- Summary

- Table Of Content

- Methodology

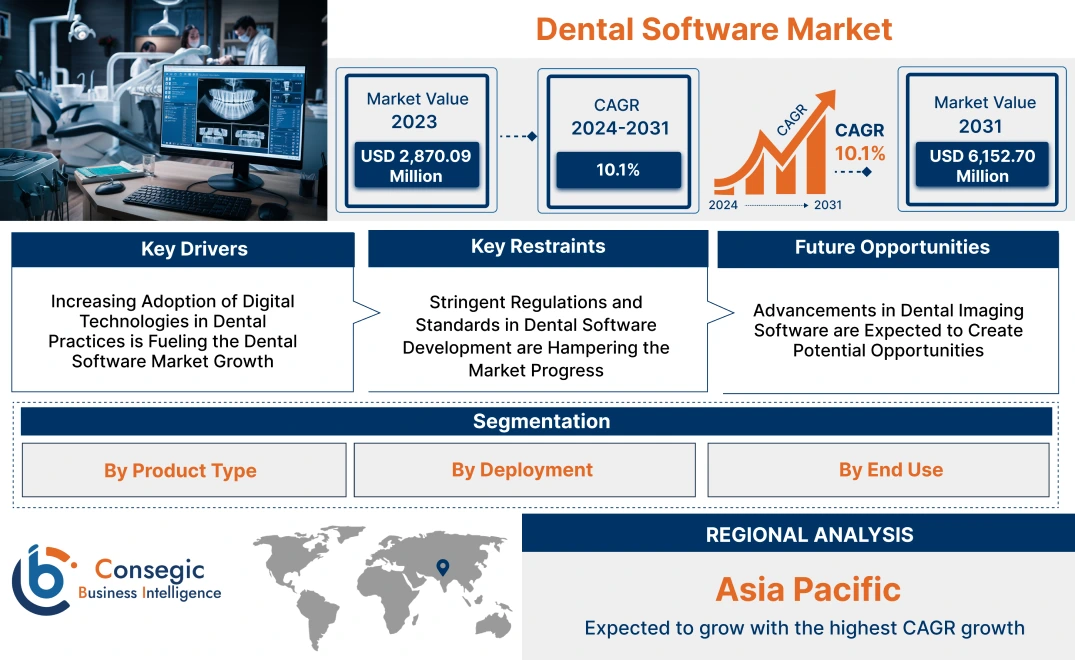

Dental Software Market Size:

Dental Software Market size is growing with a CAGR of 10.1% during the forecast period (2024-2031), and the market is projected to be valued at USD 6,152.70 Million by 2031 from USD 2,870.09 Million in 2023.

Dental Software Market Scope & Overview:

Dental software is a type of specialized software designed to optimize dental practice operations and enhance patient care. These software solutions serve as comprehensive management tools, improving efficiency, and boosting overall practice performance. A key feature of dental software is patient management, which involves maintaining detailed patient records, including personal information, medical history, treatment plans, and financial details. Efficient appointment scheduling is another key feature, enabling the practice to manage patient appointments, send reminders, and follow up effectively. Clinical documentation is streamlined through tools for charting, treatment planning, and maintaining detailed clinical notes. Dental software systems integrate digital imaging capabilities, allowing dentists to capture, store, and analyze dental images directly within the patient's record. Financial management is another critical aspect, with software providing tools for generating invoices, processing payments, and managing insurance claims. By automating these tasks, dental software reduces administrative burdens and improves financial efficiency.

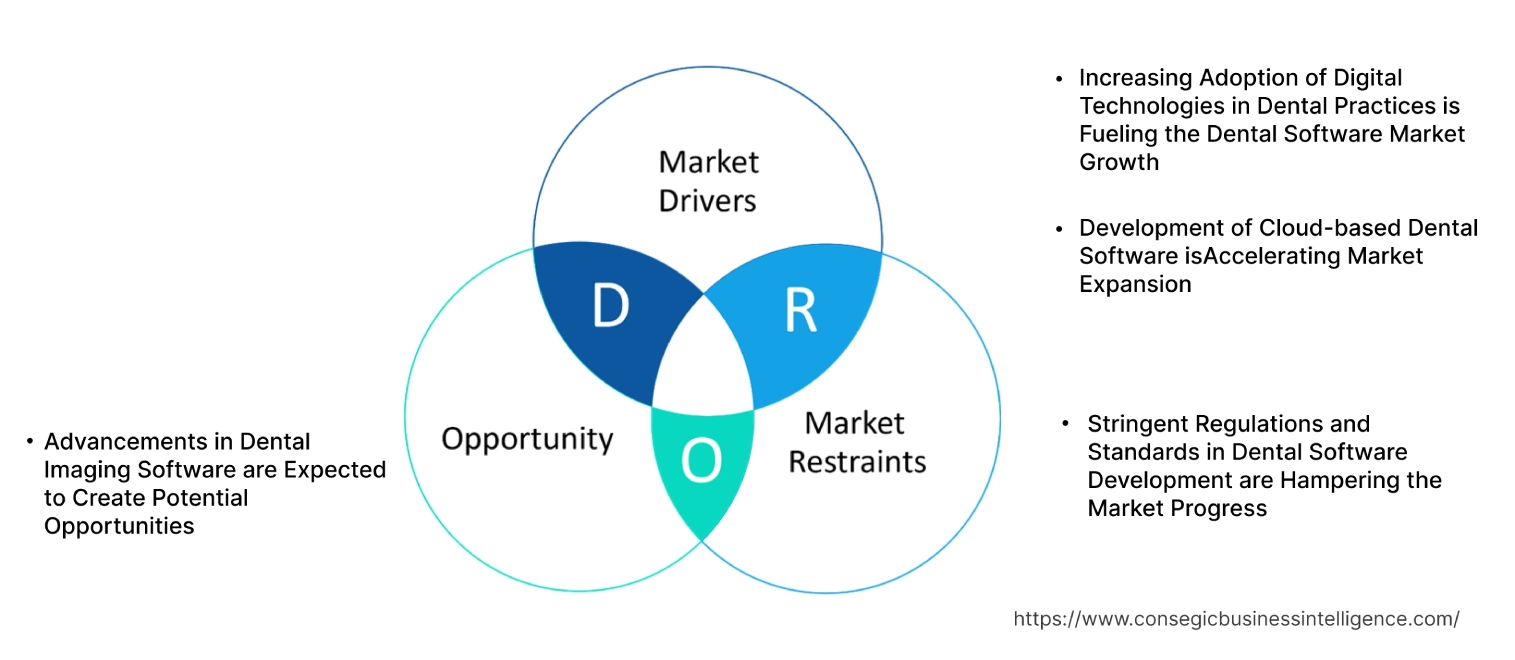

Dental Software Market Dynamics - (DRO) :

Key Drivers:

Increasing Adoption of Digital Technologies in Dental Practices is Fueling the Dental Software Market Growth

The rapid digitalization of dental practices represents a fundamental transformation in modern dentistry, serving as a prominent factor for the dental software market expansion. This digital revolution encompasses multiple interconnected technologies that collectively necessitate sophisticated software solutions. Prominent technologies such as digital imaging technologies including intraoral scanners and X-rays among others require robust software platforms for image acquisition, processing, storage, and analysis.

Additionally, the introduction of artificial intelligence and machine learning algorithms into the software has introduced capabilities like automated caries detection, treatment planning assistance, and predictive analytics making these solutions critical components of modern dental practices. Moreover, the shift towards paperless solutions has fuelled the adoption of practice management solutions that handle everything from electronic health records and scheduling to billing and insurance claims. Furthermore, the adoption of dental designing software is supporting the reduction in time to fabricate dentures.

- For instance, based on the analysis published on NCBI in December 2022, it is stated that 79.7% of participants in a survey reported that digital dentures took less time to fabricate than conventional dentures. 63.5% of participants agreed that digital dentures are advancing the dental industry. This influences the utilization of dental designing software.

Thus, the convergence of technology and dentistry has significantly transformed dental practices driving the adoption of these software, streamlining workflows, improving patient care, and ultimately enhancing overall dental services.

Development of Cloud-based Dental Software is Accelerating Market Expansion

The development of cloud-based dental software solutions represents a transformative shift in the dental software industry. Cloud-based software refers to applications and programs stored and managed remotely accessible via the internet. This approach enables users to access and store data and programs online, eliminating the need for physical servers or local hard drive storage. This boosts the market growth significantly through enhanced accessibility, scalability, and cost-effectiveness. Additionally, cloud-based software eliminates the need for extensive on-premise infrastructure and costly hardware investments, making advanced dental technology solutions more accessible to practices of all sizes.

- For instance, in May 2022, DENTSPLY SIRONA Inc. introduced DS Core, a new open platform designed to streamline the entire digital dentistry workflow. This platform integrates the company's devices, services, and technologies, enabling dentists to collaborate more efficiently with labs, partners, and specialists. Developed in collaboration with Google Cloud, DS Core aims to simplify dental processes and allow dentists to prioritize patient care.

This development has improved data management capabilities, enabling real-time access to patient records, treatment plans, and imaging data from any location with internet connectivity. This is particularly valuable for multi-location practices and dental service organizations. Thus, the dental software market is poised for significant growth due to the development of cloud-based solutions that provide enhanced accessibility, scalability, and cost-effectiveness.

Key Restraints :

Stringent Regulations and Standards in Dental Software Development are Hampering the Market Progress

Developing dental software requires adherence to stringent regulations and standards to ensure the software's safety, quality, and effectiveness. These regulations vary based on the software's specific function, intended use, and the geographic region where it is marketed. Developers must carefully navigate these regulatory landscapes to bring innovative and compliant software solutions to market.

In the United States, the Food and Drug Administration (FDA) regulates medical devices, including dental software. This includes software that controls or influences a medical device, provides diagnostic or therapeutic functions, or processes and analyzes medical data. Dental software that falls under FDA jurisdiction requires pre-market clearance through the 510(k) process, depending on its classification. In the European Union, the Medical Device Regulation (MDR) and the In Vitro Diagnostic Medical Devices Regulation (IVDR) govern the regulation of medical devices, including dental software. These regulations establish rigorous requirements for device design, manufacturing, and clinical evaluation. Dental software that meets the definition of a medical device under the MDR must comply with stringent standards for safety, performance, and cybersecurity.

These regulations impose significant requirements on developers, including rigorous testing, strict data privacy measures, and adherence to complex guidelines further increasing development costs, delaying time-to-market, and limiting innovation. Compliance with these regulations is particularly difficult for smaller companies and startups as companies are hesitant to invest in risky or unconventional approaches due to the high cost of failure. Overall, the dental software market is hampered by stringent regulations and standards in software development.

Future Opportunities :

Advancements in Dental Imaging Software are Expected to Create Potential Opportunities

Dental imaging software is undergoing significant advancements improving the way dental professionals diagnose and treat patients. One of the most notable advancements is the integration of artificial intelligence (AI) into dental imaging software. AI algorithms analyze dental images, identifying potential issues such as cavities, periodontal disease, and even early signs of oral cancer. This automation not only saves time for dental professionals but also increases the accuracy of diagnostic analysis. AI is supporting the development of advanced dental imaging software.

- For instance, in November 2024, Overjet, the company specializing in detail artificial intelligence, introduced IRIS, an innovative AI-powered dental imaging software that leverages cloud technology to enhance X-ray interpretation. By simplifying complex analysis, IRIS empowers dentists to make more accurate diagnoses.

Additionally, 3D imaging technologies, such as cone-beam computed tomography (CBCT), are becoming increasingly accessible. CBCT provides detailed three-dimensional images of the teeth, jawbone, and surrounding structures, enabling dentists to plan complex procedures with greater precision. This technological leap is resulting in improved image quality, enhanced diagnostic accuracy, and streamlined workflows further promoting the trends in the development of innovative dental imaging software.

Dental Software Market Segmental Analysis :

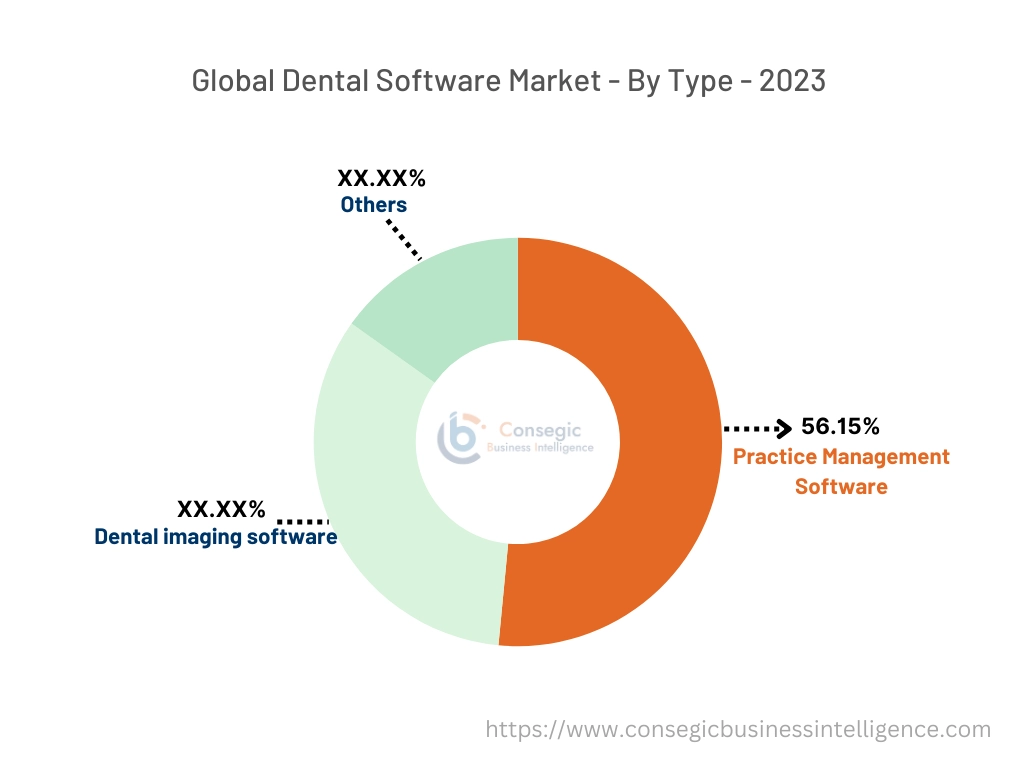

By Product Type:

Based on product type, the market is categorized into practice management software, patient communications software, dental imaging software, and others.

Trends in the Type:

- Increasing use of artificial intelligence and machine learning for clinical decision-making support is the trend positively influencing segment growth.

The practice management software segment accounted for the largest market share of 56.15% in 2023.

- Dental practice management software (DPMS) is a widely used tool that helps dental offices streamline their operations. This software typically includes features such as appointment scheduling, patient record management, billing, and reporting amongst others.

- It serves as a centralized platform allowing the staff to easily access and update patient information, manage appointments, and handle billing, invoicing, and insurance claims. By automating administrative tasks and reducing paperwork, this software helps dental clinics improve their efficiency and focus on providing quality patient care.

- Dental practice management software offers a multitude of benefits for dental practices. By automating routine tasks, this type of software significantly increases efficiency, reducing errors and saving time for dental professionals. Moreover, it enhances the patient's experience through convenient online access to their health records. With real-time insights into practice performance, practice management software allows dental practices to optimize operations and identify areas for improvement.

- Additionally, accurate financial tracking and streamlined billing processes facilitated by DPMS lead to better financial management and improved revenue cycle management.

- Moreover, DPMS helps dental practices ensure compliance with regulatory requirements, mitigating potential risks and legal liabilities. Thus, the multiple functionalities and incorporation of several features provided by dental practice management software are boosting segment growth.

The dental imaging software segment is expected to grow at the fastest CAGR over the forecast period.

- Dental imaging software is a specialized tool designed to efficiently manage, analyze, and interpret dental images such as X-rays, CT scans, and intraoral photographs.

- By seamlessly integrating with digital imaging equipment, this software allows dental professionals to view, edit, and store images with utmost precision.

- It enhances the diagnostic process by offering high-quality images and sometimes includes features for image analysis and interpretation making it crucial for practices that emphasize diagnostic and treatment planning accuracy.

- Additionally, trends and advancements in dental imaging software are expected to create significant opportunities for segment growth in the market.

- For instance, in 2023, Planmeca Oy introduced Planmeca Romexis, the powerful software platform for dentistry, offering an extensive range of tools for dental imaging, diagnosis, and treatment planning for all indications and dental specialties.

- Thus, dental imaging software serves as a crucial tool for modern dental practices. By streamlining image management, enhancing diagnostic capabilities, and facilitating precise treatment planning, this technology improves patient care.

By Deployment:

Based on the deployment the market is categorized into web-based, cloud-based, and on-premises.

Trends in the Deployment:

- The adoption of subscription-based pricing models and software-as-a-service offerings is the trend influencing the deployment of software.

The on-premises segment accounted for the largest market share in 2023.

- On-premises software is installed and run on local servers or computers. It is deployed in a server connected to a local network, allowing other devices on the same network to access it.

- In this model, dental clinics and hospitals purchase and install software on their data centers. Their internal IT teams handle the infrastructure needed to ensure secure and scalable software usage.

- On-premises software offers several advantages. It provides complete control over customization and data security, ensuring that the practice's specific needs are met, and patient information is protected. Additionally, it enables offline access to patient records, ensuring uninterrupted workflow even in the absence of an internet connection.

- By optimizing performance for specific hardware and network infrastructure, on-premises software delivers faster response times and smoother user experience.

- Overall, based on dental software market analysis on-premises solutions continue to be a viable option for many dental practices due to their focus on data security, customization, performance, and long-term cost-effectiveness.

The cloud-based segment is expected to grow at the fastest CAGR over the forecast period.

- A cloud-based system is a broad term for anything that involves the delivery of hosted services via the Internet. Cloud-based software refers to a program or application that's stored, managed, and available through the cloud or internet. Computing with cloud-based software is utilized to access and store programs and data over the internet, rather than on a server at a physical location or on the hard drive of the computer.

- Cloud-based deployment allows dental professionals to access patient records, schedule appointments, and manage their practice from anywhere with an internet connection. Real-time updates ensure seamless collaboration among clinicians.

- Additionally, cloud-based software eliminates the need for expensive hardware and IT infrastructure, making it a cost-effective solution. Its scalability allows practices to adapt to changing needs. Moreover, automatic updates ensure that software presents the latest features and security patches. Hence, the several advantages provided by cloud-based deployment fuel the introduction of advanced cloud-based software.

- For instance, in November 2024, DentiMax , the company providing dental technology solutions, announced the launch of DentiMax Flow. DentiMax Flow is innovative cloud software designed to transform dental practices that offers a comprehensive suite of features, including appointment scheduling, patient record management, billing, reporting, SMS messaging, document storage, and more. DentiMax Flow is a major advancement in its product offerings, combining seamless cloud accessibility with a powerful, user-friendly interface.

- Overall, cloud-based dental software offers numerous opportunities and trends for dental practices enhancing efficiency, and ensuring data security among others.

By End-Use:

Based on end use, the market is categorized into dental clinics, hospitals, and others.

Trends in the End User:

- Growing emphasis on patient engagement and communication tools is a trend supporting the incorporation of innovative features in software.

The dental clinics segment accounted for the largest market share in the year 2023 and is expected to grow at the fastest CAGR over the forecast period.

- Dental clinics serve a crucial role as primary centers for comprehensive diagnostic and treatment centers for dental issues, offering a sophisticated ecosystem of medical expertise and advanced technologies.

- Dental software has evolved the practices in dental clinics, offering a multitude of benefits. By streamlining patient management, clinical documentation, financial operations, and practice management, this software supports clinics to provide efficient and high-quality care.

- Patient records are securely stored and easily accessible, allowing for efficient appointments and timely communication. Clinical documentation is simplified through digital charting and imaging, aiding in accurate diagnosis and treatment planning. Financial management is optimized with automated billing, insurance claims, and inventory tracking. Additionally, practice management features such as staff scheduling and marketing tools enhance operational efficiency and patient acquisition.

- Moreover, the growing awareness of dental care is accelerating dental visits further promoting the demand for the software to manage patient data, improving diagnosis and treatment regimes.

- For instance, based on the analysis provided by the American Dental Association in November 2023, it is stated that an estimated 43% of the U.S. population visited a dentist in 2021.

- Overall, the software influences clinics to deliver exceptional patient care, improve operational efficiency, and make informed business decisions.

Regional Analysis:

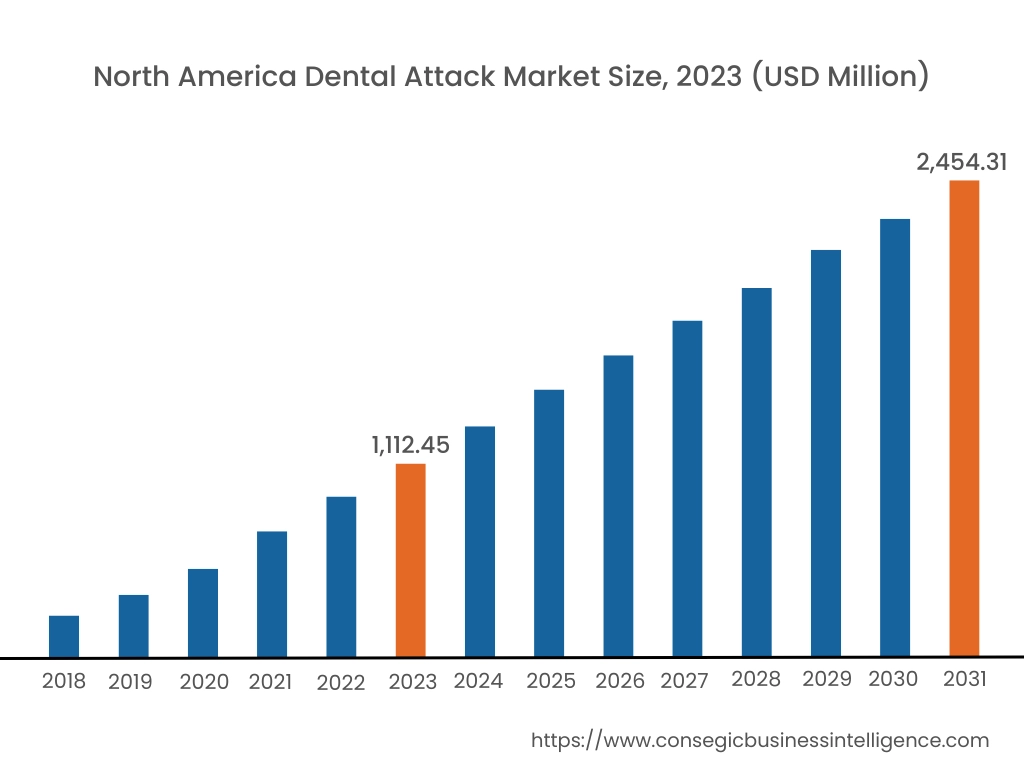

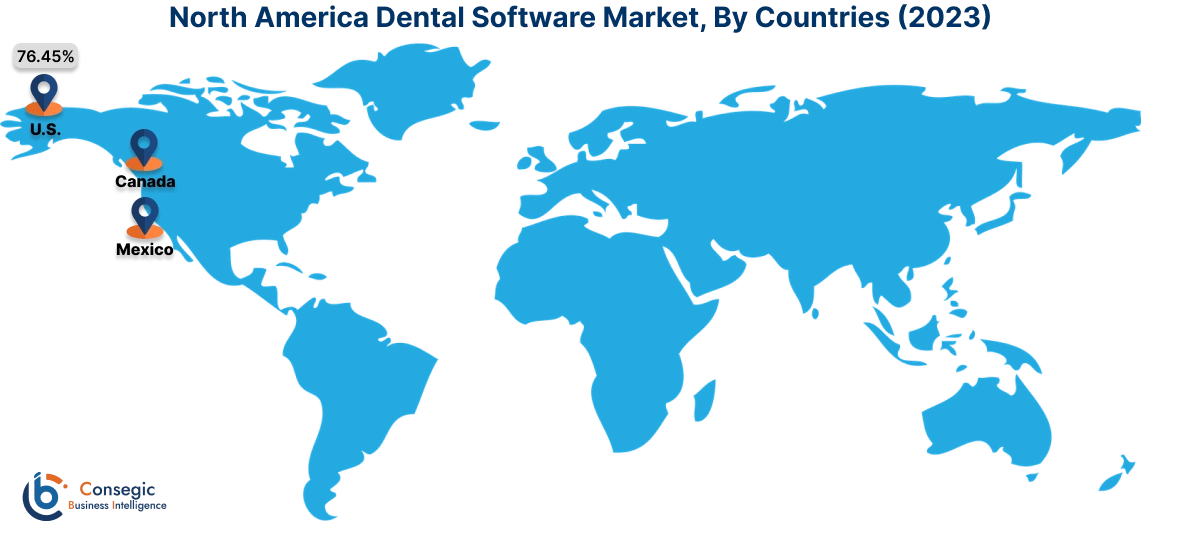

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2023, North America accounted for the highest market share at 38.76% and was valued at USD 1,112.45 Million and is expected to reach USD 2,454.31 Million in 2031. In North America, the U.S. accounted for the highest market share of 76.45% during the base year of 2023. The dental software market is gaining significant rise in North America owing to the confluence of multiple factors such as the rising awareness of oral health resulting in the increased demand for dental services. The increasing adoption of electronic health records (EHR) is driving the demand for software solutions in dental practices that seamlessly integrate with these systems. This integration improves efficiency, reduces errors, and enhances patient care.

- For instance, according to the data published by the Assistant Secretary for Technology Policy, as of 2021, nearly 9 in 10 or 88% of U.S. office-based physicians adopted any electronic health record and nearly 4 in 5 or 78% had adopted a certified EHR. This suggests the growing adoption of digital technologies, including dental software by physicians.

Additionally, North America boasts a robust healthcare infrastructure with advanced diagnostic and treatment facilities, leading to demand for dental software for improved patient data management. Moreover, rising healthcare costs in the region are driving the adoption of dental software as it helps dental practitioners manage operations and administrative costs that improve revenue cycle management. This makes it a suitable solution for cost-effective practices.

Furthermore, significant investments in research and development are fueling the development of advanced software. Region's favorable reimbursement policies coupled with the presence of key industry players further contribute to the dental software market size in NA. Overall, North America remains a dominant force in the global dental software market trend. The region's robust healthcare infrastructure, coupled with increasing awareness of oral health and the widespread adoption of electronic health records, is driving significant demand for advanced dental software solutions.

The Asia-Pacific is experiencing the fastest growth for the market, with a CAGR of 10.7% over the forecast period. The growth is attributed to factors such as the increasing prevalence of dental problems, increasing dental tourism, rising healthcare expenditure, and improvements in healthcare infrastructure. As the healthcare infrastructure develops it increases awareness about the benefits associated with the adoption of digital technologies including dental software. Moreover, growing healthcare investments are creating the demand for efficient data management tools in dental setups further fueling dental software market demand.

Europe boasts a well-developed healthcare infrastructure with advanced diagnostic and treatment facilities, enabling the adoption of dental software in dental setups. Additionally, growing awareness about oral care coupled with advancements in the software is fueling dental software market growth. Many European countries have strong public healthcare systems that provide access to quality healthcare services, including those in dental clinics further propelling the dental software market expansion.

The Middle East and Africa (MEA) region is witnessing a notable surge in the adoption of dental software. The burgeoning healthcare sector in the Middle East is playing a pivotal role in driving demand. Many countries in the MEA region are investing in developing their healthcare infrastructure. This includes building hospitals, and dental clinics, and improving access to diagnostic tools, which are essential for detecting dental issues. The combined impact of these factors is creating a favorable environment for the trajectory of the dental software market share in the MEA region.

Latin America is an emerging region in the dental software market. The combination of growing awareness, technological advancements, and rising disposable income is driving a significant trend in the dental software market in Latin America. These factors collectively present a promising factor for dental healthcare providers, to adopt software in dental practices.

Top Key Players & Market Share Insights:

The Dental Software market is highly competitive with major players providing services to the national and international markets. Key players are adopting several strategies in product innovation to hold a strong position in the global dental software market. Key players in the dental software industry include-

- Carestream Dental LLC. (U.S.)

- Dentally (UK)

- Overjet (U.S.)

- DentiMax (U.S.)

- Henry Schein, Inc (U.S.)

- CleverDev Software (U.S.)

- Planmeca Oy (Finland)

- Datacon Dental Systems (U.S.)

- NXGN Management, LLC. (U.S.)

- CareStack (U.S.)

Recent Industry Developments :

Product Launches:

- For instance, in November 2024, Overjet, the company specializing in detail artificial intelligence, introduced IRIS, an innovative AI-powered dental imaging software that leverages cloud technology to enhance X-ray interpretation. By simplifying complex analysis, IRIS empowers dentists to make more accurate diagnoses.

- In November 2024, DentiMax, the company providing dental technology solutions, announced the launch of DentiMax Flow. DentiMax Flow is innovative cloud software designed to transform dental practices that offers a comprehensive suite of features, including appointment scheduling, patient record management, billing, reporting, SMS messaging, document storage, and more. DentiMax Flow is a major advancement in its product offerings, combining seamless cloud accessibility with a powerful, user-friendly interface.

- In 2023, Planmeca Oy introduced Planmeca Romexis, the powerful software platform for dentistry, offering an extensive range of tools for dental imaging, diagnosis, and treatment planning for all indications and dental specialties.

- In May 2022, DENTSPLY SIRONA Inc. introduced DS Core, a new open platform designed to streamline the entire digital dentistry workflow. This platform integrates the company's devices, services, and technologies, enabling dentists to collaborate more efficiently with labs, partners, and specialists. Developed in collaboration with Google Cloud, DS Core aims to simplify dental processes and allow dentists to prioritize patient care.

Mergers and Acquisitions:

- In January 2023, Planet DDS, the provider of cloud-based dental software, announced the acquisition of Cloud 9 Software from Accel-KKR, an investment firm focused on software and tech-enabled businesses. The acquisition of Cloud 9 allows Planet DDS to continue its strong force as a multi-specialty dental software platform while adding the strength and experience of Cloud 9 in orthodontic and pediatric practice management software.

- In March 2020, Align Technology, Inc. announced an acquisition of privately held Exocad Global Holdings GmbH for approximately USD 406.68 million in cash. Exocad is a key player in the dental CAD/CAM software market and offers fully integrated workflows to dental labs and dental practices via a broad customer base of partners, and resellers.

Dental Software Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 6,152.70 Million |

| CAGR (2024-2031) | 10.1% |

| By Type |

|

| By Deployment |

|

| By End-Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Dental Software market? +

In 2023, the Dental Software market is USD 2,870.09 Million.

Which is the fastest-growing region in the Dental Software market? +

Asia Pacific is the fastest-growing region in the Dental Software market.

What specific segmentation details are covered in the Dental Software market? +

Type, Deployment, and End User segmentation details are covered in the Dental Software market

Who are the major players in the Dental Software market? +

Carestream Dental LLC. (U.S.), Dentally (UK), and CleverDev Software (U.S.) are some of the major players in the market.