Acne Treatment Market Size :

Consegic Business Intelligence analyzes that the acne treatment market size is growing with a CAGR of 4.7 % during the forecast period (2023-2031). The market accounted for USD 9,035.37 million in 2022 and USD 9,409.43 million in 2023, and the market is projected to be valued at USD 13,562.81 million by 2031.

Acne Treatment Market Scope & Overview :

Acne is a skin condition that results in the formation of pimples, blackheads, and whiteheads on the skin. The highly affected area is the one with high sebaceous gland activity. The reason for the development of acne generally includes hormonal changes, excess oil production, and bacterial growth. Additionally, as per the analysis, these lesions are also caused when hair follicles are clogged. Acne conditions vary from mild to severe, generally depending on the physical and psychological condition of an individual. The treatment for acne is characterized based on its formulations, which include topical creams, gels, serums, and various oral treatments. These formulations contain ingredients such as benzoyl peroxide, salicylic acid, niacinamide, or antibiotics that target bacterial growth or excess oil production.

Topical treatments include formulations that are directly applied over the affected area, while oral treatments are those that are consumed orally to fight off bacteria or to target excess sebum production. These treatments play an important role in managing and treating mild to severe acne conditions and are characterized based on their efficiency in reducing acne lesions and preventing new breakouts. Moreover, the rise in the beauty and wellness industry and dermatological research are leading to innovations for clear and healthy skin.

Acne Treatment Market Insights :

Global Acne Treatment Market Dynamics - (DRO)

Key Drivers :

Increasing prevalence of acne

The increasing prevalence of acne across the globe is driving the demand for acne treatment industry worldwide. Acne is a skin condition that is becoming more common and affecting a large population. They are commonly caused when the hair follicles under the skin get clogged because of excess oil or dead skin. Acne causes several types of lesions or pimples. These are usually differentiated into whiteheads, blackheads, papules, pustules, nodules, and cystic acne. Based on the analysis, this acne generally occurs because of excess oil production in the pores of the skin, buildup of dead cells or dead skin, and growth of bacteria in the skin.

Several methods are established for the treatment of acne. Each treatment varies based on the age, nature type of acne, and severity of the acne. The common types of acne treatments usually include topical medications, oral acne medications, hormone therapy, and other clinical therapies which include steroids, lasers, and chemical peels. Acne mostly affects adolescents and young adults. For instance, according to the National Center for Biotechnology Information, in June 2023, stated that the prevalence of acne in adolescents is about 80% worldwide with 20% of individuals affected with severe acne. Adult acne is estimated to affect 40% of the population worldwide. Thus, the rise of acne conditions is driving the demand of the acne treatment market.

Advancements in therapies and treatment of acne

Advancements in therapies and treatment of acne have developed because of the growing response of more effective, targeted, and patient-friendly solutions. More efficient and precise acne treatments are being discovered as a result of ongoing research and development. Advanced treatments tend to target particular acne types or causes, enabling more effective and personalized solutions, provided according to each patient's needs.

Technological advancements in clinical treatments including laser and light therapies provide safe, noninvasive acne treatment solutions. These treatments estimate inflammation, target the bacteria that cause acne, and encourage skin repair without any side-effects of prescription drugs. For instance, according to the National Center for Biotechnology Information, in October 2022, stated that 1726-nm laser system is a safe and effective treatment to treat mild, moderate, and severe acne. Thus, these advances are driving the trend and demand of the market.

Key Restraints :

High cost of prescription medications, side effects, and safety concerns associated with acne treatment

The rise in the cost of prescription medication and adverse side effects of acne treatment and therapies is the substantial factor that confines the growth of the acne treatment market. Regulatory requirements, the specialized nature of dermatological drugs, and research and development expenses are some factors that influence the high cost of prescription medication for the treatment of acne.

Some acne treatments, mostly those involving prescription medication, come with certain side effects affecting the individuals. The side effects range from mild skin irritation to severe issues such as allergic reactions, dryness of skin, or changes in pigmentation. The need for thorough testing and monitoring to ensure the safety of the patient, adds to the developmental cost of the medication. Advocating for pricing transparency, and programs to improve accessibility to dermatological care are some possible strategies to address the cost of the prescription acne drug.

Thus, despite the growing number of individuals suffering from acne, the high cost and side effects of acne medications are restraining the acne treatment market growth.

Future Opportunities :

Increasing approvals of novel drugs, and therapies.

The process of approving new medicines and treatments for acne is dynamic and includes regulatory review, through scientific analysis and dedication to enhancing dermatological care. Pharmaceutical companies consistently assign resources and funds towards research and development to come up with creative solutions that serve the various requirements of individuals suffering from acne.

The approval of novel medications and treatments for acne represents advancements in the field of dermatological science by providing patients with more options for efficient and individualized care. Through constant change, the healthcare sector treats acne and the overall health of the skin more effectively. For instance, in October 2023, the FDA approved IDP-126 gel (Cabtreo, Bausch Health) for the treatment of acne in patients above 12 years of age. It is a triple combination gel containing combination of clindamycin phosphate (1.2%), adapalene (0.15%), and benzoyl peroxide (3.1%). It is reported to be the first FDA-approved fix-dosed triple combination gel. Thus, these novel drugs are creating lucrative opportunities and trends for the expansion of the acne treatment market in the upcoming years.

Acne Treatment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 (USD Billion) | USD 13,562.81 Million |

| CAGR (2023-2031) | 4.7% |

| Base Year | 2023 |

| By Acne type | Non-inflammatory acne, Inflammatory acne |

| By Treatment type | Therapeutic treatment (Topical medication, Antibiotics, Anti-inflammatory drugs, Chemical peels, and Others), and Devices (Laser therapy devices, Radiofrequency devices, and Others) |

| By End-User | Hospitals and Clinics, Specialty centers, and Others |

| By Region | North America, Asia-Pacific, Latin America, Europe, Middle East & Africa |

| Key Players | Teva Pharmaceuticals USA, Glenmark Pharmaceuticals U.S, Boiron, Piramal Pharma Solutions, Johnson & Johnson Consumer Inc, L'Oréal Paris, Sanify Healthcare, Bausch & Lomb Incorporated, Sun Pharmaceutical Industries, Inc, Cipla Limited, Dr. Reddy's |

Global Acne Treatment Market Segmental Analysis

By Acne Type :

The acne type is categorized into non-inflammatory acne and inflammatory acne. In 2022, the inflammatory acne segment accounted for the highest market revenue in the acne treatment market and is expected to hold the highest CAGR over the forecast period. The common and more severe form of acne is known as inflammatory acne. It is typically red, painful, and inflammatory lesions filled with blood and pus. Propionibacterium acnes is a bacteria that strives in the hair follicle, which usually triggers an immune reaction that results in inflammatory acne. When the hair follicles get clogged with dead cells or excess oil, the immune system reacts by causing inflammation in the affected area. This inflammation creates an ideal environment for bacteria to thrive, leading to the development of acne.

Inflammatory acne results in various types of lesions, including papules, pustules, nodules, or cysts. Nodules and cysts are deeper and more painful than pustules and papules, which are smaller and contain pus. If left untreated, inflammatory acne persists and causes acne scars or post-inflammatory hyperpigmentation. As per the analysis, to effectively manage and alleviate symptoms, dermatological interventions frequently involve topical or systemic medications that target both bacterial infection and inflammatory response. For instance, according to the Journal of Cosmetic Dermatology, in March 2021, reported that inflammatory papular acne accounted for 72.8%, and is observed to be the most common type of acne. Thus, the occurrence and high prevalence of inflammatory acne are driving the growth of the segment.

By Treatment Type :

By treatment type of the acne treatment market is categorized into therapeutic treatment and devices. The therapeutic treatment is further bifurcated into topical medication, antibiotics, anti-inflammatory drugs, chemical peels, and others. In 2022, the therapeutic treatment segment accounted for the highest market revenue in the acne treatment market. Treatment for acne is generally topical or systematic, and they address different factors that contribute to the condition. Topical therapies that address inflammation and unclog pores include retinoids, antibiotics, benzoyl peroxide, and azelaic acid.

Oral antibiotics and isotretinoin are prescribed for severe cases and are components of systemic treatment. This treatment tries to control hormonal changes, stops bacterial growth, and prevents excessive oil production. Oral antibiotics generally include doxycycline and minocycline for the treatment of acne. For instance, the National Center for Biotechnology Information, in March 2023, reported that doxycycline (36.7%) and minocycline (36.5%) are the most commonly prescribed antibiotics for the treatment of acne. Thus, the major use of therapeutic treatment is propelling the segment trend.

Moreover, the devices segment is expected to hold the highest CAGR over the forecast period. Devices are further segmented into laser therapy devices, radiofrequency devices, and others. Various devices are available to treat acne, providing minimally invasive alternatives to traditional skin care methods. These devices target distinct features of acne pathogenesis using a variety of technologies. Based on the analysis, blue light therapy, red light therapy, laser therapy, microdermabrasion devices, and microneedling devices are the most preferred devices for the treatment of acne. For instance, in September 2021, the FDA microneedling devices are approved for the treatment of facial acne scars, facial wrinkles, and abdominal scars in patients aged 22 years or older. As a result, the market trend for acne and acne scar treatments is expected to grow in the coming years.

By End-User :

By end-user, the acne treatment market is categorized into hospitals and clinics, specialty centers, and others. In 2022, the hospital and clinics segment accounted for the highest acne treatment market share of 43.70% in the market and is expected to grow with the CAGR over the forecast period. Acne drugs and treatment are available in hospitals and clinics as they are specialized treatments and prescribed drugs. Acne conditions usually require specialized consultations to evaluate the type severity and specific characteristics of acne. Dermatologists usually prescribe topical treatments such as retinoids, benzoyl peroxide, and antibiotics for the treatment of different types of acne. Various clinical procedures such as extractions, chemical peels, and corticosteroids are usually used and prescribed in clinics and hospitals.

The hospitals and clinics ensure access to advanced diagnostics and professional help. Collaboration between healthcare professionals and patients is essential for the treatment of acne. For instance, in March 2023, Private equity firm Kedaara Capital has acquired a major stake in Oliva Skin & Hair Clinic, a medico-aesthetic dermatology clinic, for USD 65 million. The acquisition is expected to benefit the treatment of acne. Thus, the aforementioned factors are propelling the demand and acne treatment market trend in the coming years.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

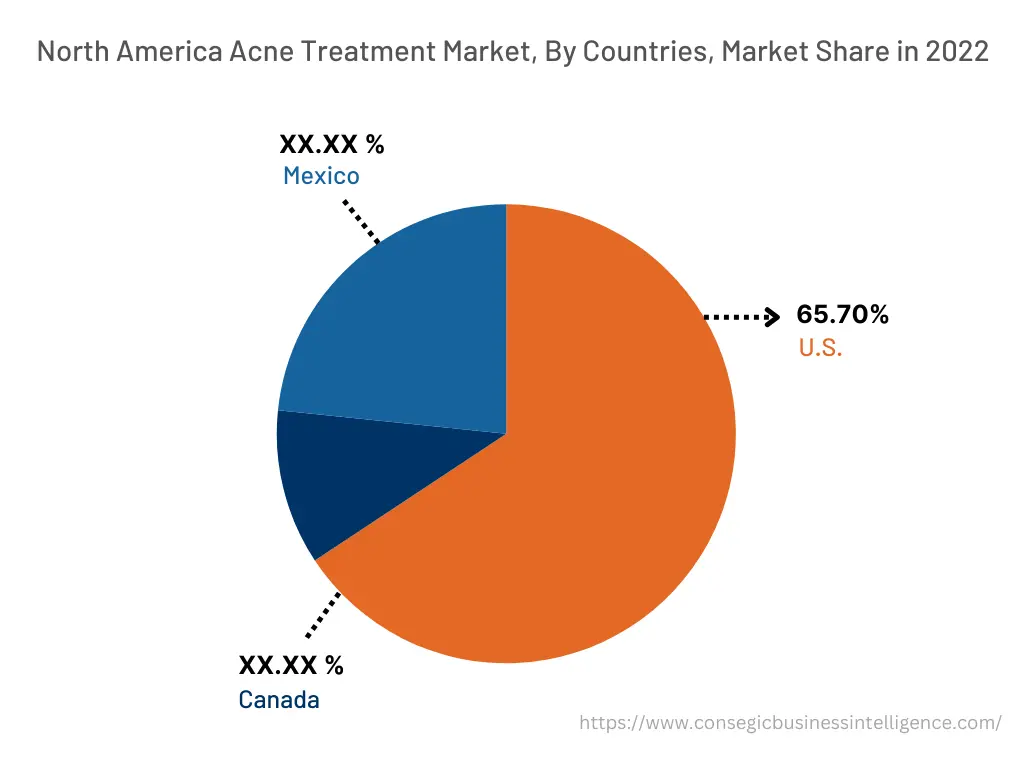

In 2022, North America accounted for the highest market share at 33.15% valued at USD 2,995.23 million in 2022 and USD 3,127.70 million in 2023, it is expected to reach USD 4,612.71 million in 2031. In the North America region, the U.S. accounted for the dominant market share of 65.70% in the year 2020. This is due to the new product launches and the increase in research activities by leading companies. For instance, Glenmark Pharmaceuticals, in July 2022, launched MINYM GEL which is a topical minocycline 4% gel developed for the treatment of moderate to severe acne. Thus, as per the acne treatment market analysis, the new product launches and increase in research activities by leading companies are collectively boosting the market for acne treatment across the North America region and creating lucrative trends and acne treatment market opportunities in North America.

Furthermore, the Asia Pacific region is expected to witness significant expansion over the forecast period, growing at a CAGR of 5.5% during 2024-2031. This is mainly due to the higher prevalence of acne and the rise in pharmaceutical industries in this region.

Thus, the high prevalence of acne and the rise in the pharmaceutical industry across the region are creating potential opportunities and trends to increase the acne treatment market demand across Asia Pacific region in the coming years.

Top Key Players & Market Share Insights :

The acne treatment market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include -

- Teva Pharmaceuticals USA

- Glenmark Pharmaceuticals U.S

- Boiron

- Piramal Pharma Solutions

- Johnson & Johnson Consumer Inc

- L'Oreal Paris

- Sanify Healthcare

- Bausch & Lomb Incorporated

- Sun Pharmaceutical Industries Inc

- Cipla Limited

- Dr. Reddy's

Recent Industry Developments :

- In September 2023, Sun Pharma Canada launched a novel topical formulation called WINLEVI (clascoterone cream 1% w/w) for the treatment of acne.

Key Questions Answered in the Report

What is the market size of the acne treatment industry in 2023? +

In 2023, the market size of acne treatment is USD 9,409.43 million.

What will be the potential market valuation for the acne treatment industry by 2031? +

In 2031, the market size of acne treatment will be expected to reach USD 13,562.81 million.

What are the key factors restraining the growth of the acne treatment market? +

High cost of prescription medications, side effects and safety concerns associated with acne treatment.

What is the dominating segment in the acne treatment market by drug type? +

In 2022, the therapeutic treatment segment accounted for the highest market share in the overall acne treatment market.

Based on current market trends and future predictions, which geographical region is growing at the fastest CAGR over the forecast period in the acne treatment market? +

Asia Pacific region accounted for the highest CAGR in the overall acne treatment market.