- Summary

- Table Of Content

- Methodology

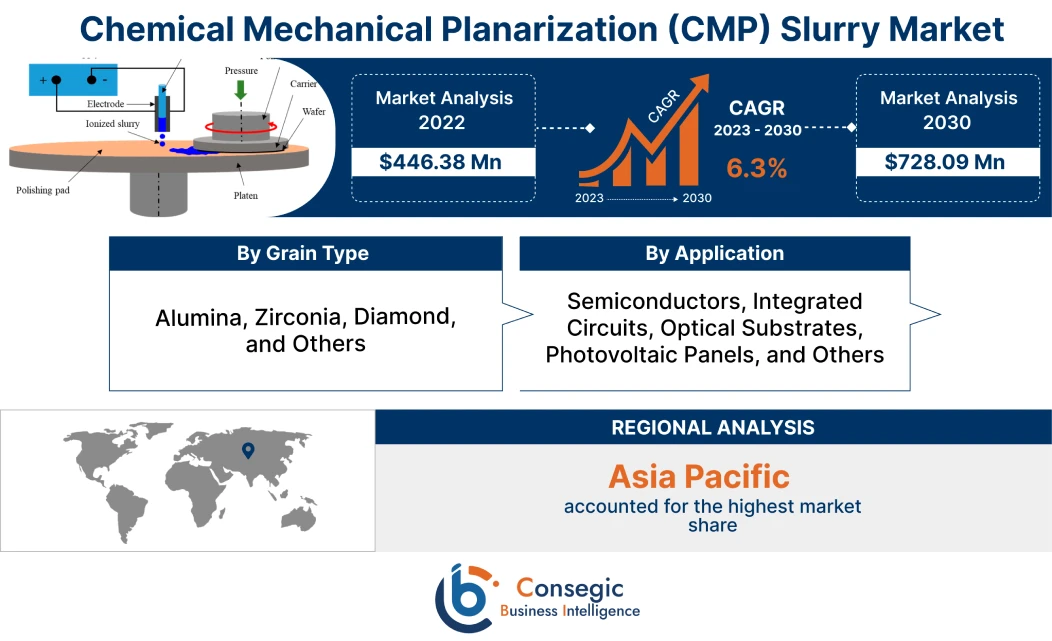

Chemical Mechanical Planarization (CMP) Slurry Market Size :

Consegic Business Intelligence analyzes that the Chemical Mechanical Planarization (CMP) Slurry Market size is estimated to reach over USD 854.3 Million by 2032 from a value of USD 525.62 Million in 2024 and is projected to grow by USD 549.15 Million in 2025, growing at a CAGR of 6.3 % from 2025 to 2032.

Chemical Mechanical Planarization (CMP) Slurry Market Scope & Overview:

Chemical mechanical planarization (CMP) slurries refer to a process consisting of a nano-sized abrasive powder diffused in a chemically reactive solution. The chemical etching processing in chemical mechanical planarization (CMP) slurry softens the material. In addition, the chemical mechanical planarization (CMP) slurries lead to efficient mechanical abrasion. This process eliminates the material, thereby flattening the topographic features and ensuring the surface planar. The major grain types of chemical mechanical planarization (CMP) slurries include alumina, zirconia, diamond, and others. These grain types ensure superior performance results for the chemical mechanical planarization (CMP) slurries. Thus, chemical mechanical planarization (CMP) slurries are ideal for various applications, including semiconductors, integrated circuits, optical substrates, photovoltaic panels, and others.

Chemical Mechanical Planarization (CMP) Slurry Market Insights :

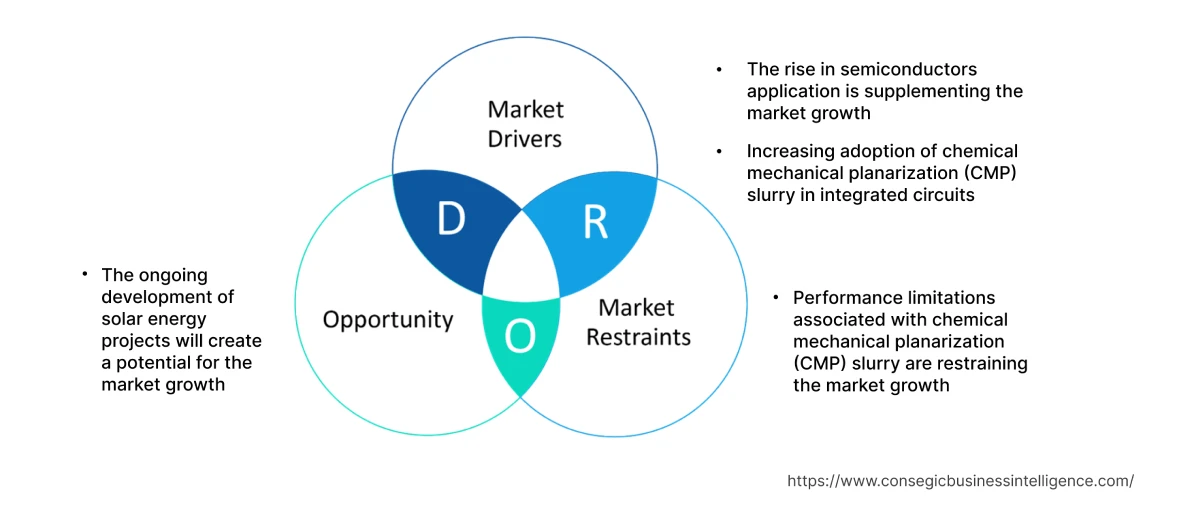

Key Drivers :

The rise in semiconductors application is supplementing the market growth

Chemical mechanical planarization (CMP) slurry is employed in the manufacturing process of semiconductors to create a smoother surface. The key trends such as public-private partnerships, incentive plans, attracting foreign players to set up manufacturing plants in their countries, tax rebates, and others are boosting the production growth of semiconductors. For instance, in 2022, the European Commission adopted the European Chips Act as part of the EU's effective set of measures to achieve the security of supply, resilience, and Europe's technological leadership in the semiconductor industry. The European Chips Act is expected to bring EURO 43 billion (USS 49.2 billion) of public and private funding for the European semiconductor industry by 2030. As a result of new government initiatives, the production activities related to semiconductors are increasing. Thus, the increasing application of semiconductors is fuelling the demand for chemical mechanical planarization (CMP) slurry to efficiently eliminate excess materials. This, in turn, is driving the growth of the market.

Increasing adoption of chemical mechanical planarization (CMP) slurry in integrated circuits

Chemical mechanical planarization (CMP) slurry is frequently deployed in integrated circuits to achieve the desired planarity of the substrate and the deposited layers. The development of new manufacturing facilities, the technological advancements associated with electronics & assembly, and others are the prominent aspects driving integrated circuits production. For instance, according to the recent data published by the Japan Electronics and Information Technology Industries Association (JEITA), in 2020, global electronics production, including integrated circuits was USD 30,337 hundred million, and in 2021, it was USD 33,602 hundred million, year-on-year growth rate of 10.8%. Therefore, the rise in the production of integrated circuits is driving the demand for chemical mechanical planarization (CMP) slurry to flatten uneven areas. This prime factor is amplifying market growth.

Key Restraints :

Performance limitations associated with chemical mechanical planarization (CMP) slurry are restraining the market growth

The chemical mechanical planarization (CMP) slurry undergoes rigorous physical conditions. As a result, chemical mechanical planarization (CMP) slurry can produce significant contaminants on the wafer surface as compared with the other semiconductor manufacturing processing steps. For illustration, chemical mechanical planarization (CMP) slurry can produce several defects, including corrosion, scratches, erosion, and dishing. Thus, the above performance limitations associated with the chemical mechanical planarization (CMP) slurry is posing a major bottleneck for the market growth at the global level during the projected forecast period.

Future Opportunities :

The ongoing development of solar energy projects will create a potential for the market growth

Chemical mechanical planarization (CMP) slurry is an ideal choice for photovoltaic panels as it is deployed in rotary buffing equipment to eliminate small volumes of surface material from crystalline workpieces. The shifting focus on the production of electricity through renewable energy is a prominent aspect spurring the development of new solar projects. For instance, as of July 2023, various solar energy projects are under the construction phase, including USD 100 million 119-MW solar park in Saudi Arabia (project completion year 2025), USD 1,000 million 1,00 MW Smoky Valley Solar Project in the United States (project completion year 2025), and others. Henceforth, the development of new solar power projects at the global level is accelerating the demand for photovoltaic panels. This will drive the demand for chemical mechanical planarization (CMP) slurry as it is utilized in the manufacturing of photovoltaic panels, thereby creating a lucrative opportunity for market growth in the forecast years.

Chemical Mechanical Planarization (CMP) Slurry Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 854.3 Million |

| CAGR (2025-2032) | 6.3% |

| By Grain Type | Alumina, Zirconia, Diamond, and Others |

| By Application | Semiconductors, Integrated Circuits, Optical Substrates, Photovoltaic Panels, and Others |

| By Region | Asia-Pacific, Europe, North America, Latin America, Middle East & Africa |

| Key Players | Hitachi, Ltd., Fujifilm Corporation, Cabot Microelectronics Corporation, Fujimi Corporation, Merck KGaA, DuPont, Saint-Gobain Ceramics & Plastics, Inc., BASF SE, Showa Denko Materials Co. Ltd, and AGC Inc. |

Chemical Mechanical Planarization (CMP) Slurry Market Segmental Analysis :

By Grain Type :

The grain type segment is categorized into alumina, zirconia, diamond, and others. In 2024, the alumina segment accounted for the highest market share of 38.95% in the overall chemical mechanical planarization (CMP) slurry market. Alumina is a significantly hard-wearing ceramic with superior engineering capabilities and ready-material availability. Alumina forms the basis of a wide range of chemical mechanical planarization (CMP) slurry products. This makes chemical mechanical planarization (CMP) slurry an ideal solution for applications such as semiconductors, integrated circuits, and others. For instance, in November 2021, Texas Instruments, a manufacturer of semiconductors, announced plans to build a new 300-mm semiconductor wafer fabrication facility in Texas, United States. The development work on the Texas Instruments semiconductor facility commenced by the end of 2022 and be finished by the beginning of 2025. Hence, the growth of the production of the above products is spurring the demand for alumina to ensure superior strength. This, in turn, is benefiting the segmental growth.

However, the zirconia segment is projected to be the fastest-growing segment during the forecast period. This is due to the increasing research and development activities for the adoption of zirconia in chemical mechanical planarization (CMP) slurry at the global level, which is fostering segmental growth.

By Application :

The application segment is categorized into semiconductors, integrated circuits, optical substrates, photovoltaic panels, and others. In 2024, the semiconductors segment accounted for the highest market share in the chemical mechanical planarization (CMP) slurry market. The chemical mechanical planarization (CMP) slurry is equipped with crucial performance features such as low defectivity and a high removal rate. These performance characteristics ensure high removal rates, low defectivity, and specific selectivity for multiple films. As a result, chemical mechanical planarization (CMP) slurry is an ideal solution for semiconductors. For instance, in July 2022, STMicroelectronics and GlobalFoundries, prominent manufacturers of semiconductors, announced their plan for the development of a new semiconductor plant in France. The construction of this plant will be completed by 2026. Hence, the development of new semiconductor manufacturing facilities is augmenting the demand for chemical mechanical planarization (CMP) slurry to ensure robust performance. This vital determinant will accelerate market growth in the upcoming years.

However, the integrated circuits segment is expected to be the fastest-growing segment during the forecast period. This growth is attributed to factors such as increasing investment in new integrated circuit manufacturing facilities, increasing production activities, and others.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

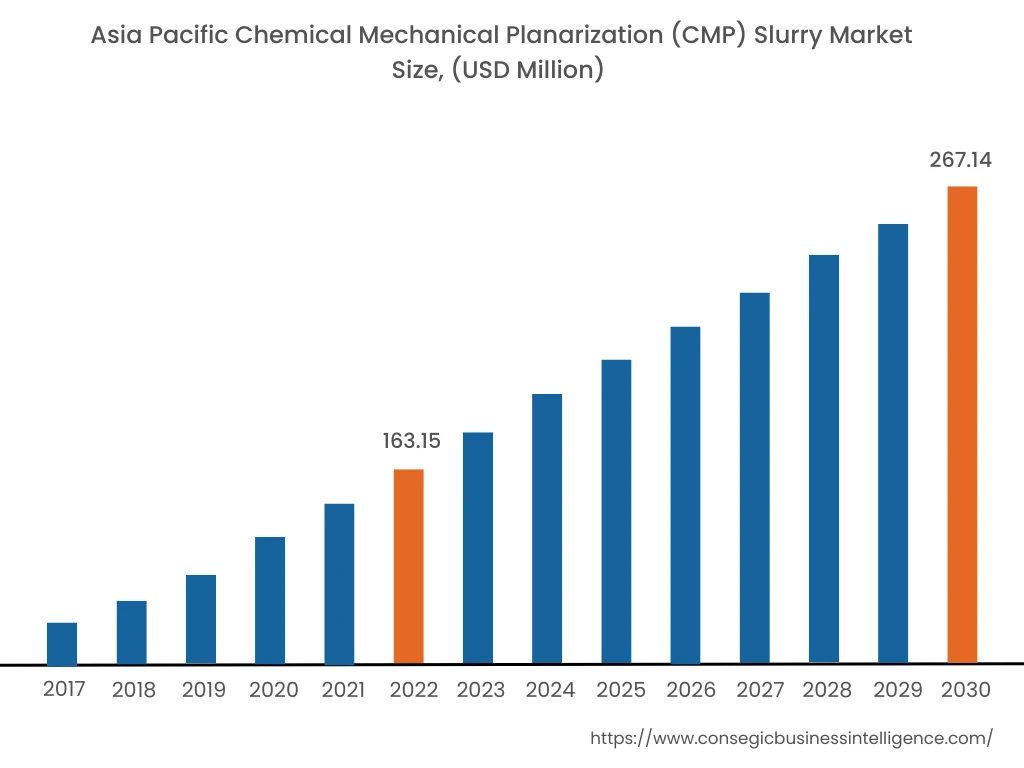

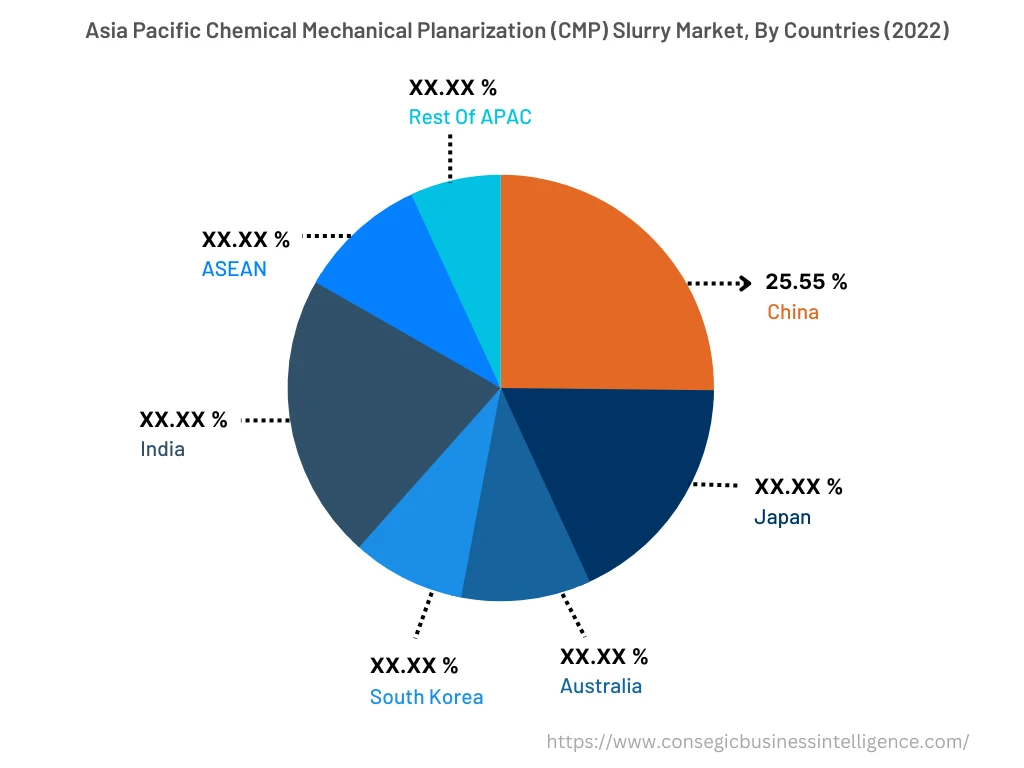

In 2024, Asia Pacific accounted for the highest market share at 36.55% and was valued at USD 154.8 million and is expected to reach USD 260.13 million in 2032. In Asia Pacific, China accounted for the highest market share of 25.55% during the base year of 2024. The increasing adoption of chemical mechanical planarization (CMP) slurry in applications such as semiconductors, integrated circuits, photovoltaic panels, and others is driving market growth in the Asia Pacific region. For instance, according to the Japan Electronics and Information Technology (JEITA), in 2020, the Japan electronics production such as semiconductors, integrated circuits, and others was Japanese Yen 9,964,769 million (USD 93,389.8 million), and in 2021, it was Japanese Yen 10,954,346 million (USS 99,772.2 million). In 2021, the annual growth rate of the electronics industry in Japan consisting of semiconductors, integrated circuits, and others was 9.9%. Hence, the advancement of the above industries is favoring the market growth in the Asia Pacific region.

Furthermore, North America is expected to witness significant growth over the forecast period, growing at a CAGR of 6.9% during 2025-2032. This is due to the presence of various chemical mechanical planarization (CMP) slurry industry players, the development of new semiconductor manufacturing facilities, and others.

Top Key Players & Market Share Insights:

The chemical mechanical planarization (CMP) slurry market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include -

- Hitachi, Ltd.

- Fujifilm Corporation

- BASF SE

- Showa Denko Materials Co. Ltd

- AGC Inc.

- Cabot Microelectronics Corporation

- Cabot Microelectronics Corporation

- Merck KGaA

- DuPont

- Saint-Gobain Ceramics & Plastics, Inc.

Recent Industry Developments :

- In February 2022, Merck Korea, a leading semiconductor material developer, opened a new semiconductor chemical mechanical polishing (CMP) slurry manufacturing facility in South Korea. Merck Korea will manufacture semiconductor materials in the South Korean facility. Hence, the construction of new CMP slurry units to ensure efficient semiconductor material production will propel the market growth in the upcoming years.

Key Questions Answered in the Report

What was the market size of the chemical mechanical planarization (CMP) slurry industry in 2024? +

In 2024, the market size of chemical mechanical planarization (CMP) slurry was USD 525.62 million.

What will be the potential market valuation for the chemical mechanical planarization (CMP) slurry industry by 2030? +

In 2030, the market size of chemical mechanical planarization (CMP) slurry will be expected to reach USD 735.51million.

What are the key factors driving the growth of the chemical mechanical planarization (CMP) slurry market? +

The rise in semiconductors application is supplementing the chemical mechanical planarization (CMP) slurry market growth.

What is the dominating segment in the chemical mechanical planarization (CMP) slurry market by grain type? +

In 2024, the alumina segment accounted for the highest market share of 38.95% in the overall chemical mechanical planarization (CMP) slurry market.

Based on current market trends and future predictions, which geographical region is the dominating region in the chemical mechanical planarization (CMP) slurry market? +

Asia Pacific accounted for the highest market share in the overall chemical mechanical planarization (CMP) slurry market.