- Summary

- Table Of Content

- Methodology

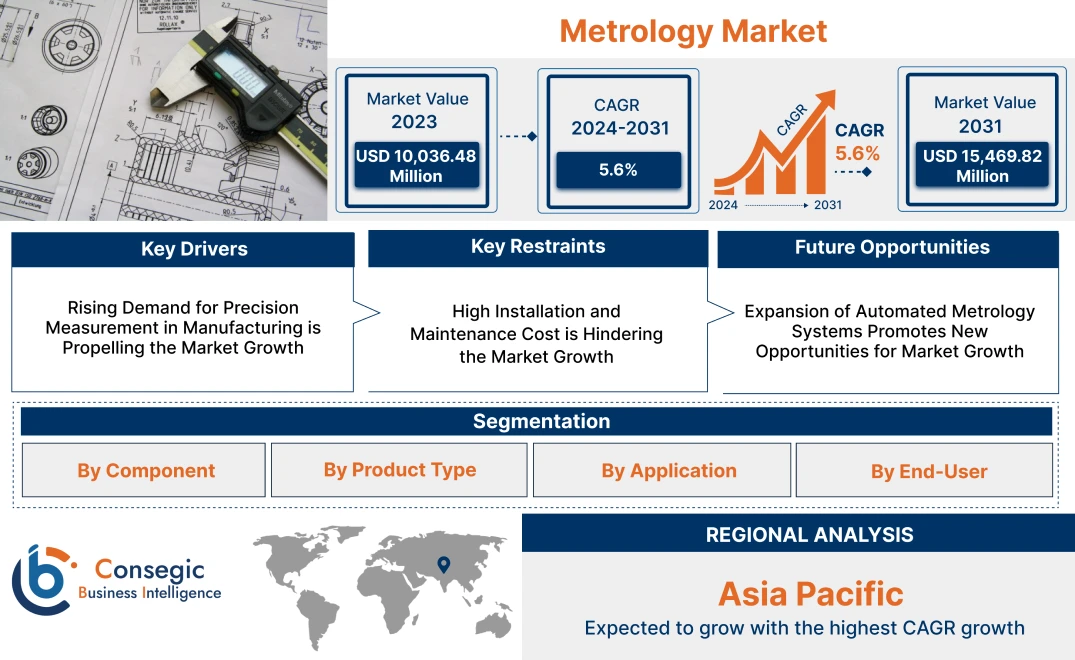

Metrology Market Size:

Metrology Market size is estimated to reach over USD 15,469.82 Million by 2031 from a value of USD 10,036.48 Million in 2023 and is projected to grow by USD 10,415.46 Million in 2024, growing at a CAGR of 5.6% from 2024 to 2031.

Metrology Market Scope & Overview:

Metrology refers to the science of measurement. It involves the establishment of units of measurement and ensuring consistency and reliability of these measurements across different applications. It ensures that the measurements are accurate, consistent, and reliable for quality control, compliance with standards, and scientific research. Additionally, it ensures products meet required specifications, and helps companies meet international standards, making their products reliable and safe. Moreover, measurements are accurate, consistent, and reliable, which is essential for maintaining quality, meeting standards, and advancing scientific research. From manufacturing processes to everyday commercial transactions, measuring systems influence how things are measured and evaluated. The aforementioned benefits of metrology are major determinants for increasing their deployment in aerospace, automotive, healthcare, and other industries.

Metrology Market Insights:

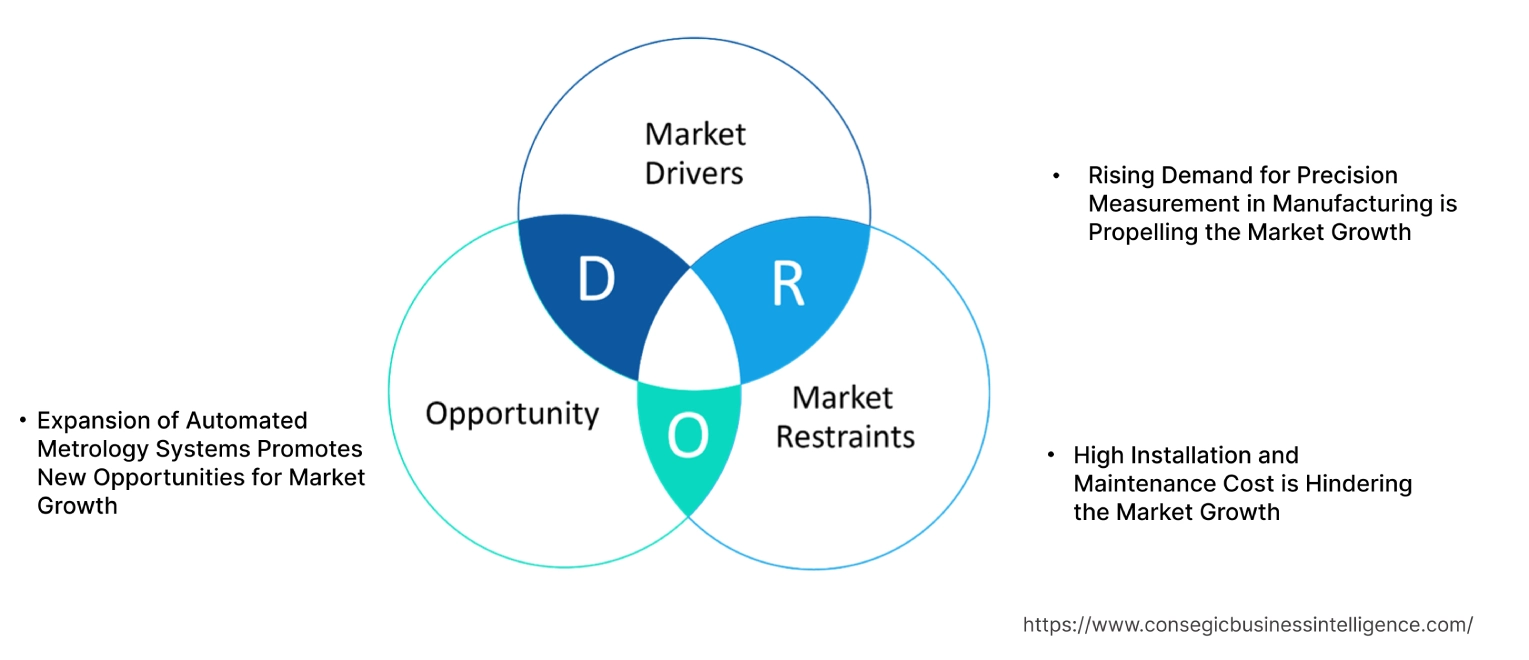

Key Drivers:

Rising Demand for Precision Measurement in Manufacturing is Propelling the Market Growth

The demand for precision in manufacturing is becoming increasingly critical as industries like aerospace, automotive, and electronics continue to evolve. These sectors deal with complex components that require meticulous attention to detail, often down to micrometer or even nanometer accuracy. In such high-stakes industries, even minor deviations can lead to significant issues, ranging from performance failures to safety hazards. Additionally, advanced measuring tools help manufacturers catch defects early in the production process, preventing costly recalls and rework. This leads to more consistent product quality and reduces waste. Moreover, automation in measuring systems, including in-line measurement systems, enables real-time monitoring of production lines. This ensures that any deviations are identified immediately, allowing for quicker adjustments and minimizing downtime.

- In July 2021,, FARO Technologies, Inc. launched Quantum Max ScanArm, an advanced portable measurement tool. It ensures enhanced speed, accuracy, and resolution in measurement with Laser Line Probes (LLPs) features including xR, xP, and xS. Its portable and flexible nature makes it ideal for in-process inspections, reducing downtime and improving production efficiency in manufacturing environments where precision is paramount.

Therefore, the rising demand for accuracy and reliability in the manufacturing sector is boosting the metrology market growth.

Key Restraints :

High Installation and Maintenance Cost is Hindering the Market Growth

Installing advanced measuring systems, such as 3D scanners, laser trackers, and high-precision coordinate measuring machines (CMMs), often involves substantial expenditure. The initial purchase price of sophisticated measuring equipment is typically high. High-precision instruments, especially those with advanced features and capabilities, require a significant capital investment. Additionally, proper installation of measuring systems also requires modifications to the physical environment. This could involve structural changes to accommodate large equipment, ensuring appropriate power and data connections, and controlling environmental factors.

Moreover, ongoing maintenance is crucial to ensure that measuring systems operate accurately and reliably which requires regular calibration. This involves checking and adjusting the equipment to ensure it meets specified accuracy standards, which is expensive for highly sophisticated systems. Furthermore, as technology evolves, measuring systems become outdated. The cost of upgrading or replacing outdated equipment to keep pace with technological advancements adds to the long-term maintenance expenses.

Hence, the high costs associated with the installation and maintenance of advanced measurement systems are hindering the metrology market demand.

Future Opportunities :

Expansion of Automated Metrology Systems Promotes New Opportunities for Market Growth

The future will see a continued rise in automated measuring systems, which integrate directly into production lines. These systems provide real-time measurement data, allowing for immediate adjustments and reducing defects. As industries move toward Industry 4.0, fully automated measuring processes will become a key component of smart factories, improving efficiency, and accuracy, and reducing costs. Additionally, the expansion of robotics and AI-driven automation in measuring will also unlock new opportunities in mass production and continuous manufacturing, ensuring improved product quality.

- In October 2023, AMETEK introduced the SmartView Surface Inspection System, to deliver a seamless automatic solution. The system uses advanced imaging and machine learning algorithms for accurate, real-time defect detection, reporting, and visualization, improving product quality and reliability.

Furthermore, as AI systems grow more sophisticated, the potential for fully autonomous, self-learning measuring systems becomes realistic. These systems could make required adjustments, predict faults, and continually improve measurement accuracy without human intervention.

Consequently, automated measurement systems enable to achievement of greater accuracy, efficiency, reliability, and quality control processes, boosting the metrology market opportunities.

Metrology Market Segmental Analysis :

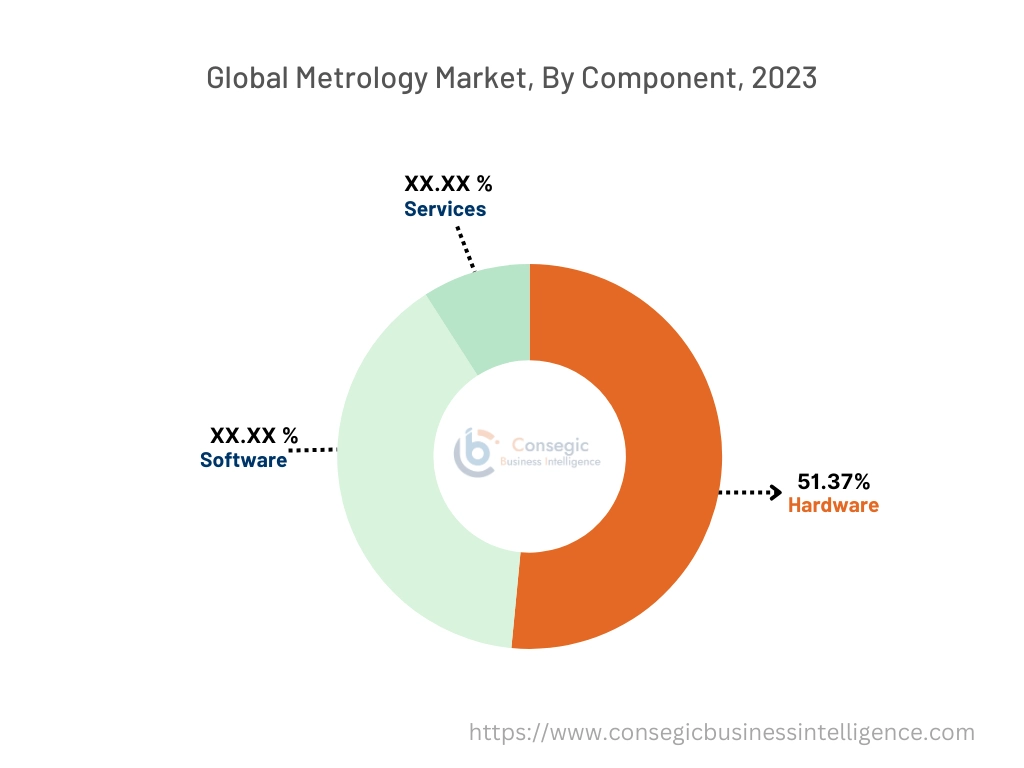

By Component:

Based on components, the market is trifurcated into hardware, software, and services.

Trends in the Component:

- There is a growing trend towards real-time data processing and visualization in measuring software. This capability allows for immediate analytics and feedback, improving the efficiency and responsiveness of measurement processes.

- Metrology service providers are increasingly offering consulting services to help businesses optimize their measurement processes. Customization of measurement solutions to meet specific sector requirements and challenges is becoming more common.

The hardware component accounted for the largest revenue share of 51.37% in the year 2023.

- The hardware component incorporates measurement tools including Coordinate Measuring Machines (CMMs), laser scanners, X-ray Computed Tomography (CT) systems, and others.

- These instruments offer enhanced accuracy, speed, and automation capabilities, addressing the needs of industries requiring high-precision measurements.

- In March 2021, Nikon launched the Nikon XT H 225 ST 2x, an X-ray computed tomography (CT) system. This new hardware offers rapid, high-resolution imaging for non-destructive testing and inspection, addressing the needs of industries requiring detailed internal analysis of components.

- Thus, due to high precision and reliability for accurate measurements in diverse applications of hardware measuring tools is fueling the metrology market trend.

The software component is anticipated to register the fastest CAGR during the forecast period.

- Software component refers to various software solutions and applications used to enhance, control, and study measurement processes.

- This component plays a crucial role in enabling precise measurements, interpreting data, and real-time analytics that support faster and more accurate decision-making.

- Additionally, the integration of AI and machine learning into measuring software is transforming data analytics and decision-making. These technologies enable predictive maintenance, automated defect detection, and enhanced data interpretation.

- In November 2023, Cohu introduced Artificial Intelligence (AI) Inspection software to its DI-Core analytics platform. It offers real-time computation that allows manufacturers to enhance visual inspection accuracy along with production speed. This software uses deep learning and neural networks to improve precision in inspection.

- Overall, the software component in the measuring component encompasses a wide range of applications and tools that enhance the functionality of measurement systems.

By Product Type:

Based on product type, the market is segmented into coordinate measuring machines (CMM), optical digitizers and scanners, measuring instruments, x-ray and computed tomography (CT), automated optical inspection, 2d equipment, and others.

Trends in the Product Type:

- Optical digitizers and scanners are evolving with enhanced resolution and scanning speeds. These advancements allow for more detailed and faster data capture, which is crucial for applications requiring high precision and quick turnaround times.

- Automated optical inspection systems are increasingly incorporating machine vision and AI technologies to enhance defect detection capabilities and improve inspection accuracy. This trend enables AOI systems to identify defects that may be missed by traditional methods.

The coordinate measuring machine (CMM) accounted for the largest revenue share in the year 2023.

- A coordinate measuring machine (CMM) is a versatile and precise instrument used in manufacturing and assembly processes to measure the physical geometrical characteristics of an object.

- It is used to measure various types of parts and assemblies, providing critical data for quality control, product development, and verification.

- In April 2023, Hexagon launched Leitz PMM-C ultra-high accuracy coordinate measuring machines (CMMs). This new line of CMMs includes improved accuracy and reduced measurement uncertainty along with flexibility. It features a SENMATION sensor automation system which allows the use of various tactile and optical sensors.

- Hence, CMs are essential tools in modern manufacturing and quality control, offering precise and reliable measurements, and driving the global metrology market share.

The X-ray and computed tomography (CT) is anticipated to register the fastest CAGR during the forecast period.

- X-ray and computed tomography are advanced imaging technologies used for the inspection and study of objects, providing detailed internal and external views without damaging the object.

- It is crucial for industries where internal structures and defects must be thoroughly examined.

- Factors including high-resolution, 3D imaging of internal features, allowing for detailed inspection and analytics, drive the demand.

- In May 2023, Philips unveiled Philips CT 3500, an AI-powered computed tomography system. This encompasses a range of image reconstruction and features that enhance workflow to deliver consistency, speed, image quality, and accuracy in diagnosis.

- Therefore, X-ray and CT scanning for detailed analysis and quality control are anticipated to boost the growth of the metrology market during the forecast period.

By Application:

Based on application, the market is segmented into reverse engineering, quality control and inspection, mapping and modeling, research and development, virtual simulation, 3d scanning, and others.

Trends in the Application:

- The virtual simulation using measured data is increasingly being adopted in the manufacturing sector to simulate assembly processes, enabling companies to identify design flaws before actual production begins.

- In research and development, X-ray and CT are increasingly used to analyze novel materials and composites at the microscopic level. This capability supports the development of new materials with enhanced properties for various applications.

Quality control and inspection accounted for the largest revenue share in the year 2023 and is anticipated to register the fastest CAGR during the forecast period.

- Quality control and inspection is a set of procedures used to ensure that products and services are consistent, reliable, and meet the desired standards of quality.

- It involves monitoring and evaluating various aspects of production or service delivery to maintain and improve quality.

- This application is widely adopted across industries including automotive, aerospace, manufacturing, and healthcare, where precise measurements and adherence to strict quality standards are crucial.

- For instance, Hexagon introduced the Leica Absolute Tracker ATS600 which combines laser tracking and large-scale measurement capabilities. This system is designed for 3D analysis, automated quality control, and inspection in various industries. The device allows scanning from up to 60 meters away, providing precise measurement data and real-time, significantly improving the inspection process.

- Therefore, the dominance of quality control and inspection ensures product quality, safety, and compliance proliferating the metrology market.

By End-User:

Based on end-users, the market is segmented into aerospace and defense, automotive, manufacturing, healthcare, and others.

Trends in the End-User:

- Measuring systems are being integrated into Industry 4.0 frameworks, enabling real-time data collection and analytics. This integration supports predictive maintenance and enhances overall manufacturing efficiency.

- The aerospace and defense sectors are increasingly using measuring tools for the inspection of advanced materials and complex components. Innovations in materials including composites and alloys require high-precision measurement techniques to ensure safety and performance.

The automotive segment accounted for the largest revenue share in the year 2023.

- The automotive sector's demand for high-precision measurement is driven by the complexity of modern vehicles.

- Components including engines, transmissions, and electronic systems require stringent quality control and precise measurement to ensure performance and safety.

- In April 2021, Mitutoyo Corporation launched Quick Vision Pro Series, a computer numerical control (CNC) vision measurement system. The system enables high-speed and automated measurements by helping to maintain improved accuracy and efficiency for the semiconductor and automotive industries.

- Overall, the need for precision and quality control in the automotive sector is driving the global metrology market trend.

Healthcare is anticipated to register the fastest CAGR during the forecast period.

- The healthcare sector is rapidly adopting advanced technologies for diagnostic and therapeutic purposes.

- Measuring solutions are crucial for ensuring the accuracy and reliability of medical devices, imaging systems, and surgical instruments.

- Additionally, X-rays and CT are essential for non-invasive imaging and analysis of the internal structures for patient diagnostic and therapeutic methods.

- In March 2022, Siemens Healthineers released the imaging solution MAGNETOM Free. Star and NAEOTOM Alpha to MRI and CT portfolio for healthcare diagnosis. These solutions incorporate cutting-edge measuring technologies to enhance the precision of MRI and CT scans, providing clearer and more accurate, high-resolution images for diagnosis and treatment planning.

- Therefore, the rising need for non-invasive diagnosis and analytics in the healthcare sector is anticipated to boost the metrology market.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

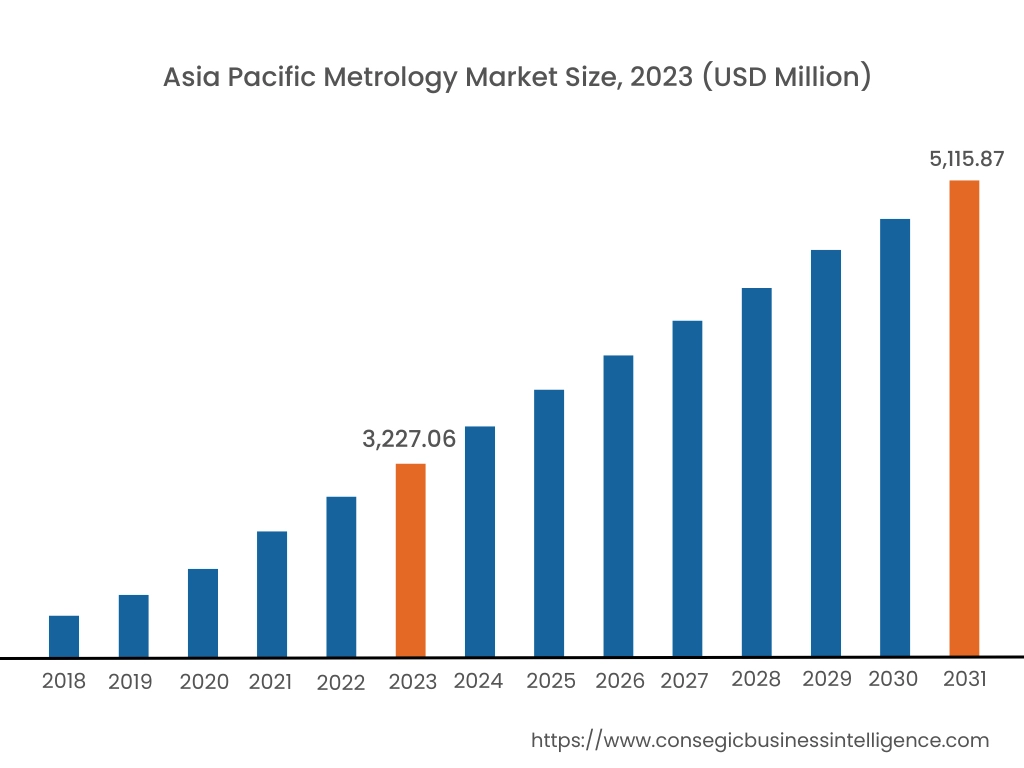

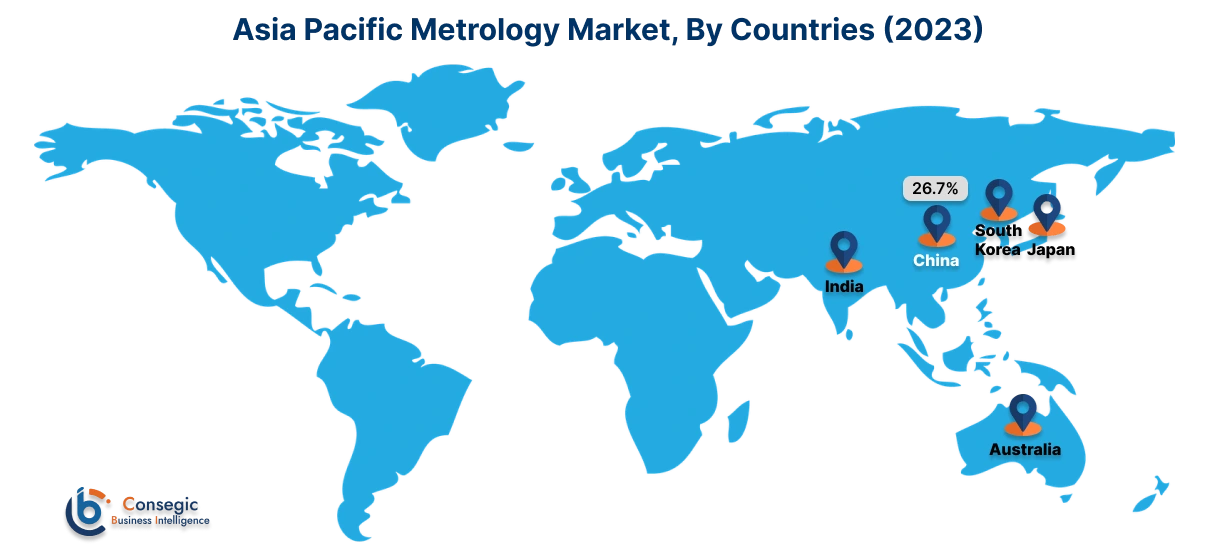

Asia Pacific region was valued at USD 3,227.06 Million in 2023. Moreover, it is projected to grow by USD 3,356.87 Million in 2024 and reach over USD 5,115.87 Million by 2031. Out of this, China accounted for the maximum revenue share of 26.7%. The Asia-Pacific region, particularly China, Japan, and India, is experiencing rapid industrialization and growth in manufacturing sectors. This region is becoming a major player in the metrology market due to increased manufacturing activities and the adoption of advanced technologies. Moreover, the rise of emerging technologies in electronics, semiconductor, pharmaceutical, and healthcare sectors is significantly driving the need for sophisticated measuring solutions catering to provide precision measurement.

- In October 2022, Mitutoyo Corporation (Japan) introduced SurfaceMeasure1008S, an-line sensor which is capable of profile measurement and 3D dimensional inspection. It features various measurement tools, improved USbility, a high-precision sensor for stable measurement, and high environmental resistance enabling in-line 1005 inspection. It particularly caters to the needs of a wide range of fields including semiconductors, electronics, pharmaceuticals, and healthcare.

North America is estimated to reach over USD 5,377.31 Million by 2031 from a value of USD 3,520.88 Million in 2023 and is projected to grow by USD 3,651.04 Million in 2024. North America, particularly the United States and Canada, is a leader in adopting and advancing measuring technologies. This region benefits from a strong focus on innovation, with significant investments in research and development, particularly in the automotive, aerospace, and healthcare sectors. Additionally, the need for precise measurement solutions is driven by advancements in healthcare technologies and aerospace engineering. North America's robust healthcare infrastructure and leading aerospace sector contribute to the high adoption of measuring solutions.

- In April 2022, Faro Technologies, Inc (US) launched FARO Sphere for effective data transfer, and FARO Focus Premium Laser Scanner for fast, accurate, and complete field capture. It is a 3D digital reality capture and collaboration platform integrated with cloud-based workflow for enhanced precision and fast 3D model creation.

According to metrology market analysis, European countries including Germany, France, and the UK are prominent markets for measuring solutions. The region adheres to stringent regulatory standards for quality and precision particularly in the automotive sector which fuels the metrology market expansion.

Latin America is seeing growth in its manufacturing sector, particularly in Brazil and Mexico. This expansion is leading to increased adoption of measuring solutions for quality control and precision measurement boosting the metrology market.

The Middle East and Africa region are emerging in the metrology market, driven by infrastructure projects and the development of industrial sectors. Countries including UAE and South Africa are seeing increased investments in technology and manufacturing.

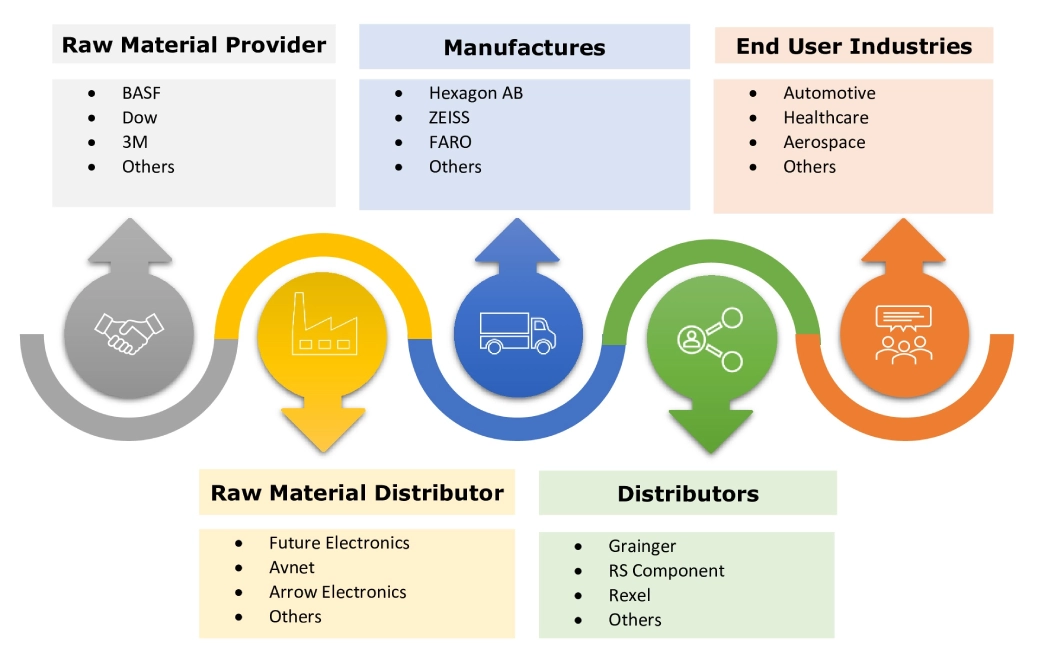

Top Key Players & Market Share Insights:

The metrology market is highly competitive with major players providing accurate measurements to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the metrology market. Key players in the metrology industry include-

- FARO Technologies, Inc. (US)

- Hexagon AB (Sweden)

- Zeiss Group (Germany)

- KLA Corporation (US)

- Creaform Inc. (Canada)

- Perceptron, Inc. (US)

- GOM GmbH (Germany)

- Wenzel Group GmbH & Co. KG (Germany)

- Mitutoyo Corporation (Japan)

- Nikon Metrology NV(Belgium)

- Renishaw plc (UK)

- AMETEK, Inc. (US)

- KEYENCE Corporation (Japan)

- Bruker Corporation (US)

- InnovMetric Software Inc. (Canada)

Recent Industry Developments :

Product Launches:

- In February 2024, Philips launched an AI-enabled Philips CT 5300 system for diagnosis, interventional procedures, and screening. This system enhances accuracy in diagnosis, streamlines work efficiency and maximizes system up-time to help improve patient outcomes. The Philips CT 5300 system meets advanced diagnostic imaging requirements for cardiac care patient guidelines.

- In December 2023, Hitachi High-Tech Corporation introduced GT2000, a high-precision measurement system. It is equipped with a detection system for 3D semiconductor devices and uses low-damage high-speed multi-point measurement functions for high-NA EUV imaging to minimize damage and improve yield mass production.

- In November 2023, ZEISS launched ZEISS INSPECT 3D measuring software. This software solution is designed for the inspection and evaluation of 3D measurement data. It offers necessary functions for the defect analysis of od computed tomography data. It uses a Multiview to divide the workspace for the inspection of CT data with precision and accuracy.

Product Enhancement:

- In June 2024, AMETEK enhanced AMETEK Surface Vision, an automated surface inspection system. This system uses high-resolution imaging, machine learning, and AI-driven analysis to detect even the smallest defects in electronic components. It provides a traceability system for the automotive sector and helps in the automated decision-making process.

Collaborations:

- In January 2024, Faro Technologies, Inc. collaborated with RFK TeK Alliance to launch the FARO technology center. The center features Faro's 3D measuring hardware and software. It introduced the NASCAR Next Gen car for an advanced level of accuracy and precision for more detailed analysis across the NASCAR sector.

Metrology Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 15,469.82 Million |

| CAGR (2024-2031) | 5.6% |

| By Component |

|

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

Which region will lead the global metrology market? +

The Asia-Pacific region is anticipated to register CAGR during the forecast period with a strong focus on innovation, with significant investments in research and development, particularly in the automotive, aerospace, and healthcare sectors. Additionally, the need for precise measurement solutions is driven by advancements in healthcare technologies and aerospace engineering. North America’s robust healthcare infrastructure and leading aerospace industry contribute to the high adoption of metrology solutions.

What is the key market trend? +

There is a growing trend towards real-time data processing and visualization in metrology software. This capability allows for immediate analysis and feedback, improving the efficiency and responsiveness of measurement processes.

Who are the major players in the metrology market? +

The major key players in metrology market are FARO Technologies, Inc. (US), Hexagon AB (Sweden), Zeiss Group (Germany), Mitutoyo Corporation (Japan), Nikon Metrology NV (Belgium), Renishaw plc (UK), KLA Corporation (US), Creaform Inc. (Canada), Perceptron, Inc. (US), GOM GmbH (Germany), AMETEK, Inc. (US), KEYENCE Corporation (Japan), Bruker Corporation (US), InnovMetric Software Inc. (Canada), Wenzel Group GmbH & Co. KG (Germany) and others.

What is metrology? +

Metrology refers to the science of measurement. It involves the establishment of units of measurement and ensuring consistency and reliability of these measurements across different applications. It ensures that the measurements are accurate, consistent, and reliable for quality control, compliance with standards, and scientific research.