- Summary

- Table Of Content

- Methodology

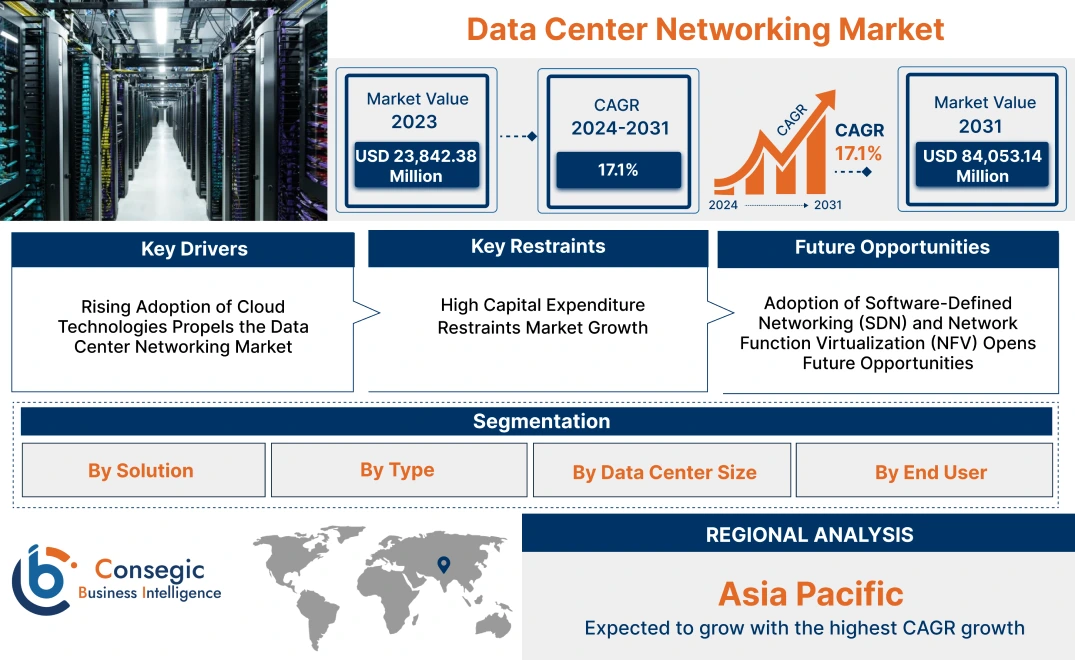

Data Center Networking Market Size:

Data Center Networking Market size is estimated to reach over USD 84,053.14 Million by 2031 from a value of USD 23,842.38 Million in 2023 and is projected to grow by USD 27,484.54 Million in 2024, growing at a CAGR of 17.1% from 2024 to 2031.

Data Center Networking Market Scope & Overview:

Data center networking is the combination of multiple networking components including switching, routing, load balancing, and analytics, to optimize, store, process, and transfer data. This allows smooth transmission and flow of data between servers and storage systems. The advantages include high-speed transfers, connectivity, enhanced operational efficiency, and scalability. The applications range from cloud computing, and IT to big data analytics and machine learning. The primary end-use industries include IT and telecom, healthcare, government, and financial services.

Data Center Networking Market Insights:

Key Drivers:

Rising Adoption of Cloud Technologies Propels the Data Center Networking Market

Cloud technologies ensure scalability in the organization's operations. This makes the adoption of efficient, reliable, and secure data center networks, extremely important due to the data traffic which is exponentially increasing. Moreover, in order to enhance the networking capabilities, which is uninterrupted enterprises are shifting more towards cloud services.

- In August 2021, the Cloud One regional data center was launched by Trend Micro. This ensures data security by protecting servers, resources, and applications in the cloud.

Therefore, the uninterrupted connection and the security provided drive the data center networking market growth.

Key Restraints :

High Capital Expenditure Restraints Market Growth

The cost for the development and maintenance of data center infrastructure is extremely hefty, especially if it involves components that are high-end in nature, such as high-performance hardware and software licenses.

Additionally, smaller enterprises cannot afford to invest in this infrastructure, due to financial restrictions, further limiting the adoption of data center networking. As per the market trends analysis, the high cost involving the data center infrastructure restricts the data center networking market demand.

Future Opportunities :

Adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) Opens Future Opportunities

The integration of technologies such as Software-Defined Networking (SDN) and Network Function Virtualization (NFV) in data center networks provide flexible, programmable, and scalable networking solutions, reducing dependency on costly hardware and improving overall efficiency. As businesses seek to reduce operational costs while enhancing network performance, SDN and NFV present attractive alternatives to traditional networking solutions. These advancements allow data centers to be more agile, optimizing network resources and reducing hardware investments.

- In July 2021, Samsung announced the expansion of its Software-Defined Networking (SDN) solutions portfolio. This includes new offerings and capabilities, ensuring flexibility and powering private 5G networks.

Therefore, the analysis of the market shows that the flexibility, efficiency, and reduced dependency on expensive hardware boosts the data center networking market opportunities.

Data Center Networking Market Segmental Analysis :

By Solution:

Based on the solution, the market is trifurcated into networking hardware (switches, routers, cables, and others), networking software (network management software, network security software, and network virtualization software), and services ( integration services, consulting services, and support services).

Trends in the Solution:

- In order to ensure the proper integration between on-premises and cloud-based networks, services are extremely critical, especially as the data centers are shifting to hybrid.

- Operations such as network issues, minimization of downtime, and ensuring operational efficiency can be easily addressed with predictive maintenance solutions driven by AI.

Networking Hardware segment accounted for the largest revenue share in 2023.

- The fundamental components of data centers for data transmission like switches, routers, and cables are included in the networking hardware.

- It is of great significance for large-scale operations as they ensure the seamless integration between devices and services.

- There is an increasing shift towards this hardware with the growing adoption of advanced technologies like 5G technologies and cloud computing, which require high-speed data transfer and reduced latency.

- For instance, the upgrade to CloudEngine series called CloudEngine 16800-X by Huawei, includes features such as high-density 400GE and intelligent scheduling algorithms. It meets the cross-region computing needs and large-scale data centers.

- In conclusion, the segmental analysis shows that the advancements in technology leading to the increasing need for seamless and fast-paced data transfer drive the data center networking market demand.

Networking Software is anticipated to register the fastest CAGR during the forecast period.

- Components essential for the optimization and security of data center operations such as network management, security, and virtualization solutions are included in networking software.

- Automation of network functions, enhancement of security protocols, and real-time monitoring of the network are ensured using this software.

- Increased flexibility and scalability are ensured with the increasing adoption of software-defined networking (SDN) in data centers.

- For instance, automation of design, deployment, and operation of data center networks is done with Juniper's Apstra, across multiple vendors and topologies. It ensures the optimization of performance with advanced analytics and provides predictive insights.

- In conclusion, the automation and the real-time monitoring feature places the networking software sector as the fastest growing in the market.

By Type:

Based on type, the market is bifurcated into physical network infrastructure (Physical Switches, Physical Routers, and Cables and Connectors) and virtual network infrastructure (Virtual Switches, Network Function Virtualization (NFV), and Software-Defined Networking (SDN)).

Trends in the Type:

- In hyperscale data centers, bandwidth capacity and reduction in latency are achieved with physical network infrastructure innovations, like optical transceivers

- AI and machine learning are significantly improving the efficiency of network management by automating the process.

The physical network infrastructure segment accounted for the largest revenue of the total data center networking market share in 2023.

- Components like physical switches, routers, and cables are included in the physical infrastructure, ensuring data transmission across networks at a high speed.

- Industries like finance and healthcare, prioritize this infrastructure as it provides security, performance, and low latency.

- With the adoption of technologies like edge computing and AI-based applications, the fast-paced transmission of data becomes of great significance, increasing the need for physical infrastructure.

- According to Dell'Oro Group's new analyst report, there was significant growth in the physical infrastructure during Q1 2023, with sales reaching $6.1 billion during this time period. The improvement in the supply chain during Q4 2023, is reflected in Q1 2023, enabling the company to work on backlog of orders.

- Hence, the security and high performance provided, assists physical network infrastructure to enhance the data center networking market growth.

The virtual network infrastructure segment is anticipated to register the fastest CAGR during the forecast period.

- Technologies that allow data centers to abstract network functions from hardware such as virtual switches, SDN, and network function virtualization (NFV) are included in the Virtual network infrastructure.

- With the help of virtualizing network functions, these technologies allow flexibility, scalability, and utilization of resources in the data centers.

- There is also a growth in the adoption of cloud-based technologies and remote work environments, allowing the data centers to adapt to varying workloads, as well as optimize their performance.

- For instance, by launching a new Virtual Data Center (VDC) node in Virginia, Telefónica Tech has expanded its offerings to the U.S. market. The VDC provides security, flexibility, and disaster recovery services, as it is built on VMWare technology.

- In conclusion, the growing need for flexibility and scalability drives the data center networking market trends.

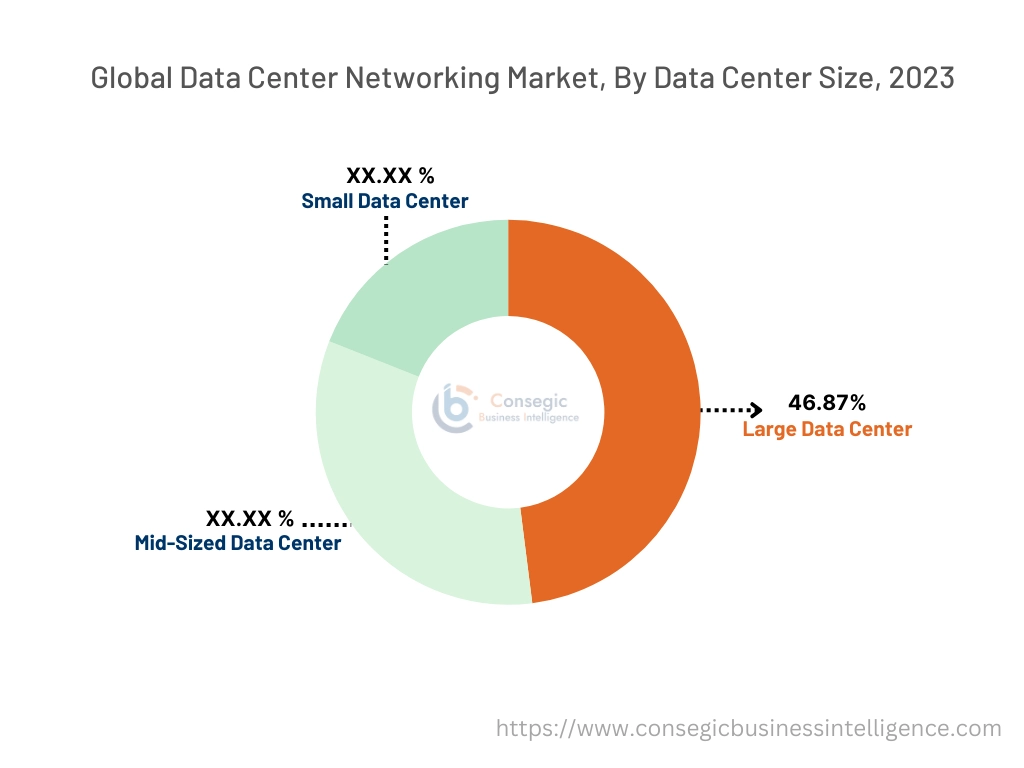

By Data Center Size:

Based on application the market is segmented into Oncology, Immunology, Cardiovascular Diseases, Infectious Diseases, Neurology, Ophthalmology, Rare Diseases, and others.

Trends in the Data Center Size:

- In order to ensure scalability, and reconfiguration based on the data requirements, energy efficiency, and performance, medium-sized data centers are continuously adopting AI-enables platforms and modular designs.

The large data centers segment accounted for the largest revenue share of 46.87% in 2023.

- Industries requiring extensive processing power and storage capabilities like the finance industry, healthcare industry, and entertainment industry can utilize large data centers in order to handle the massive amount of data.

- The continuous adoption of technologies like AI, machine learning, and big data contributes to the need for large data centers.

- In February 2022, a data center platform was launched on the North Virginia Campus by Corscale. The first project Gainesville Crossing is a 300-megawatt, with its development done in Prince William County.

- In conclusion, the growing requirement to handle massive amounts of data by big companies drives the market.

Small Data Centers are anticipated to register the fastest CAGR during the forecast period.

- Localized data processing is provided closer to the user by small data centers in order to ensure quick response time.

- Industries which on technologies like IoT devices, remote monitoring, and real-time data analysis find these centers extremely useless, as they require a faster response.

- They reduce the latency and enhance the performance of data-driven operations.

- In conclusion, the rising demand for edge computing and IoT applications is propelling the expansion of small data centers at an unprecedented rate.

- Hence, the rising need for quick responses and reduced latency drives the data center networking market trends.

By End User:

Based on end users, the market is segmented into cloud service providers, telecommunication providers, enterprise data centers, and managed service providers.

Trends in the End User:

- In order to allocate resources that are dedicated to specific use cases, advanced network slicing technologies to enhance the 5G services are deployed in the data centers.

- AI-based predictive analytics like Cisco's DNA Center, improves the overall efficiency of the operations, by automating a few of the processes.

The cloud service providers segment accounted for the largest revenue of the overall data center networking market share in 2023.

- Cloud service providers like AWS, Microsoft Azure, and Google Cloud are the leaders in modern digital infrastructure. They offer scalable and flexible data storage and processing services.

- These companies support a wide range of applications, which vary from business continuity and distribution to AI and machine learning workloads.

- The growth in dependency on cloud-based solutions, which is forced by an increase in remote work and digital transformation, is the major key driver for significant demand for cloud service providers.

- Cloud service providers are important for managing large-scale data operations, particularly as enterprises shift to hybrid cloud models.

- In September 2023, the Shared Data Center as a Service was launched by HCLTech, accelerating the enterprise cloud migration. It includes shared data centers, dedicated data centers, and regulated workloads.

- In conclusion, the cloud service provider segment continues to boom due to its ability to offer scalable, cost-effective solutions that support modern digital workloads.

The managed service providers segment is anticipated to register the fastest CAGR during the forecast period.

- Managed service providers (MSPs) offer third-party outsourced network and data center management services. This helps businesses work on their company's core operations, while MSPs can assist them with their IT infrastructure.

- These providers are quite in demand from small and medium enterprises that lack the resources needed to manage and handle complete network infrastructure on company premises.

- One major reason why MSPs are so popular now is the growing complexity of IT environments along with the need for cost-effective and flexible solutions.

- MSPs offer complete support, which includes network management, security, and performance optimizations, which makes them a vital figure in the business chain across industries.

- For instance, Data Center Management Services by Microland optimizes the on-premises environments which include private clouds and virtualized infrastructure. Their security solutions include Managed Hosting and Virtualization, providing asset management, security, and capacity planning.

- In conclusion, the rising complexity of IT infrastructures and the need for specialized expertise is expected to boost the data center networking market opportunities.

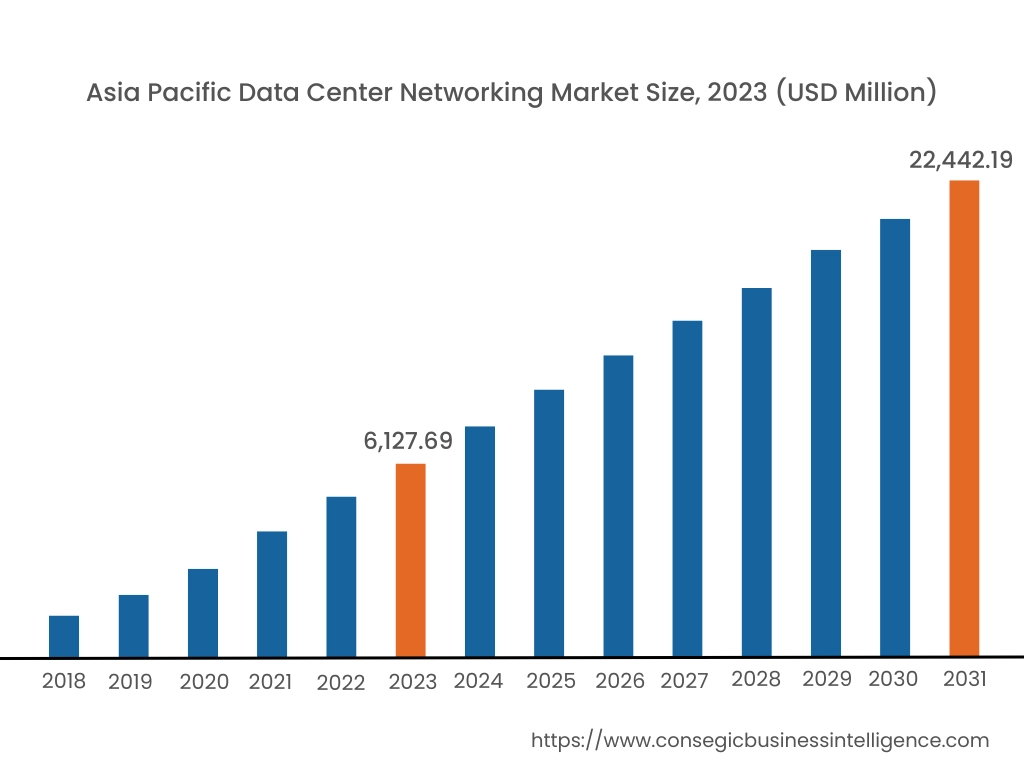

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

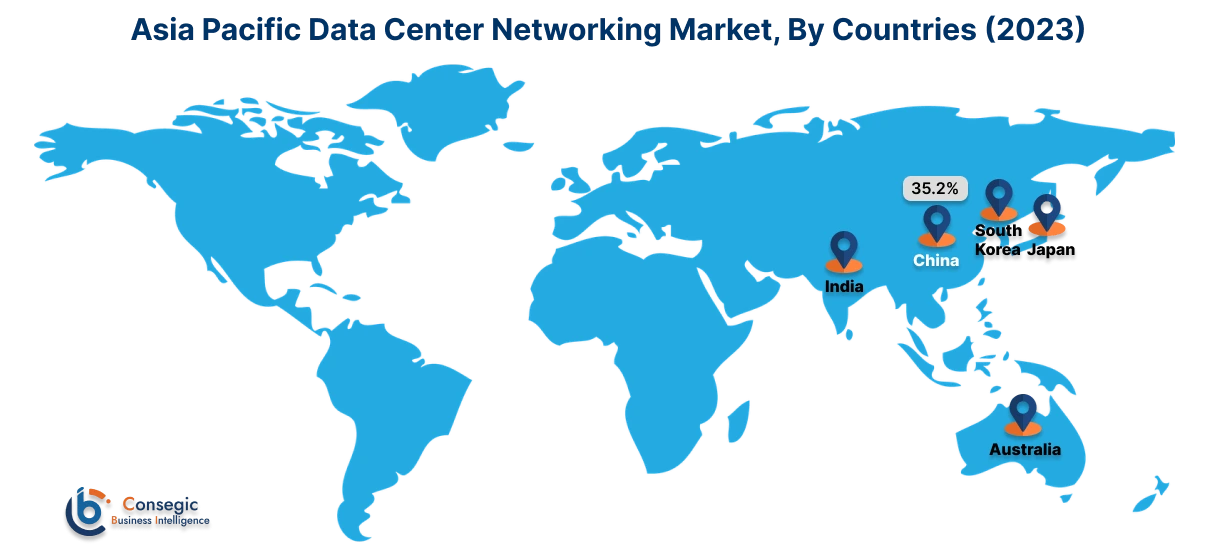

Asia Pacific region was valued at USD 6,127.69 Million in 2023. Moreover, it is projected to grow by USD 7,086.64 Million in 2024 and reach over USD 22,442.19 Million by 2031. Out of this, China accounted for the maximum revenue stake of 35.2%. As per the data center networking market analysis, due to the rapid digitalization and adoption of 5G by organizations, especially in countries like China, India, and Japan. The 5G technologies require advanced data centers in order to handle the data traffic and reduce latency.

- In May 2021, a new retail data center was launched in China, due to growth and sales opportunities. This is due to the government-imposed cybersecurity laws regarding data protection, handling, and storage.

North America is estimated to reach over USD 28,662.12 Million by 2031 from a value of USD 8,064.69 Million in 2023 and is projected to grow by USD 9,302.94 Million in 2024. The primary driver is strong technological infrastructure, and high data demands across various industries in this region, like banking, healthcare, and retail. The shift towards cloud computing and the development of data centers at a massive scale further accelerates the data center networking market expansion.

- In July 2023, the American companies Iron Mountain Data Centers and Ciena Collaborated to launch the Metro Wave network service. This offers up to 100G using ultra-low latency, as well as interconnects data centers.

The move towards sustainability and data centers with energy-efficiency protocols is a primary driving factor for the market in Europe. The data center networking market analysis shows that in the Middle East & Africa, the increasing focus on digital transformation and government investments in IT is driving the market. The rising demand for cloud-based services and digital platforms in countries like Brazil and Mexico propels the data center networking market expansion in Latin America.

Top Key Players & Market Share Insights:

The data center networking market is highly competitive with major players providing data center networking services and products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global data center networking market. Key players in the data center networking industry include -

- Cisco Systems, Inc (USA)

- Arista Networks, Inc. (USA)

- Hewlett Packard Enterprise Development LP (USA)

- Dell Technologies Inc. (USA)

- Huawei Technologies Co., Ltd. (China)

- Juniper Networks, Inc. (USA)

- NVIDIA Corporation (USA)

- Extreme Networks, Inc. (USA)

- Mellanox Technologies (USA)

- Fortinet, Inc. (USA)

Recent Industry Developments :

Product Launches:

- In September 2024, an AI-driven data center automation platform was launched by Nokia. This ensures the overall human error reduction and reduced network disruption.

- In January 2024, Juniper announces the release of new MIST AI updates. Two QFX switches and a PTX router were introduced for AI-based data center servers.

Business Expansion:

- In March 2023, OVHcloud expanded its data center portfolio to the Indian marketplace, by launching its first data center here.

Mergers & Acquisitions:

- In July 2024, PS Networks was acquired by Circet to expand its portfolio with the data center market, providing various services and maintaining efficiency and reliability.

- In April 2024, Southwest Data Products, Inc. was acquired by Nucor Corporation, to enhance the cloud and colocation data center operators.

- In March 2024, Verna, a green data center platform was acquired by Ardian, in order the expand the investing and managing assets knowledge.

Data Center Networking Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 84,053.14 Million |

| CAGR (2024-2031) | 17.1% |

| By Solution |

|

| By Type |

|

| By Data Center Size |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Data Center Networking Market? +

Data Center Networking Market size is estimated to reach over USD 84,053.14 Million by 2031 from a value of USD 23,842.38 Million in 2023 and is projected to grow by USD 27,484.54 Million in 2024, growing at a CAGR of 17.1% from 2024 to 2031.

What specific segmentation details are covered in the data center networking market report? +

The data center networking market report includes specific segmentation details for a solution, type, data center size, end user, and region.

Which is the fastest segment anticipated to impact the market growth? +

In the Data Center Size segment, small data centers are the fastest-growing segment during the forecast period due to the high-speed data transmission and scalability.

Who are the major players in the data center networking market? +

The key participants in the data center networking market are Cisco Systems (USA), Arista Networks (USA), Juniper Networks (USA), Hewlett Packard Enterprise (HPE) (USA), Dell Technologies (USA), Huawei Technologies (China), NVIDIA (USA), Extreme Networks (USA), Mellanox Technologies (USA), Fortinet (USA)