- Summary

- Table Of Content

- Methodology

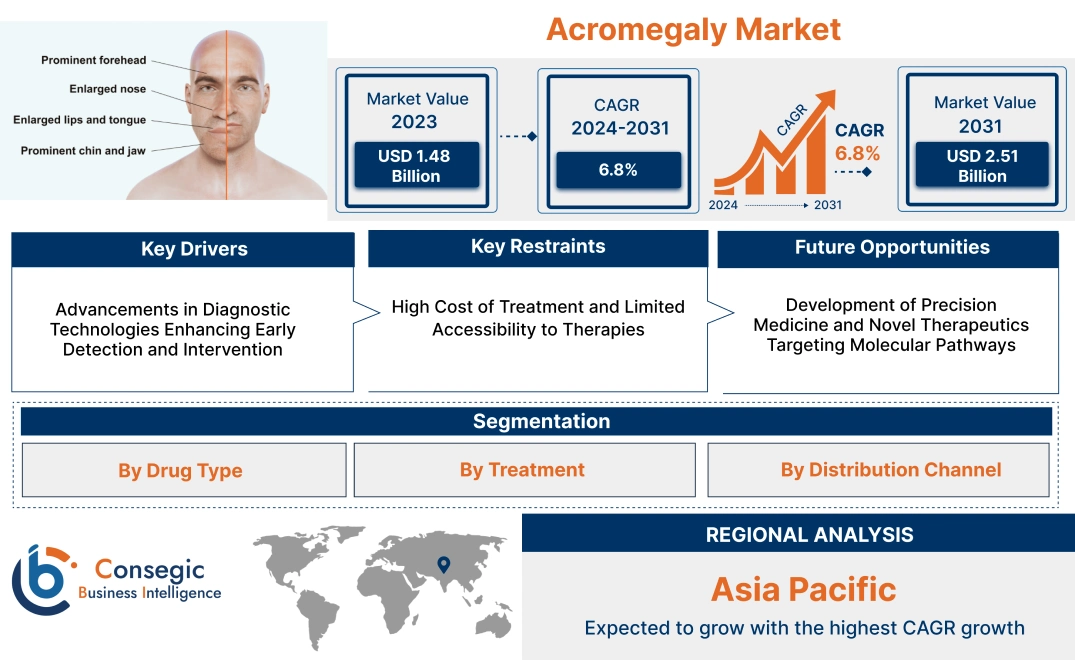

Acromegaly Market Size:

Acromegaly Market size is estimated to reach over USD 2.51 Billion by 2031 from a value of USD 1.48 Billion in 2023 and is projected to grow by USD 1.55 Billion in 2024, growing at a CAGR of 6.8% from 2024 to 2031.

Acromegaly Market Scope & Overview:

Acromegaly is a rare hormonal disorder caused by the excessive production of growth hormone, usually due to a benign tumor on the pituitary gland. The condition leads to abnormal growth of bones and tissues, particularly in the hands, feet, and face. Left untreated, acromegaly can result in serious complications such as cardiovascular disease, diabetes, and joint problems. Treatment options include surgery to remove the tumor, medication to reduce growth hormone levels, and radiation therapy for cases where surgery is not feasible. Hospitals, endocrinology clinics, and research institutions are the primary end-users in this market. As more healthcare providers focus on improving the diagnosis and treatment of acromegaly, the market is expected to experience steady growth, driven by increasing patient awareness and the availability of advanced therapeutic options.

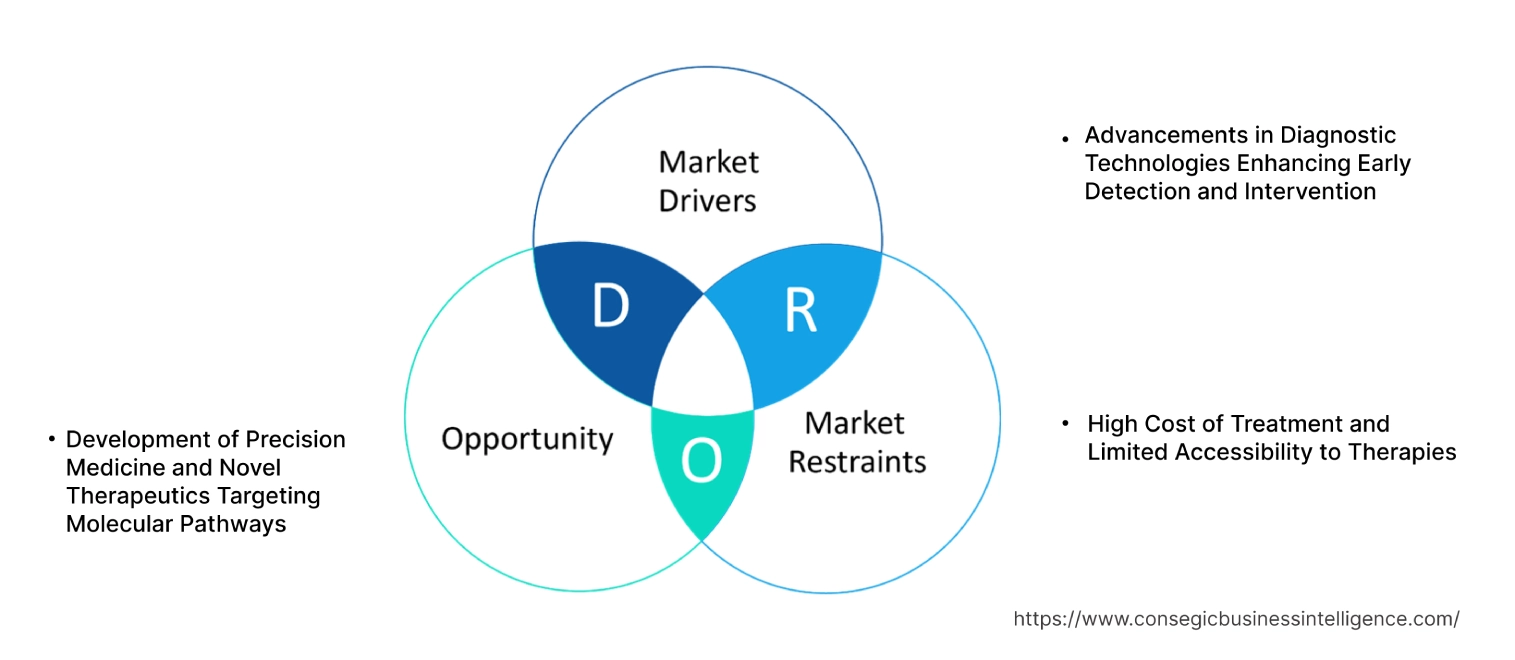

Acromegaly Market Dynamics - (DRO) :

Key Drivers:

Advancements in Diagnostic Technologies Enhancing Early Detection and Intervention

The acromegaly market growth is significantly driven by advancements in diagnostic technologies, particularly those that improve early detection and facilitate timely intervention. The introduction of high-resolution MRI and sensitive immunoassays for measuring growth hormone (GH) and insulin-like growth factor 1 (IGF-1) levels has revolutionized the early diagnosis of acromegaly. Early detection is critical for managing the disease, as it reduces the risk of severe complications such as cardiovascular issues, diabetes, and joint deformities. The development of standardized diagnostic protocols, combined with the integration of artificial intelligence (AI) in imaging technologies, allows for more precise identification of pituitary adenomas—the common cause of acromegaly. AI-driven imaging tools enable clinicians to detect smaller adenomas and evaluate tumor progression more accurately, leading to earlier and more effective treatment interventions. These technological advancements are increasing the demand for sophisticated diagnostic tools, particularly in regions where healthcare providers are prioritizing early screening and comprehensive disease management strategies.

Key Restraints :

High Cost of Treatment and Limited Accessibility to Therapies

The high cost of acromegaly treatments remains a significant barrier to patient access and restraint on acromegaly market demand, especially in regions with limited healthcare funding. The mainstays of acromegaly treatment include surgery, radiotherapy, and pharmacological therapies, such as somatostatin analogs (SSAs), GH receptor antagonists, and dopamine agonists. Among these, pharmacological treatments are the most expensive, with therapies like SSAs requiring long-term administration, often at substantial annual costs. For instance, the yearly expense of somatostatin analogs such as octreotide can reach tens of thousands of dollars, which places a financial burden on both patients and healthcare systems. Moreover, many patients require lifelong monitoring and treatment adjustments, further driving up healthcare costs. Limited availability of generic alternatives and inconsistent reimbursement policies exacerbate the issue, particularly in emerging markets where healthcare infrastructure is less developed. These challenges have restricted the adoption of newer, more effective treatments, creating disparities in access and impacting overall market growth.

Future Opportunities :

Development of Precision Medicine and Novel Therapeutics Targeting Molecular Pathways

The growing focus on precision medicine and the development of novel therapeutics targeting specific molecular pathways in acromegaly present significant acromegaly market opportunities. Advances in understanding the molecular mechanisms driving GH overproduction and its downstream effects have paved the way for innovative treatment options. For example, monoclonal antibodies targeting the GH receptor, as well as small-molecule inhibitors designed to block IGF-1 activity, offer the potential for more targeted, effective therapies. These emerging treatments could provide better efficacy and reduced side effects compared to conventional therapies, particularly for patients with poor responses to existing drugs. Furthermore, genomic and proteomic profiling is enabling the stratification of patients based on their unique molecular signatures, allowing for more personalized treatment regimens. Pharmaceutical companies are investing heavily in clinical trials to develop next-generation drugs that could improve patient outcomes, reduce treatment resistance, and minimize long-term complications. Thus, the market trends analysis shows that as these therapies progress through the clinical pipeline, they are expected to broaden the treatment landscape, offering new opportunities.

Acromegaly Market Segmental Analysis :

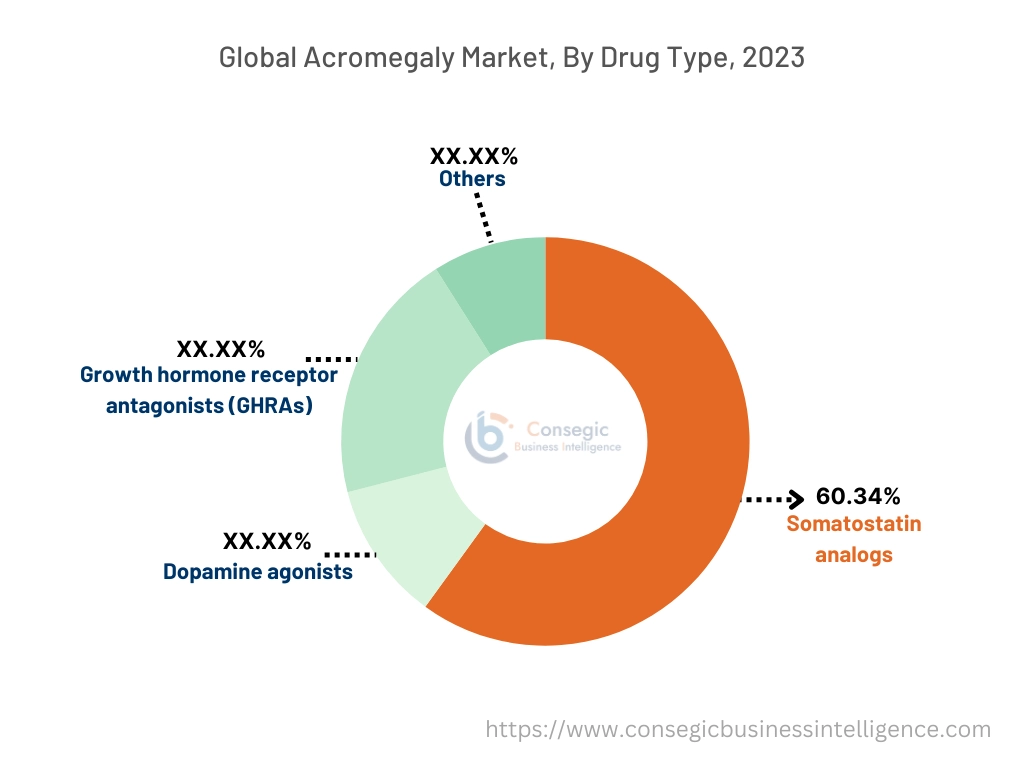

By Drug Type:

Based on drug type, the market is segmented into somatostatin analogs, dopamine agonists, growth hormone receptor antagonists (GHRAs), and others.

The somatostatin analogs segment accounted for the largest revenue share of 60.34% of the total acromegaly market share in 2023.

- Somatostatin analogs, such as octreotide and lanreotide, are the first-line pharmacological treatments for acromegaly, as they effectively inhibit growth hormone (GH) release and help normalize insulin-like growth factor 1 (IGF-1) levels.

- These drugs are widely preferred due to their ability to control both hormone levels and tumor growth in patients who are not suitable for surgery or radiation therapy.

- Additionally, the availability of long-acting formulations, which improve patient compliance, contributes to the segment's dominance in the market.

- The high efficacy, safety profile, and sustained-release formulations make somatostatin analogs the most commonly prescribed drugs in this market.

- Thus, the market trends analysis shows that somatostatin analogs dominate the market, driven by their high efficacy in controlling GH levels and the availability of long-acting formulations that improve patient compliance, driving the acromegaly market growth.

The growth hormone receptor antagonists (GHRAs) segment is anticipated to register the fastest CAGR during the forecast period.

- Growth hormone receptor antagonists, such as pegvisomant, block the action of GH at its receptor site, effectively reducing IGF-1 levels in patients with acromegaly.

- These drugs are particularly beneficial for patients who are resistant to somatostatin analogs or have not achieved adequate control with other treatments.

- The increasing use of GHRAs, coupled with ongoing clinical trials exploring their expanded use, is expected to drive the segment.

- The potential for new GHRA formulations and combinations with other therapies also supports the segment's rapid growth.

- Therefore, the segmental trends analysis depicts that GHRAs are expected to grow rapidly due to their efficacy in treating patients resistant to other therapies and ongoing research focused on developing new formulations, creating lucrative acromegaly market opportunities.

By Treatment:

Based on treatment, the market is segmented into medications, surgery, and radiation therapy.

The medications segment accounted for the largest revenue share in 2023.

- Medications remain the cornerstone of acromegaly treatment, particularly for patients who cannot undergo surgery or those who require additional therapy post-surgery.

- The wide range of pharmacological options, including somatostatin analogs, dopamine agonists, and GHRAs, enables personalized treatment approaches based on patient response and disease severity.

- Medications are often used as long-term management strategies to control GH and IGF-1 levels, especially in patients with residual or recurrent disease after surgery.

- The growing use of combination therapies and the development of novel drug formulations further reinforce the dominance of this segment.

- Thus, the segmental trends depict that medications dominate the market due to their pivotal role in long-term disease management and the increasing use of combination therapies to enhance treatment outcomes, boosting the acromegaly market demand.

The surgery segment is anticipated to register the fastest CAGR during the forecast period.

- Surgical intervention, particularly transsphenoidal surgery, is considered the first-line treatment for acromegaly when the tumor is accessible and resectable.

- Advances in surgical techniques, such as endoscopic surgery, have improved the success rates of tumor removal, reducing GH levels and alleviating symptoms in a majority of patients.

- The increasing availability of minimally invasive surgical techniques and the growing demand for definitive tumor removal are expected to drive the segment.

- Additionally, surgery is often combined with pharmacological treatments or radiation therapy for optimal disease control.

- Thus, the segmental trends portray that the surgery segment is expected to grow rapidly, driven by advancements in minimally invasive techniques and the increasing demand for definitive tumor removal in patients with acromegaly, proliferating the acromegaly market trends.

By Distribution Channel:

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and online pharmacies.

The hospital pharmacies segment accounted for the largest revenue share in 2023.

- Hospital pharmacies play a critical role in the distribution of acromegaly treatments, particularly for patients who receive injectable therapies like somatostatin analogs and GHRAs.

- These pharmacies ensure access to specialized medications, often required for patients undergoing complex treatments involving surgery or radiation therapy.

- Additionally, the integration of hospital pharmacies with healthcare providers allows for better monitoring of treatment adherence and outcomes, which is crucial in managing a rare and chronic condition like acromegaly.

- Thus, the acromegaly market analysis shows that hospital pharmacies lead the market, driven by their role in providing specialized medications and supporting integrated care for patients undergoing complex acromegaly treatments.

The online pharmacies segment is anticipated to register the fastest CAGR during the forecast period.

- The increasing shift towards digital healthcare services and the growing preference for convenient, home-based delivery of medications are driving the rapid growth of online pharmacies.

- These platforms offer patients easier access to long-term therapies, such as somatostatin analogs and other acromegaly medications, particularly for those who may find it difficult to visit hospital pharmacies regularly.

- The convenience of home delivery, coupled with competitive pricing and subscription services, is expected to drive the market.

- Online pharmacies are expected to grow rapidly due to the increasing demand for convenient and accessible medication delivery services, particularly for patients on long-term treatments, boosting the acromegaly market expansion.

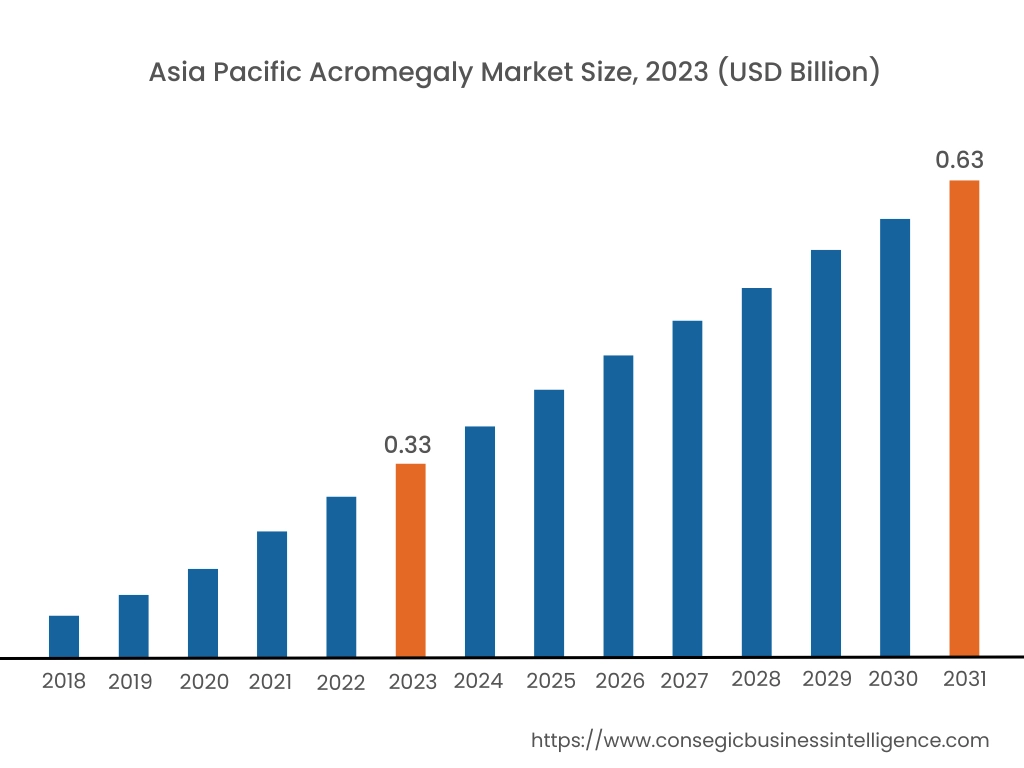

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 0.33 Billion in 2023. Moreover, it is projected to grow by USD 0.35 Billion in 2024 and reach over USD 0.63 Billion by 2031. Out of this, China accounted for 32.1% of the total market share. Asia-Pacific is witnessing the fastest CAGR in the market, driven by increasing healthcare investments and improving diagnostic capabilities in countries like China, Japan, and India. The rising prevalence of hormonal disorders and growing awareness among healthcare professionals contribute to market expansion. Government initiatives to improve healthcare infrastructure and access to treatment further support growth. However, challenges such as limited access to specialized care in rural areas and affordability issues may impede the uptake of advanced therapies.

The acromegaly market analysis shows that the North American region holds a substantial share of the market, primarily due to a well-established healthcare infrastructure and high awareness levels. The United States, in particular, has a significant patient population and access to advanced treatment options, including somatostatin analogs and growth hormone receptor antagonists. The presence of major pharmaceutical companies investing in research and development further propels market development. However, the high cost of treatment and potential side effects may pose challenges to market expansion.

Europe represents a significant portion of the global acromegaly market, with countries like Germany, France, and the UK leading in terms of diagnosis and treatment. The region benefits from strong government support for rare disease management and a robust healthcare system. Ongoing clinical trials and research efforts are enhancing the adoption of novel therapies. However, stringent regulatory frameworks and high costs associated with advanced treatments could challenge rapid market expansion.

The regional trends analysis depicts that the Middle East & Africa region shows promising potential in the market, particularly in countries like Saudi Arabia, the UAE, and South Africa. Increasing healthcare investments and rising incidences of hormonal disorders drive the demand for advanced treatment options. The expanding medical tourism sector, particularly in the UAE, where high-quality treatments are offered, further supports market progress. Nonetheless, limited local manufacturing capabilities and the high cost of treatments remain barriers to broader market penetration in this region.

Latin America is an emerging market for treatment, with Brazil and Mexico being the primary drivers. The rising prevalence of hormonal disorders and increasing focus on improving healthcare infrastructure contribute to the market's expansion. Government initiatives aimed at enhancing access to advanced treatments, combined with the region's increasing awareness of acromegaly, support market growth. However, economic constraints and unequal access to advanced healthcare technologies in some areas present challenges to market development in this region.

Top Key Players & Market Share Insights:

The acromegaly market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global acromegaly market. Key players in the acromegaly industry include –

- Novartis International AG (Switzerland)

- Pfizer Inc. (USA)

- Ipsen Pharma (France)

- Chiasma, Inc. (USA)

- Crinetics Pharmaceuticals (USA)

- Amolyt Pharma (France)

- Camurus AB (Sweden)

- Strongbridge Biopharma plc (USA)

- Antisense Therapeutics Limited (Australia)

- Italfarmaco S.p.A. (Italy)

Recent Industry Developments :

Clinical Trails:

- In June 2023, Amolyt Pharma launched a Phase 1 clinical trial for AZP-3813, a peptide growth hormone receptor antagonist, to treat acromegaly. Somatostatin analogs, which reduce IGF-1 levels and control tumor growth, are the standard first-line therapy for acromegaly.

- In October 2021, Ipsen Pharma reported positive results from a Phase III clinical trial of their investigational drug, osilodrostat, for acromegaly treatment. The trial showed that osilodrostat effectively normalized insulin-like growth factor 1 (IGF-1) levels in patients with acromegaly.

- In April 2021, Crinetics Pharmaceuticals announced positive Phase II clinical trial results for paltusotine (formerly CRN00808) in acromegaly patients. Paltusotine is an oral, nonpeptide somatostatin receptor type 2 biased agonist designed to selectively inhibit growth hormone secretion.

Acromegaly Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 2.51 Billion |

| CAGR (2024-2031) | 6.8% |

| By Drug Type |

|

| By Treatment |

|

| By Distribution Channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Acromegaly Market? +

In 2023, the Acromegaly market was USD 1.48 billion.

What will be the potential market valuation for Acromegaly by 2031? +

In 2031, the market size of Acromegaly is expected to reach USD 2.51 billion.

What are the segments covered in the Acromegaly market report? +

The drug types, treatments, and distribution channels are the segments covered in this report.

Who are the major players in the Acromegaly market? +

Novartis International AG (Switzerland), Pfizer Inc. (USA), Ipsen Pharma (France), Chiasma, Inc. (USA), Crinetics Pharmaceuticals (USA), Amolyt Pharma (France), Camurus AB (Sweden), Strongbridge Biopharma plc (USA), Antisense Therapeutics Limited (Australia), Italfarmaco S.p.A. (Italy) are the major players in the Acromegaly market.