- Summary

- Table Of Content

- Methodology

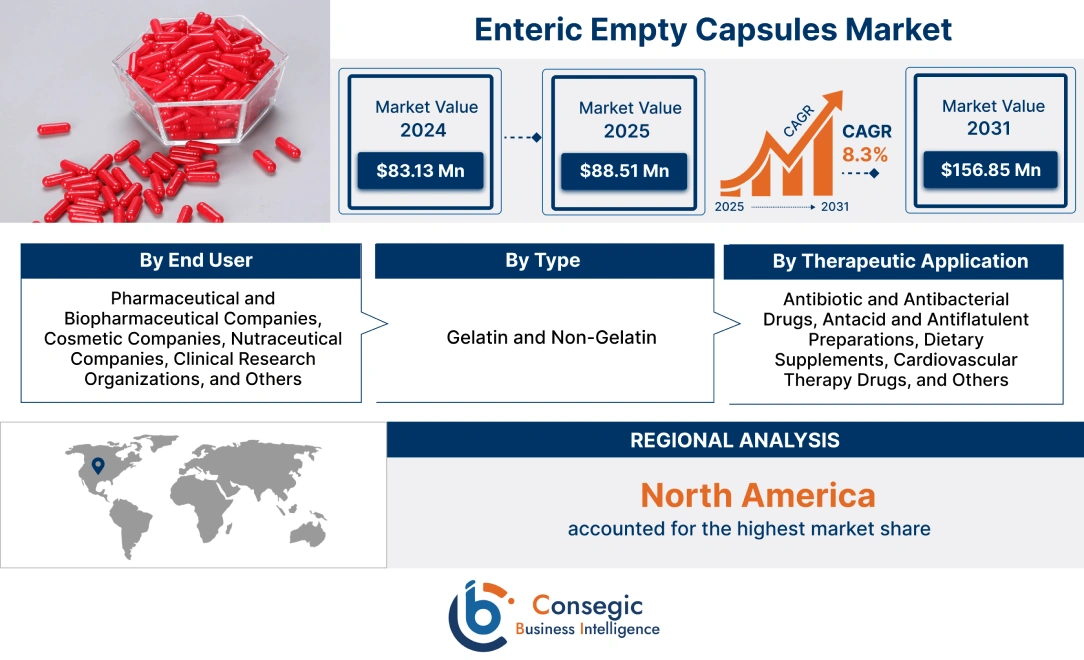

Enteric Empty Capsules Market Size :

Enteric Empty Capsules Market size is estimated to reach over USD 156.85 Million by 2032 from a value of USD 83.13 Million in 2024 and is projected to grow by USD 88.51 Million in 2025, growing at a CAGR of 8.30 % from 2025 to 2032.

Enteric Empty Capsules Market Scope & Overview :

An enteric empty capsule is a type of capsule that is designed to resist disintegration and dissolution in the stomach. This allows the contents of the capsule to pass through the stomach and into the small intestine, where they are more effectively absorbed. Owing to the coating outside the capsule, the product is widely incorporated in pharmaceutical applications as it is the most common way to achieve acid resistance. Based on the analysis, the process simplifies drug enteric delivery implementation and allows the ingredients to reach the small intestine for maximum absorption process. Also, the capsules protect the stomach from acidic nature and digestive discomfort. The capsules are less likely to cause any gastric side effects such as nausea, stomach upset, and others. The capsules offer better targeted delivery of nutrients to where they are needed most in the human body. Moreover, the products also have longer shelf life than traditional empty capsules.

Enteric Empty Capsules Market Insights :

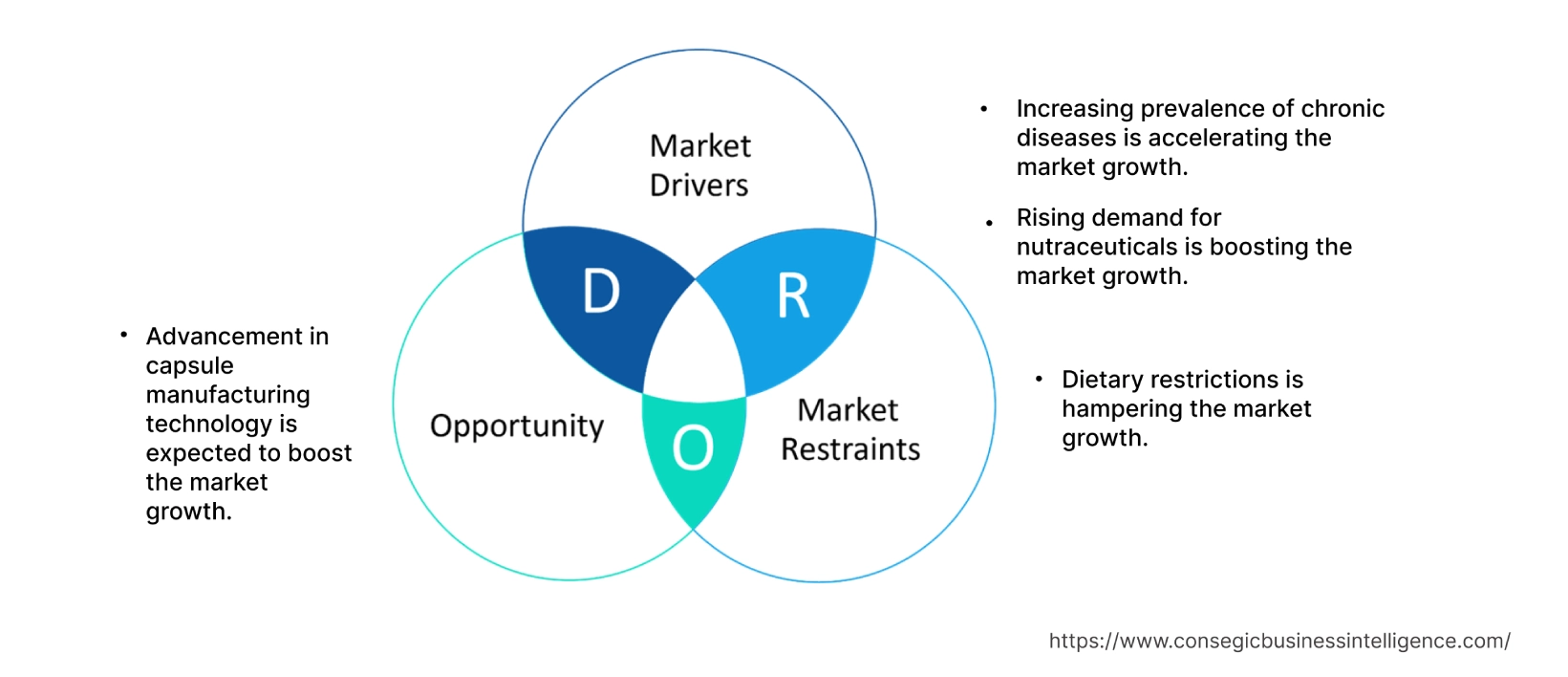

Key Drivers :

Increasing prevalence of chronic diseases is accelerating the market

Enteric empty capsules are largely essential for providing supplements and medications in treating chronic diseases. Owing to certain features of the capsules such as accurate dosage and compatibility with different kinds of drugs, the capsules are largely required in treatments for chronic conditions. Moreover, as per the analysis, increasing cases of cancer, heart disease, diabetes, respiratory illness, and neurovascular stroke globally are leading to driving the requirement for enteric empty capsules market. For instance, in 2021, according to an article by the Centers for Disease Control and Prevention, obesity prevalence in the U.S. was around 41.9% between 2017 to March 2020. Thus, owing to increasing chronic disorders globally due to multiple aforementioned factors, are propelling the market.

Rising demand for nutraceuticals is boosting the market

The enteric empty capsules are regarded as one of the preferred and efficient dosage forms for the delivery of nutraceuticals. Based on the analysis, the increasing prevalence of noncommunicable diseases such as diabetes, cancer, and others is leading to more requirement for capsules for different medications and treatment purposes. For instance, according to a report by Pain American Health Organization in 2022, noncommunicable diseases (NCDs) kill 41 million people each year worldwide, equivalent to 71% of all deaths globally. In America, 5.5 million deaths are by NCD every year. Also, increasing requirement for nutraceuticals across the globe is fostering the requirement for these capsules. According to a report by the Ministry of Food Processing Industries in 2021, India's nutraceutical market is prepped to be a leader at USD 4 to 5 billion by 2025. It is expected to grow approximately to USD 18 billion by 2025. The report also mentions growing requirement for immunity-boosting supplements and vitamin capsules is driving more demand for the entry empty capsules. Hence, due to rising requirement for nutraceuticals and growing noncommunicable diseases, the enteric empty capsules market is witnessing significant development in the trends.

Key Restraints :

Dietary restrictions is hampering the market

Enteric empty capsules have gelatin as the most common material used in the production process. Gelatin is prepared from collagen, which is made from the by-products of slaughtered animals which include bones, hides, hooves of cattle, fish, pigs, horses, and others. Thus, dietary restrictions for animal-origin-based products by different consumers prove to be a major restraint for hampering the enteric empty capsules industry. Hence, due to certain dietary restrictions and cultural practices followed by different individuals, the enteric empty capsules market growth is getting hampered to a certain extent.

Future Opportunities :

Advancement in capsule manufacturing technology is expected to boost the market

Different innovations in capsule manufacturing technology such as the development of automated capsule filling machines and others are expected to boost the enteric empty capsules market opportunities and trends further. The high efficiency and speed of the automated capsule filling machines is bringing in growing production capacity and reduction in manufacturing costs. Furthermore, innovations in capsule materials such as plant-based capsules are extracting major requirement in the market due to the vegetarian-friendly attribute of the product. Thus, different advancements in capsule design and materials by the key players of the market are improving the drug delivery process, enhancing product quality, improving patient compliance, and others. For instance, in 2021, Evonik launched new enteric protected ready-to-fill capsules for fast and high-performance drug development. They launched a new product named EUDRACAP, which is suitable for early drug development stages through a commercial scale and by using sensitive molecules. Hence, different technological innovations in the capsules by the key market players are creating lucrative opportunities and trends in the forecast years.

Enteric Empty Capsules Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 156.85 Million |

| CAGR (2025-2032) | 8.3% |

| By Type | Gelatin and Non-Gelatin |

| By Therapeutic Application | Antibiotic and Antibacterial Drugs, Antacid and Antiflatulent Preparations, Dietary Supplements, Cardiovascular Therapy Drugs, and Others |

| By End User | Pharmaceutical and Biopharmaceutical Companies, Cosmetic Companies, Nutraceutical Companies, Clinical Research Organizations, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Lonza Group Ltd, Evonik, The Roxlor Group, CapsCanada Corporation, Qualicaps Inc., CapsulCN International Co., Ltd., Natural Capsules Limited, Snail Pharma Industry Co. Ltd, ACG Group, and Anhui Huangshan Capsule Co., Ltd. |

Enteric Empty Capsules Market Segmental Analysis :

By Type :

The type segment is categorized into gelatin and non-gelatin. In 2024, the gelatin segment accounted for the highest market revenue and is expected to grow at the fastest CAGR over the forecast period in the enteric empty capsules market. Owing to the low cost and high availability of gelatin in the market, the gelatin product is witnessing significant growth. Furthermore, based on the analysis the protein content in the gelatin capsules acts as a catalyst for the growth of the gelatin type in the market. Moreover, different benefits of the product offering such as increased bioavailability, easy digestion, and others are boosting the growing requirement for gelation capsules. Furthermore, gelatin is widely needed by people suffering from joint and skin disorders. Also, gelatin capsules are largely used in the pharmaceutical and nutraceutical sectors for dietary supplements and other medications. Hence, due to the aforementioned advantages of the product, gelatin capsules are witnessing significant growth and trends in the enteric empty capsules market.

By Therapeutic Application :

The therapeutic application segment is categorized into antibiotic and antibacterial drugs, antacid and antiflatulent preparations, dietary supplements, cardiovascular therapy drugs, and others. In 2024, the dietary supplements segment accounted for the highest market share and is expected to grow at the fastest CAGR over the forecast period in the enteric empty capsules. This is due to the increasing requirement for dietary supplements owing to the wide availability of the products in the market. Also, increasing health consciousness and a growing focus on personalized nutrition is boosting the growth of dietary supplements. The product is widely used by fitness enthusiasts, body builders, youth as well as aging population for bridging the nutritional gaps and addressing health needs and concerns. Empty capsules are ideal for encapsulation of various powdered supplements such as amino acids, protein powder, pre-workout formulas, and others. Hence, as per the analysis, due to the growing dietary supplements market coupled with increasing awareness of healthy lifestyles and changing consumer behavior for lifestyle modification, there is increasing need for the dietary supplements application. For instance, according to a report by the Ministry of Food Processing Industries, in 2021, the dietary supplements market in India was valued at USD 3924.44 million in 2020 and is expected to reach USD 10,198.57 million by 2026 which is a 22% growth rate year on year. Hence, due to the aforementioned benefits of the application, the dietary supplement segment is witnessing significant growth and trends in the market.

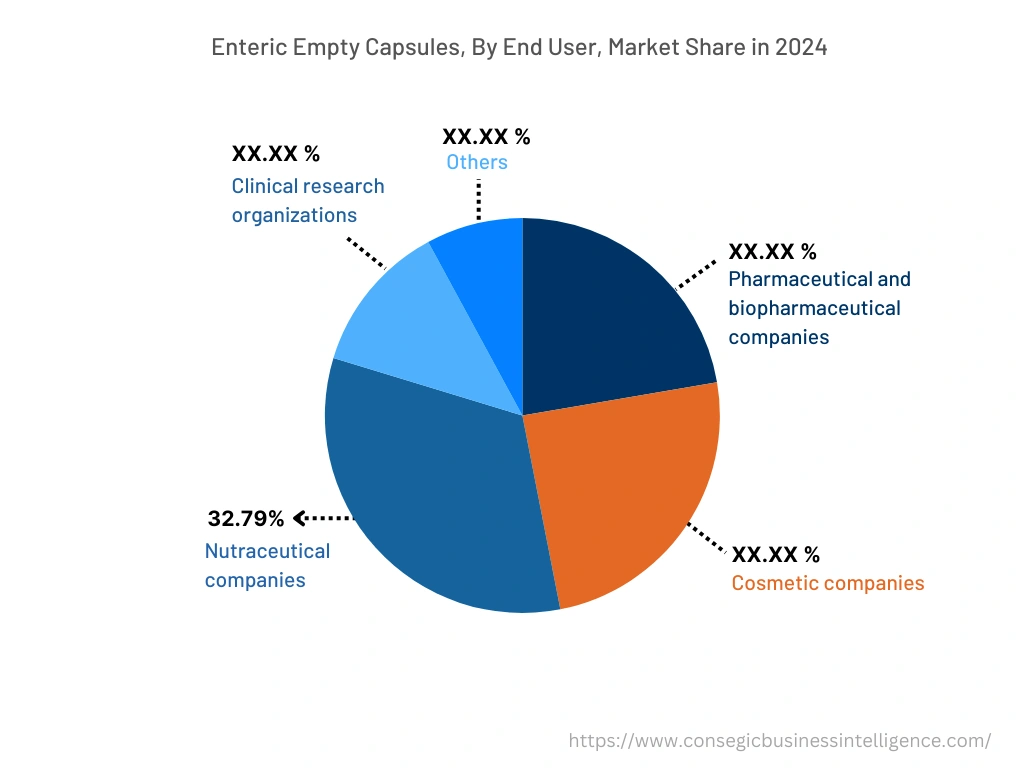

By End-User :

The end user segment is categorized into pharmaceutical and biopharmaceutical companies, cosmetic companies, nutraceutical companies, clinical research organizations, and others. In 2024, the nutraceutical companies segment accounted for the highest enteric empty capsules market share of 32.79% in the market. An increase in nutraceutical intake to boost immunity and growing consciousness for healthy lifestyle is increasing the requirement for the segment. Furthermore, the rapid expansion of the nutraceutical sector coupled with rising consumption of supplement capsules such as minerals, vitamins, and others are driving major need for the nutraceutical companies segment. For instance, according to a report by Invest India in 2020, the nutraceuticals market is expected to grow from USD 4 billion in 2017 to USD 18 billion in 2025, due to increasing demand for dietary supplements from upper and middle class consumers in India. Hence, due to increasing enteric empty capsules market demand in nutraceutical companies, the segment is witnessing significant development and trends in the market.

Moreover, the cosmetic companies segment is expected to grow at the fastest CAGR in the enteric empty capsules market during the forecast period. Enteric empty capsules are largely used in cosmetic companies for the utilization of the product in treating skin problems and different skin conditions, enhancing the texture of the skin, and improving beauty enrichment. Also, the growing cosmetics sector globally is driving the major enteric empty capsules market growth. For instance, according to a report in 2023 by Cosmetics Europe, a personal care association, the retail sales price for cosmetic products in the European market was around USD 94 billion in 2022 and is forecasted to increase significantly. The largest national markets for cosmetics and personal care products within Europe are Germany, France, Italy, UK, Spain, and Poland. Hence, due to the increasing cosmetic sector and wide demand for enteric empty capsules in the cosmetic sector, the segment is witnessing significant expansion and trends in the enteric empty capsules market.

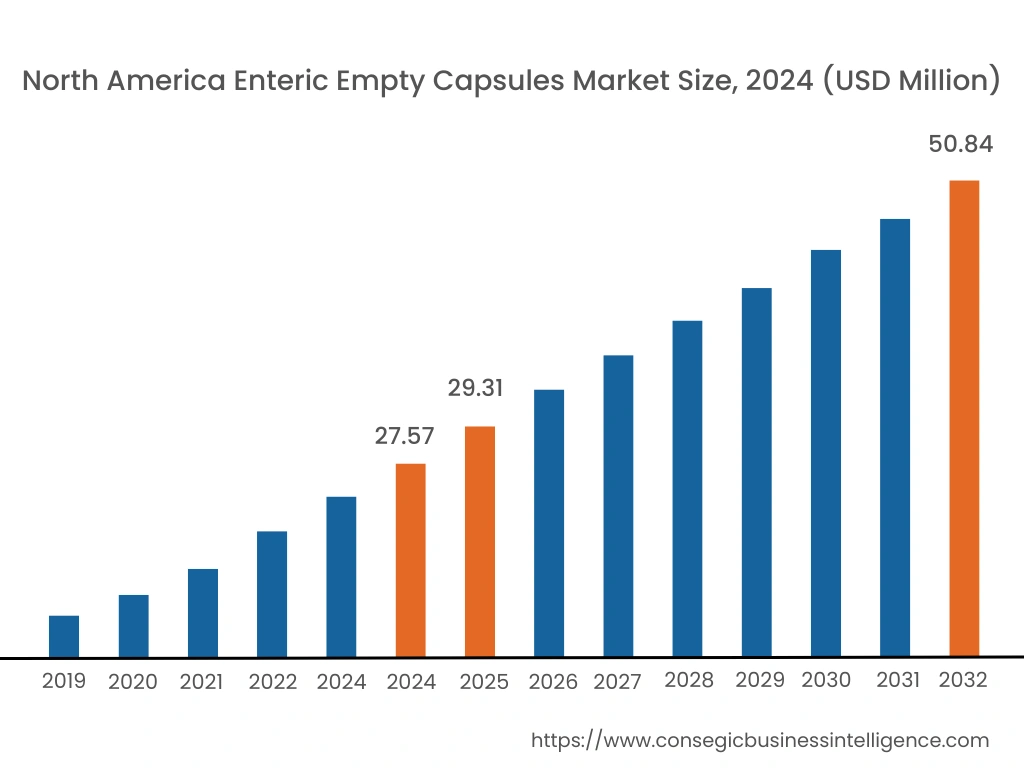

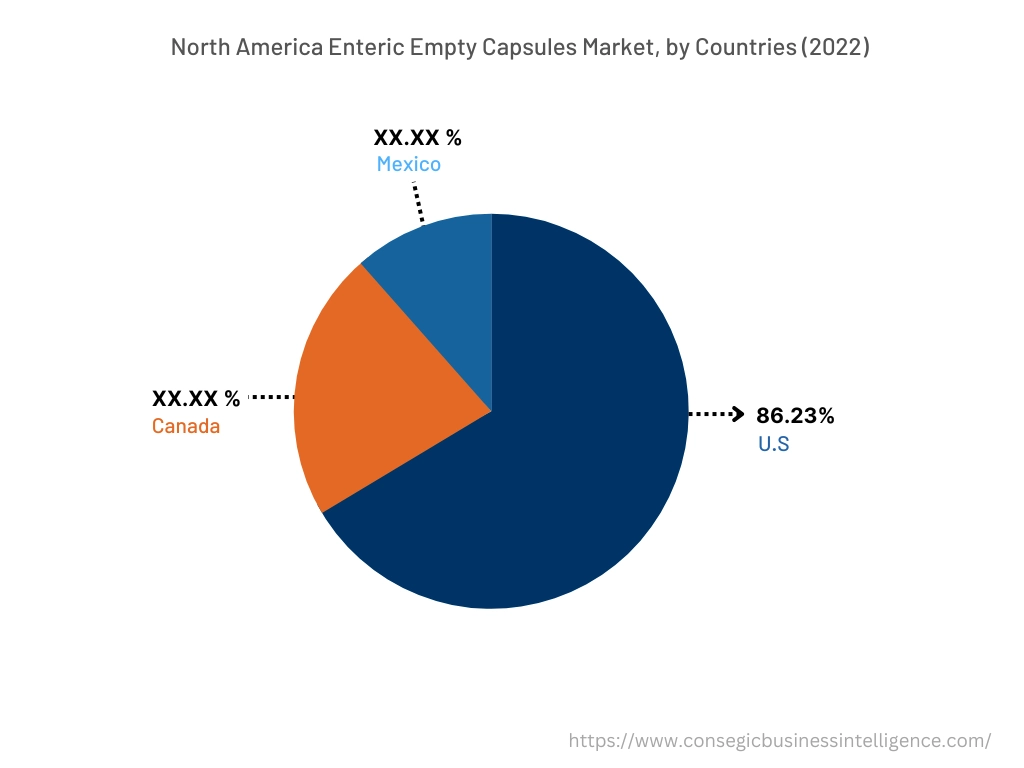

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, North America accounted for the highest market share at 33.56%, valued at USD 27.57 million and is projected to grow to USD 29.31 million in 2025, it is expected to reach USD 50.84 Million in 2032. In North America, the U.S. accounted for the highest market share of 86.23% during the base year 2024. Based on the enteric empty capsules market analysis, this is due to the presence of key players in the region, coupled with advanced healthcare facilities in North America. Also, favorable government initiatives and increasing demand for preventive care in the region is boosting the market expansion in the region. Advanced treatment options coupled with an established healthcare system act as a catalyst for the expansion of the enteric empty capsules market in the region. Hence, due to the aforementioned factors, the enteric empty capsules market trend is growing significantly in North America.

Moreover, Asia Pacific is expected to witness significant expansion over the forecast period, growing at a CAGR of 8.7% during 2025-2032. As per the analysis, growing pharmaceutical and nutraceutical industries in the region is boosting the demand for enteric empty capsules. For instance, according to a report by India Brand Equity Foundation in 2023, the market size of the pharmaceuticals sector in India is expected to reach around USD 65 billion by 2024, and USD 130 billion by 2030. Also, pharmaceutical exports from India reach more than 200 nations around the world. Hence, the increasing pharmaceutical sector is leading to larger expansion of the enteric empty capsules market in the region.

Top Key Players & Market Share Insights :

The global enteric empty capsules market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Lonza Group Ltd

- Evonik

- Snail Pharma Industry Co. Ltd

- ACG Group

- Anhui Huangshan Capsule Co., Ltd.

- The Roxlor Group

- CapsCanada Corporation

- Qualicaps Inc.

- CapsulCN International Co., Ltd.

- Natural Capsules Limited

Recent Industry Developments :

- In May 2021, Evonik launched a new platform, called EUDRACAP platform, to help the pharmaceutical industry accelerate the speed to market for complex oral drug products in early development stages. EUDRACAP is Evonik's latest system solution built on the company's unique technology platform for advanced drug delivery.

- In November 2022, Lonza Group Ltd launched an innovative new capsule solution for intestinal (enteric) drug delivery. The product, Enprotect capsule does not disintegrate during stomach transit and only releases its contents in the intestine.

Key Questions Answered in the Report

What was the market size of the enteric empty capsules industry in 2024? +

In 2024, the market size of enteric empty capsules was USD 83.13 million.

What will be the potential market valuation for the enteric empty capsules industry by 2032? +

In 2032, the market size of enteric empty capsules will be expected to reach USD 156.85 million.

What are the key factors driving the growth of the enteric empty capsules market? +

Rising demand for nutraceuticals is fueling market growth at the global level.

What is the dominating segment in the enteric empty capsules market by end user? +

In 2024, the nutraceutical companies segment accounted for the highest market share of 32.79% in the overall enteric empty capsules market.

Based on current market trends and future predictions, which geographical region is the dominating region in the enteric empty capsules market? +

North America accounted for the highest market share in the overall enteric empty capsules market.