- Summary

- Table Of Content

- Methodology

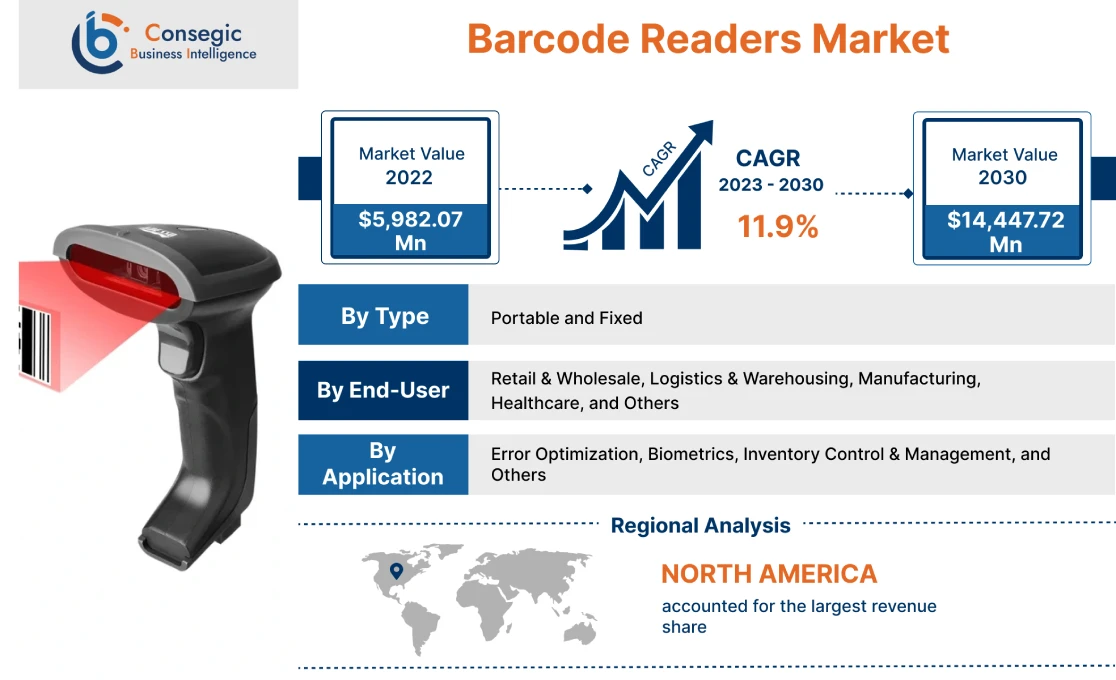

Barcode Readers Market Size :

Global Barcode Readers Market size is estimated to reach over USD 14,447.72 Million by 2030 from a value of USD 5,982.07 Million in 2022, growing at a CAGR of 11.9% from 2023 to 2030.

Barcode Readers Market Scope & Overview:

A barcode reader is an optical scanner that decodes the barcode to obtain information about a particular product. They comprise of components including a lens, light source, and a sensor that translates optical impulses into electrical signals. Companies are utilizing barcode scanners to capture and read information contained in a barcode. Barcode scanners assist in processing data printed in the form of barcode on products' packaging including manufacturing date, product cost, expiry date, and others.

Barcode Readers Market Insights :

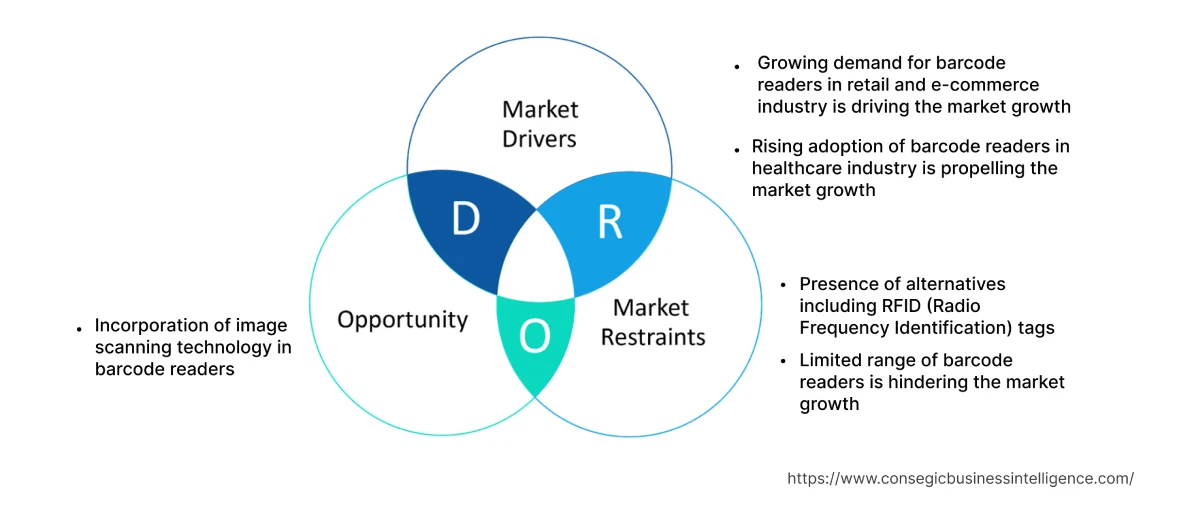

Key Drivers :

Growing demand in retail and e-commerce industry

The increasing demand for barcode readers in retail and e-commerce sector to streamline business operations is driving the growth of the market. They play a crucial role in receiving and dispatching orders. Moreover, they are used in periodic cycle counts to confirm that inventory records reflect the actual quantities of the product in the warehouse quickly and accurately.

Furthermore, they are employed for order receiving and restocking purposes to ensure that the product matches the purchased order. For instance, in October 2022, Socket Mobile, Inc. launched new barcode plus QR code scanners called DuraScan D820, DuraSled DS820, and SocketScan S820 for application in QR code payments, digital identification verification, and real-time supply chain tracking. Analysis of market trends concludes that the ability of barcode scanners to maintain sales information and track products across the supply chain networks is accelerating the barcode readers market demand.

Rising adoption in healthcare industry

The growing adoption of barcode readers in the healthcare sector to manage patient records and data is proliferating the growth of the market. Medication manufacturers utilize them to help healthcare professionals track and reorder supplies in order to save time and money. In clinical settings, barcode reader increases the accuracy of medication management to keep patients safe and healthy. For instance, in March 2021, CodeCorp collaborated with Dryrain, MediTech and ACS MediHealth to integrate camera-based barcode scanning in devices, thereby reducing the chances of medication errors in hospitals. Analysis of market trends concludes that the application of the readers in the healthcare sector for managing medical records and reducing data errors is propelling the barcode readers market demand.

Key Restraints :

Presence of alternatives including RFID (Radio Frequency Identification) tags

The presence of alternate technologies such as RFID (Radio Frequency Identification) tags is hindering the growth of barcode readers market. RFID technology deploys electromagnetic fields to identify and scan tags printed on objects. Moreover, RFID tags have the ability to read multiple patterns simultaneously in comparison to the barcode readers. Analysis of market trends concludes that the ability of RFID technology to scan multiple objects is restraining the proliferation of barcode readers market.

Limited range of barcode readers

The limited range of barcode readers for scanning different products is hindering the growth of the market. The object has to be in close proximity to the barcode reader to provide accurate and speedy tracking of products and inventory. The object within the range of 15 feet from the scanner is accurately detected by the barcode reader. Analysis of market trends concludes that the inability of the readers to detect objects above 15 feet range is restraining the expansion of the market.

Future Opportunities :

Incorporation of image scanning technology in barcode readers

The incorporation of image scanning technology in the readers is expected to present potential opportunities for the expansion of barcode readers market. The integration of image scanning technology allows the readers to detect objects at any orientation or angle. As a result, the they take barcode readings on a fast-moving conveyor belt conveniently and efficiently. Consequently, image scanning technology eliminates the need to hold items in front of the scanner, thereby saving time and improving the productivity of the business. Incorporation of image scanning technology is emerging as one of many barcode readers market opportunities that will drive market expansion.

Barcode Readers Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 14,447.72 Million |

| CAGR (2023-2030) | 11.9% |

| By Type | Portable and Fixed |

| By Application | Error Optimization, Biometrics, Inventory Control & Management, and Others |

| By End-User | Retail & Wholesale, Logistics & Warehousing, Manufacturing, Healthcare, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Wasp Barcode Technologies, Microscan Systems, Denso, Motorola solutions, Honeywell, Datalogic, Opticon, Zebra Technologies, Unitech Electronics Co., Ltd., Cognex Corp, Bluebird Inc., Newland EMEA, Code Corporation |

Barcode Readers Market Segmental Analysis :

By Type :

Based on the type, the market is bifurcated into portable and fixed. In 2022, the fixed segment accounted for the highest barcode readers market share Fixed-position readers include stationery scanners and presentation scanners used in logistics and manufacturing applications to track products or inventory as they move through the production process. Analysis of barcode readers market trends concludes that the application of fixed readers in retail stores and shopping malls is driving the proliferation of the market. Fixed readers are deployed in retail sector for check-out applications, where fast and accurate transaction is ensured in both grocery and non-food retail stores.

The portable segment is anticipated to witness fastest CAGR during the forecast period. Portable readers include rugged scanners, PDA scanners, and automatic readers deployed in a wide variety of settings, including warehouses, retail stores, and office buildings. Portable readers play a crucial role in tracking shipping, receiving, and Work-In-Progress (WIP) inventories. Moreover, they are utilized for patient identification, medical records management, and medication verification in the healthcare sector. For instance, in September 2020, Omron Corporation launched V4 10-H handheld barcode reader offering applications in life science and industrial applications. Analysis of market trends concludes that the application of the readers in hospitals and other medical facilities is accelerating the barcode readers market growth.

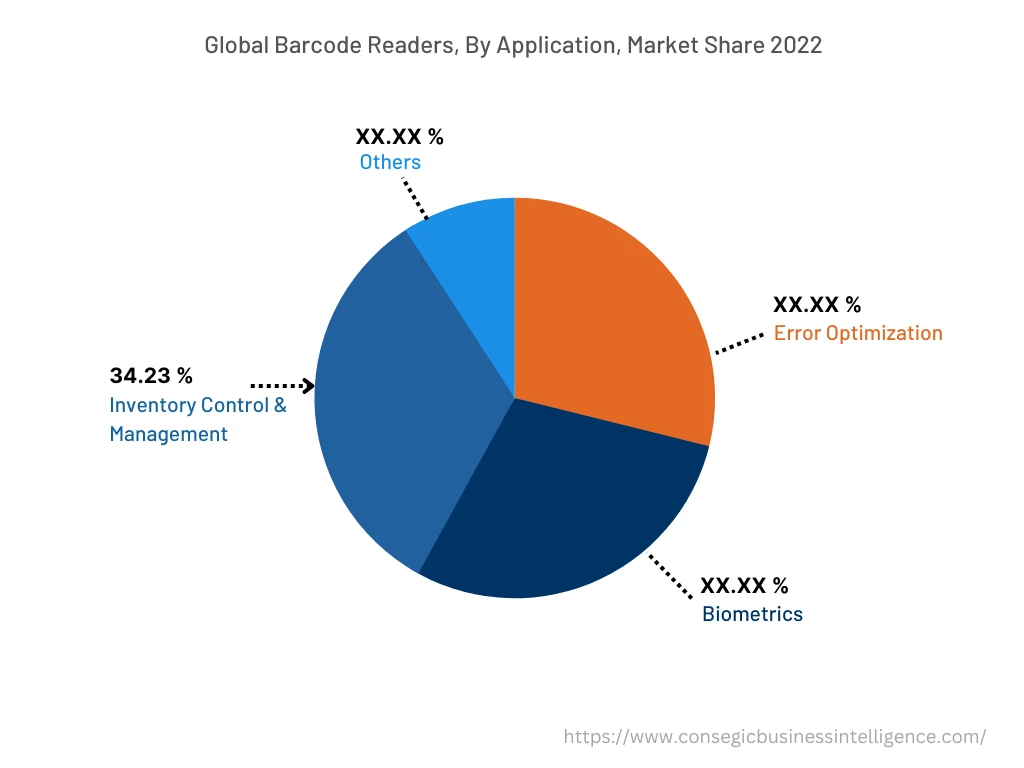

By Application :

Based on the application, the market is separated into error optimization, biometrics, inventory control & management, and others. The inventory management & control segment accounted for the largest revenue share of 34.23% in the year 2022. Barcode scanning technology allows businesses to track inventory efficiently by scanning the barcodes on products stored in a storeroom or warehouse. For instance, in November 2021, iTradeNetwork introduced a new mobile solution called OrderMaestro featuring Scan-to-Search feature that automates and streamlines inventory and order management for foodservice operators by simple barcode scanning, voice recognition, and others. Therefore, barcodes reader plays a crucial role in automating inventory management processes for managing and storing a large number of products efficiently in a limited space.

The error optimization segment is anticipated to register fastest CAGR growth during the forecast period. Barcode scanning technology allows businesses to reduce and optimize errors during various business operations. Barcode scanner reduces the chances of human error, thereby increasing the productivity of the business. Moreover, barcodes scanners increase the efficiency of business operations by conserving resources, saving money, and improving the overall productivity of the business.

By End-User :

Based on the end-user, the market is segregated into retail & wholesale, logistics & warehousing, manufacturing, healthcare, and others. The logistics & warehousing segment accounted for the largest revenue share in the year 2022. Logistics and warehousing involve collection of manual information from barcodes to perform inventory counts and management. Therefore, the readers allow businesses to maintain a record of each container, rack and item by following a digitized and automated procedure. The barcode readers market analysis concluded that the deployment of barcode scanners in warehouses for quality control applications is driving the expansion of the market.

The retail & wholesale segment is anticipated to register the fastest CAGR growth during the forecast period. The readers are utilized for configuration needs at the checkout counter as it ensures accurate inventory tracking. Moreover, they have application including order receiving and restocking purposes to ensure smooth and proper functioning of retail operations. For instance, in September 2022, Social Mobile launched a wireless handheld barcode scanner called RHINO T5se featuring integrated Honeywell scan engine and Push-to-Talk buttons in retail sector. Thus, the ability of barcode scanners to streamline internal and external retail operations is contributing to the expansion of the market.

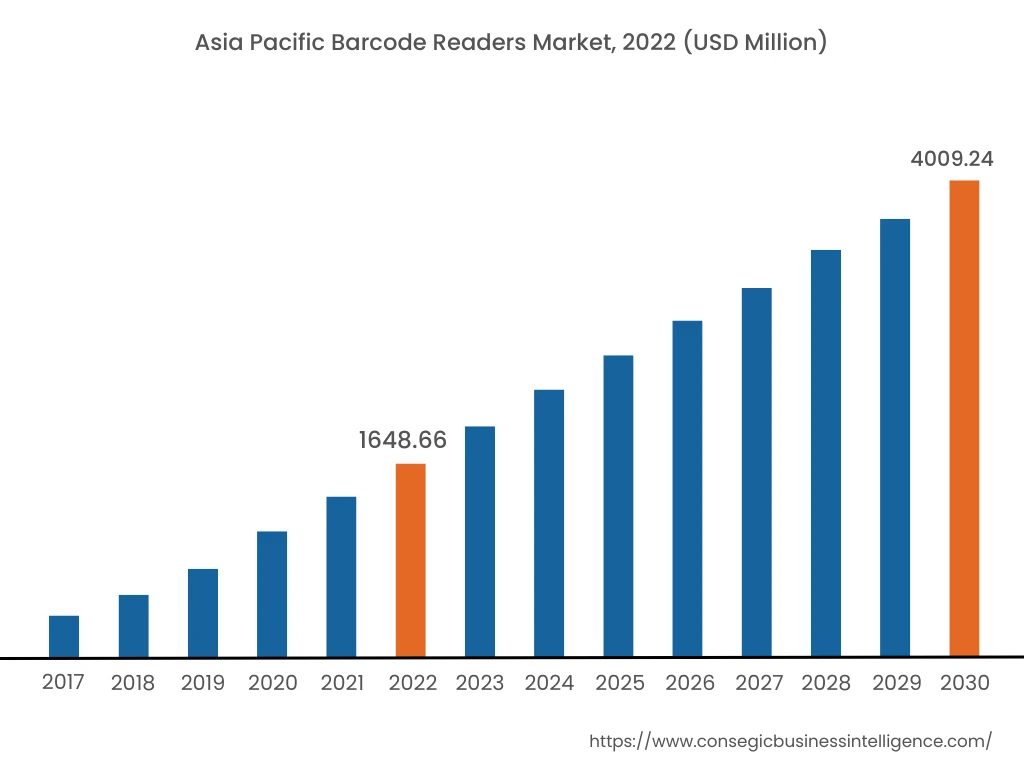

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2022. The high demand for automation in the region due to the need for improved efficiency, increased productivity, and reduced operational costs is driving the proliferation of barcode readers market. Examination of market trends concludes that North America has a high adoption rate of advanced technologies in the region to facilitate automation in various industries further accelerate the growth of the barcode readers market. Additionally, key players such as Microscan Systems, Zebra Technologies, and Code Corporation are constantly driving innovation and developing new scanning solutions, leading to the expansion of the market.

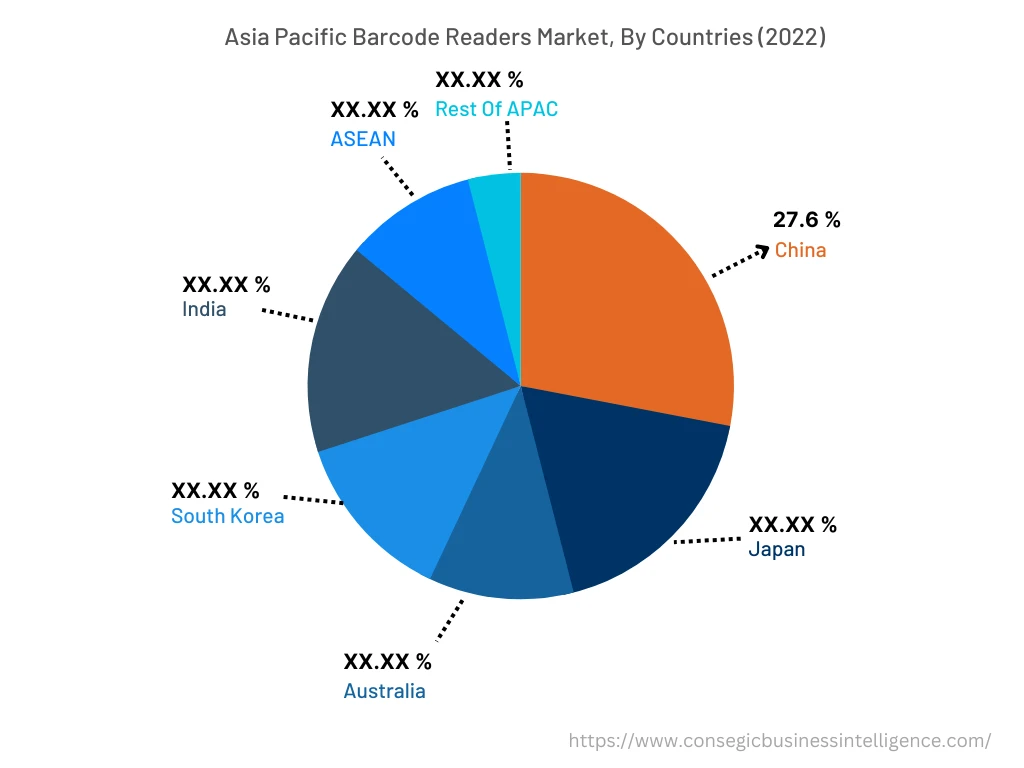

The Asia-Pacific region accounted for a revenue share of USD 1,648.66 million in 2022 and is expected to reach USD 4,009.24 million in 2030, registering a CAGR of 12.0% during the forecast period. Additionally, in the region, China accounted for the largest revenue share of 27.6% in the year 2022. The demand for barcode readers in Asia-Pacific is attributed to the growing e-commerce, logistics, and warehouse industry. Their increasing demand to streamline various business operations such as inventory management and error optimization in the aforementioned industries is driving the expansion of the market. Therefore, key players are adopting various business strategies for developing advanced barcode scanning systems. For instance, in January 2023, CipherLab Co., Ltd. launched 2564ER Rugged Handheld Scanners providing flexibility of operations in warehouse and manufacturing industries. Examination of market trends concludes that the expansion and retail and warehouse automation is driving the proliferation of the regional market.

Top Key Players & Market Share Insights:

The barcode readers market is characterized by the presence of major players providing product to the national and international markets. The major companies operating in the barcode readers industry are adopting various business strategies such as product innovation, research and development (R&D), and application launches to accelerate the market expansion. Key players in the barcode readers market include-

- Wasp Barcode Technologies

- Denso

- Bluebird Inc.

- Newland EMEA

- Code Corporation

- CipherLab Co. Ltd.

- Motorola solutions

- Honeywell International Inc.

- Datalogic S.p.A

- Opticon

- Zebra Technologies

- Unitech Electronics Co. Ltd.

- Cognex Corp

Recent Industry Developments :

- In January 2020, Scandit entered into a partnership with Samsung to offer a range of barcode scanning software products in a smartphone for data capture tasks.

- In November 2021, Smart Engines launched new barcode scanning system featuring AI technology to scan 1D and 2D barcodes data suitable for a wide range of receipts, and taxes.

- In May 2022, Scandit launched the Scandit Barcode Scanner accompanied with OCR SDK 6.3. The products are launched with improvements in scanning, a reconstructed Cordova/Phonegap plugin, a reconstructed Xamarin Plugin that functions in Beta along with ID scanning capabilities.

- In March 2024, Cognex Corporation, a leading manufacturer in machine vision launched 380 Modular Vision Tunnel accompanied with DataMan® 380 as an addition to their Modular Vision Tunnel range of products. It offers high throughput and traceability by utilizing the DataMan 380 reader.

Key Questions Answered in the Report

What is Barcode Reader? +

Barcode readers are the scanners that decodes the information stored in the barcodes and transfers it to the computer. Barcode readers are used to get details on the price, manufacturing date, and other information of the product.

What specific segmentation details are covered in the barcode readers report, and how is the dominating segment impacting the market growth? +

By end-user segment has witnessed logistics & warehousing as the dominating segment in the year 2022, due the increasing adoption of barcode scanners for performing inventory counts.

What specific segmentation details are covered in the barcode readers market report, and how is the fastest segment anticipated to impact the market growth? +

By type segment has witnessed portable as the fastest-growing segment during the forecast period due to the application of barcode scanners in retail industry for tracking shipping, receiving, and Work-In-Progress (WIP) inventories.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia-Pacific region is expected to register fastest CAGR growth during the forecast period due to growing retail and e-commerce industry in the region.