Endoscopy Devices Market Size :

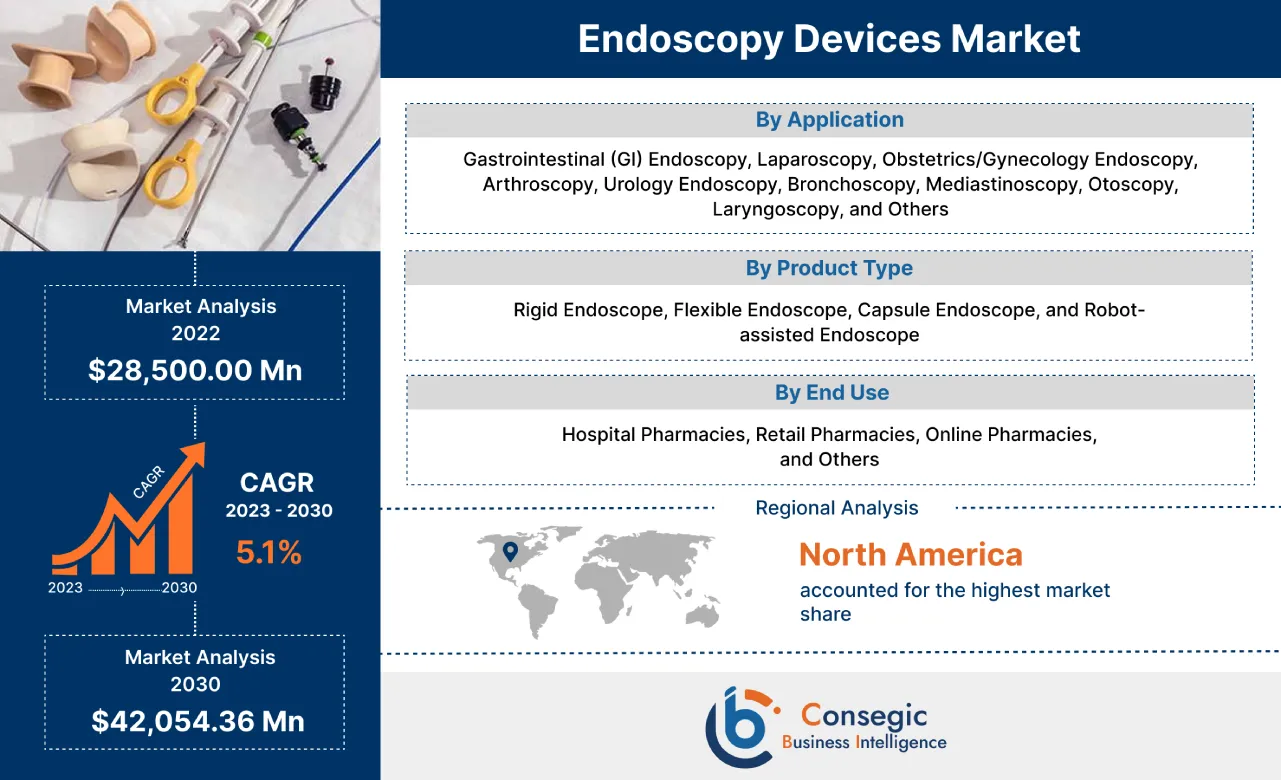

Consegic Business Intelligence analyzes that the Global Endoscopy Devices Market size is growing with a CAGR of 5.1% during the forecast period (2023-2030), and the market is projected to be valued at 42,054.36 million by 2030 from 28,500.00 million in 2022.

Endoscopy Devices Market Scope & Overview:

Endoscopy is a medical procedure that diagnoses any complications associated with visceral organs. This process is used mainly to determine cavities in the body. Physicians and endoscopists widely use the product as they analyze the internal organs of the body with the help of a camera or light source placed at the tip of endoscopes. An endoscopy device consists of an optical lens, image sensor, and light source. These devices have wide applications and demand in different surgical procedures namely laparoscopy, bronchoscopy, arthroscopy, and others.

Endoscopy Devices Market Insights :

Endoscopy Devices Market Dynamics - (DRO) :

Key Drivers :

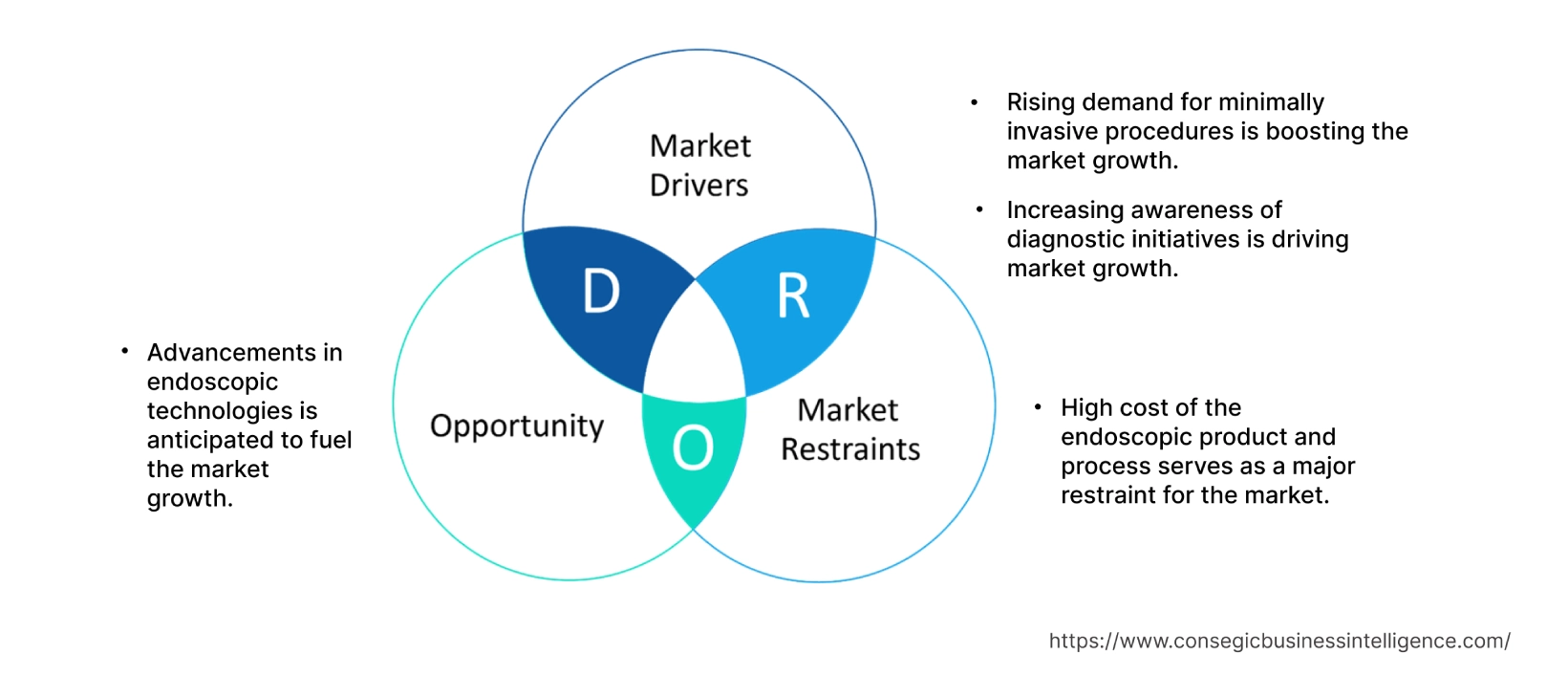

Rising demand for minimally invasive procedures

Endoscopy devices are used to view the inside of the body, while minimally invasive procedures are performed through small incisions. These two technologies are often used together to diagnose and treat medical conditions with less pain and recovery time than traditional surgery. Due to the rising number of minimally invasive surgeries globally, there has been a major demand for endoscopes in different surgical procedures. Analysis of market trends concludes that the increasing health concerns such as the rising number of obesities, geriatric population, and chronic diseases are driving the expansion in the endoscopy devices market. For instance, in 2021, according to an article by the Centers for Disease Control and Prevention, obesity prevalence in the U.S. was around 41.9% between 2017 to March 2020. As a result, the rise in obesity conditions has increased heart disease, stroke, and cancer. Hence, increasing health concerns globally have been driving significant growth in the endoscopy devices market.

Increasing awareness of diagnostic initiatives

Increasing awareness of diagnostic initiatives and endoscopy devices can help to improve early diagnosis and treatment of diseases, leading to better outcomes for patients. Analysis of market trends concludes that advanced product launches by the key players in the endoscopy devices market are boosting the market growth. For instance, in 2023, Fujifilm expanded its endoscopy solutions portfolio for gastrointestinal applications. The company launched two new products, namely, ClutchCutter and FushKnife. Thus, an increase in product portfolio and the launch of new products by the key players is fostering the proliferation of the market. Moreover, increasing awareness of diagnostic initiatives and devices helps to improve early diagnosis and treatment of diseases boosting the endoscopy devices market demand.

Key Restraints :

High cost of the endoscopic product and process

Endoscopy process comes with a high price due to advanced technology involvement and thus affordability becomes a concern. Due to this, it has a lower penetration rate in certain developing regions. Analysis of market trends concludes that the expensive endoscopy process coupled with the absence of skilled endoscopists is hampering the market proliferation. Unfavorable healthcare infrastructure and developments in certain emerging nations globally serve as a hindrance to the market expansion of endoscopy devices. Hence, the aforementioned factors are likely to deter market expansion.

Future Opportunities :

Advancements in endoscopic technologies

Major technological changes by the key players operating in the endoscopic devices market such as reduction of withdrawal time for endoscopes, safe and efficient methods for removing polyps, augmented reality, and others are anticipated to surge the market growth. Analysis of market trends concludes that the production of new and advanced devices by various players in the endoscopy devices market serves as the biggest opportunity for market proliferation. For instance, in 2020, Olympus Corporation launched EVIS X1, one of the most advanced endoscopy systems. This system has improved outcomes from disorders of oesophagus, stomach, and bronchial diseases. Advancements in endoscopic technologies is anticipated to emerge as one of many endoscopy devices market opportunities that will drive market expansion significantly over the forecast period.

Endoscopy Devices Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 42,054.36 Million |

| CAGR (2023-2030) | 5.1% |

| By Product Type | Rigid Endoscope, Flexible Endoscope, Capsule Endoscope, and Robot-assisted Endoscope |

| By Application | Gastrointestinal (GI) Endoscopy, Laparoscopy, Obstetrics/Gynecology Endoscopy, Arthroscopy, Urology Endoscopy, Bronchoscopy, Mediastinoscopy, Otoscopy, Laryngoscopy, and Others |

| By End Use | Hospitals, Ambulatory Surgery Centers, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Olympus Corporation, Fujifilm, Stryker Corporation, Boston Scientific Corporation, Smith & Nephew Inc., Richard Wolf GmbH, PENTAX Medical, Machida Endoscope Co., Ltd., Cook Medical, B Braun Melsungen AG |

Endoscopy Devices Market Segmental Analysis :

By Product Type :

The product type segment is categorized into rigid endoscope, flexible endoscope, capsule endoscope, and robot-assisted endoscope. In 2022, the flexible endoscope segment accounted for the highest market share and is expected to grow at the fastest CAGR in the overall endoscopy devices market. The flexible endoscope is demanded widely by medical professionals in the diagnosis of different chronic diseases such as stomach cancer, respiratory infections, and others as it offers enhanced efficiency and safety. Assessment of market trends indicates that the high incidence of chronic diseases is significantly impacting the rate of flexible endoscope usage in the endoscopy devices market. For instance, according to WHO, around 125 million people in the U.S. were diagnosed with chronic disorders in 2022. The diseases that were most commonly found among U.S. citizens were arthritis, diabetes, cardiovascular disease, allergies, and others. Hence, the growth of the flexible segment is anticipated to increase in the following years owing to the rising prevalence of chronic diseases globally.

However, the rings segment is expected to grow at the fastest-growing segment in the market during the forecast period. Rings hold an immense symbolic value and are commonly used to signify important milestones such as engagements, weddings, anniversaries, and other special occasions. The emotional significance attached to these events creates a constant demand for rings. As a result, the aforementioned factors are likely to generate a high demand for rings over the forecast period.

By Application :

The application segment is categorized into gastrointestinal (GI) endoscopy, laparoscopy, obstetrics/gynecology endoscopy, arthroscopy, urology endoscopy, bronchoscopy, mediastinoscopy, otoscopy, laryngoscopy, and others. In 2022, the gastrointestinal (GI) endoscopy segment accounted for the highest endoscopy devices market share. This is due to the large prevalence of gastrointestinal diseases globally coupled with rising cases of colorectal cancer. Assessment of market trends indicates that the increasing advancements in endoscopic technologies for the diagnosis of functional gastrointestinal disorders by the key players in the market is acting as a catalyst for the endoscopy devices market growth.

Moreover, the urology segment is expected to grow at the fastest CAGR in the overall endoscopy devices market during the forecast period. This is due to rising chronic diseases globally such as cancer, and others. For instance, according to the National Cancer Institute, estimated new bladder cancer cases would be around 82,290 in 2023, out of which estimated deaths would be around 16,710. Hence, increasing bladder cancer cases will aid the urology segment to grow in the market.

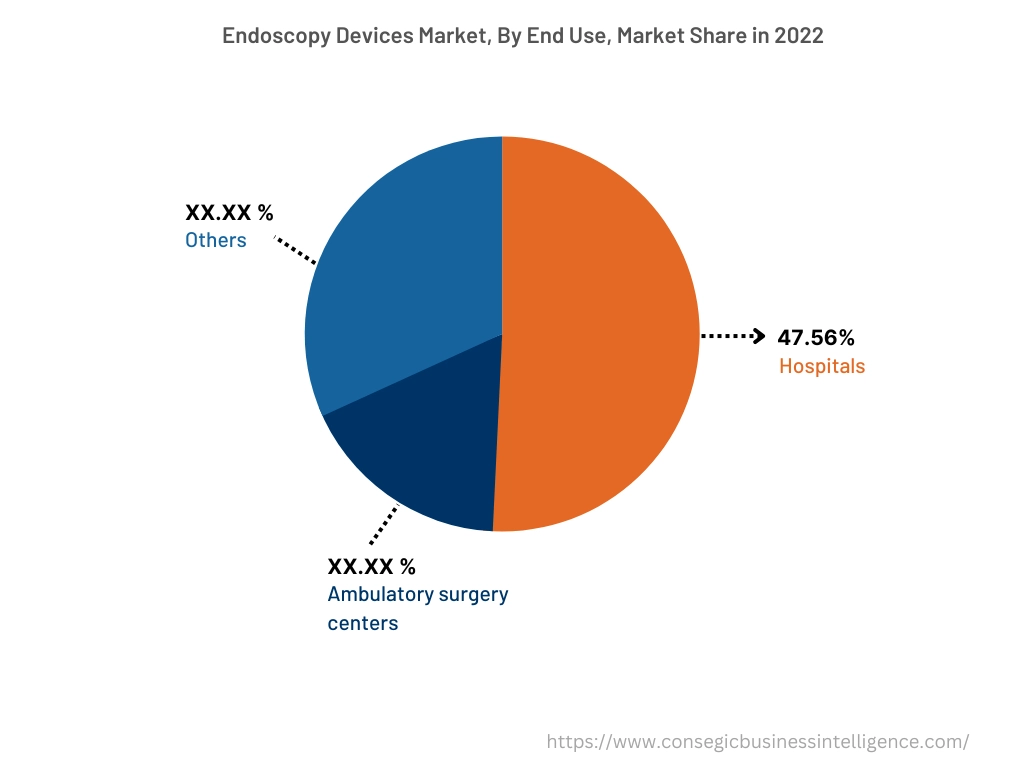

By End-User :

The end use segment is categorized into hospitals, ambulatory surgery centers, and others. In 2022, the hospitals segment accounted for the highest market share of 47.56% in the endoscopy devices market. Rising preference for diagnosis and treatments in hospitals is driving the market proliferation globally. Analysis of endoscopy devices market trends concludes that the increasing number of surgeries and endoscopy procedures being performed in hospitals globally is driving segmental growth. Also, the availability of advanced equipment and better endoscopic facilities in hospitals is acting as a catalyst for this segmental's highest market share. Hence, due to the aforementioned factors, there is a significant expasnion observed of the hospitals segment in the overall endoscopy devices market.

Moreover, the ambulatory surgery centers segment is expected to grow at the fastest CAGR in the overall endoscopy devices market during the forecast period. The endoscopy devices market analysis concluded that the rising preference for minimally invasive procedures, reduction in hospital stays, and faster recovery time are a few of the major driving factors for the ambulatory surgery centers segment in the endoscopy devices market.

By Region :

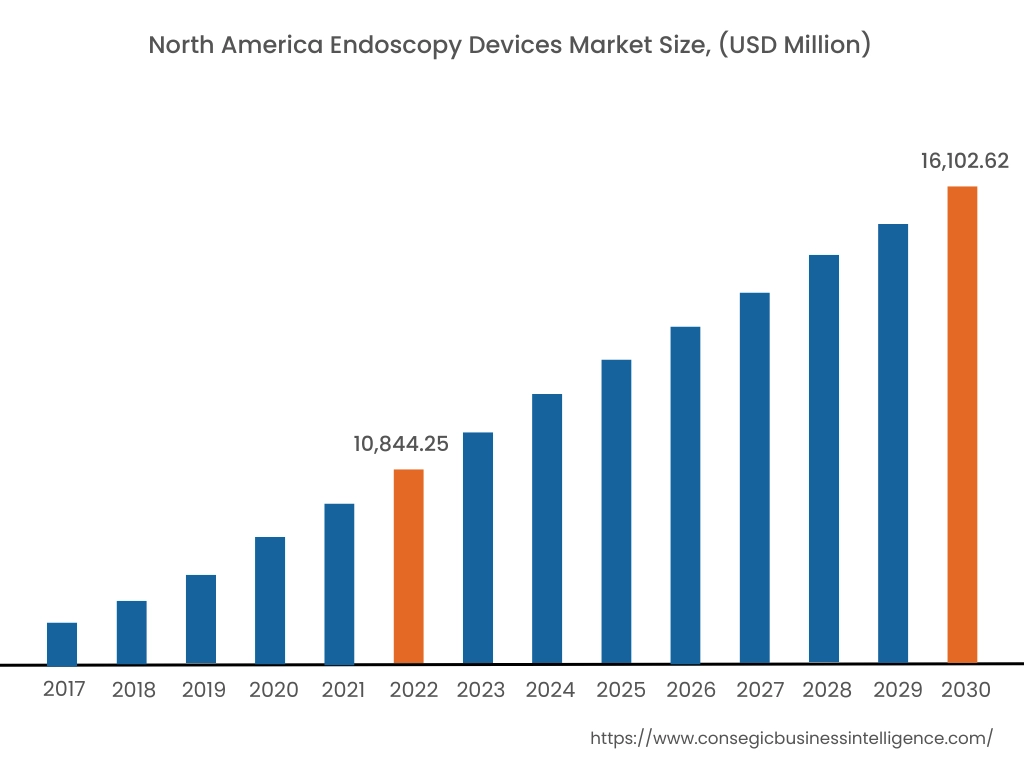

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

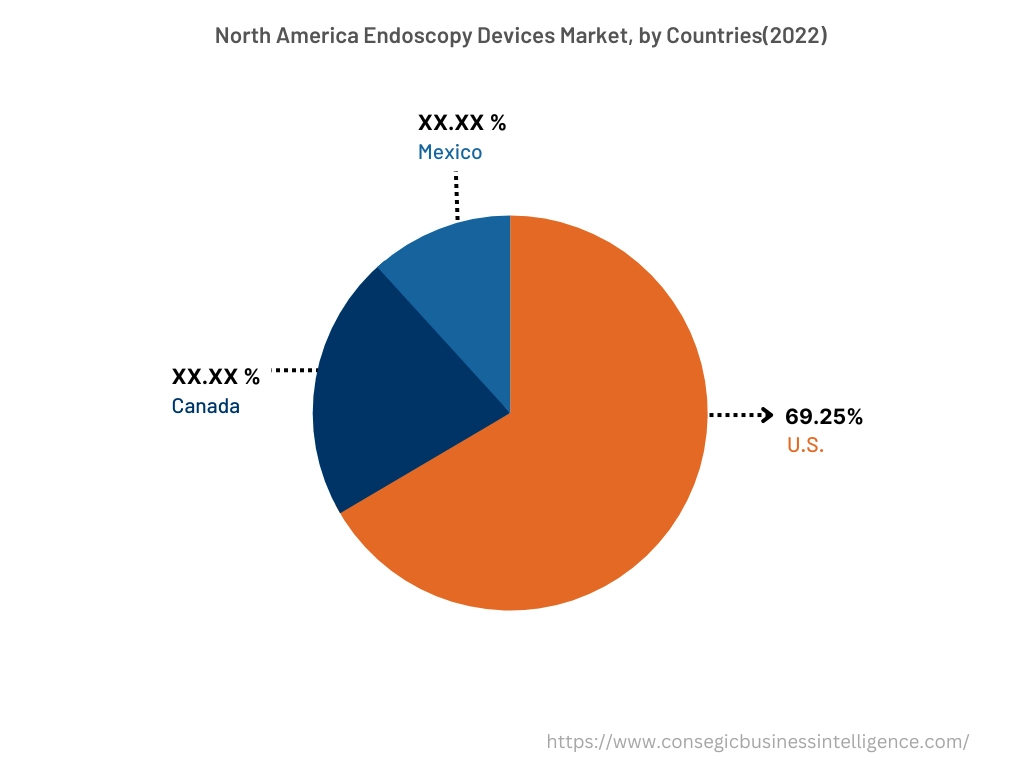

In 2022, North America accounted for the highest market share of 38.05% and was valued at USD 10,844.25 million and is expected to reach USD 16,102.62 million in 2030. In the North America region, the U.S. accounted for the highest market share of 69.25% during the base year 2022. The rising prevalence of chronic diseases such as diabetes, cancer, gastrointestinal disorders, and others in North America is driving the market growth. Also, rising demand for minimally invasive procedures, coupled with enhanced healthcare infrastructure is driving the market proliferation in North America.

Moreover, Asia Pacific is expected to grow at the fastest CAGR of 5.7% during the forecast period due to the increase in population and rising number of patients suffering from different diseases. Moreover, the rise in government initiatives and investments, and improving healthcare infrastructure in countries such as India, and China, among others is driving the market growth. For instance, according to IBEF, India's public expenditure on the healthcare industry reached around 2.1% of GDP in 2023, in comparison to 1.6% in 2021, showcasing an increase in public expenditure on the healthcare industry. Further, the Indian government is also planning to introduce a credit incentive program worth USD 6.8 billion to boost the country's healthcare infrastructure. Hence, the increasing investments in healthcare infrastructure in the Asia Pacific is expected to enhance the market expansion during the forecast period.

Top Key Players & Market Share Insights:

The endoscopy devices market is highly competitive, with several large players and numerous small and medium-sized enterprises. The major companies operating in the endoscopy devices industry have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. Analysis of market trends concludes that the market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Olympus Corporation

- Fujifilm

- Machida Endoscope Co., Ltd.

- Cook Medical

- B Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- Smith & Nephew Inc.

- Richard Wolf GmbH

- PENTAX Medical

Recent Industry Developments :

- In December 2021, Fujifilm launched 15 endoscopy products in the period of last 30 months in the U.S. This marks innovations in the detection, treatment, and diagnosis of digestive diseases. These products have wide incorporation in hospitals and ambulatory surgery centers.

- In November 2022, Boston Scientific Corporation acquired Apollo Endosurgery, Inc. Apollo Endosurgery has a wide product portfolio of devices used during endoluminal surgery procedures, to mitigate gastrointestinal defects, manage gastrointestinal complications, and others. This acquisition is expected to transform lives through innovative medical solutions.

Key Questions Answered in the Report

What was the market size of the endoscopy devices market in 2022? +

In 2022, the market size of endoscopy devices market was USD 28,500.00 million

What will be the potential market valuation for the endoscopy devices market by 2030? +

In 2030, the market size of endoscopy devices market will be expected to reach USD 42,054.36 million.

What are the key factors driving the growth of the endoscopy devices market? +

Rising demand for minimally invasive procedures is the key factor driving the growth of the endoscopy devices market.

What is the dominating segment in the endoscopy devices market by end use? +

In 2022, the hospitals segment accounted for the highest market share of 47.56% in the overall endoscopy devices market.

Based on current market trends and future predictions, which geographical region will have the fastest impact on the endoscopy devices market's growth in the coming years? +

Asia Pacific is expected to be the fastest-growing region in the market during the forecast period.