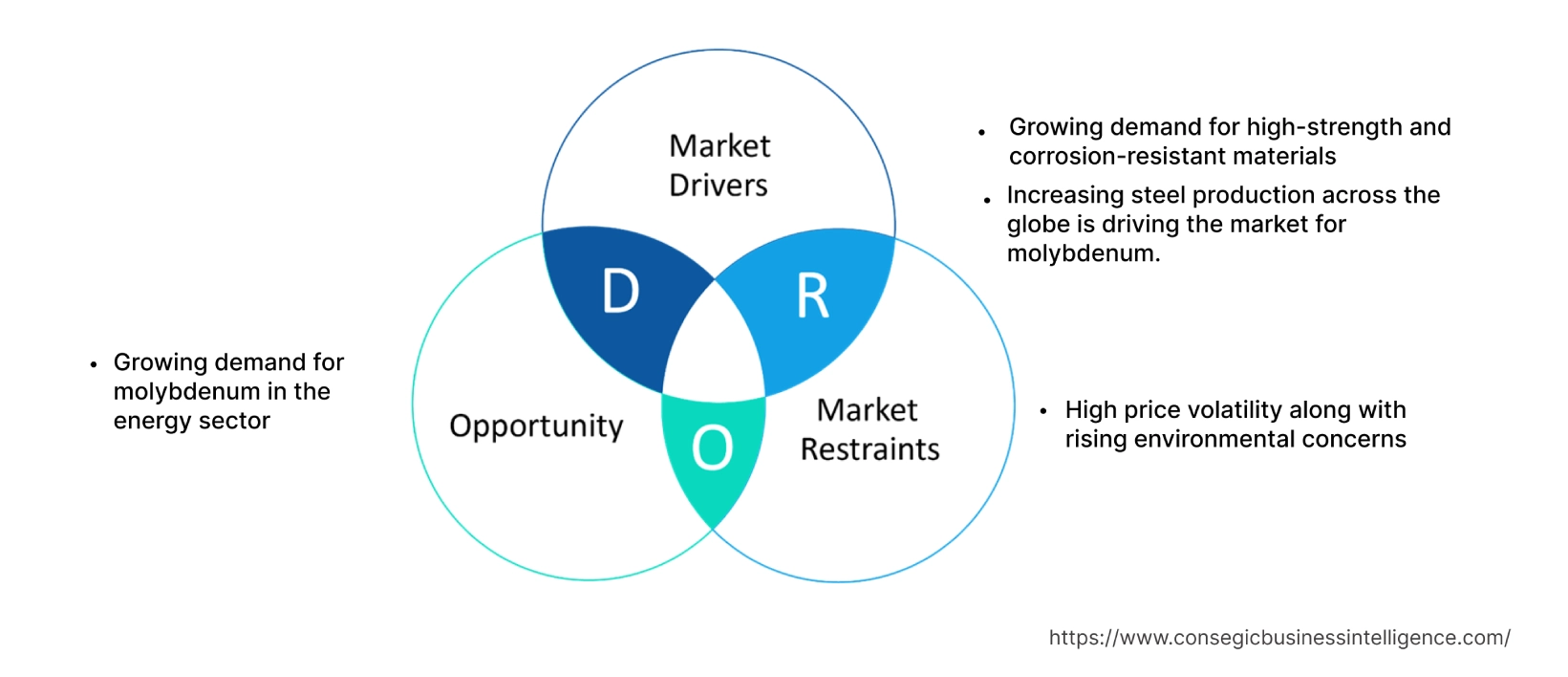

Key Drivers :

Growing demand for high-strength and corrosion-resistant materials

Molybdenum is a versatile element that is added to alloys to improve their strength, hardness, ductility, and corrosion resistance. It is used in a variety of electronic components, such as transistors and circuit boards. As the requirement for electronics continues to grow, the demand is also expected to increase. It is a versatile element that is added to alloys to improve their strength, hardness, ductility, and corrosion resistance. Molybdenum alloys are used in a wide range of automotive components, including engine parts, landing gear, and suspension systems. Significant growth in the production of electric vehicles is driving the need for lightweight and high-strength materials which is benefiting the segment growth across the globe. They are used in a wide range of applications, including aircraft and automotive parts, construction materials, and oil and gas equipment. For instance, according to the report by the International Energy Agency in July 2023, electric vehicle sales in 2022 accounted for 22 million, which is a 4% increase from the previous year 2020. Hence, the analysis of market trends shows that the growth in demand for high-strength and corrosion-resistant materials from various end-user industries is driving the molybdenum market growth worldwide.

Increasing steel production across the globe is driving the market.

Molybdenum is used to produce steel by adding it to molten iron in small quantities. It has several beneficial effects on the properties of steel, such as high strength, hardness, ductility, and improved corrosion resistance. It also increases the hardness of steel by forming hard carbides. These carbides are very resistant to wear and tear, which makes this steel ideal for applications where high hardness is required.

It improves the ductility of steel by preventing the formation of grain boundaries. Grain boundaries are weak points in steel, so reducing their number makes the steel more ductile. Molybdenum alloys with iron to form iron molybdate, which dissolves in the molten iron. For instance, according to the China Iron and Steel Association (CISA) in April 2023, China's crude steel production in 2022 reached 1.032 billion tons, up 5.3% from the previous year. This was the highest annual crude steel production on record in China. It is an essential alloying element to produce high-strength, corrosion-resistant, and weldable steel. Thus, the analysis of market trends shows that it is expected to benefit from the aforementioned reasons across the globe, thus driving the molybdenum market growth.

Key Restraints :

High price volatility along with rising environmental concerns

Molybdenum is a relatively rare element in the earth's crust, and most of it is found in a few concentrated regions. This limited availability leads to price fluctuations, especially when there are disruptions in the supply chain. It is often found as a byproduct of mining copper or other minerals. Extracting and processing from these ores can be technically challenging and costly, which significantly improves the production cost. The extraction and refining require significant energy inputs. Energy costs greatly impact the overall cost of production, especially when energy prices are high.

Moreover, mining and processing can have negative environmental impacts, such as water pollution and soil contamination. These environmental concerns could lead to increased regulation of the molybdenum industry, which could increase costs and reduce supply. It is mined using a variety of methods, including surface mining and underground mining. Surface mining can disturb the land and pollute water sources. Underground mining also pollutes water sources and releases harmful gases into the air. Thus, the analysis of market trends shows that the high price volatility along with the rising environmental concerns across the globe are restraining the molybdenum market demand.

Future Opportunities :

Growing demand in the energy sector

Molybdenum is a versatile element that has several applications in clean energy production. It is used in a variety of clean energy technologies, such as solar panels, wind turbines, and fuel cells. It is used in the production of thin-film solar cells. Thin-film solar cells are a type of solar cell that is made from a thin layer of semiconductor material. It is used in the production of semiconductor material that is used in thin-film solar cells. The growing need for clean energy and increasing investments in the development of clean energy projects are increasing the market across the globe. For instance, according to the report by the International Energy Agency in May 2023, 2023, the total investment in clean energy globally is expected to reach USD 2.8 trillion. Furthermore, in February 2023, Saudi Arabia announced the launch of the world's largest solar power facility, which is expected to start operations by 2025, with a generation capacity of 2,060 MW. Thus, the analysis of market trends depicts that the increasing innovation is expected to create lucrative molybdenum market opportunities over the forecast period.

Molybdenum Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 6,791.95 Million |

| CAGR (2023-2031) | 2.9% |

| By Application | Alloys, Catalysts, Fertilizers, Foundry, and Others |

| By End-user Industry | Oil and Gas, Steel Industry, Chemicals and Petrochemicals, Automotive, Aerospace and Defense, Electrical and Electronics, Energy and Power, Mining, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | BHP, Multi Metal Development Limited, Grupo Mexico, JINDUICHENG MOLYBDENUM CO., LTD., Climax Molydenum, CMOC Group Limited, Centera Gold Inc., Rio Tinto, and Antofagasta plc. |

Molybdenum Market Segmental Analysis :

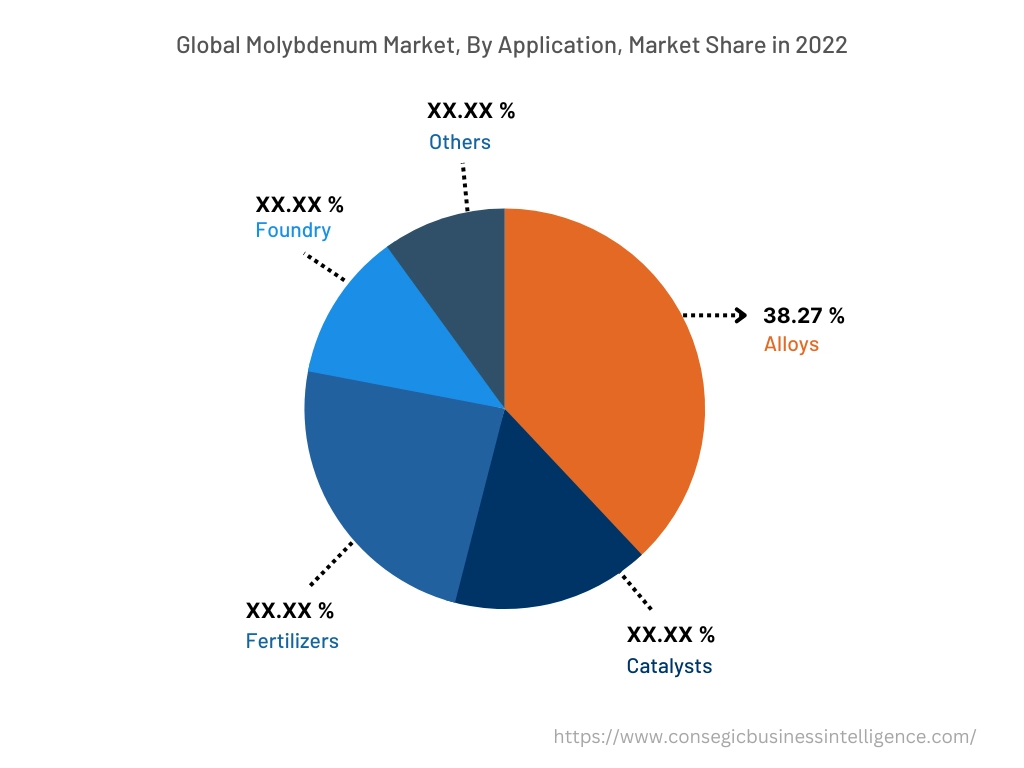

By Application :

The application is categorized into alloys, stainless steel, catalysts, fertilizers, foundry, and others. In 2022, the alloys segment accounted for the highest market share of 38.27% in the global molybdenum market, and it is also expected to grow at the highest CAGR over the forecast period. It is a versatile element that is used in a wide variety of alloys to improve their strength, hardness, ductility, and corrosion resistance. Molybdenum alloys are used in a wide range of applications, including aircraft and automotive parts, construction materials, and oil and gas equipment. The metal is used in the manufacturing of aircraft alloys, automotive alloys, construction alloys, and alloys for the oil and gas sector. It is added to aircraft alloys to improve their strength and high-temperature performance. The metal's aircraft alloys are used in a variety of aircraft components, such as engine parts, landing gear, and airframes.

Moreover, Molybdenum superalloys are also used in a variety of aircraft engine components, such as turbine blades, vanes, and combustors. Increasing investments in the manufacturing of aircraft are driving the market. For instance, in December 2022, Collins Aerospace announced plans to invest USD 200 million in India over the next five years. The investment will be used to expand the company's R&D and production facilities in India. Thus, the analysis of segment trends shows that the increasing investments in the development of aircraft manufacturing facilities are driving the molybdenum market trends globally.

By End-Use-Industry :

The end-user industry segment is categorized into oil and gas, steel, chemicals and petrochemicals, automotive, aerospace and defense, electrical and electronics, energy and power, mining, and others. In 2022, the steel segment accounted for the highest market share in the overall molybdenum market share. The increasing steel production across various parts of the globe is driving the segment worldwide. For instance, according to the World Steel Association (World Steel), China Baowu Group was the world's largest producer of crude steel in 2020, China's steel production increased by 80.67% in 2020, accounting for 115.29 million metric tons which were 63.81 million metric tons in 2017. Thus, segmental trend analysis shows that the significant growth in steel production is driving the molybdenum market demand across the globe.

Moreover, the energy and power segment is expected to hold the highest CAGR over the forecast period. It is a versatile element that has several applications in solar energy. It is used in a variety of solar technologies, such as solar cells, solar panels, and solar inverters. Increasing launches of solar energy plants are driving the segment's growth. For instance, in July 2022, the government of India launched the 92 MW Kayamkulam Floating Solar Project in Kerala. The project was set up at the National Thermal Power Corporation's (NTPC) Kayamkulam unit. Modi made the announcement virtually as part of the Ujjwal Bharat Ujjwal Bhavishya-Power @2047 program. The growing initiative for green energy is creating lucrative molybdenum market trends over the forecast period.

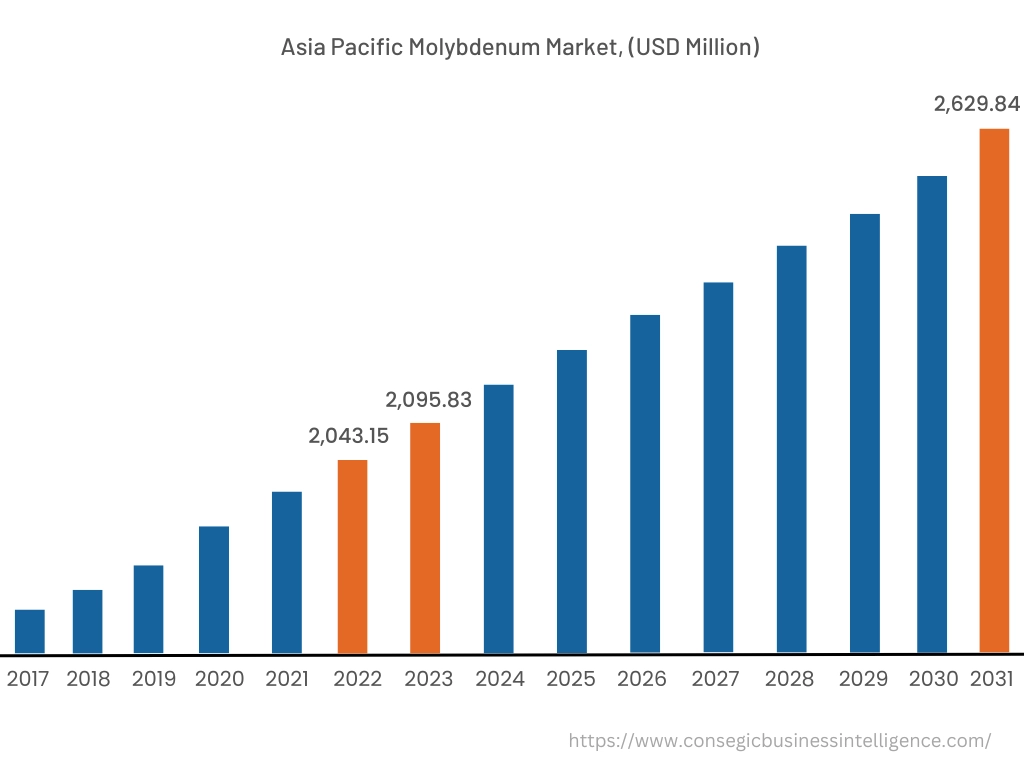

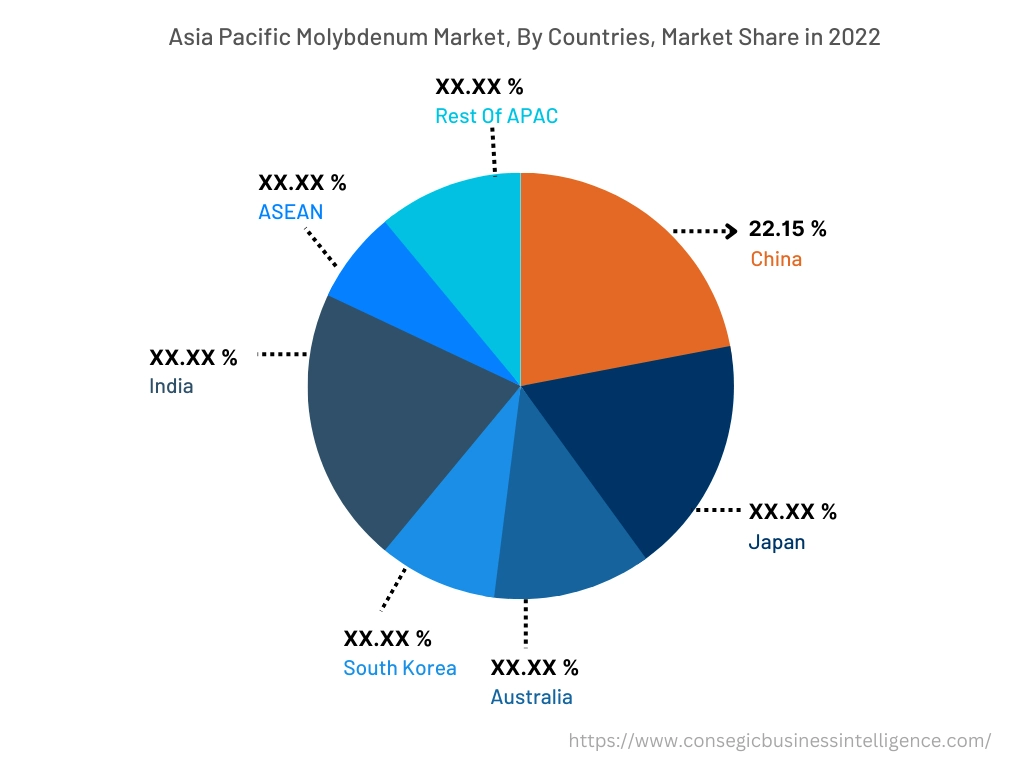

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2022, Asia Pacific accounted for the highest market share at 38.55% valued at USD 2,043.15 Million in 2022 of the total molybdenum market share and USD 2,095.83 Million in 2023, it is expected to reach USD 2,629.84 Million in 2031, and it is also the fastest growing region across the globe, growing with a CAGR of 3.4% over the forecast period. In Asia-Pacific, China holds 22.15% of market share in 2022. As per the molybdenum market analysis, the Asia Pacific region is growing owing to the significant rise of a variety of industries, such as steel, construction, and automotive. The significant rise in the capacity of steel is driving molybdenum market expansion across the region. For instance, according to the data published by the Ministry of Steel in India, Capacity for domestic crude steel expanded from 137.97 MT in 2017-18 to 154.06 MT in 2021-22, CAGR of 3.7%. Crude steel production grew at 4.2% annually (CAGR) from 103.13 MT in 2017-18 to 120.29 MT in 2021-22. Furthermore, growing infrastructure and manufacturing developments across developed countries such as China are driving steel production across the region. For instance, according to the report by the Organization for Economic Cooperation and Development in February 2022, Crude steel production in Asia increased by 14.0% during the first half of 2021 year-on-year, with China increasing by 10.7%, India by 31.4%, Japan by 13.8% and Korea by 8.3%. Thus, the analysis of regional trends shows that all these above-mentioned factors are collectively driving the demand from various end-user industries across the Asia Pacific region and creating lucrative molybdenum market opportunities in the Asia Pacific region.

Top Key Players & Market Share Insights:

The molybdenum market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The molybdenum market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the molybdenum industry include-

- BHP

- Multi Metal Development Limited

- Centera Gold Inc.

- Rio Tinto

- Antofagasta plc.

- Grupo Mexico

- JINDUICHENG MOLYBDENUM CO., LTD.

- Climax Molydenum

- CMOC Group Limited

Recent Industry Developments :

- In October 2022, Zijin Mining Group Co., Ltd. acquired 84% equity interest in Anhui Jinsha Molybdenum Co., Ltd. at a consideration of USD 0.81 billion through public tender.

- In August 2021, CMOC Group Limited announced an investment of USD 2.51 billion to expand the Tenke Fungurume Mine (TFM) in the Democratic Republic of Congo (DRC).

Key Questions Answered in the Report

What was the market size of the molybdenum market in 2022? +

In 2022, the market size of molybdenum was USD 5,300.00 million.

What will be the potential market valuation for the molybdenum industry by 2031? +

In 2031, the market size of molybdenum will be expected to reach USD 6,791.95 million.

What are the key factors driving the growth of the molybdenum market? +

Growing demand for high-strength and corrosion-resistant materials across the globe is fueling market growth at the global level.

What is the dominant segment in the molybdenum market for the application? +

In 2022, the alloys segment accounted for the highest market share of 38.27% in the overall molybdenum market.

Based on current market trends and future predictions, which geographical region is the dominating region in the molybdenum market? +

Asia Pacific accounted for the highest market share in the overall market.