- Summary

- Table Of Content

- Methodology

Appearance Boards Market Introduction :

Appearance Boards Market size is estimated to reach over USD 28,061.14 Million by 2030 from a value of USD 17,721.03 Million in 2022, growing at a CAGR of 6.1% from 2023 to 2030.

Appearance Boards Market Definition & Overview:

Appearance boards, also known as select boards or finish boards, refer to flat, rectangular building material, widely employed in the construction industry. They are available in a variety of wood species including pine, cedar, oak, maple, and others, allowing for different aesthetic options. Additionally, as per the analysis, these boards are of varying lengths, widths, and thicknesses, and are deployed for various applications including interior and exterior trim, furniture, cabinetry, and decorative woodworking projects.

Appearance Boards Market Insights :

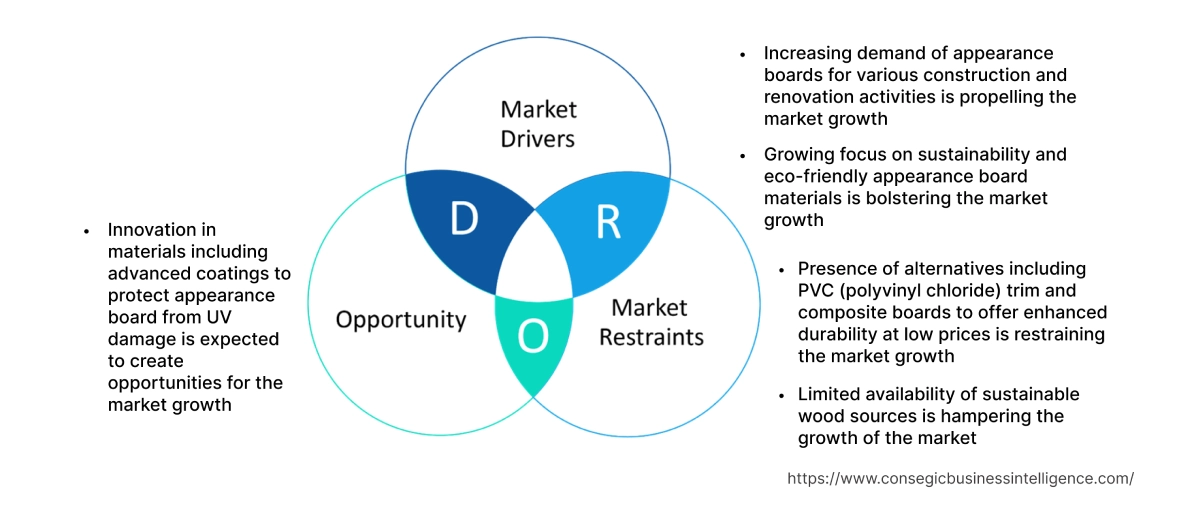

Key Drivers :

Increasing demand of appearance boards for various construction and renovation activities is propelling the market growth

Appearance boards are extensively employed for interior trim namely baseboards, crown molding, and window casings. The rise in construction and renovation activities increases the requirement for interior trim and finishing touches to enhance the overall aesthetic appeal of a space. They provide a visually pleasing and durable solution for above-mentioned applications, thus contributing significantly in driving the market growth.

Additionally, the growing importance of aesthetics in construction and renovation projects is also increasing the requirement for high-quality finishes. The boards are specifically designed for a refined appearance, free from major defects and blemishes. The boards offer a smooth and consistent surface, enhancing the visual appeal of walls, ceilings, and other architectural elements. Subsequently, as per the analysis, the surge in construction and renovation activities is contributing remarkably in accelerating the growth of the appearance boards market. For instance, in December 2022, according to the New Zealand government, building construction activity rose by 3.8% in September 2022 in comparison to June 2022. The non-residential building activity grew by 4.9% whereas residential building construction rose by 3.1%.

Growing focus on sustainability and eco-friendly appearance board materials is bolstering the market growth

Appearance boards procured from responsibly managed forests and certified sustainable sources are gaining popularity among consumers who prioritize eco-friendly materials. Additionally, the rising requirement for materials made from recycled or renewable sources to provide improved aesthetics and performance to solid wood is also contributing significantly in driving the market growth. The boards made from bamboo, reclaimed wood, or engineered wood products including plywood or medium-density fiberboard (MDF) cater to the sustainability-focused market, thus contributing remarkably in boosting the appearance boards industry. Consequently, as per the analysis, manufacturers are implementing efficient production processes to minimize waste and maximize the use of raw materials, resulting in reduced wastage and environmental impact. For instance, in January 2021, Plyco launched sustainable plywood products that have a negligible environmental impact. The sustainable plywood is manufactured to reduce the wastage of raw material, thus contributing considerably in bolstering the trends of the appearance boards market.

Key Restraints :

Presence of alternatives including PVC (polyvinyl chloride) trim and composite boards to offer enhanced durability at low prices is restraining the market

PVC trim and composite boards are more cost-effective compared to appearance boards, especially in terms of upfront costs. The alternative materials have lower price points, creating a large budget-conscious customer base in comparison to these boards. In addition, based on the analysis, PVC trim and composite boards offer advantages in terms of durability and low-maintenance requirements. PVC and composite boards are resistant to moisture, rot, insects, and warping, suitable for exterior applications and areas exposed to harsh environmental conditions. The enhanced durability and low-maintenance features of PVC trim and composite boards create a large customer base, thus limiting the expansion of the application boards market.

Limited availability of sustainable wood sources is hampering the growth of the market

The limited availability of sustainably sourced wood is creating challenges in the supply chain for these boards. Manufacturers are facing difficulties in procuring a consistent and reliable supply of sustainably harvested wood, leading to supply shortages, increased costs, and difficulties in meeting the appearance boards market demand. Additionally, as per the analysis, sustainable wood sources require adherence to strict regulations and certifications, leading to higher production costs for these boards. Sourcing wood from sustainably managed forests and obtaining certified materials involve additional expenses including certifications, audits, or compliance with specific standards. Consequently, the increased costs of the wood are a deterrent for manufacturers, thus hindering the expansion of the appearance boards market.

Future Opportunities :

Innovation in materials including advanced coatings to protect appearance board from UV damage is expected to create opportunities for the market growth

Innovations in surface treatments and finishes enhance the appearance and performance of these boards. Manufacturers introduce advanced coatings, stains, or protective layers that provide improved resistance to scratches, UV damage, or staining. The innovations enhance the visual appeal of the boards and also increase the longevity and durability, thus creating potential appearance boards market opportunities for market trends. Moreover, innovation in materials and finishes enables greater customization and personalization options for these boards. Manufacturers develop these boards that are easily modified or adapted to suit specific customer preferences, including size, shape, profile, or surface treatment. According to the analysis, the customization capability caters to the growing requirement for personalized products and provides opportunities and trends for differentiation and market.

Appearance Boards Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 28,061.14 Million |

| CAGR (2023-2030) | 6.1% |

| By Type | Particle Board, Block Board, Plywood, Medium Density Fiber Board, and Others |

| By Application | Commercial and Residential |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Alexandria Moulding, Inc., Action TESA, Boise Cascade Company, Builders Choice Pvt Ltd, Claymar Construction, LLC, Kastamonu Entegre, Mendocino Redwood Company, Norbord Inc., Stora Enso Oyj, Roseburg Forest Products Co., Tom's Quality Millwork Inc, Welldonewood |

Appearance Boards Market Segmental Analysis :

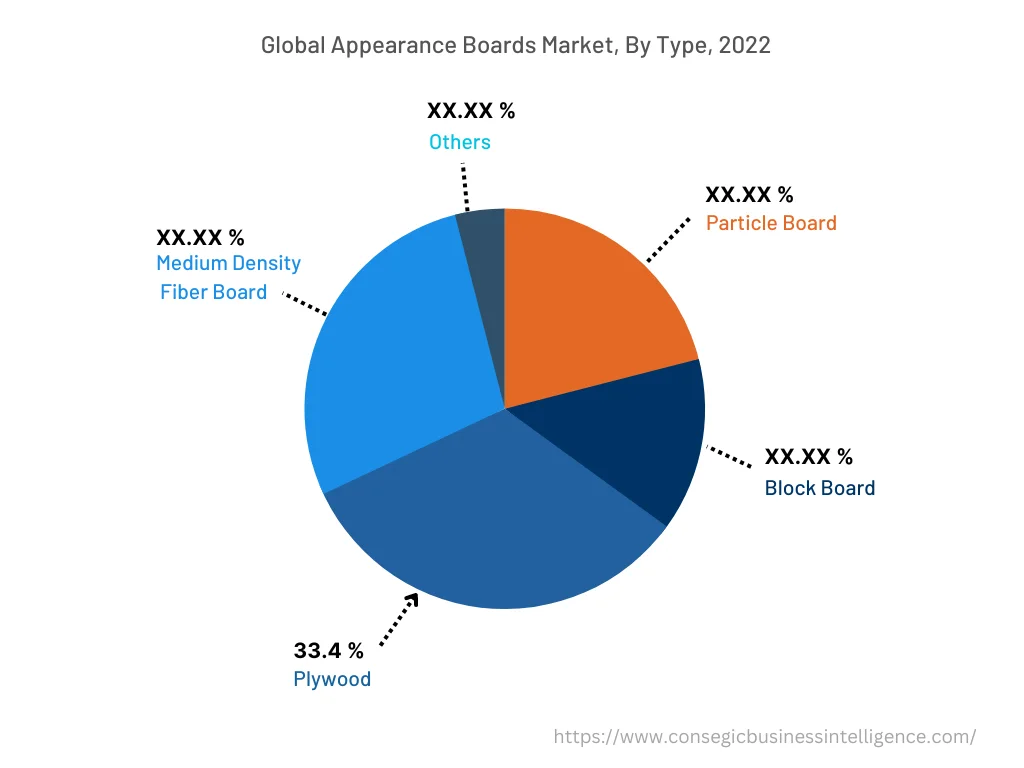

Based on the Type :

The type segment is classified into particle board, block board, plywood, medium-density fiber board, and others. Plywood accounted for the largest market share of 33.4% in 2022 as plywood is known for the exceptional strength and durability. Additionally, plywood is constructed by bonding multiple layers of wood veneers with alternating grain directions, resulting in a strong and stable panel. The structural integrity is ideal for a wide range of applications, including construction, furniture, cabinetry, and flooring. Moreover, plywood is extensively employed in both structural and appearance-related applications. As per the analysis, the strength, dimensional stability, resistance to warping, and antiviral material offered by plywood are suitable for load-bearing purposes including roofs, walls, and flooring. For instance, in August 2022, Century Plyboards Ltd. introduced ViroKill Plywood to offer long-lasting and durable defense against germs, bacteria, and viruses. Plywood is constructed using advanced materials and acts as a shield from viral, bacterial microbial, and fungal attacks. Thus, the aforementioned factors are propelling the trends of the segment.

Medium Density Fiberboard (MDF) is expected to register the fastest CAGR in the appearance boards market during the forecast period. The rise is attributed to the smooth and consistent surface of MDF that provide a uniform base for painting, laminating, and applying veneers. The increasing requirement of smoothed surface MDF for furniture manufacturing, cabinetry, millwork, and decorative paneling is contributing significantly in spurring the expansion of the appearance boards market. Additionally, MDF is considered an eco-friendly alternative to solid wood as MDF is manufactured from recycled wood fibers, reduces waste, and minimizes the environmental impact. Moreover, some manufacturers offer low-emission or formaldehyde-free MDF, further alluring environmentally conscious consumers and projects. In conclusion, the growing requirement for sustainable and eco-friendly materials is driving the adoption of MDF, thus contributing notably in propelling the market.

Based on the Application :

The application segment is classified into residential and commercial. Residential segment accounted for the largest market share in 2022 as appearance boards namely plywood and MDF are utilized for wall paneling to enhance the aesthetic appeal of interior spaces. These boards create a warm and inviting atmosphere, add texture or patterns to walls, and act as a backdrop for artwork or furniture. Additionally, the improvements in material including anti-bacterial coating and zero emission plywood to offer a healthy and emission-free interior of the home also contribute remarkably in accelerating the expansion of the residential segment. For instance, in January 2020, Greenply Industries launched a green club plus seven hundred plywoods in India to offer healthy homes with improved strength. The emission-free plywood is manufactured to be utilized for making furniture, false ceilings, and paneling in household applications, thus contributing considerably in driving the expansion of the appearance boards market.

The commercial segment is anticipated to witness the fastest CAGR in the appearance boards market during the forecast period. The expansion of the market is endorsed by the increasing adoption of these boards in retail and hospitality spaces to create visually appealing interiors. They are utilized for wall cladding, storefronts, display fixtures, and custom millwork, enhancing the overall ambiance and aesthetics of the space. Additionally, they are also employed in office interiors for wall paneling, partitions, reception desks, cabinetry, and conference room tables, providing a professional and stylish look to the workspace. Furthermore, based on the analysis, the increasing adoption of these boards in designing commercial spaces including restaurants, bars, and cafes is also driving the market. The boards are applied to walls, ceilings, bar fronts, booth seating, and other decorative elements to create a unique and inviting atmosphere for patrons. In conclusion, the rising demand of these boards from various commercial sectors including retail & hospitality, offices, and restaurant & bars are collectively responsible in driving the market trends.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

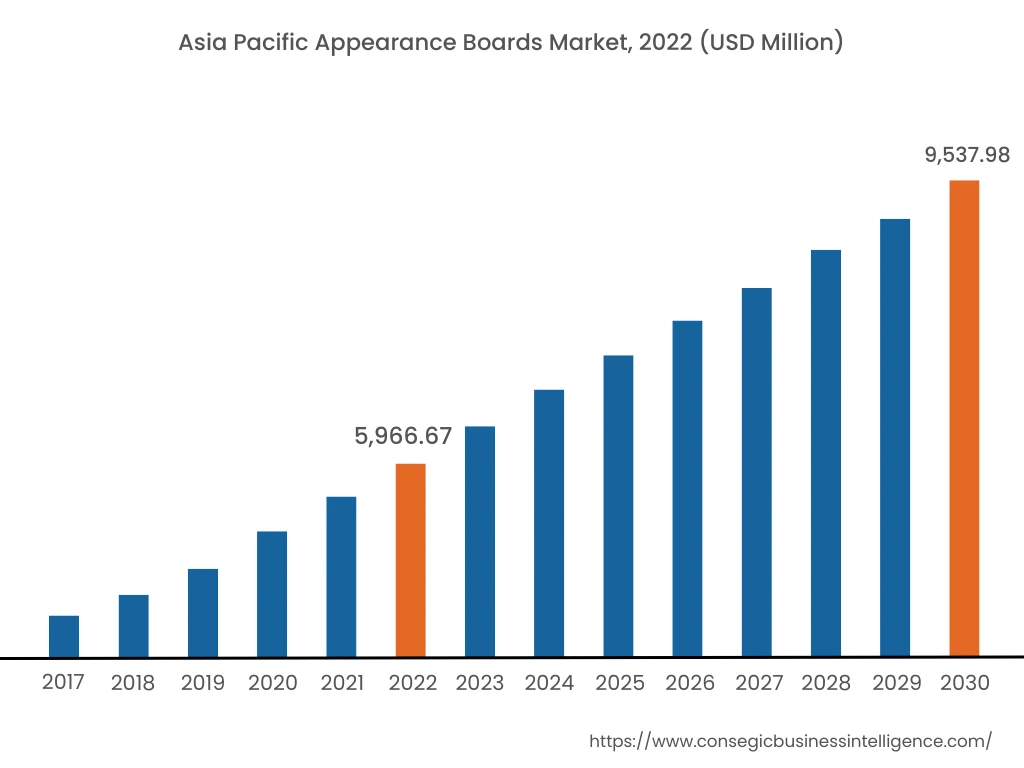

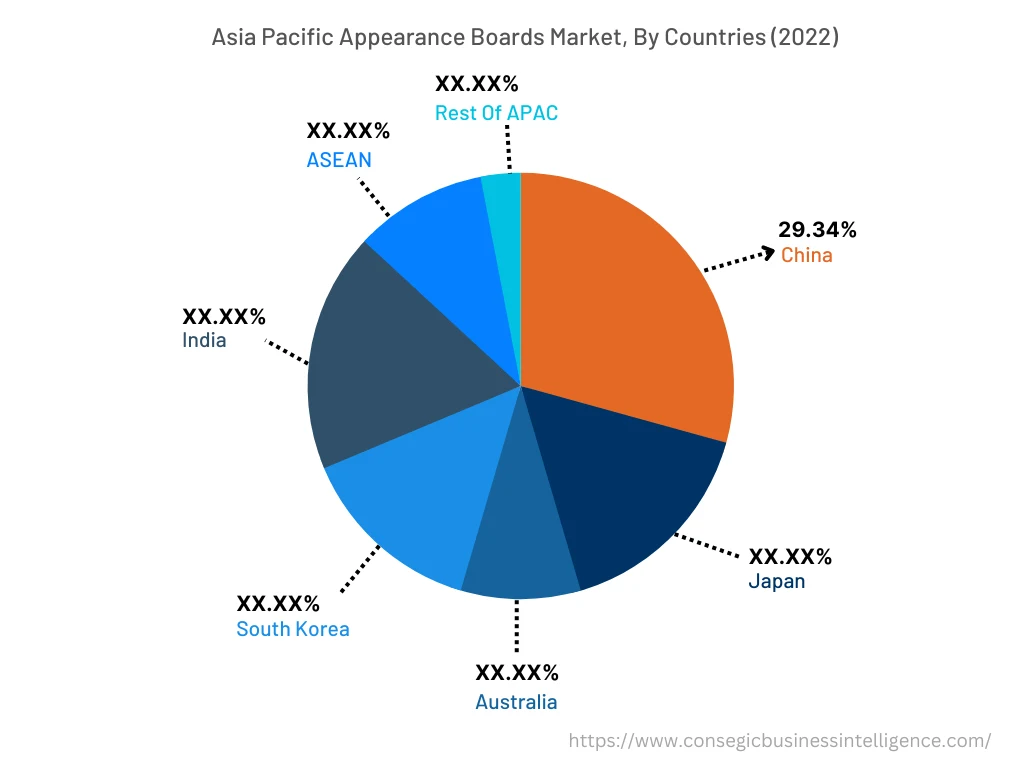

Asia Pacific accounted to the largest appearance boards market share of USD 5,966.67 Million in 2022 and is expected to register the CAGR of 6.2% accounting to USD 9,537.98 Million in 2030 in the appearance boards market. In addition, in the region, China accounted for the maximum revenue share of 29.34% in the year 2022. Based on the appearance boards market analysis, the expansion is attributed to the rising demand for affordable housing as the region encompasses some of the densely populated countries including China and India. These boards, particularly plywood and particle board, are widely employed in residential construction due to the cost-effectiveness and versatility. For instance, in March 2023, according to Türkiye İMSAD Report, 118 thousand new residential buildings were constructed in Turkey in 2021. Consequently, the construction of new residential buildings increases the demand of these boards, which in turn, promotes the market expansion and trends in Asia Pacific countries.

North America is anticipated to witness the fastest CAGR in the appearance boards market during the forecast period. The rise is credited to the rising renovation and remodeling activities in North America that increases the demand of these boards to be used for wall paneling, cabinetry, flooring, and other decorative applications. Additionally, the growing emphasis on sustainability and eco-friendly materials in construction and design is also increasing the adoption of these boards made from sustainable sources or utilizing recycled materials. Moreover, the demand for these boards with low environmental impact, including the boards certified by organizations namely the Forest Stewardship Council (FSC), are also contributing in driving the expansion of eco-friendly appearance boards market trends in North America.

Top Key Players & Market Share Insights:

The competitive landscape of the global appearance boards market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and application launches have accelerated the appearance boards market growth and trends. Key players in the market include-

- Alexandria Moulding, Inc.

- Action TESA

- Stora Enso Oyj

- Roseburg Forest Products Co.

- Tom's Quality Millwork Inc

- Welldonewood

- Boise Cascade Company

- Builders Choice Pvt Ltd

- Claymar Construction, LLC

- Kastamonu Entegre

- Mendocino Redwood Company

- Norbord Inc.

Recent Industry Developments :

- In January 2023, Koskisen utilized Stora Enso's bio-based binder, NeoLigno for manufacturing a zero particle board to replace fossil-fuel-based resins in furniture boards. The zero particle board is designed to reduce the environmental impact and also to meet the sustainability goals.

- In September 2022, Action TESA introduced ABRAZE, a highly scratch-resistant pre-laminated board in India. The advanced appearance board offers resistance against moisture and stains and encompasses antiviro technology that kills approximately 99.99% of bacteria, viruses, and microbes.

Key Questions Answered in the Report

What are appearance boards? +

Appearance boards also known as select boards or finish boards, refer to flat, rectangular building material, widely employed in the construction industry to offer the enhanced visual appeal of walls, ceilings, and other architectural elements.

What specific segmentation details are covered in the appearance boards market report, and how is the dominating segment impacting the market growth? +

Plywood dominates the market owing to the exceptional strength and durability. Additionally, plywood is constructed by bonding multiple layers of wood veneers with alternating grain directions, resulting in a strong and stable panel.

What specific segmentation details are covered in the appearance boards market report, and how is the fastest segment anticipated to impact the market growth? +

The commercial segment is anticipated to register the fastest CAGR due to the increasing adoption of appearance boards in retail and hospitality spaces to create visually appealing interiors. Appearance boards are utilized for wall cladding, storefronts, display fixtures, and custom millwork, enhancing the overall ambiance and aesthetics of the space.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

North America is expected to witness the fastest CAGR during the forecast period owing to the increasing demand of appearance boards for wall panelling, cabinetry, flooring, and other decorative applications.