- Summary

- Table Of Content

- Methodology

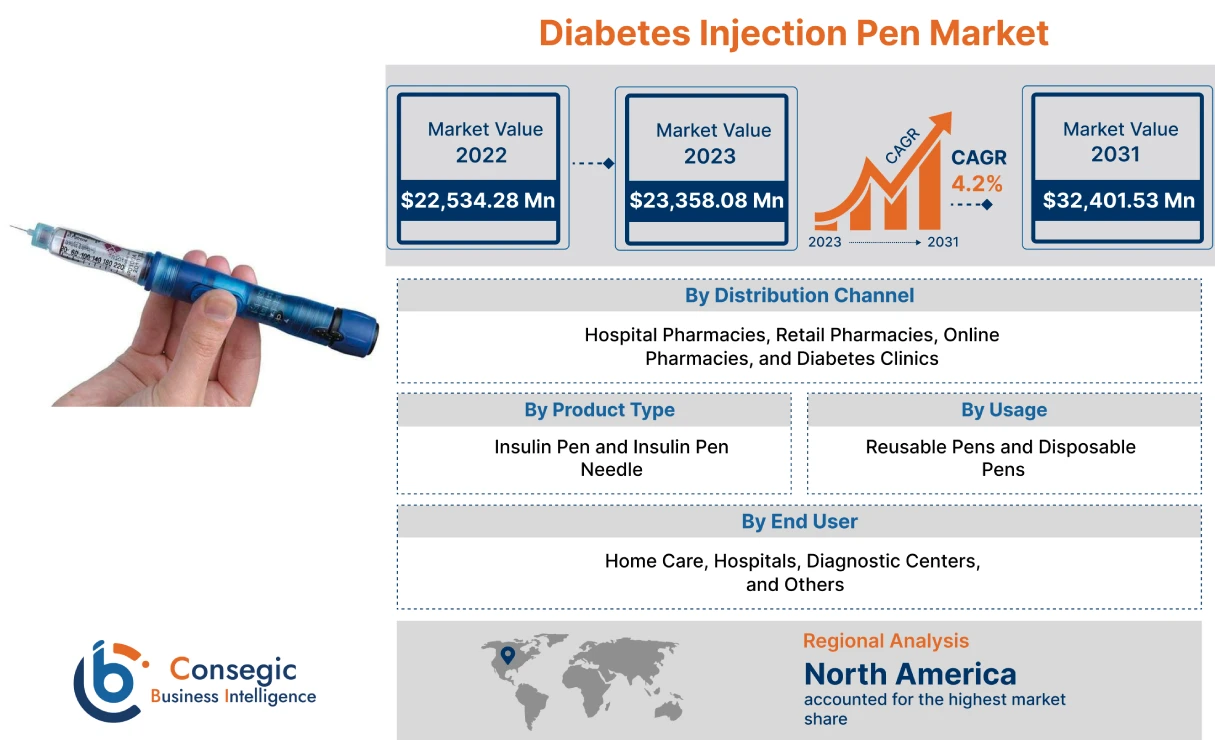

Diabetes Injection Pen Market Size :

Consegic Business Intelligence analyzes that the diabetes injection pen market size is growing with a CAGR of 4.2% during the forecast period (2023-2031). The market accounted for USD 22,534.28 million in 2022 and USD 23,358.08 million in 2023, and the market is projected to be valued at USD 32,401.53 Million by 2031.

Diabetes Injection Pen Market Scope & Overview:

A diabetes injection pen is a device used to inject insulin under the skin. Insulin is a hormone that helps the body's cells use glucose for energy. People with diabetes either do not produce enough insulin or their cells do not respond to insulin properly. This can lead to high blood sugar levels. These pens are a convenient and easy-to-use way to deliver insulin injections. They are pre-filled with insulin and have a pre-attached needle, so patients can simply inject themselves without having to measure and draw up the insulin.

Diabetes Injection Pen Market Insights :

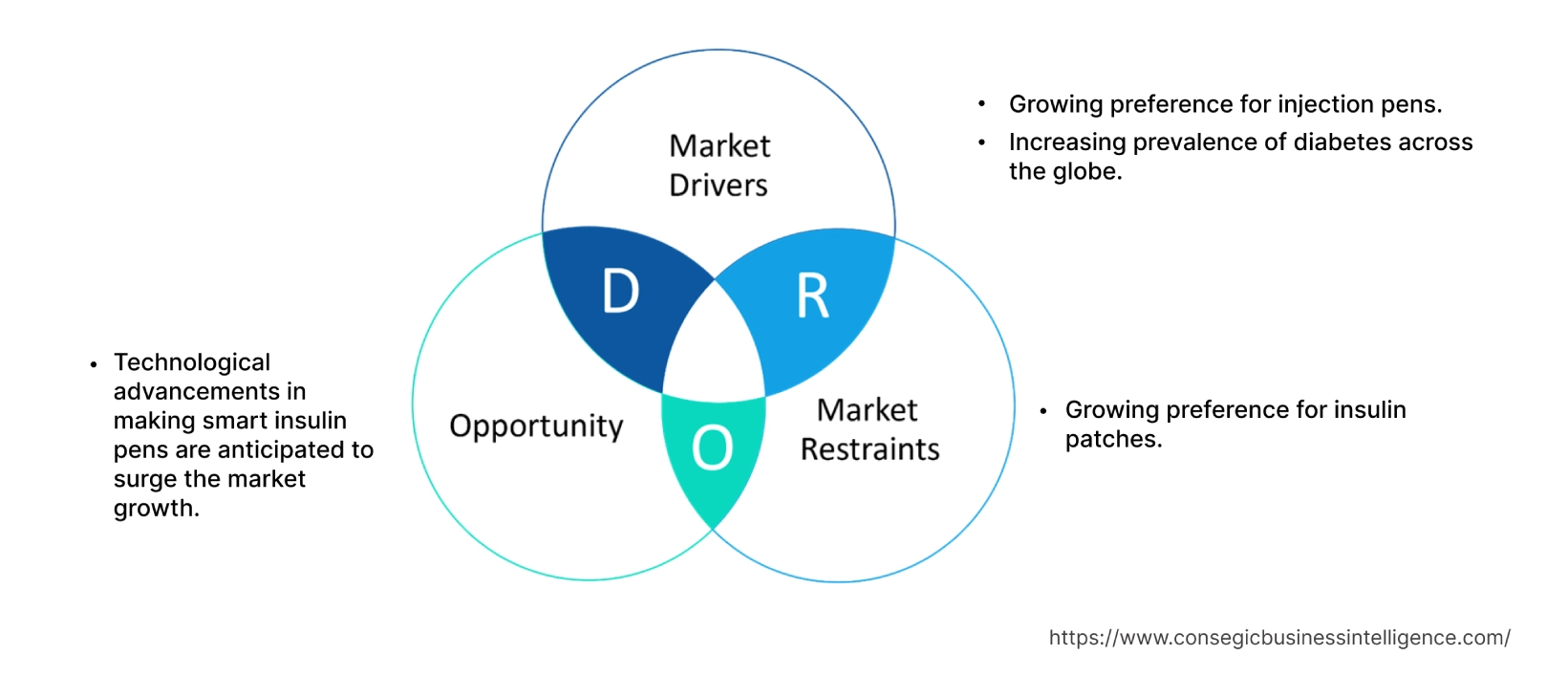

Key Drivers :

Growing preference for injection pens boosts the market

Diabetes injection pens are becoming more popular due to their convenient use and accurate performance. Unlike syringes, injection pens come preloaded with insulin and can be administered anywhere without the presence of a medical professional. Also, customers prefer to use injection pens instead of syringes when self-administering owing to the high accuracy of injection pens. Moreover, injection pens have to ability to deliver very small doses of insulin which is challenging for syringes and vials. As a result, the growing preference for injection pens due to their high accuracy, easy administration, less pain, and others is driving the market and leading key players to keep developing better technology for injection pens. Moreover, increasing approvals for diabetes pens across the globe are also driving the diabetes injection pen market growth.

- For instance, in May 2022, the U.S. Food and Drug Administration (FDA) approved Mounjaro (tirzepatide) injection for adults with type 2 diabetes. It is taken once a week and comes in an easy-to-use pen. Mounjaro helps to control blood sugar by working on two different hormones in the body. It can be used in addition to diet and exercise to help people with type 2 diabetes reach their blood sugar goals.

Thus, as per the diabetes injection pen market analysis, the increasing preference for injection pens as well as growing approvals for these medications are driving the market.

Increasing prevalence of diabetes across the globe drives the market.

The increasing prevalence of diabetes across the globe is driving the demand for diabetes injection pens worldwide. They are used to control the symptoms of diabetes in humans. They are a convenient and easy-to-use way to deliver insulin injections, which are essential for managing blood sugar levels in people with diabetes. The number of people suffering from diabetes worldwide has escalated substantially and is predicted to further increase in the future.

- According to the World Health Organization report in 2021, over 422 million people worldwide suffer from diabetes and the cases as well as the prevalence of diabetes has been steadily increasing since 1990.

- Furthermore, according to the International Diabetes Federation (IDF), 537 million adults worldwide will suffer from diabetes in 2021, and this number is projected to reach 643 million by 2030 and 783 million by 2045.

Thus, as the prevalence of diabetes increases, so does the adoption of diabetes injection pens, as they are a convenient and easy-to-use way to deliver insulin injections, which are essential for managing blood sugar levels in people with diabetes.

Key Restraints :

Growing preference for insulin patches limits the market growth.

An insulin patch is a small, wearable device that delivers insulin through the skin. It is a newer alternative to traditional insulin injections, which require patients to use a needle and syringe. Insulin patches are newer insulin delivery devices that pose direct competition for injection pens. Insulin patches are small digital devices that are modern alternatives for injection pens and syringes. They are smart devices that can be programmed to automatically deliver a dose without any attention from the patient.

- According to a survey conducted by the National Institute of Health in January 2018, about 71% of the participants who participated in the survey wanted to switch to the insulin patch and were primarily in preference of diabetes insulin pens and syringes.

Moreover, insulin patches last for up to 2 weeks making them very convenient and easy to use. As a result, the manufacturers of diabetes injection pens may face a decline in revenue, as the aforementioned factors are anticipated to hamper the market in the following years. Thus, the market trends analysis shows that increasing preference for insulin patches is restraining the diabetes injection pen market demand across the globe.

Future Opportunities :

Technological advancements in making smart insulin pens are anticipated to surge the market growth.

The market has witnessed significant advancement in recent years, with manufacturers focusing on technological advancement to develop smart insulin pens. Smart insulin pens can be connected to mobile apps to store and track a patient's blood sugar and insulin dosage records. Also, tracking these metrics is useful as they can help determine appropriate dosing and injection times for better diabetes management. Increasing launches of technologically advanced injection pens are driving the diabetes injection pen market demand.

- For instance, In November 2020, Medtronic launched the InPen, the first FDA-cleared smart insulin pen for people who use multiple daily injections (MDI) of insulin. The InPen is integrated with the Guardian Connect continuous glucose monitoring (CGM) system.

Thus, the development of technology in the market is likely to shape the industry, making it more competitive and responsive to evolving patient needs, boosting the diabetes injection pen market opportunities.

Diabetes Injection Pen Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 32,401.53 Million |

| CAGR (2023-2031) | 4.2% |

| By Product Type | Insulin Pen and Insulin Pen Needle |

| By Usage | Reusable Pens and Disposable Pens |

| By End User | Home Care, Hospitals, Diagnostic Centers, and Others |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Diabetes Clinics |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | B. Braun, Novo Nordisk, Eli Lilly and Company, Ypsomed, Biocon, Medtronic BIGFOOT BIOMEDICAL, Emperra GmbH E-Health Technologies, Owen Mumford, Haselmeier, Tonghua Dongbao Pharmaceutical Co., Ltd., and Gan & Lee Pharmaceuticals |

Diabetes Injection Pen Market Segmental Analysis :

By Usage :

The usage is categorized into reusable pens and disposable pens. In 2022, the reusable pens segment accounted for the highest market share in the market, and it is also expected to grow at the highest CAGR over the forecast period.

The adoption of reusable diabetes injection pens is increasing for several reasons, such as cost savings, environmental benefits, convenience, durability, features, and others. They can save patients money in the long run, as they do not need to be replaced as often as disposable pens. They are more environmentally friendly than disposable pens, as they reduce the amount of plastic waste that is produced. Furthermore, they are often more convenient to use than disposable pens, as they can be pre-filled with insulin and carried easily. Thus, segmental trends analysis portrays that the high convenience and environmental benefits of reusable diabetes pens are driving the diabetes injection pen market growth globally.

Based on the Product Type :

The product type is bifurcated into insulin pen and insulin pen needle.

In 2022, the insulin pen needle segment accounted for the highest market in the diabetes injection pen market share, and it is also expected to grow at the highest CAGR over the forecast period. Insulin pen needles are small, thin needles that are used to inject insulin from an insulin pen. They are typically made of stainless steel and have a plastic hub at the end. Insulin pen needles are available in a variety of lengths and gauges, so patients can choose the size that is most comfortable for them. The demand for insulin pen needles is increasing due to the rising prevalence of diabetes around the world.

- For instance, according to the report by Diabetes Atlas Organization In 2021, an estimated 537 million adults worldwide were living with diabetes, and this number is projected to reach 643 million by 2030.

Thus, analysis of trends shows that the adoption of insulin pen needles is increasing due to the increasing demand for convenient and easy-to-use insulin injections across the globe.

By Distribution Channel :

The end-user industry segment is categorized into hospital pharmacies, retail pharmacies, online pharmacies, and diabetes clinics.

In 2022, the retail pharmacies segment accounted for the highest market in the overall diabetes injection pen market share. Retail pharmacies play an important role in helping patients with diabetes manage their condition. By providing convenient, affordable, and accessible access to injection pens, retail pharmacies help patients live healthier and more fulfilling lives. Retail pharmacy stores are easy to access, offer competitive prices on injection pens, and can provide patients with information and support on how to use injection pens safely and effectively. In addition, they are often the first point of contact for patients with diabetes. When patients are diagnosed with diabetes, their doctor will typically refer them to a retail pharmacy to pick up their insulin and diabetes supplies. The high benefits and easy availability of injection pens across retail pharmacy stores are driving the diabetes injection pen market trends worldwide.

Moreover, the online pharmacies segment is expected to hold the highest CAGR over the forecast period. The increasing sale of pharmaceutical products through e-commerce platforms is expected to provide lucrative growth opportunities for online pharmacies over the forecast period.

- For instance, according to the report by the National Investment Promotion and Facilitation Agency in June 2021, the Indian e-pharmacy sales in 2019 accounted for USD 0.5 billion which is expected to reach USD 4.5 billion compounded rate of 44%.

Thus, the analysis of segmental trends depicts that the growing e-pharmacy sales are providing lucrative diabetes injection pen market opportunities over the forecast period.

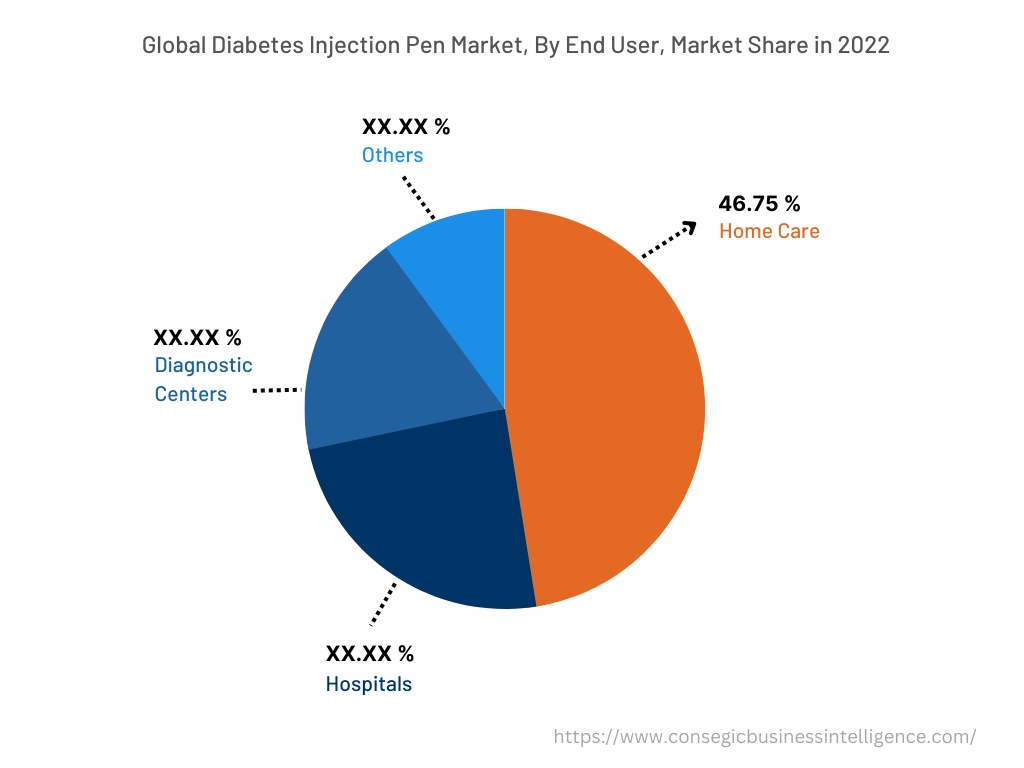

By End-User :

The distribution channel segment is categorized into home care, hospitals, diagnostic centers, and others.

In 2022, the home care segment accounted for the highest market share of 46.75% in the overall diabetes injection pen market. Home care providers play an important role in helping people with diabetes manage their condition. They can provide patients with education and support on how to use injection pens safely and effectively. Additionally, home care providers can monitor patients' blood sugar levels and help them to adjust their insulin regimen as needed. Overall, home care is the largest end-user of injection pens across the globe because it offers several benefits to people with diabetes, including personalized care, convenience, and flexibility. Thus, the segmental trends analysis shows that the surge is due to the high advantages and convenience offered by injection pens in the home care setting are driving the diabetes injection pen market trends globally.

Furthermore, the hospital segment is expected to hold the highest CAGR over the forecast period. Hospitals play an important role in the distribution of diabetes injection pens to their patients which is a key factor driving the segment growth across the globe. Furthermore, they can help hospitals to increase efficiency. This is because they can save nurses time and effort. Nurses can spend less time drawing up and injecting insulin if patients are using injection pens. As the prevalence of diabetes is continuously growing the adoption of diabetes injection pens is expected to increase from the hospital segment over the forecast period.

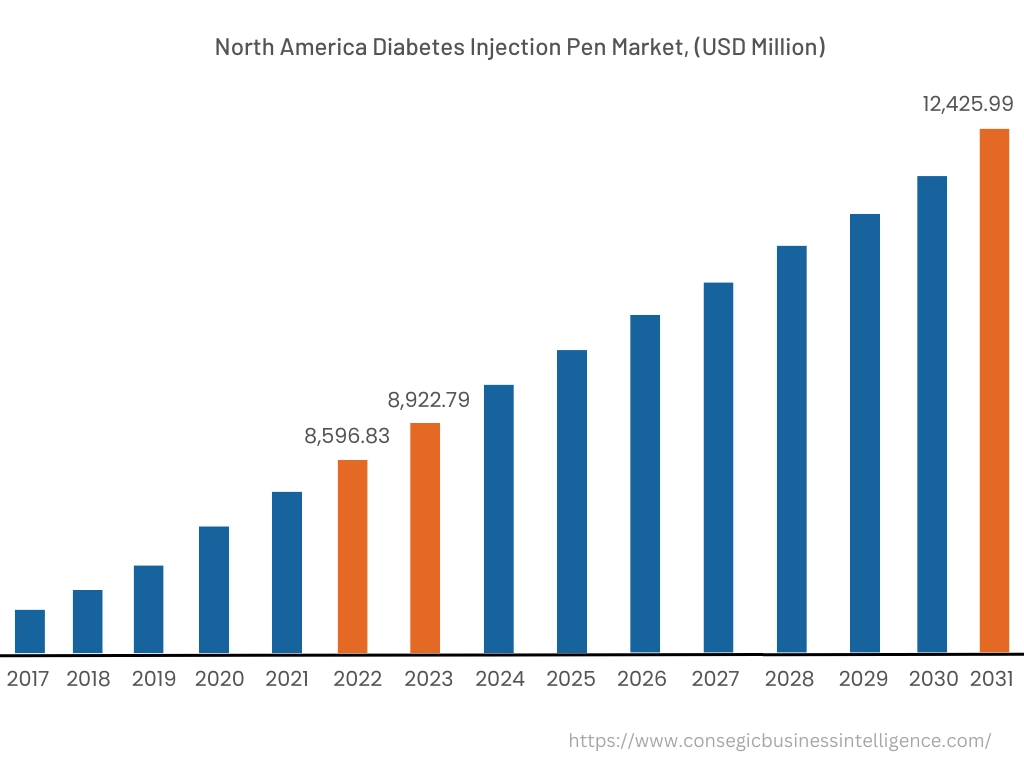

Based on the Region :

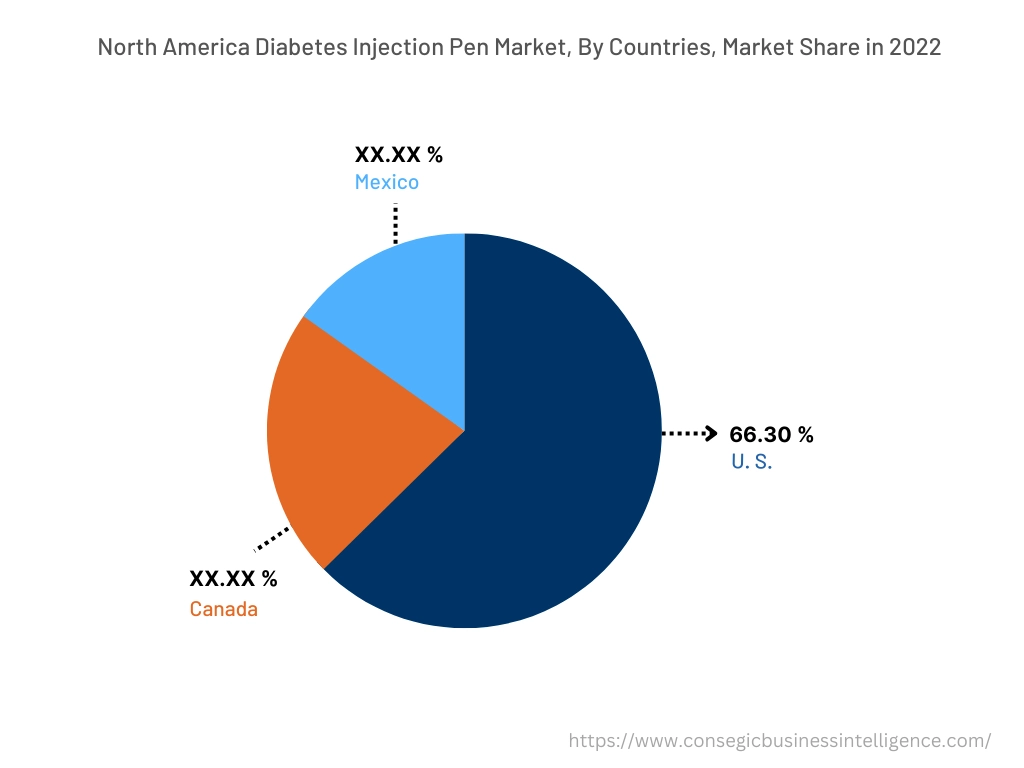

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2022, North America accounted for the highest market share at 38.15% valued at USD 8,596.83 Million in 2022 and USD 8,922.79 Million in 2023, it is expected to reach USD 12,425.99 Million in 2031. In North America, the U.S. accounted for the highest market share of 66.30% during the base year of 2022. As per the diabetes injection pen market analysis, North America has a well-established healthcare infrastructure, with a high number of hospitals, clinics, and pharmacies. This makes it easy for people with diabetes to access injection pens and other essential diabetes supplies. Moreover, the high prevalence of diabetes across the region is driving the diabetes injection pen market expansion across the region.

- For instance, according to the CDC's (Centers for Disease Control) National Diabetes Statistics Report for 2022 cases of diabetes have risen to an estimated 37.3 million in the U.S.

Thus, the high prevalence of diabetes across the region is driving the demand for diabetes injection pens across North America.

Furthermore, Asia Pacific is expected to witness significant growth over the forecast period, growing at a CAGR of 4.7% during 2023-2023. The regional trends analysis shows that there is a growing awareness of diabetes management in the Asia Pacific region. This is leading to an increase in the demand for injection pens. Furthermore, Governments in the Asia Pacific region are increasing their support for diabetes management. This is leading to increased access to injection pens and other essential diabetes supplies, which is expected to create lucrative growth opportunities for the market across the region over the forecast period.

- For instance, in September 2022, Novo Nordisk received marketing approval from China's NMPA for its smart insulin pen, Novopen Six. This is the first smart insulin pen approved in China.

All these above-mentioned factors are collectively boosting the diabetes injection pen market expansion in the Asia Pacific region.

Top Key Players & Market Share Insights:

The global diabetes injection pen market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market stake through mergers, acquisitions, and partnerships. The key players in the diabetes injection pen industry include-

- B. Braun

- Novo Nordisk

- Owen Mumford

- Haselmeier

- Tonghua Dongbao Pharmaceutical Co., Ltd.

- Gan & Lee Pharmaceuticals

- Eli Lilly and Company

- Ypsomed

- Biocon

- Medtronic

- BIGFOOT BIOMEDICAL

- Emperra GmbH E-Health Technologies

Recent Industry Developments :

- In November 2020, Medtronic announced the launch of InPen. The InPen is the first and only FDA-cleared smart insulin pen for people who require multiple daily injections (MDI) of insulin. It's also the first smart insulin pen approved in Europe that's integrated with real-time CGM.

- In August 2020, Biocon announced the launch of Semglee which is an in-vial and pre-filled pen presentation. Semglee is an insulin glargine-yfgn injection that helps control high blood sugar in adults and pediatric patients with type 1 diabetes and adults with type 2 diabetes.

- In August 2020, Emperra GmbH E-Health Technologies a German medical technology company announced the launch of the world's first Bluetooth insulin pen. The ESYSTA BT pen transfers insulin doses directly to the patient's digital blood glucose diary.

Key Questions Answered in the Report

What was the market size of the diabetes injection pen market in 2022? +

In 2022, the market size of diabetes injection pen was USD 22,534.28 million.

What will be the potential market valuation for the diabetes injection pen industry by 2031? +

In 2031, the market size of diabetes injection pen will be expected to reach USD 32,401.53 million.

What are the key factors driving the growth of the diabetes injection pen market? +

Growing preference for injection pen across the globe is fueling market growth at the global level.

What is the dominant segment in the diabetes injection pen market for the end user? +

In 2022, the home care segment accounted for the highest market share of 46.75% in the overall diabetes injection pen market.

Based on current market trends and future predictions, which geographical region is the dominating region in the diabetes injection pen market? +

North America accounted for the highest market share in the overall market.