- Summary

- Table Of Content

- Methodology

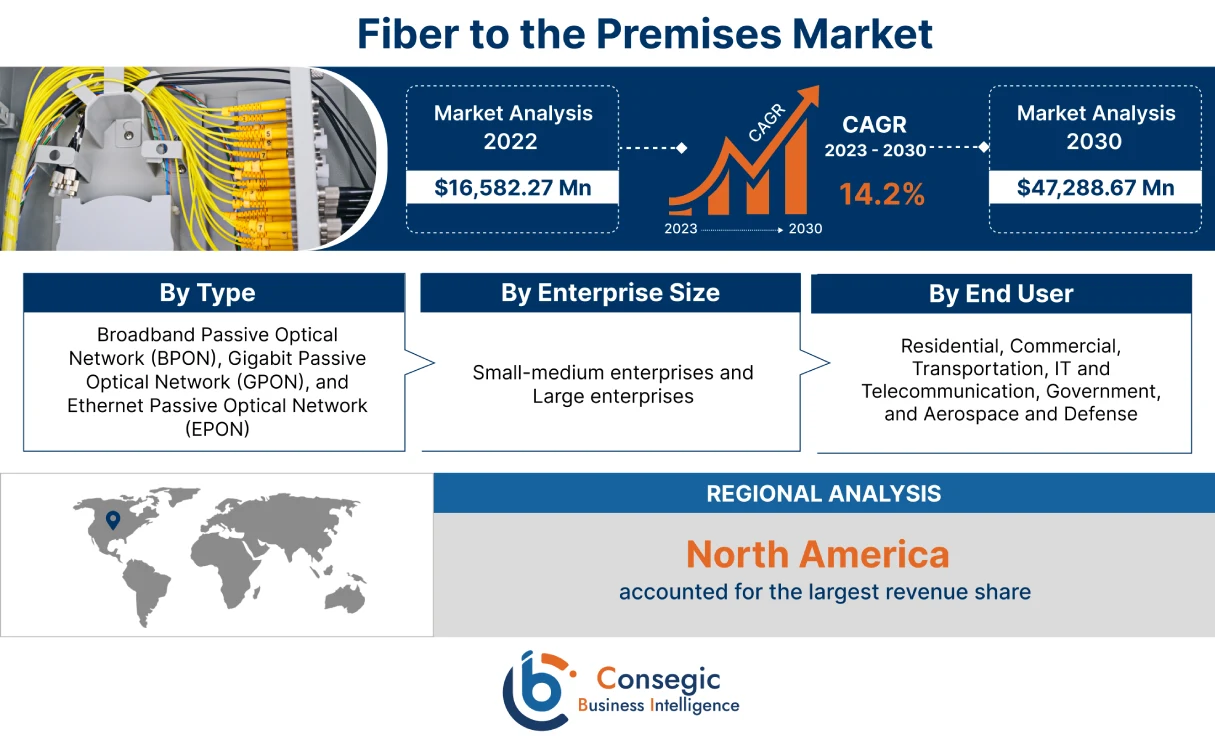

Fiber to the Premises Market Size :

Fiber to the Premises Market is estimated to reach over USD 47,288.67 Million by 2030 from a value of USD 16,582.27 Million in 2022, growing at a CAGR of 14.2% from 2023 to 2030.

Fiber to the Premises Market Scope & Overview:

Fiber to the Premises (FTTP), also known as Fiber to the Home (FTTH), is a high-speed broadband network architecture that provides direct fiber-optic connectivity from the service provider to individual residences or businesses. FTTP is considered one of the most advanced methods of delivering internet and telecommunications services. Additionally, in an FTTP network, the entire communication link is built using fiber-optic cables, made of thin glass or plastic strands that transmit data using light signals. Furthermore, the technology allows for significantly higher data transmission speeds and greater bandwidth capacity compared to traditional copper-based networks.

Fiber to the Premises Market Insights :

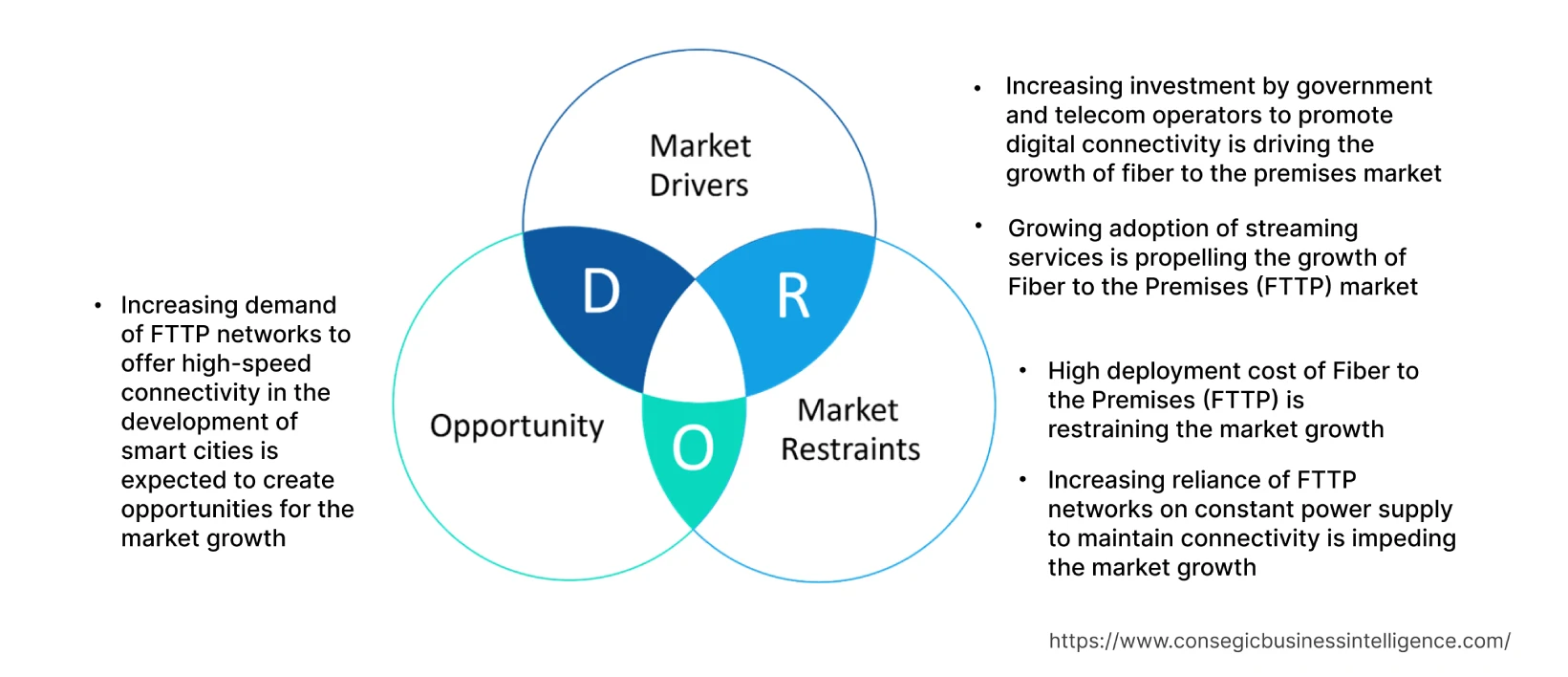

Key Drivers :

Increasing investment by government and telecom operators to promote digital connectivity is driving the market.

Governments and telecommunication operators provide funding and subsidies to incentivize the deployment of high-speed broadband infrastructure, including FTTP networks. Financial support helps to balance the high upfront costs associated with fiber-optic cables, thus contributing significantly to driving the adoption. The funds also aid in expanding the broadband network to underdeveloped areas for accessing high-speed internet connection. Additionally, the rollout of the 5G network also raises the demand for high-speed broadband infrastructure, which in turn, promotes the market. Consequently, the increasing investment by telecommunication operators to expand the 5G infrastructure to improve digital connectivity is contributing considerably to accelerating the fiber to the premises market growth.

- For instance, in January 2023, according to the India Brand Equity Foundation (IBEF), the Indian telecommunication sector is projected to achieve an investment of USD 18 billion for the expansion of 5G infrastructure. The major operators include Reliance Industries with an investment of USD 24 billion, Bharti Airtel up to USD 3.38 billion, and BSNL registering an investment of USD 1.93 billion.

Growing adoption of streaming services is propelling the market.

Consumer's shift from traditional television to streaming platforms for entertainment purposes is raising the demand for high-speed and reliable internet connections to deliver a seamless viewing experience. Streaming platforms offer a wide range of bandwidth-intensive content, including HD and ultra-high-definition (UHD) videos, live sports events, and interactive gaming. The content requires fast and stable internet connections to ensure smooth playback without interruptions and buffering. Fiber to the premises network provides the necessary bandwidth capacity and low latency required to support multiple devices streaming high-definition (HD) or even 4K/8K content. Additionally, FTTP networks deliver the required speeds and low latency to handle the data-intensive nature of streaming services, resulting in a superior viewing experience. In conclusion, the increasing demand to enable a seamless viewing experience at the streaming platforms is driving the fiber to the premises market demand.

- For instance, in February 2022, according to the University of Lowa report, the video streaming industry grew by 24.8% from 2015-2020, becoming the fastest-growing industry worldwide.

Additionally, the video streaming industry is also projected to witness a rise of 30% in the next decade, thus contributing notably to promoting fiber to the premises market growth.

Key Restraints :

High deployment cost of Fiber to the Premises (FTTP) is restraining the market.

The upfront costs associated with deploying fiber to the premises infrastructure are high, which serves as the major restraining factor for market growth. The high costs include the installation of fiber-optic cables, fiber termination equipment, optical line terminals (OLTs), customer premises equipment (CPE), and other necessary network components. Additionally, the expenses related to network planning, design, engineering, and project management also contribute to additional upfront costs, further limiting the adoption. The high deployment cost limits the adoption of FTTP by small enterprises with limited financial resources, thereby hampering the fiber to the premises market demand.

Increasing reliance on FTTP networks for constant power supply to maintain connectivity is impeding the market.

Fiber to the premises networks heavily relies on continuous power supply to maintain connectivity limits the adoption of FTTP in areas with unreliable power infrastructure. Additionally, extending FTTP networks to remote or rural areas is difficult in terms of power availability as remote areas lack stable and consistent power infrastructure. Moreover, to address power outages, backup power solutions including batteries and generators are employed. However, analysis of market trends depicts that implementing and maintaining backup power solutions tends to be costly as backup power systems need periodic maintenance, fuel refills, and replacements, adding to the operational expenses of FTTP providers.

Future Opportunities :

Increasing demand for FTTP networks to offer high-speed connectivity in the development of smart cities is expected to create market opportunities.

Smart cities rely on interconnected devices, sensors, and infrastructure to enhance urban services and improve quality of life. The applications require robust and high-speed connectivity to transmit and process large volumes of data in real time. Fiber to the premises networks provide the necessary bandwidth and low latency required to support the diverse range of smart city applications, including smart transportation, energy management, public safety, healthcare, and environmental monitoring. In addition, FTTP networks also provide the reliable and high-speed connectivity required to support the vast number of IoT devices and sensor networks deployed across smart cities. Subsequently, the market trends analysis shows that the proliferation of IoT applications in smart city infrastructure is projected to create potential fiber to the premises market opportunities.

Fiber to the Premises Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 47,288.67 Million |

| CAGR (2023-2030) | 14.2% |

| By Type | Broadband Passive Optical Network (BPON), Gigabit Passive Optical Network (GPON), and Ethernet Passive Optical Network (EPON) |

| By Enterprise Size | Small-medium enterprises and Large enterprises |

| By End-User | Residential, Commercial, Transportation, IT and Telecommunication, Government, and Aerospace and Defense |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Huawei Technologies Co., Ltd., Calix, Inc., Adtran, Inc., Nokia Corporation, ZTE Corporation, Fiberhome India Pvt Ltd. BizNet, Netuno, ER-Telecom, Optimum (Altice USA) |

Fiber to the Premises Market Segmental Analysis :

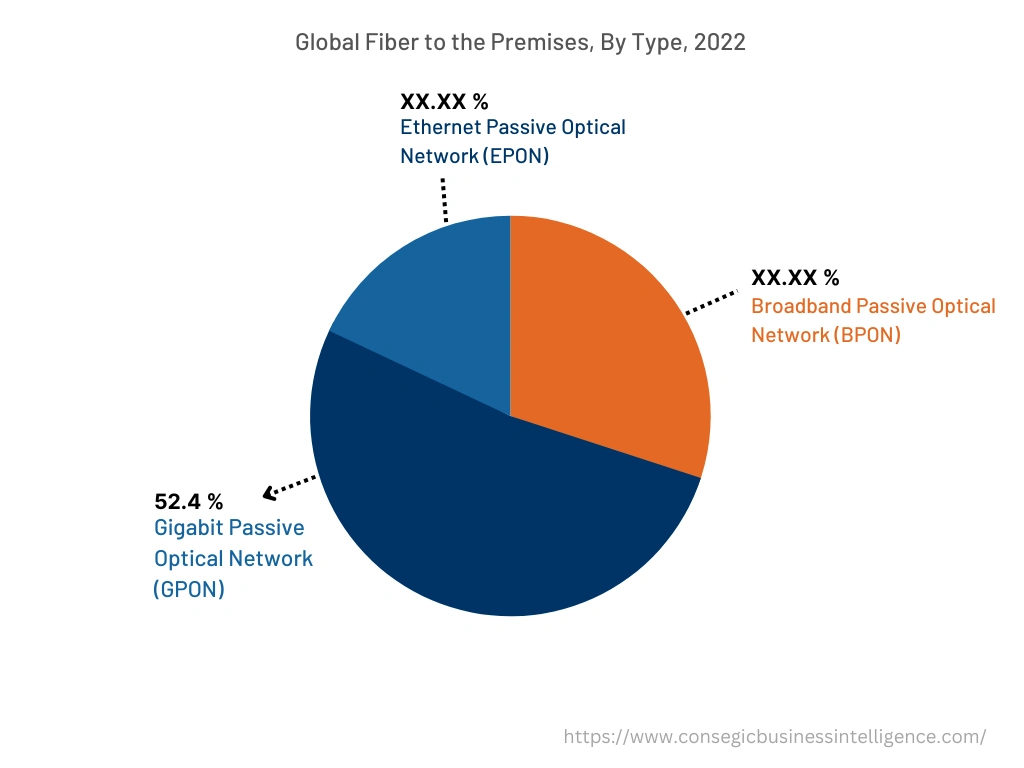

By Type :

The type segment is trifurcated into Broadband Passive Optical Network (BPON), Gigabit Passive Optical Network (GPON), and Ethernet Passive Optical Network (EPON).

GPON accounted for the largest market share of 52.4% in 2022 as GPON offers high bandwidth capabilities, allowing for the delivery of gigabit speeds to end-users. In addition, GPON provides sufficient capacity to support bandwidth-intensive applications, including video streaming, cloud services, and emerging technologies, namely virtual and augmented reality. Moreover, GPON is designed to be highly scalable, allowing for the expansion of the network to accommodate more subscribers and increased traffic. GPON's architecture supports multiple optical network terminals (ONTs) and is easily upgraded to meet future capacity requirements of high-speed broadband connectivity.

- For instance, in April 2023, Brightspeed started the official selling of XGS-PON, a gigabit internet service via fiber to the premises network to offer high-speed broadband connectivity in homes and small enterprises. The advanced GPON network provides high download speeds for video streaming and other bandwidth-intensive applications, thus contributing remarkably to bolstering the growth of the GPON segment.

Ethernet Passive Optical Network (EPON) is anticipated to witness the fastest CAGR during the forecast period. EPON leverages Ethernet technology that is extensively employed in local area networks (LANs) and enterprise environments. Additionally, the seamless integration of EPON with Ethernet networks reduces deployment complexity and cost, driving the adoption and growth of Ethernet passive optical networks. Moreover, EPON offers symmetrical upstream and downstream bandwidth, providing equal speeds in both directions. The feature is particularly advantageous for applications that require symmetric data transmission, namely video conferencing, cloud computing, and uploading large files. Consequently, analysis of segmental trends depicts that the aforementioned factors including the symmetrical bandwidth of EPON and integration with Ethernet networks are expected to drive the fiber to the premises market trends during the forecast period.

By Enterprise Size :

The enterprise size segment is bifurcated into small-medium enterprises and large enterprises.

Large enterprises accounted for the largest market share of the total fiber to the premises market share in 2022 as large enterprises have higher bandwidth requirements compared to residential users and small businesses. The enterprises rely on fast and reliable internet connectivity to support their operations and involve data-intensive activities including cloud computing, video conferencing, large-scale file transfers, and remote access to corporate networks. Fiber to the premise technology, with the ability to provide high-speed and symmetrical bandwidth, is appropriate to meet the growing bandwidth demand of large enterprises more effectively than other connectivity options. Additionally, FTTP networks are easily scaled to accommodate the growing needs of large enterprises, add new locations, increase user capacity, and support emerging technologies without significant infrastructure changes. The flexibility of FTTP allows large enterprises to adapt the network according to the changing business requirements and optimize connectivity, thus contributing significantly to driving the fiber to the premises market trends.

Small-medium enterprises are anticipated to witness the fastest CAGR during the forecast period. The growth is attributed to the increasing adoption of cloud services and e-commerce solutions by small and medium enterprises that require fast and reliable internet connectivity. Fiber to the premises offers a high-speed broadband infrastructure for the efficient functioning of various operations in SMEs. In addition, FTTP eliminates the need for expensive leased lines and multiple broadband connections, reducing recurring costs for small enterprises with limited budgets. Consequently, the segmental trends analysis shows that the aforementioned factors are collectively responsible for increasing the adoption of fiber to the premises in small-medium enterprises to optimize connectivity expenses.

By End-User :

The end-user segment is categorized into residential, commercial, transportation, IT and telecommunication, government, and aerospace and defense.

Residential sector accounted for the largest market share of the overall fiber to the premises market share in 2022 owing to the large customer base that requires internet connectivity for various purposes, including entertainment, communication, education, and remote work. Additionally, residential users increasingly rely on high-speed internet for activities namely streaming video content, online gaming, video conferencing, and downloading large files. Fiber to the premises technology offers the necessary bandwidth and low latency to meet user demands, providing a superior internet experience compared to traditional broadband options including DSL and cable.

- For instance, in June 2022, Bharti Airtel launched fiber to the home broadband service in Ladakh and Andaman and Nicobar Islands to offer high-speed broadband to customers in remote areas. Additionally, Airtel expects to grow its installed home passes by 150% accounting to 40 million by 2025 by delivering high-speed broadband in the residential sector, particularly for online learning, work for home, and online entertainment.

The commercial sector is anticipated to register the fastest CAGR during the forecast period. The commercial sector, including businesses and large enterprises, requires fast and reliable internet connectivity to support various operations including cloud-based applications, remote work, video conferencing, and data-intensive tasks. Fiber to the premises technology offers the necessary bandwidth and low latency required to meet the growing connectivity needs of commercial enterprises. In addition, as per the fiber to the premises market analysis, it also provides robust and scalable connectivity required to support the aforementioned applications and to enable seamless integration of cloud-based services.

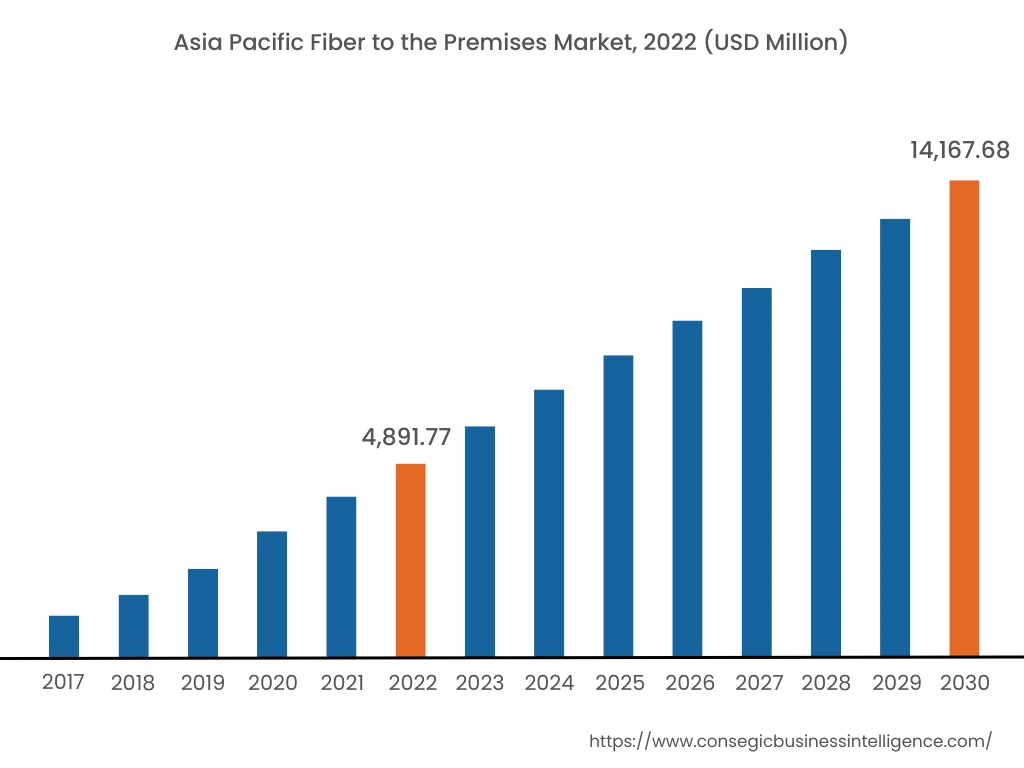

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2022 as the region, particularly the United States, is at the forefront of technological advancements, including broadband infrastructure. Additionally, analysis of regional trends depicts that the region has made significant investments in fiber optic networks, with extensive deployment of fiber to the premises infrastructure in many urban and suburban areas. Moreover, the North American market has a competitive landscape with multiple internet service providers (ISPs) including Calix, Inc., Adtran, Inc., and Netuno Inc. offering fiber to the premises services. The competition fosters innovation, improved service quality, and attractive pricing options for consumers. Furthermore, the increasing investments by the government to provide high-speed internet infrastructure are also contributing remarkably to fueling the fiber to the premises market opportunities.

- For instance, in June 2023, the US Department of Commerce invested USD 42.45 billion through the Broadband Equity Access and Deployment (BEAD) program with an aim to connect Americans to reliable and affordable high-speed internet.

Consequently, the increasing government investment to enhance the digital infrastructure by installing high-speed broadband networks is driving the fiber to the premises market expansion.

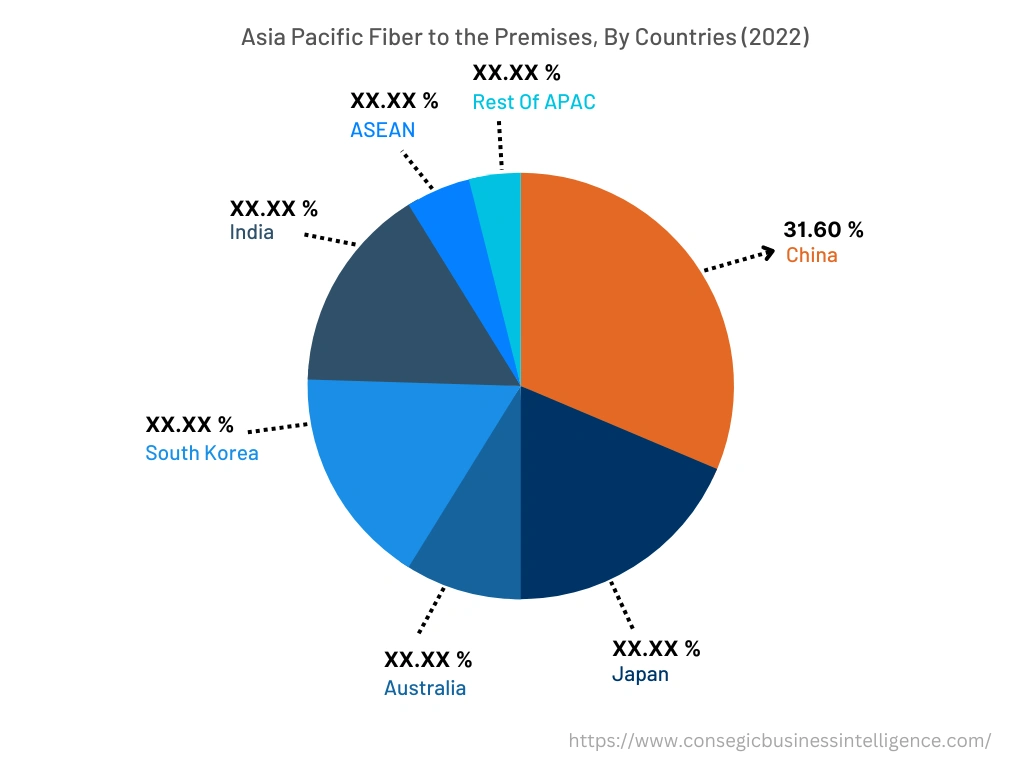

Asia Pacific accounted for USD 4,891.77 Million in 2022 and is expected to register the fastest CAGR of 14.5% accounting to USD 14,167.68 Million in 2030 in the fiber to the premises market. In addition, in the region, China accounted for the maximum revenue share of 31.60% in the year 2022. The regional trends analysis shows that the growth in the region is attributed to the increasing internet penetration and expanding e-commerce sector in Asia Pacific countries that escalated the demand for faster and more reliable internet connectivity. Fiber to the premise technology provides the required infrastructure to support the growing number of internet users in the region. In addition, governments in the Asia Pacific region are actively promoting the deployment of high-speed broadband networks, including FTTP, to improve the digital infrastructure of the region. Moreover, many Asia Pacific countries have launched national broadband plans, initiated public-private partnerships, and allocated funds to accelerate the development of broadband infrastructure. Subsequently, government support and investments, increasing internet penetration, and expanding the e-commerce sector are creating a favorable environment for the fiber to the premises market expansion in the region.

Top Key Players & Market Share Insights:

The landscape of the global fiber to the premises market is highly competitive and has been examined in the report, along with complete profiles of the key players operating in the industry. In addition, the surge in innovations, acquisitions, mergers, and partnerships has further accelerated the growth of the market. Major players in the fiber to the premises industry include-

- Huawei Technologies Co., Ltd.

- Calix, Inc.

- Netuno

- ER-Telecom

- Optimum (Altice USA)

- Adtran, Inc.

- Nokia Corporation

- ZTE Corporation

- Fiberhome India Pvt Ltd

- BizNet

Recent Industry Developments :

- In June 2023, Optimum launched a 100% fiber to the home network in Texas offering thousands of West Texas businesses and residents improved connectivity including increased bandwidth, gigabit symmetrical speeds, and unlimited data.

- In February 2020, ETSI launched the fifth generation of fiber to the home to provide a full fiber connection and improved broadband network for various applications including AR/VR video streaming and online gaming.

Key Questions Answered in the Report

What is fiber to the premise? +

Fiber to the Premises (FTTP), also known as Fiber to the Home (FTTH), is a high-speed broadband network architecture that provides direct fiber-optic connectivity from the service provider to individual residences or businesses.

What specific segmentation details are covered in the fiber to the premises market report, and how is the dominating segment impacting the market growth? +

GPON dominates the market in 2022 as GPON offers high bandwidth capabilities, allowing for the delivery of gigabit speeds to end-users. In addition, GPON provides sufficient capacity to support bandwidth-intensive applications, including video streaming, cloud services, and emerging technologies, namely virtual and augmented reality.

What specific segmentation details are covered in the fiber to the premises market report, and how is the fastest segment anticipated to impact the market growth? +

Commercial segment is anticipated to witness the fastest CAGR as the sector requires fast and reliable internet connectivity to support various operations including cloud-based applications, remote work, video conferencing, and data-intensive tasks.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period due to the increasing internet penetration and expanding e-commerce sector in Asia Pacific countries that escalate the demand for faster and more reliable internet connectivity.